That’s a plea from an X post a year ago. He presented various calculations (which are hard to replicate, because he does funny things like mixing CES numbers and CPS numbers), but indeed BLS calculates such a series: the U6 unemployment rate, which contrary to his assertion, economists are aware of. I will follow up on citing this series, even if Dr. Antoni has not in the past eight months.

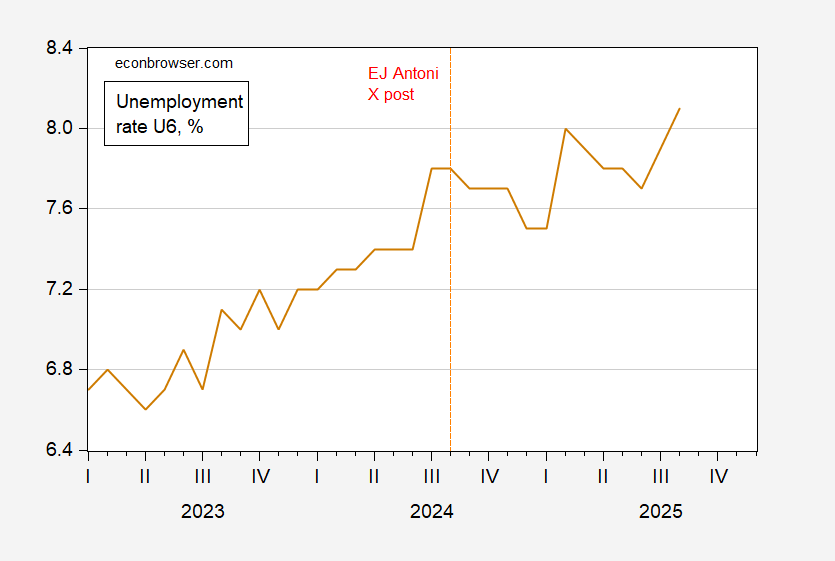

Figure 1: Total Unemployed, Plus All Persons Marginally Attached to the Labor Force, Plus Total Employed Part Time for Economic Reasons, as a Percent of the Civilian Labor Force Plus All Persons Marginally Attached to the Labor Force (U-6), % s.a. (tan). Source: BLS via FRED.

I do not believe Dr. Antoni has mentioned this alternative series in the past eight months.

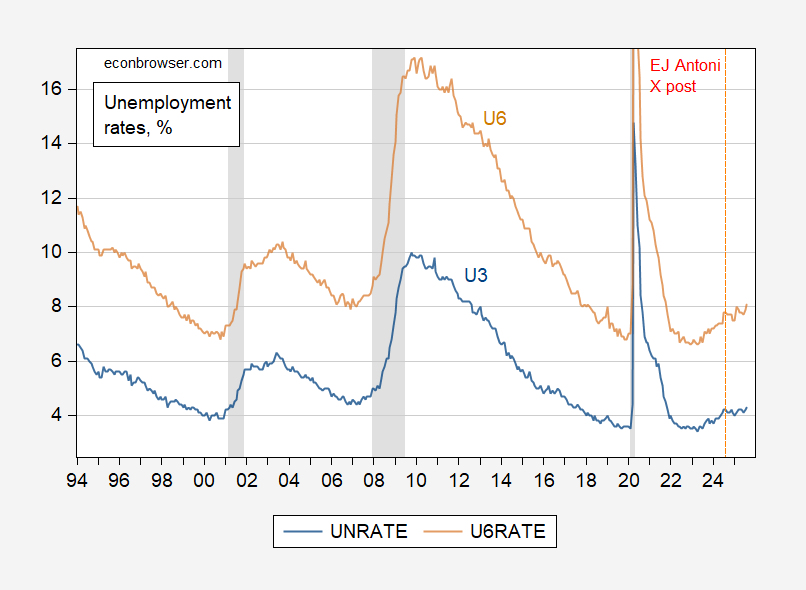

For context, here’re U6 vs U3 (“official”) unemployment rates.

Figure 2: Total Unemployed, Plus All Persons Marginally Attached to the Labor Force, Plus Total Employed Part Time for Economic Reasons, as a Percent of the Civilian Labor Force Plus All Persons Marginally Attached to the Labor Force (U-6), (tan), unemployment rate (U-3), both in %, s.a. Source: BLS via FRED.

Maybe Dr. Antoni has eschewed focusing on this series because U6 has risen 0.3 (0.6) ppts while U3 has risen only 0.1 (0.3) bps over the past year (since January 2025).

Here’s U6 minus U3:

https://fred.stlouisfed.org/graph/?g=1MsXz

We have data for 4 business cycles. The most obvious feature of this comparison between narrow and broad jobless rates is that the gap widens quickly during recessions and narrows gradually during expansions. In the case of the housing boom and bust, the gap was obviously widening in the final quarters of the expansion. The causes of the housing bust were largely internal to the economy.

On the way into the Covid recession, the gap was at its narrowest point for the expansion just before recession arrived – understandable, given the cause of the ultimate recession was mostly external to the operation of the economy.

The same was more or less true for the recession in 2000; the narrowest gap was just a few months s prior to recession. So were 9/11 and Y2K. We can argue over whether Y2K was external to the economy, though it certainly helped inflate the tech bubble.

So here we are, with the gap having widened more than it did prior to any of those other three recessions. This pretty strongly suggests that those marginally attached to the labor market are having a tough time. That’s consistent with spending patterns, and also means that the jobless claims data may be less helpful in tracking the health of the labor market – and the economy – than in the past. If my guess about internal vs external causes is right, it also means we have problems internal to the economy. Wonder what those could be?

Noise in the U6-U3 series obscures the turning point, but it was pretty clearly sometime around the end of 2023, or before – more reason for Biden’s “vibe” problem.

I’m not surprised that Antoni claimed a data series which the rest of us have long known about doesn’t exist. The available explanations for such a claim are ignorance and dishonesty, both of which little Antoni displays in abundance.

You can always count on little EJ to misrepresent