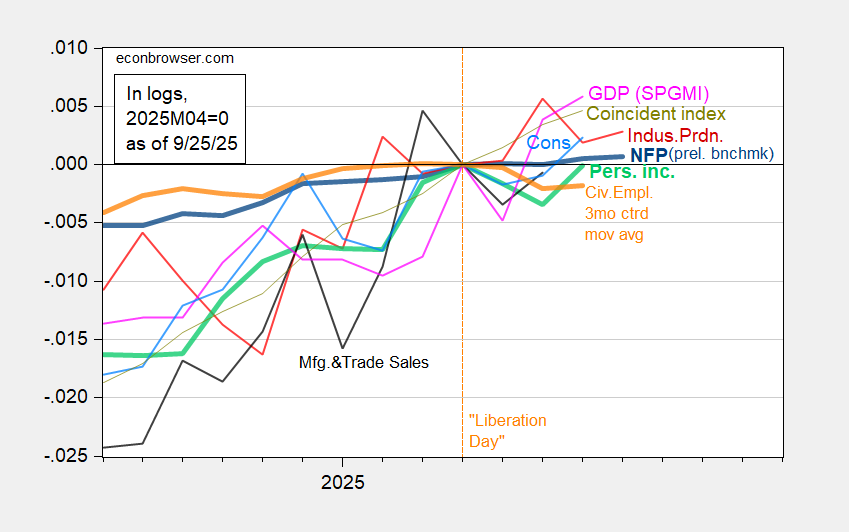

Nonfarm payroll employment, personal income essentially flat, civilian employment down, since 2025M04 (“Liberation Day” month).

Figure 1: Implied preliminary benchmark NFP (bold blue), industrial production (red), personal income ex-current transfers (bold light green), manufacturing and trade industry sales (black) monthly GDP (pink), civilian employment, 3 month centered moving average of smooth population controls version (bold orange), consumption (light blue), and coincident index (chartreuse), all in logs 2025M04=0 (normalized to “Liberation Day”). Source: BLS via FRED, BLS, and Federal Reserve, BEA, Census, Philadelphia Fed via FRED, SP Global Market Insights (9/2/2025), and author’s calculations.

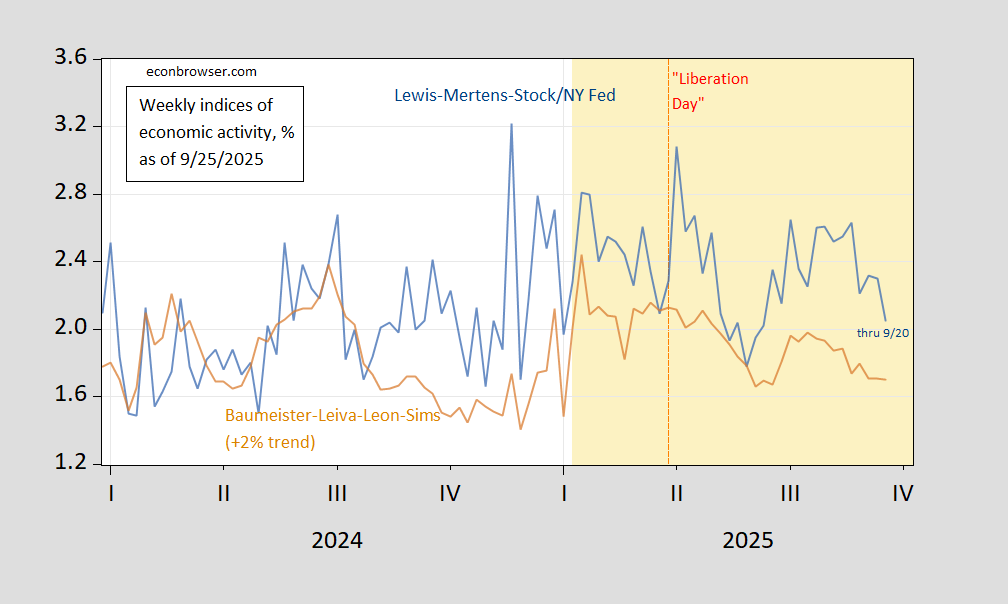

High frequency indicators suggest a slowdown in mid-September (which is end of Q3).

Figure 2: Lewis-Mertens-Stock WEI (blue), and Baumeister-Levia-Leon-Sims WECI plus trend growth of 2% (tan), both in %. Source: Dallas Fed via FRED, Weekly State Indexes.

Given the Q2 3rd GDP release, likely that real consumption will rise in August. Still, that’s backward looking, while the WEI and WECI indicate deceleration in September.

Also, while we’re waiting:

https://fred.stlouisfed.org/graph/?g=1MC67

Not gonna solve the housing shortage like that.

Residential fixed investment is about 4% of GDP, but swings hard with the business cycle, so contributes more than its share to swings in the business cycle.

Last week Trump promised to reduce drug prices by 1,500%. Today he put a 100% tariff on imported drugs.

Can someone help me out with the math? I don’t know if the drug store is going to pay me or I’m going to have to pay them.