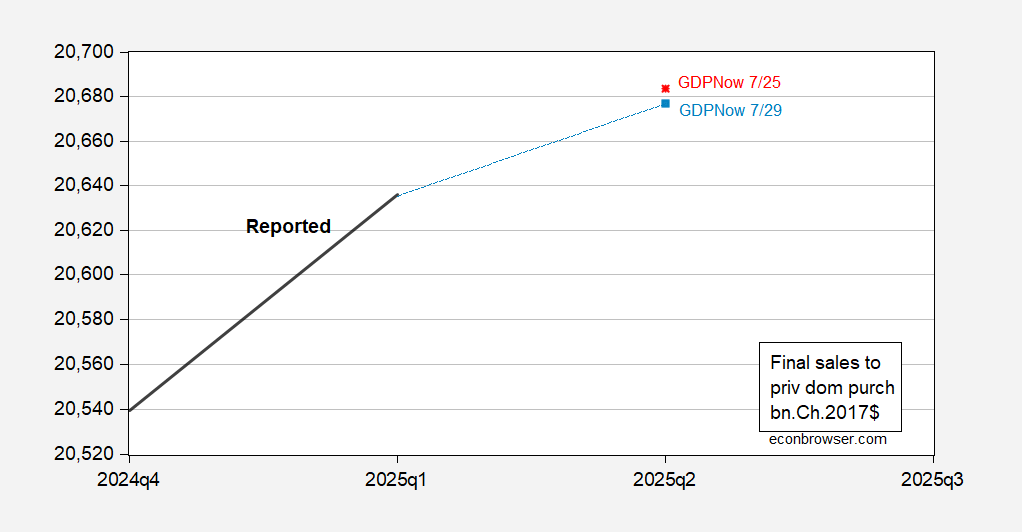

Atlanta Fed nowcast incorporating advance economic indicators indicates 2.9% q/q AR, up from 2.4%. The news is in final sales to private domestic purchasers.

Figure 1: Final sales to private domestic purchasers (bold black), GDPNow of 7/25 (red *), GDPNow of 7/29 (light blue square), all in bn.Ch.2017$ SAAR. Source: BEA 2025Q1 3rd release, Atlanta Fed, and author’s calculations.

Since this series excludes imports and exports as well as inventories, it should be less affected by distortions associated with tariff front-running. That nowcasted final sales growth in Q2 is 0.8% SAAR, down from 0.9% just four days ago. Moreover, this Q2 growth rate is less than half the 1.9% in Q1, and 2.9% in 2024Q4.

So, don’t be overly focused on GDP.

In the nearly 200 quarters since the Great Moderation began, real final sales to domestic purchasers has grown 0.9% (SAAR) or less only 6 times without recession following pretty immediately behind:

https://fred.stlouisfed.org/graph/?g=1KXLc

It happened in Q1, 1987, a couple of times as the expansion of the 1990s got underway, twice again as the expansion of the twenty-teens got underway and in Q3, 2022. Back in the late 1950s, it happened more regularly.

This time is different, of course. This time we have a tariff shock and a labor shock dragging on the economy, along with whatever other b

In the nearly 200 quarters since the Great Moderation began, real final sales to domestic purchasers has grown 0.9% (SAAR) or less only 6 times without recession following pretty immediately behind:

https://fred.stlouisfed.org/graph/?g=1KXLc

It happened in Q1, 1987, a couple of times as the expansion of the 1990s got underway, twice again as the expansion of the twenty-teens got underway and in Q3, 2022. Back in the late 1950s, it happened more often.

This time is different, of course. This time we have a tariff shock and a labor shock dragging on the economy, along with whatever other bad ideas crawl out of the swamp.

RIP Ozzy

And Chuck Mangione. Two ends of a well-loved spectrum.

Well, the Business Dynamics Survey for Q4 of last year is out, and as anticipated it cut the reported NFP gains by more than half, to 287,000.

For the earlier Quarters of 2024, the gains (losses) were 403,000, (163,000), and (1,000), for an annual gain of 616,000, vs. the reported NFP gain of 2,012,000.

If that weakness has carried over to this year, we could be tipping into recessionary job losses right now.

Speaking of recessionary data points:

https://www.census.gov/economic-indicators/

The Census Bureau’s 15-component Index of Economic Activity is looking quite recession-y for Q2. It is a rehash of data we’ve already seen, but so is GDP. Helps with perspective.