That’s the title of my presentation at the 2025 Minnesota Economic Association annual meeting, where I had the honor of speaking at the Leonid Hurwicz Lecture. It was a fantastic opportunity to share my thoughts and in responding to thoughtful questions, expand my views. The event took place at St. Catherine University yesterday.

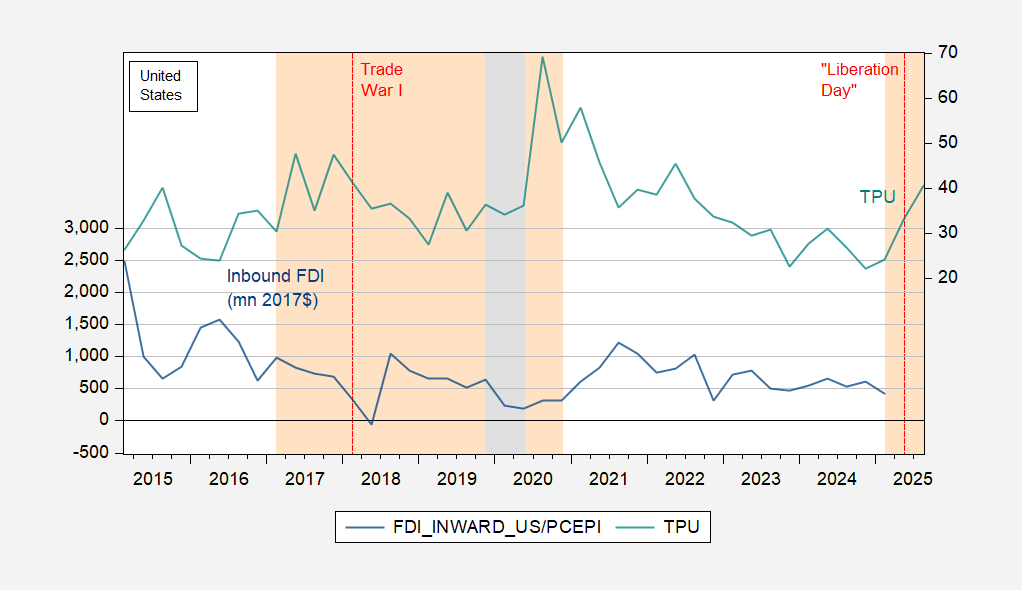

Here’s one picture:

Figure 1: Inbound FDI, mn Ch.2017$ (blue, left scale), Trade Policy Uncertainty (teal, right scale). Trump administration periods shaded light orange. NBER defined peak-to-trough recession dates shaded gray. Source: OECD, BEA, matteoiacoviello.com, NBER, and author’s calculations.

I discussed trade protectionism, policy uncertainty, restrictions on immigration, reduced foreign direct investment, and the threat to dollar dominance (slides here).

During the Economic Data Roundtable, Dr. Abigail Wozniak (Minneapolis Fed), Angelina Trâm Nguyễn (Minnesota DEED), and Dr. Aaron Sojourner (Upjohn Institute) spoke on issues relating to how the collection and development of labor market data critically supports policymaking, with emphasis on the indispensable nature of government data compilation.

Many thanks to Kristine West and Louis Johnston and the other officers of the MEA for the opportunity!

Direct foreign investment plunged in 2014 after the BRIC bubble fully popped as seen in commodities. There is little meat on those bones. Nor is immigration being “restricted”. Indeed, illegal immigration has risen in 2025 despite actual inflows being down and reduction in demand. What that means, actual immigration enforcement is reduced. Deportations down. Stop falling for ” theater “. Nor is there much protectionism. Another outdated term. Actual capital markets have been deregulated, which mean easier for foreign capital flows to enter the us.

Stop talking the book and understand the grift. Debt markets are collapsing, much like in 2007, this time to corporate debt markets. Wait until 2026 when it spreads upstream like 2008.

Calling a 9% tariff high is embarrassing. Its a useless small consumption tax.

Looks like you have a case of Dunning-Kruger, and not the good kind.

Every bar has some guy who’ll tell anyone who’ll listen that everybody has it wrong – everybody but him. They often sprinkle their conversation with “pull your head out of the sand” or “you need to think for yourself”, when what they really want is to do the thinking for you. No thanks. In the present instance, the dismissal of other people’s ideas is ‘stop falling for “theater”‘. The goal is the same as ever, to dismiss ideas so as to avoid addressing them.

Oh, and if 9% is a meaningless tax, let’s raise your tax rate by 9% – yours, but not mine, thank you very much.

Dismissing other people’s views instead of addressing them is spineless. Grow a pair and show us your evidence. Stop with the finance-bro bloviating and make an argument, so the rest of us can get a look at it. If you can.

Otherwise, the wrong side of Dunning-Kruger it is.

Thanks for posting! The slide on deportations is especially interesting to me. In Wisconsin – we have an aging population and already have a caregiver crisis with rural assisted living facilities closing – also an estimated one in four frontline caregivers are immigrants – with Medicaid cuts to supports and taking these workers out of an already dwindling workforce in rural areas – this problem will become especially acute in coming years. One impact – some of those aged 40-60 will drop out of workforce to care for older parents.

Also – as of this morning 10/26 – Trump has raised tariffs on Canada by another 10% – Canada supplies about ~15–16% of Wisconsin’s total imports and the state is fairly exposed to Canadian trade conditions – looking at the WPF – Wisconsin’s Shifting Economy – since 2020/21/22 WI imports from China have fallen and imports from Mexico and Canada have risen – Canada ranks as the state’s second largest source of imported goods at $6.3 billion. Wisconsin imports a wide variety of goods from Canada, including paper ($856.9 million), chemicals ($559.4 million), and processed foods ($563.6 million). The value of state imports from Canada has remained relatively consistent since 2018. https://wispolicyforum.org/research/wisconsins-shifting-import-economy/ Wisconsin can not catch a break from disastrous Trump/GOP policies.

Scott Bessent: “Martha, in case you don’t know it, I’m actually a soybean farmer, so I have felt this pain too.”

Oh, I’m sure this billionaire is feeling the pain. Are his children going shoeless?

Remember that whole disagreement over “taxation without representation?”

Once again we have a king who can raise or lower our taxes at his whim. Republicans have become the Loyalist Tories of the Revolutionary War. Democrats could do a better job of emphasizing this specific point.

Just to be clear, Bessent lied about being a soybean farmer. He’s a landlord over soybean farmers. He reported over $1 million a year leasing land to real farmers.

I wonder if he will give them rent relief now that he and his boss Trump have crippled them — what am I think, of course he won’t. He’s a soulless hedge fund trader.