We would’ve gotten Q3 advance GDP yesterday, and September personal income and outlays today, ordinarily. What indicators do we have for the state of the macroeconomy? Here’s one: delinquincies on auto loans (for pools of asset backed securities).

Source: Fitch, accessed 10/31/2025.

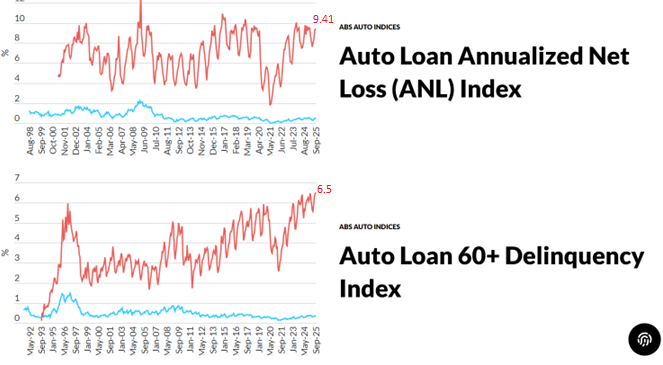

Auto loan delinquencies (60+ days) on pools of loans in subprime ABS have surged to 6.5% in September. Since there appears to be seasonality, it’s useful to compare against September 2024: 6.12%. (Delinquency rates for the prime ABS pool is relatively unchanged over the year, at 0.37%).

The ABS deliquency rate is much higher than at any period of the 2007-09 recession, and higher than on the eve of the Covid recession, arguably when the economy was slowing drastically.

The annualized net loss (ANL) index is slightly down, 9.41 vs. 9.79 in September of 2024. This index is partly supported by the increase in used car prices, e.g. Manheim Index, which has risen from 202.96 to 207.03, or 2%, over the corresponding period.

Is the delinquency rate of use in predicting an incipient recession? If the characteristics of the loans were constant, perhaps so. However, as Adams et al. (2024) point out, the post-Covid loans were of larger size than for previous origination years, and this factor appears to be an important factor in delinquencies. Hence, I would be wary of extrapolating from previous episodes the predictive power of the delinquency rate, at least in levels.

Here’s another indicator: “Kraft Heinz CEO Warns of Worst Consumer Sentiment in Decades.”

https://www.msn.com/en-us/money/companies/kraft-heinz-ceo-warns-of-worst-consumer-sentiment-in-decades/ar-AA1PqPS9

Of course, the aggregate numbers may not be all that bad if retail sales of the bottom 90% get offset by the robust spending of the top 10% who account for half of retail sales.

Tangential to the topic – AI investing:

https://www.theatlantic.com/technology/2025/10/data-centers-ai-crash/684765/?gift=nwn-guseqS6cY1kVeEKZAdaSthhtnZy-pwftXDjsd3E

Often, predictions of investment bubbles are based on over-investment. There is, however, a natural bust built into investment cycles, based on maturation of the cycle. The easiest way I know to think about natural investment busts is sigmoidal growth function:

https://www.forbes.com/sites/rebeccabagley/2013/01/02/the-key-to-growth-transformational-change/

Not all things grow according to a sigmoidal pattern, but investment based on new technology often does. After rapid growth comes maturity, and that means investment slows. An investment bust happens even without a bubble, but a bubble makes the bust worse.

As the Forbes article suggests, a sequence of innovations can mean that a firm, or a national economy, can experience continuous growth despite the flattening out of growth in a single technology – just add another new technology. However, investment in artificial intelligence is on a scale more like railroads, electrification, automobiles and personal computers rather than like work-a-day technological improvement. That’s in part what the article in The Atlantic is about – the collosal scale of AI investment.

Menzie has pointed out how large AI-related investment is as a share of total investment, with the hope (but not necessarily the expectation) that it continues:

https://econbrowser.com/archives/2025/08/banking-on-data-center-investment

Here’s a picture of real GDP growth, excluding computers and peripherals:

https://fred.stlouisfed.org/graph/?g=1NxEd

Growth ex-computers was well below stall speed in H1.

A sigmoidal growth path says that sustained AI investment growth ain’t going to happen. The risk of a slowdown in data-center investment is separate from the risk of recession from the felon-in-chief’s policies. The risk of a financial shock leading to recession is inherent in both the eventual slowdown in AI investment and in the felon’s policies. We have at least two large factors militating toward recession.

I think I have inadvertantly commented on DWilson’s comment. Should AI investment turn shakey, the top 10% might join the bottom 90% in cutting back on spending.