CEA Chair Miran asserts that some of the surprise in the employment numbers is due issues of seasonality. Can we see that? I can’t…

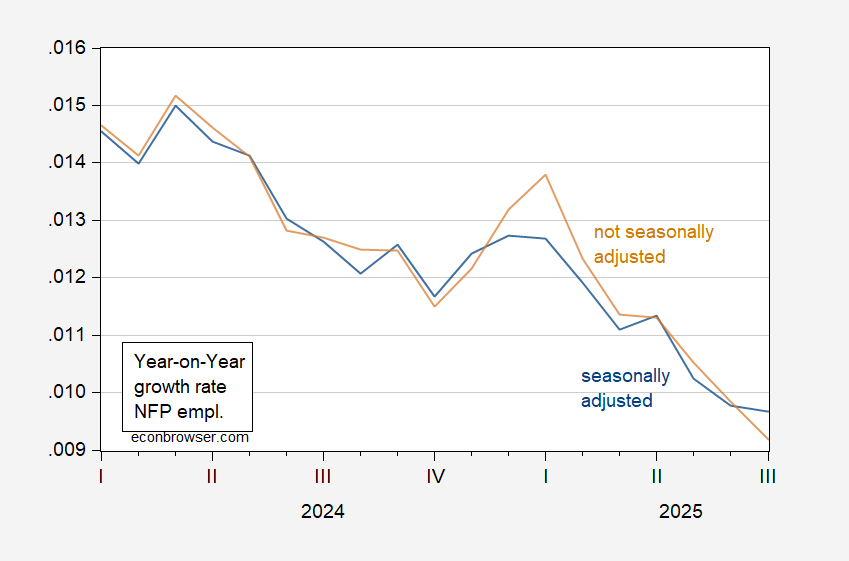

Here’s y/y growth rate of the official series and the seasonally adjusted series.

Figure 1: Year-on-year growth rate in seasonally adjusted NFP (blue), and in not seasonally adjusted NFP (tan). Growth rates calculated using log differences. Source: BLS via FRED, and author’s calculations.

The seasonally adjusted series is actually above the y/y not seasonally adjusted series!

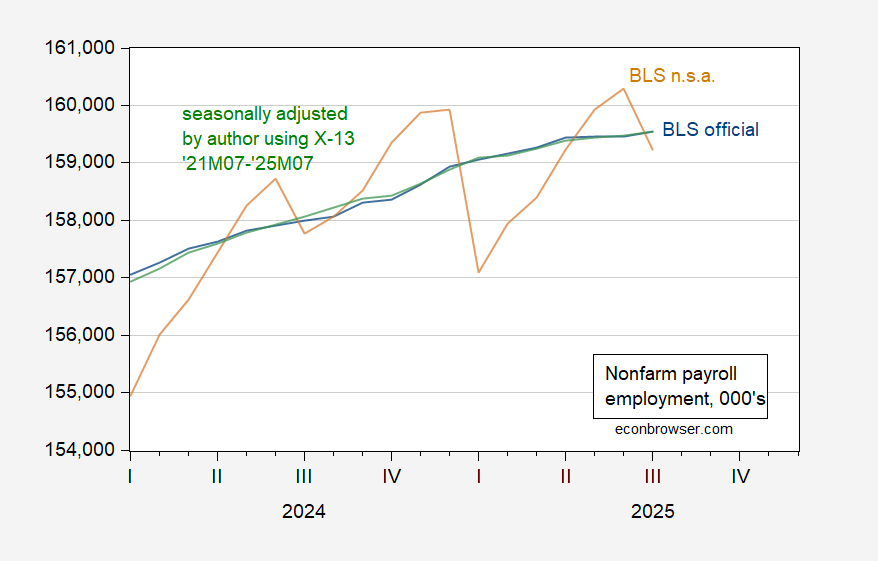

What about the level?

Figure 2: Seasonally adjusted NFP (blue), not seasonally adjusted NFP (tan), not seasonally adjusted NFP adjusted by author using X-13 (in logs, 2021M07-2025M07) (green). Source: BLS via FRED, and author’s calculations.

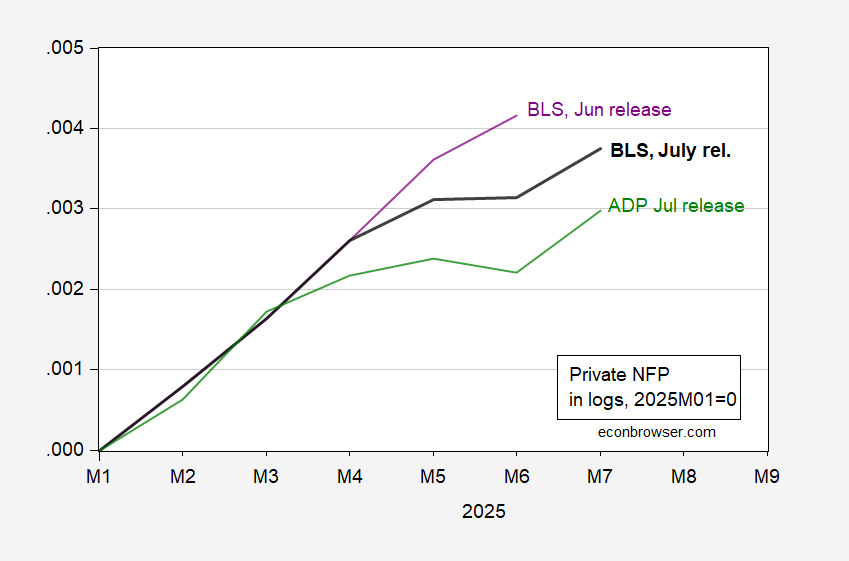

Another reason to think the BLS numbers have not been “massaged”: the July release numbers better track ADP, on private NFP.

Figure 3: Private nonfarm payroll employment, July release (bold black), Jun release (purple), ADP July release (green), all s.a., in logs, 2025M01=0. Source: BLS, ADP via FRED, and author’s calculations.

In any case, there are usually big NFP misses around turning points. Civilian employment — which is not revised month to month — peaked in April.

A decline in response rates probably contributes to the latest big revisions. The first report of any series will be less reliable when response rates fall.

If there is a seasonal adjustment “problem”, it would be nice to know what it is. There is always some possibility that seasonal factors are poorly matched to actual seasonality, but to honestly blame seasonal factors, that mismatch should be larger than normal. Is there an explanation attached to the “bad seasonals” story? I haven’t found one.

There is a longstanding market folk wisdom which holds revisions to be predictive; downward revisions mean future data will be weak, while upward revisions mean future data will be strong. I don’t know whether there is actual evidence to support this idea – looked briefly and couldn’t find any. Even if it was once true, would it still be true when response rates fall? Dunno about that, either. Any stats guys want to chime in?

The felon-in-chief is not just trying to supress facts by firing the BLS Commissioner. The Corporation for Public Broadcasting has announced it is going out of business as a result of federal spending rescissions:

https://www.npr.org/2025/08/01/nx-s1-5489808/cpb-shut-down-public-broadcasting-trump

CBS agreed to pay $16 million in shakedown money because the felon did like that his rival for the presidency was given fair treatment in an interview.

And, of course, universities are agreeing left and right to stop teaching about and to supress discussion of Israel’s exterminationist efforts in Palestine, in response to threats from the felon. They are also agreeing to end any reference to historic bigotry in their curricula and enrollment practices.

Facts are under attack by the felon on many fronts. That is not new, of course. The GOP has long insisted that tax cuts pay for themselves, that regulation always stifles growth, that unbridled market activity is healthy and fair, that election cheating is rampant and that the felon’s insurrection was mere tourism – all contrary to fact. Facts do have a liberal bias.

Did the 1-month/10-year spread just invert?

Let the hatchet fights begin:

https://www.washingtonpost.com/business/2025/08/01/kugler-resigns-fed-trump/

I do recall in the opening months of the Great Recession there were very large revisions downward for over a year. I understand that at that time the business births/death model underestimated the deaths.

Good point.

New Deal democrat recently noted that “the Business Dynamics Survey for Q4 of last year is out, and as anticipated it cut the reported NFP gains by more than half, to 287,000.”

Policy uncertainty was already elevated in Q4, and could have reduced new business formation, so that births could have been overestimated. In the early Covid days, business formation jumped. Back then, there was a great deal of money floating around from federal programs, and a great many people at home with time on their hands. With policy uncertainty high, costs rising and money in relatively short supply to individuals, births could now be weakening.

One of my forecasting colleagues thinks there was some tweaking of seasonal adjustments that played a role in the big downward revisions, using the non-seasonally adjusted data as the starting point. In any event, for the record,

First, the NSA revisions:

May:

Previously: 731k

As revised 703k

June:

Previously: 517k

As revised: 363k

Now, the SA revisions:

May:

Previously: 144k

As revised: 19k

June:

Previously:147k

As revised: 14k

At least as to May, the SA revision was much larger than the SA revision. Hardly conclusive, and the BLS made no reference to any special tweaks in the SA, but as a first hypothesis, tweaks in the SA is a decent choice.

Sort of academic now that T—-p has made clear that data which does not support him will not be allowed.

Menzie, i wrote the following about the July 2024 jobs report: the Bureau of Labor Statistics reported the second smallest increase in payroll jobs since December 2020, and the highest the unemployment rate since October 2021

hence, a year over year graph of the growth rate of the official series and the seasonally adjusted series wouldn’t reveal if there is a residual seasonal adjustment problem with July employment reports or not…

rjs: I wanted to compare the nsa y/y to sa y/y. If nsa y/y showed a big deviation from sa y/y, then I’d possibly agree that there’d been a problem w/seasonal adjustment.