What else did you expect?

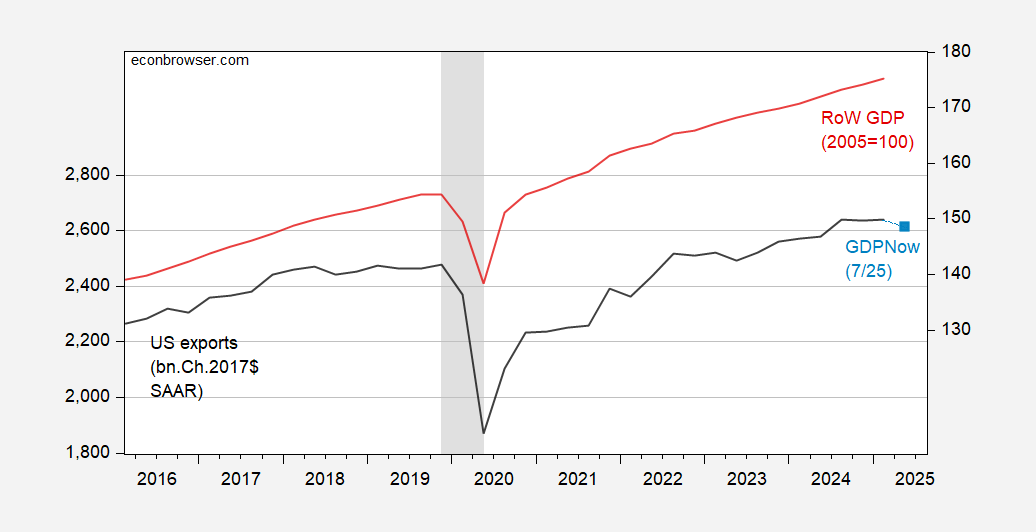

Figure 1: US exports of goods and services (black, left log scale), GDPNow nowcast (light blue square, left log scale), both in bn.Ch.2017$ SAAR; export weighted rest-of-world GDP, 2005=100 (red, right scale). NBER defined peak-to-trough recession dates shaded gray. Source: BEA 2025Q1 3rd release, Atlanta Fed, Dallas Fed, NBER and author’s calculations.

So in Q1, RoW GDP rose but real US exports fell; more telling, the dollar depreciated in inflation adjusted term from January to March, which would have in normal times induced an increase in exports…(dollar depreciation January to June is 6.5% in log terms).

The Atlanta Fed’s 7/25 nowcast indicates 3.3% q/q annualized (0.9% q/q) decline in Q2 real exports (incorporates monthly trade data through May’s numbers).

If my math is right, real exports have fallen 4 times in the past 18 quarters – a period I chosen to avoid the effects of the Covid recession. So exports have fallen about 22% of the quarters in this expansion. Two of those quarters were while the Fed was cranking up interest rates and driving down wealth, for whatever effect that might have had.

Here’s the picture, real export and nominal dollar index changes, by quarter:

https://fred.stlouisfed.org/graph/?g=1KUlO