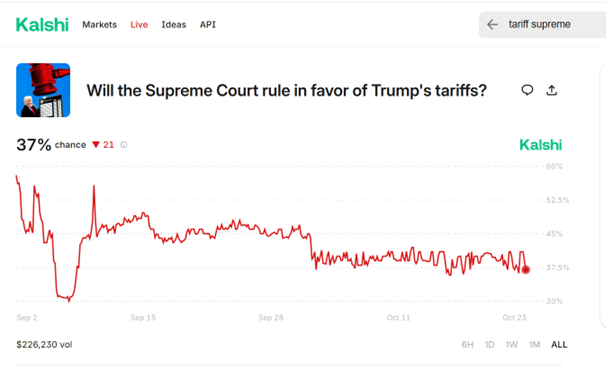

Betting is now 37% Supreme Court upholding IEEPA tariffs.

Source: Kalshi, accessed 10/23/2025.

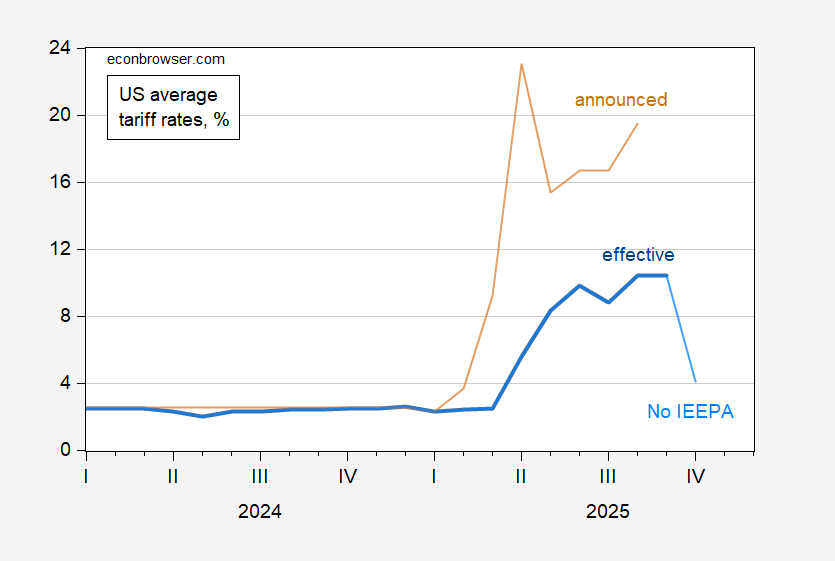

What happens if the IEEPA tariffs are struck down, effective tariff rate-wise?

Figure 1: Average effective tariff rate (blue), average declared tariff rate (tan), and average effective tariff rate if IEEPA tariffs are struck down (light blue), all in %. Calculations assumes October values of customs revenue and imports both the same as September. Assumes in October, $200 bn revenue (SAAR) comes from IEEPA tariffs per Tax Foundation. Source: OECD Interim Economic Outlook, Paweł Skrzypczyński, Tax Foundation, and author’s calculations.

I’ve used 1/10 of the Tax Foundation’s $2 trillion estimate to guess at the reduction of IEEPA tariff revenues. This is an approximation, with out-years likely having more tariff revenue due to trending imports, while more comes in early because pre-substitution timing; I’m assuming the effects offset each other.

Of course, Mr. Trump could then try to use Section 201 or other authority to impose tariffs (see here for list), although some of those alternatives would require time to implement.

Even if tariffs were re-imposed using Section 201, the courts would probably not allow retroactive imposition. So if IEEPA tariffs are srltruck down, the billions in tariffs collected would still have to be refunded. Bigger deficit.

And maybe the felon-in-chief will grant himself $230 million in federal money:

https://www.yahoo.com/news/articles/open-corruption-national-review-legal-134139279.html

Bigger deficit, but who’d notice a few million?

Hey fellow Wisconsinites – Canada is WI’s #1 market; exports are $27.5B total, with Canada ~29% and a heavy mix of industrial machinery, electrical machinery, vehicles/parts, paper/plastics, and food products—all tariff-sensitive and input-intensive. Trump’s trade war with our largest trading partner is very harmful to the state. We can ill afford to lose any more manufacturing jobs. I wonder what the Wisconsin Manufacturers & Commerce (WMC) has to say about all this?

Data!

CPI up 3.0% y/y, headline and core. That’s up 0.1ppt headline, down 0.1ppt, core, vs the August y/y.

Up 0 3% and 0.2% m/m, respectively.

I know this is slower than the median estimate, and I don’t care. That’s more a measure of how difficult forecasting is in a given period than it is of anything important. More important is that the q/q rate of headline inflation (SAAR) is 3.1%, core at 3.3%.

Money markets are slightly more convinced of a 50 basis point reduction in the fed funds rate by year end than before the data – pricing is for a sure thing.

Off topic – Argentina:

Argentina holds an election two days from now. The prospect of a poor showing for President Milei’s Libertad Avanza party, and a corruption scandal in his administration, are the proximate causes of Argentina’s recent market turmoil. A third of Senator seats and half of Deputy seats are up election.

As I understand it, the way to read election results from a market point of view is that Milei’s party will be able to uphold his vetoes if they win hold a third of Senate seats; that’s what the stink is about.

We don’t know whether the felon-in-chief will use Milei’s veto ability as his standard for continued subsidy of hedge funds invested in Argentina. One never knows what, if any, standard the felon will uphold.

If Milei appears able to veto legislation – current handicapping sees this as a long shot – then a temporary respite for Argentine assets is likely. If Milei’s party falls short of being able to sustain vetoes, his agenda is likely to be crippled no matter what the felon decides to do.

Here’s the felon-in-chief’s plan to overturn the results of yhe mid-term electiins:

https://www.nytimes.com/2025/10/22/us/politics/trump-election-deniers-voting-security.html

Democracy was nice, while we had it, buy best to move on now, I guess. It’s not like we were actually making much use of it.