As of today:

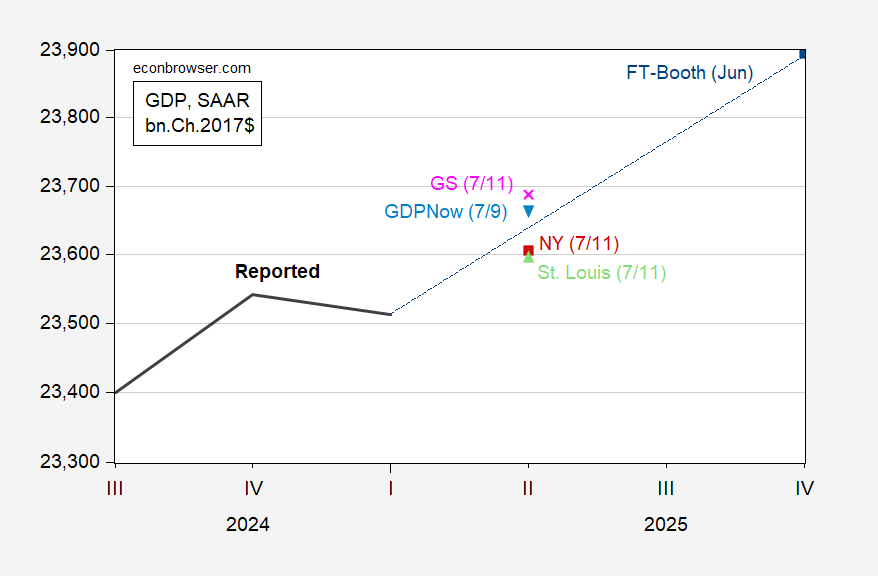

Figure 1: GDP (bold black), GDPNow of 7/9 (light blue inverted triangle), NY Fed nowcast of 7/11 (red square), St. Louis Fed news nowcast of 7/11 (light green triangle), Goldman Sachs of 7/11 (pink x), FT Booth June survey median (blue square), all in bn.Ch.2017$ SAAR. Source: BEA, Atlanta, NY, St. Louis Feds, Goldman Sachs, FT-Booth, and author’s calculations.

The Atlanta Fed nowcast (GDPNow) is a bottom up (component by component forecast), while the NY Fed nowcast is top down. The St. Louis index uses data surprises to generate the nowcast of aggregate GDP growth. Given the nature of the distortions attendant tariff front-loading, I would put more weight on the Atlanta Fed nowcast (it predicted negative growth, while the NY Fed and St. Louis Fed nowcasts predicted positive).

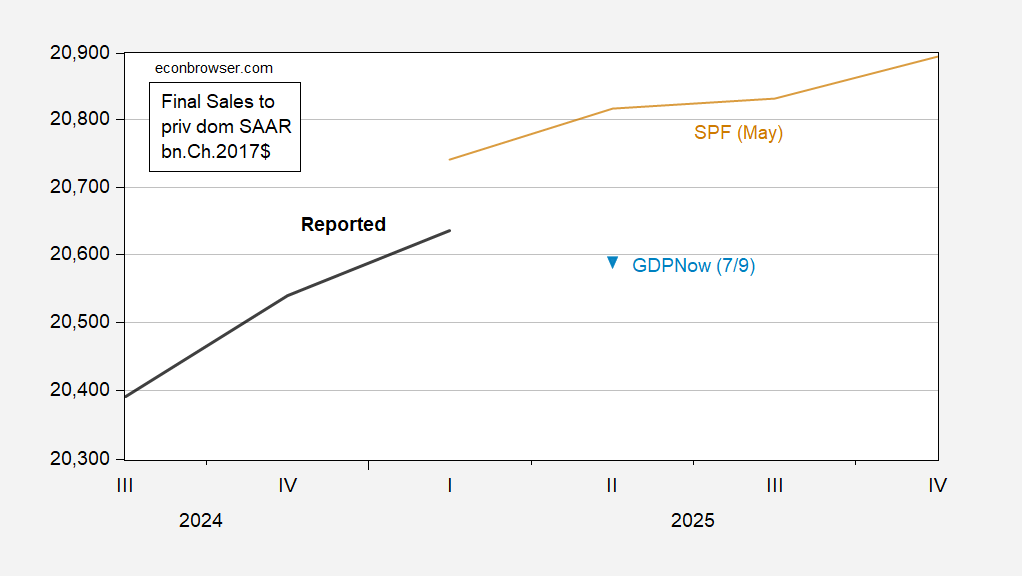

Final sales to private domestic purchasers (aka “core GDP”) should be less sensitive to distortions.

Figure 2: Final sales to private domestic purchasers (bold black), GDPNow of 7/9 (light blue inverted triangle), in bn.Ch.2017$ SAAR. Source: BEA, Atlanta Fed, and author’s calculations.

The Atlanta Fed nowcasts a slight decline (0.9% annualized) in final sales to private domestic purchasers. As is, reported sales are far below the median forecast of the May Survey of Professional Forecasters.

The final sales to domestic purchasers category is less subject to tariff distortions AND less subject to revisions in the second and third releases. The big uncertainties in the first release are from trade and inventories.

Big distortions to trade and inventories from tariffs make core GDP of particular interest now, but the underlying 9ace of growth is pretty much always clear in the first release of GDP. Revisions give people who got their forecast wrong, or who don’t want to acknowledge the actual state of the economy for political or money reasons, an opportunity to quibble. Serious people mostly get on with their lives after the first GDP release. Look at financial market reactions if you doubt it.

So anyhow, core GDP rose at the slowest pace in 7 quarters in Q1. Another below-trend reading in Q2 would be reason for concern; recessions tend to follow weakening in core GDP growth.