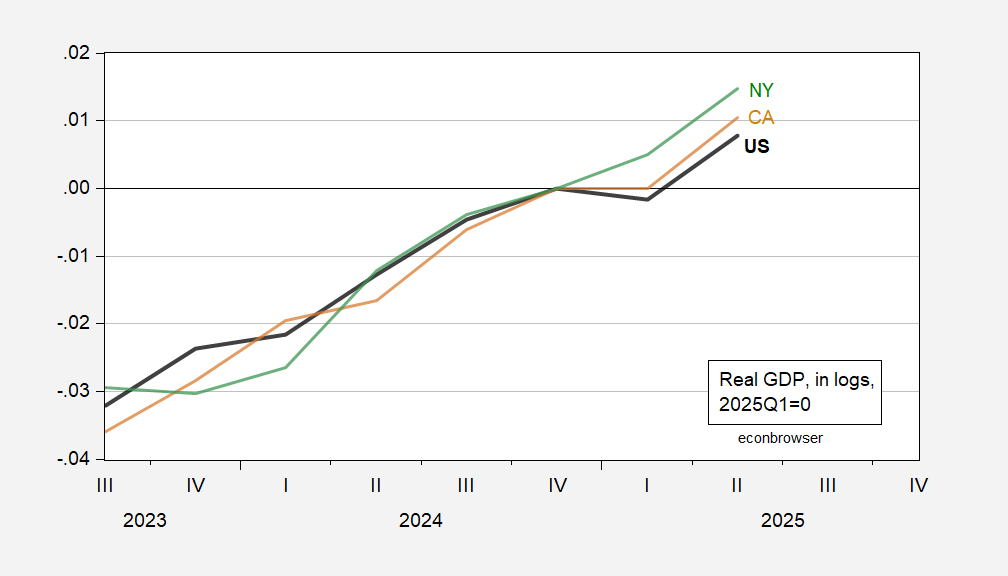

Mark Zandi has asserted that whether the US goes into recession depends on how CA and NY economies evolve. If we rely on GDP to define activity, then the outlook appears sunny.

Figure 1: Real GDP at national level (bold black), California (tan), and NY (green), all in logs, 2024Q4=0. Source: BEA, and author’s calculations.

These two states alone account for 22% of national GDP.

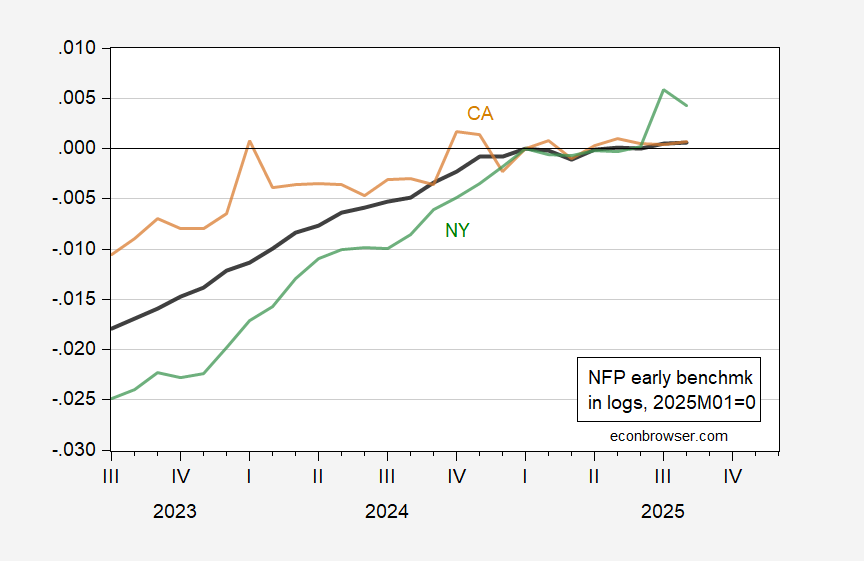

However, as has been noted elsewhere, there seems to be a disjuncture between GDP growth and employment growth, particularly over the last six months. Recessions are defined as broad decreases in economic activity, not necessarily value added (which GDP is). Another broad measure that is fairly reliably estimated is nonfarm payroll employment. Using the Philadelphia Fed’s early benchmark series, one finds the following picture.

Figure 2: Early benchmark nonfarm payroll (NFP) employment at national level (bold black), California (tan), and NY (green), all in logs, 2025M01=0. Extended forecast period revised to use August release data. Source: Philadelphia Fed, BLS, and author’s calculations.

These two states account for about 18% of total NFP. Clearly preliminary August employment in NY has risen noticeably, but California employment has been trending sideways since the beginning of the year (not surprising given it’s a trade sensitive state).

Zandi was examining a larger set of indicators at the state level than just GDP and employment. Still, it is interesting that advance knowledge of state-level employment is helpful in predicting national recessions (Owyang, et al. 2013).

Republicans in congress have enacted a tax hike in texas that amounts to several thousand dollars by letting support for the aca expire. And alot of those are red voters. Abbott and paxton seem to love increasing taxes in Texas.