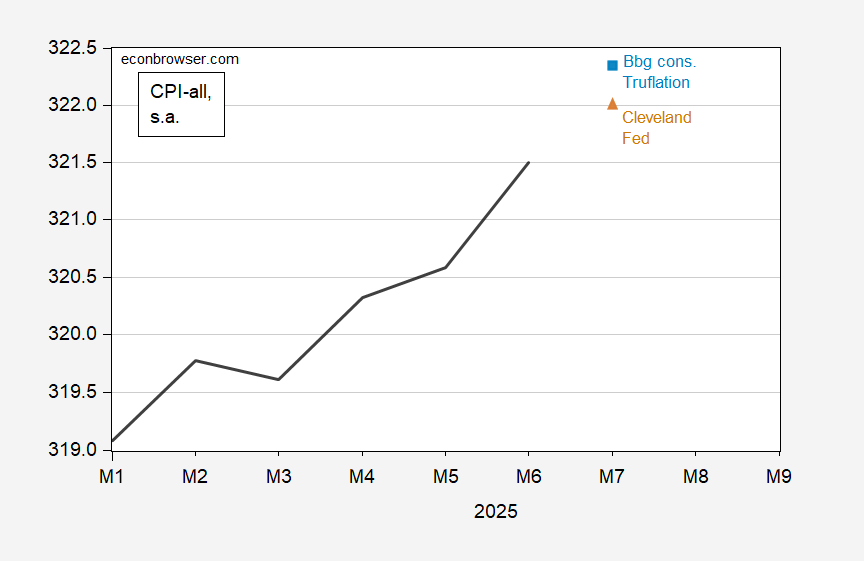

Bloomberg, Truflation at 2.8% y/y; Cleveland Fed at 2.72%.

Figure 1: CPI-all (bold black), Cleveland Fed nowcast (red triangle), Bloomberg consensus, Truflation estimate (light blue square). Source: BLS, Cleveland Fed, Truflation, author’s calculations.

Core CPI up 3.0% y/y, the highest since February. Headline steady at 2.7%, with food up, energy down. Furniture, mostly imported, is singled out for attention by BLS (uh, ouh), up 3.4% y/y, 0.4% m/m.

Food is up because of tariffs, while energy is down because of slow growth and OPEC making sure the felon-in-chief’s promise of more U.S. oil production is foiled.

By the way, oil and natural gas prices have diverged because oil drilling is so low that gas as a by-product of oil production is is getting scarce. Gotta love these little oddities.

Admittedly, I am not always the greatest at math or reading graphs. I could be fooled on these things. BUT…… the graph seems VERY steep to my eyes, PLEASE Tell me I’m not the dumb guy watching trump and Stephen Moore on his TV,

Always watch the Y-axis