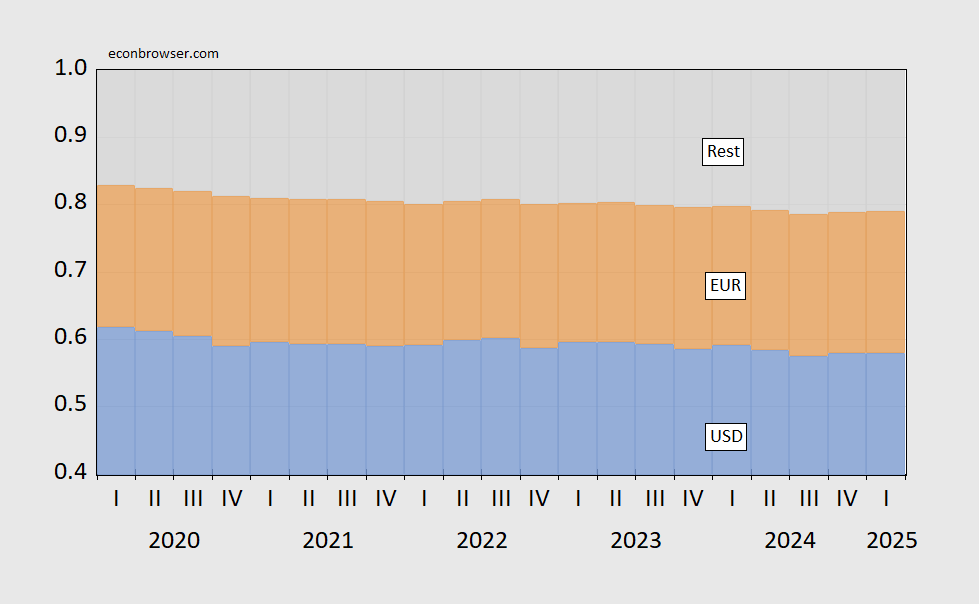

Based on IMF data (COFER, IFS):

Figure 1: USD shares of fx (blue bars), EUR (tan), all other (gray). USD(EUR) share assumes 60%(35%) of unallocated reserves are in USD(EUR). Source: IMF COFER, and author’s calculations.

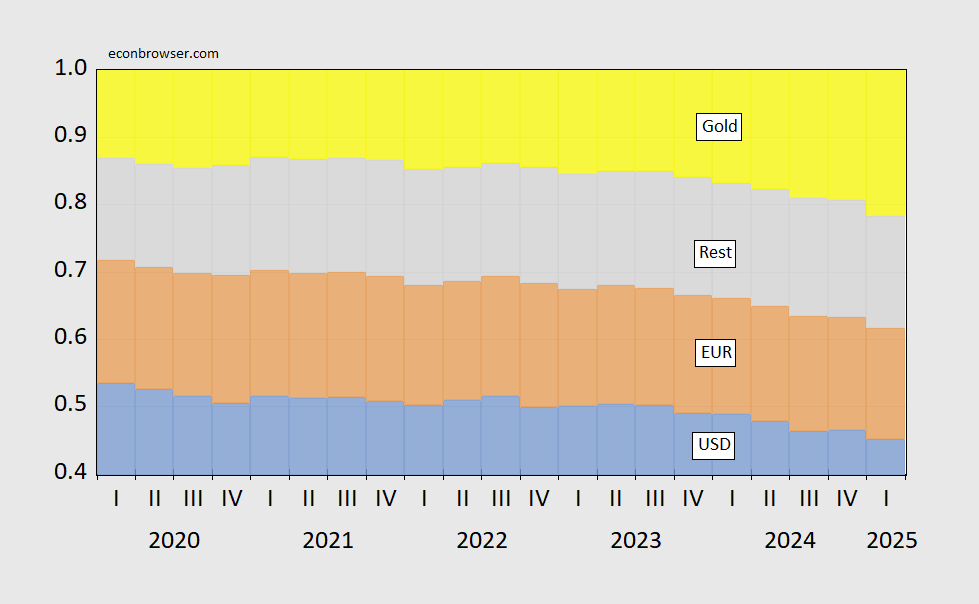

The drop in USD reserves out of total FX reserves is not apparent. However, gold has taken on a heightened importance in recent years. Taking this into account, we have Figure 2.

Figure 2: USD shares of fx and gold reserves (blue bars), EUR (tan), all other (gray), and gold (yellow). USD(EUR) share assumes 60%(35%) of unallocated reserves are in USD(EUR). Assumes quantity of gold holdings stay constant in 2025Q, and observed . Source: IMF COFER, World Gold Council, and author’s calculations.

To the extent that total reserves are the relevant measure, the dollar has dropped by 1.4 percentage points in 2025Q1; the standard deviation of changes is 0.6 ppts. If central banks on net acquired gold in Q1 (World Gold Council suggests 50 tonnes whereas I assumed 0 tonnes), then the drop would be even larger.