A paper (Nov. 2024) (first version Oct. 2024):

Downloadable data used in the paper here [xlsx].

This paper is a rebuttal to this article (paper on different server, in case article disappears from original site).

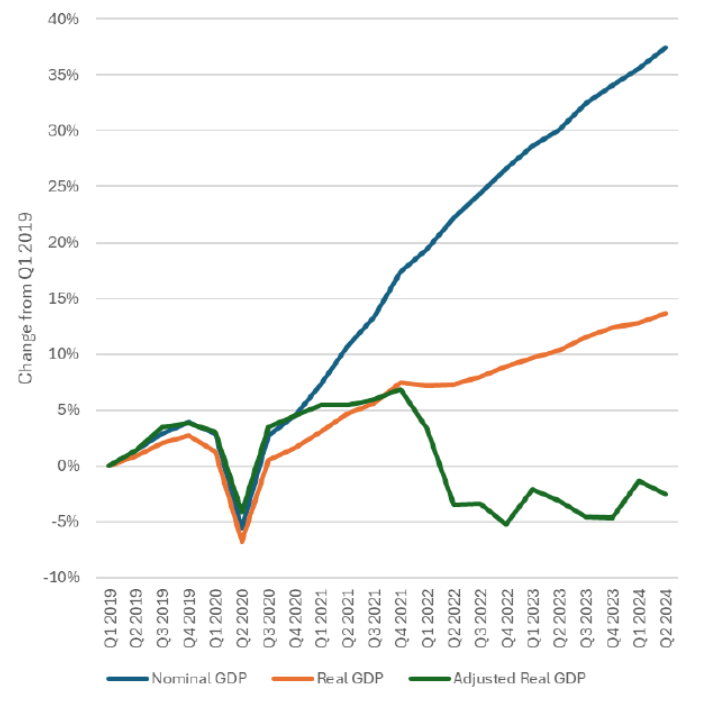

Key graph from their paper:

.

Source: Antoni and St. Onge (2024).

The challenge has been — and remains — to reproduce the green line.

Dr. Antoni’s dissertation on public finance here.

“I’ve taught plenty of economics courses. That was what we used in every single class.”

So he teaches blood leaching in this classes. Who cares? Yea – he lies even to his own students!

so the mother of two us children, who are citizens, has been held by ice for weeks now in Minnesota.. the mother is lactating and one child is supposed to be breast feeding-but is not due to the imprisonment of a mother with no criminal history. so this is where we are republicans, defenders of family values. you want to deny and jail a woman for having an abortion. and when she gives birth to the child, you cheer on the ability to separate mother and child, and would rather let the child starve to death than be fed by her mother. family values at its finest. but let’s be clear, republicans. Jesus understands exactly what you have been doing here on earth. trump will not be there to defend you at the pearly gates. how do you live with yourselves with this ungodly behavior?

no wonder the man is a genius when it comes to statistics. He makes them up!!

The dissertation (or the fragment on it that is on Proquest) is gold. No wonder that he does not understand anything about empirical analysis or theory.

I actually spent some time this morning going down the rabbit hole of Antoni’s 2024 paper. Basically for the official shelter component of inflation he substitutes the Housing Affordability Index, which consists of two components: the change in house prices, as well as the change in mortgage rates.

There are valid reasons to consider each of these substitutions for different purposes. For example, no less than Barry Ritholtz of the Big Picture has argued that Fed rate hikes actually *increase* inflation by raising the costs of mortgages in particular. And I among others have argued that replacing OER with House Cost Indexes is a better model for consumer prices (bearing in mind that in any given month or year only a small fraction of consumers make a new house purchase). More importantly, I have argued that because house prices lead OER by 12-18 months, the Fed should use a “House price indexed CPI” in setting rates, since that tells them where a major sector of inflation is likely to be in a year or so.

But putting those two components together to measure inflation strikes me as a “just-so” compilation, designed to arrive at a desired conclusion, i.e, Biden’s Presidency featured a long recession.

Interestingly, Antoni’s analysis begins in the year 2019. I have learned that politically motivated economic analysis often makes use of cherry-picked start or end dates – and it turns out that this is exactly such a case. Because lo and behold, in 2017 and 2018, house prices went up 15%, and mortgage rates increased about 15% as well, from 4.20% to 4.87%.

In other words, it appears that Antoni’s own analysis would also show a recession during the entire first 2 years of T—-p’s first term. Ooops!

You will often come across arguments that claim to be about some aspect of reality, but that are actually about definitions. It’s a good idea to check, both the other guy’s position and one’s own, for reliance on special definitions.

Little Antoni’s recession claim relies on two changes of definition – the definitions of inflation and of recession. Those two are pretty much the whole game in this case.

It’s not just weasels who wrangle over definitions. NDd mentions Ritholz arguing for a change in the housing measure used in CPI. In the only one-on-one discussion I ever had with Ritholz, he argued for a money-based definition of inflation, then a narrow commodity-based definition of inflation, rather than a definition based on a basket of goods. This was early in the era of ZIRP, and he was sure inflation was around the corner. His effort to redefine inflation would have papered over a big disninflationary structural change.

So anyhow, arguing about definitions while seeming to argue about reality generally ends up with people talking past each other. Little Antoni, in redefining inflation and recession, was talking past us, to his potential benefactors. It worked. Years from now, he’ll be pulling in big money from oligarchs for appearing on TV as “former BLS Commissioner little Antoni” and saying whatever makes his masters happy.