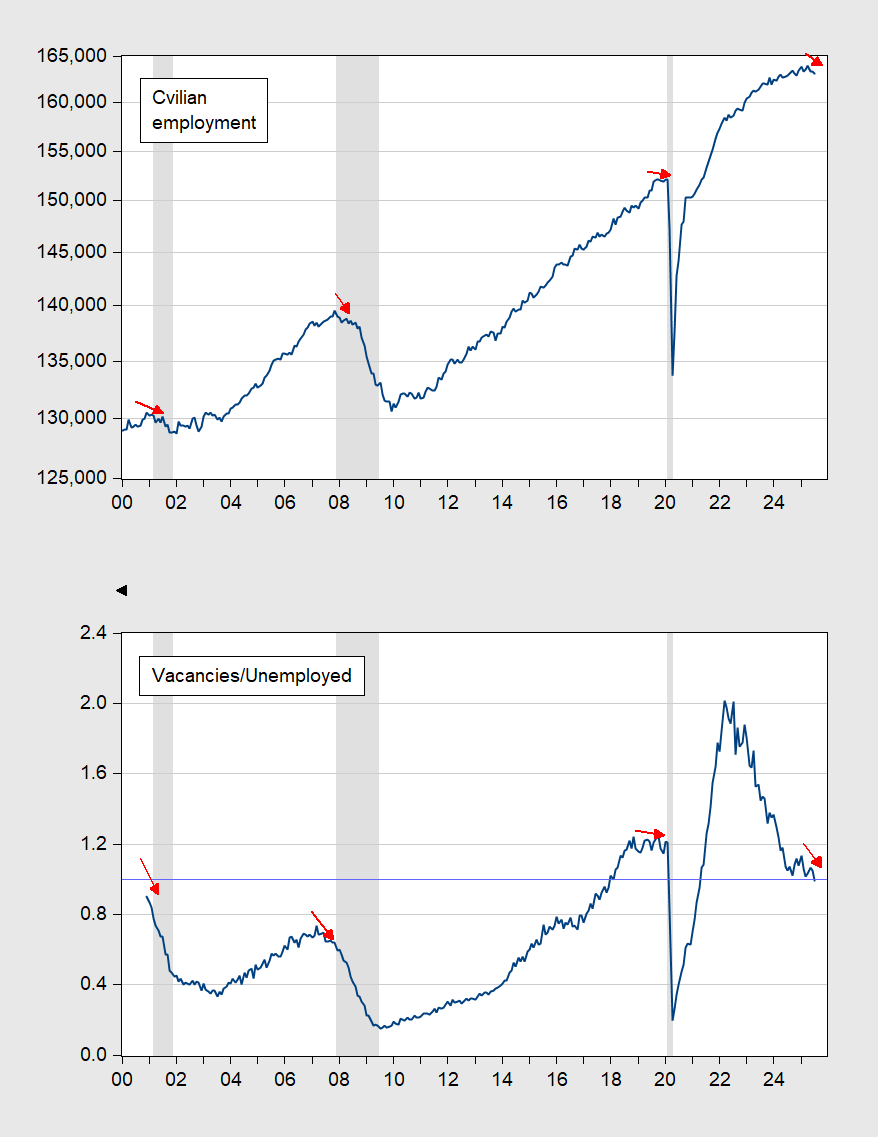

JOLTS data indicates the vacancies to unemployed ratio has descended to unity.

Figure 1: Top panel: Civilian employment (experimental series), 000’s, s.a. (blue line, log scale). Bottom panel: Vacancies to Unemployed Ratio (blue line). Horizontal light blue line at 1.0 value. NBER defined peak to trough recession dates shaded gray. Source: BLS, NBER, and author’s calculations.

The vacancies to unemployed ratio is declining to unity; while it has been lower in the past before a recession (before the 2001 and 2007-09 recessions) without going into a recession (bottom panel), it’s not done so without at the same time declining overall total civilian employment (top panel).

Relatedly, the vacancies-unemployed ratio was declining from 2022 onward, but concurrent employment growth was positive. That is no longer the case.

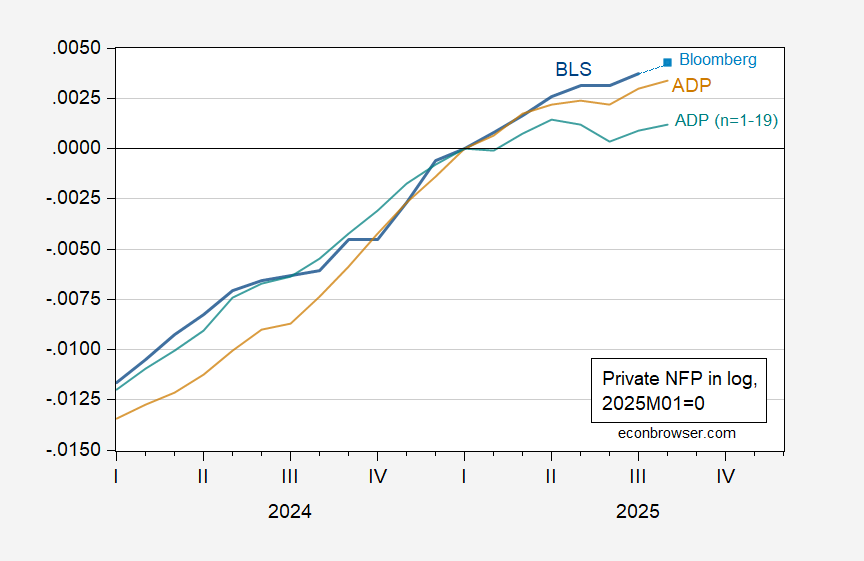

Finally, what does the ADP release tell us today? The net increase of 54K was less than the consensus of 64K. First, employment growth is decelerating, and small firm employment is showing a more marked deceleration — with August levels below prior peak.

Figure 2: BLS/CES private nonfarm payroll employment (blue), Bloomberg consensus (light blue square), ADP private nonfarm payroll employment (tan), and ADP private NFP for firms 1-19 (teal), in logs, 2025M01=0. Source: BLS, ADP via FRED, Bloomberg, and author’s calculations.

Note that according to ADP estimates, small firm (n=1-19 employees) employment constitutes 26% of total. If one believes in pecking order credit models, slowdowns should show up in small firms.

Off topic – Fed independence:

https://substack.com/home/post/p-172105215

Claudia Sahm is out with a new piece. It is an amazing bit of writing. She simultaneously sounds utterly clinical and unbiased as to Stephan Miran’s qualifications to be a member of the Fed’s Board, and offerd a chilling warning about Fed independence.

How? By pointing out that next year, regional Federal Reserve Bank Boards will perform their every-5th-year review of Fed presidents. Every one of them will be vulnerable to being replaced. Any chance the felon-in-chief won’t go to work on the regional Boards to appoint his guys? In addition, the regional Boards’ choices are subject to review by the Board of Governors. Miran or someone very like him will join Bowman and Waller, and Powell will also be replaced; four of the seven governors will be stooges, refusing to confirm the nomination of any independent thinkers. That’s how the Fed will be corrupted to enrich the felon.

Speaking of Fed independence, Jon Steinsson, et al, presented a paper at Jackson Hole on the implications of Fed credibility entitled “Beyond the Taylor Rule”. Find it here:

https://eml.berkeley.edu/~jsteinsson/papers.html

The gist is what you’d expect. The Fed could afford to deviate from the Taylor rule during the Covid slowdown because of long-earned credibility. Absent that credibility, the cost of deviation would have been higher.

When ruled by a king for whom “Apre moi, le deluge” underlies his every thought, such issues are irrelevant.

More on the sudden increase in real median household income from the Motio Research survey:

It seems very likely that the Household Survey failed to pick up the 5-6 million immigrant surge in the immediate post-pandemic years. If – just as a ballpark – the previous responses were 90% native, 10% immigrant, in 2022-24 they might have been 88% native, 12% immigrant. Since the Survey was assuming a regular total population increase, it interpreted the responses as meaning no native population growth and somewhat elevated immigrant growth. With the benchmark revision this past January, both series had to be revised sharply higher.

Then we get the second issue, in the past several months. Ever since the surge in deportations, not only are some of Los Illegales gone, but many others have refused to turn up for work, and they probably aren’t interested in telling Census surveyors that they are immigrants, whether or not they have work, and especially *where* they work. In other words, I am sure the response rate for immigrants has gone down a lot. Let’s say it is now running 92% native born and 8% immigrants. the Household Survey is interpreting this as a spike in native born population and a big decline in immigrant population, based on its pre-set total population estimates.

The big increase in the Motio series started in June, the same month that the Household Survey reported a sudden decline (totaling 1 million through July) in the foreign born population.

If lower income immigrant households stopped replying to the monthly Census survey, that would skew the median income figure to the higher earning native born, even if nobody’s income changed by even one penny.

In other words, the entire big gain this year in the graph shown to T—-p could be a mirage.

I respect the work Motio is doing, but I wonder if Prof. Chinn could see if they can shed any light on this issue.