A World Gold Council headline “Central bank gold buying picks up in May”.

Global central banks bought a net 20t in May, based on reported data, close to but still below the 12-month average of 27t. Fresh tensions in the Middle East may have reinforced the strategic appeal of gold for central banks looking to safeguard reserves against geopolitical shocks.

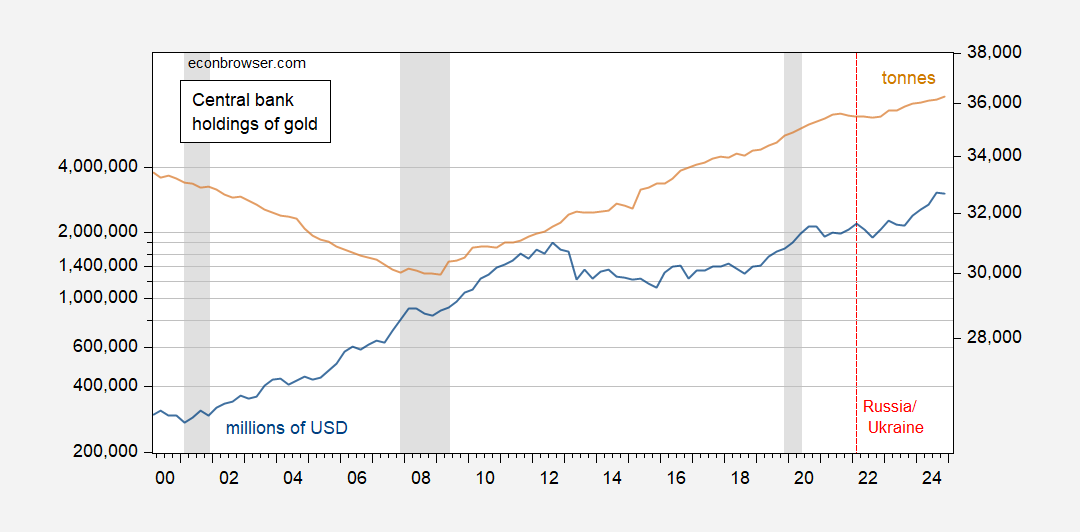

That being said, the increase in the share of total reserves in the form of gold in recent years (documented in this post) has been driven more by gold price increases rather than physical holdings.

Figure 1: Value of central bank gold reserves at market prices, in millions of USD (blue, left log scale), and quantity in tonnes (tan, right log scale). NBER defined peak-to-trough recession dates shaded gray. Source: IFS via World Gold Council, World Gold Council, and NBER.

It’ll be of interest to see how gold holdings — vs. dollar holdings — change in 2025Q1.

While we don’t have US dollar reserves, we have TIC estimates foreign holdings of Treasuries by foreigners (official and private), and those do not seem to have fallen as of April. So, too early to say the dollar is on the way out.

Ever so sorry, but off topic again – Stupid foreign policy:

Let us, for a moment, look to issues other than the harm to the U.S. economy done by the felon-in-chief and Congressional Republicans. Instead, let us consider the U.S. role in ensuring relative peace in the world.

Yes, the U.S. has been involved in wars on every populated continent but North America since WWII, but in relative terms, death in war has been relatively rare, by historic standard, during Pax Americana. Relative peace is the usual state of things when one country dominates world affairs.

The U.S. has not been particularly sophisticated in international affairs during this period, but we didn’t absolutely need to be. We were THE great power for much of the post-WWII period.

What brings me to this subject is a recent statement by China’s Foreign Minister, Wang Yi, who told EU foreign affairs chief Kaja Kallas that China cannot allow Russia to suffer defeat in Ukraine, because it would allow the U.S. to turn its attention to containing China:

https://www.cnn.com/2025/07/04/europe/china-ukraine-eu-war-intl

Sure, many of us already thought this was the case, but the felon-in-chief seems to have no idea. He has said publicly that he wants China to work toward peace in Ukraine while China has made clear that continued war is in China’s interest. How dumb do ya have to be?

The felon seems to want to contain China. Containing China requires the containment of Russia. Doing everything necessary for Ukraine’s defense helps contain Russia. That includes military support and strong economic sanctions against Russia. Pretty simple situation for most people.

But not for all. Russia has for years helped the felon-in-chief pay the rent, so he’s unable to admit what is clear as day to anyone who takes an honest look.

For those who missed it, the U.S. has just curtailed arms shipments to Ukraine, again:

https://apnews.com/article/ukraine-america-stockpiles-army-trump-pentagon-weapons-94ff0c465b58608c653b6f64c113a5b9

‘Cause reasons, ya know.