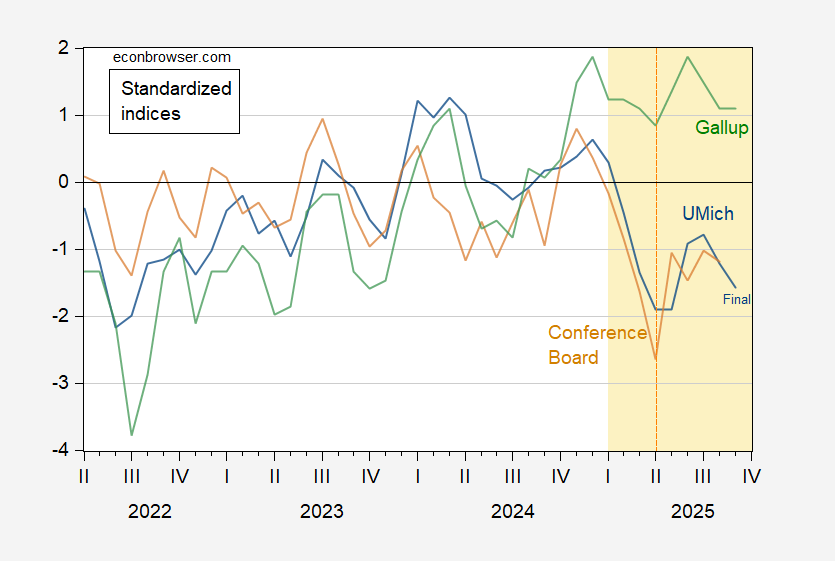

U.Michigan index revised down from preliminary.

Figure 1: U.Michigan Economic Sentiment (blue), Conference Board Confidence Index (brown), Gallup Confidence (green), all demeaned and divided by standard deviation 2021M01-2025m02. Source: UMichigan, Gallup, Conference Board, and author’s calculations.

Expectations also fell.

Off topic – The New York Fed has developed a new “measure of bank solvency based on estimates of the present values of assets, liabilities, and operating expenses”, which the authors call “economic capital”:

https://libertystreeteconomics.newyorkfed.org/2025/09/economic-capital-a-new-measure-of-bank-solvency/

Those interested can follow the link for details.

The authors draw two conclusions about the current state of solvency risk.The plain vanilla economic capital measure shows that U.S. commercial banks are in relatively good shape, with the average level of economic capital higher now than prior to the Great Financial Crisis.

However, a second version of the economic capital measure meant to assess vulnerability to bank runs is less rosy. This measure takes into account reliance on uninsured deposits. The authors conclude that “…based on our measure of stressed economic capital, post-crisis changes in prudential regulation aimed at larger banks do not appear to have resulted in materially lower solvency risk for these firms, either over time or relative to smaller banks.”

Remember Silicon Valley Bank? It relied heavily on deposits larger than the $250,000 limit on FDIC deposit insurance. That is exactly the risk which is shown by this new measure to be high and increasing. Large banks appear to be most at risk of runs.

Worth noting, in light of this new study, is this essay from the Saint Louis Fed, which argues that bank runs are likely to be faster and more severe now than in the past:

https://www.stlouisfed.org/on-the-economy/2023/may/understanding-the-speed-and-size-of-bank-runs-in-historical-comparison

This essay was prompted by the bank runs in 2022 and 2023, including at Silicon Valley, so it’s no surprise that the prevalence of uninsured deposits is among the factors cited as increasing run risk.

In sum, the risk of more runs like the one at Silicon Valley is high and increasing.

Silicon Valley Bank had an absolutely insane 94% of its deposits in uninsured accounts. And worse, SVB wasn’t a real lending bank. It just took in the billions of uninsured deposits, bought 10-year treasury bonds, and hit the golf course by 2PM. It’s a lot less work than real banking. Of course it was subject to a bank run when its treasury bonds were marked to market when rates went up. This should have been no surprise to anyone.

But note that the CEO of SVB, Gregory W. Becker, was one of the biggest lobbyists responsible for weakening the Dodd-Frank stress test rules, exempting regional banks in 2018. So in other words, SVB lobbied to get regulators to look the other way. And then they exploded. Who could have known, eh?

These techbros are pure evil. The fact that the FDIC under Biden bailed out these uninsured depositors is a disappointing failure, a repeat of the Obama bailout. Instead of bailing out the techbros, the FDIC could have temporarily covered every other bank except SVB under their “systemic risk exception”, leaving the techbros to suffer their fate. If there are no consequences for risk, then it is expected that the techbros and their banks will have no limits to their risk-taking, always counting on a taxpayer bailout.