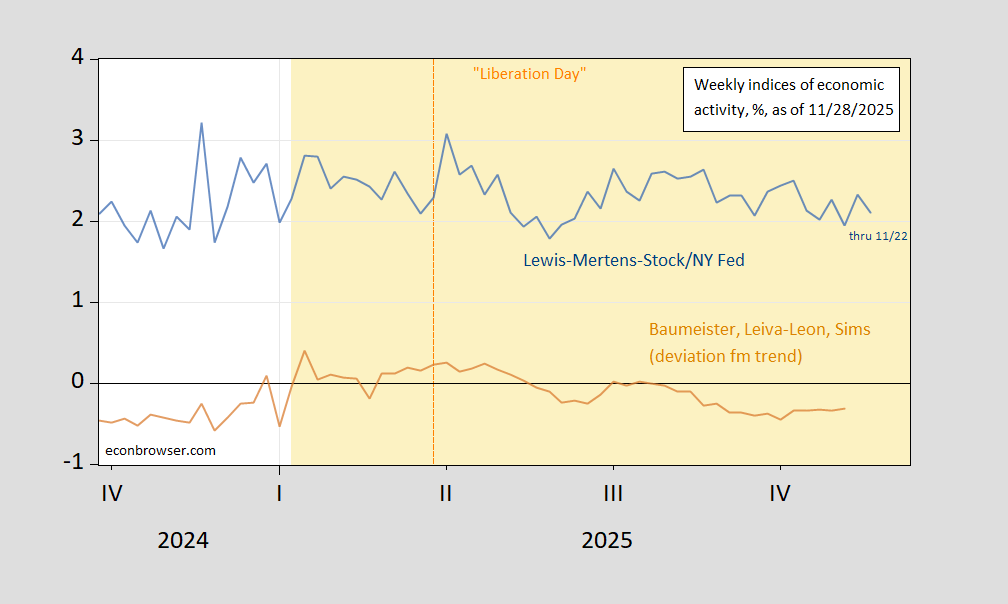

Growth has decelerated by about half a percentage point since Liberation Day.

Figure 1: Lewis-Mertens-Stock Weekly Economic Index (blue), and Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US (tan), all y/y growth rate in %. Source: Dallas Fed via FRED, WECI, accessed 11/28/2025, and author’s calculations.

Off topic – bank deregulation.

I’ve already linked to Fed gig-worker Miran’s speech, in which he says deregulating banks will allow the Fed to reduce it’s balance sheet. Here it is again:

https://www.federalreserve.gov/newsevents/speech/miran20251119a.htm

Miran is not, however, in charge of bank regulation. That responsibility falls to Michelle Bowman, also appointed by the felon-in-chief. Bowman is vice-chair for supervision, and like Miran, she thinks lighter regulation of banks is a good idea. Bowman has the power to do something about it, and she is; she has announced plans to cut the Fed’s bank supervision staff by 150, a 30% reduction:

https://www.bankingdive.com/news/federal-reserve-30-percent-employee-cuts-supervision-regulation-2026-bowman-bessent-powell/804518/

Keep in mind that “supervision” in this context doesn’t mean only “do this, don’t do that”. A great deal of a bank supervisor’s time goes into knowing what’s going on within and between banks, and between banks and their clients. The Fed has beefed up its financial intelligence effort dramatically in response to various financial shocks. Bowman will undo a part of that intelligence-gathering effort, reduce the Fed’s access to information, in the process of reducing bank regulation.

Remind me, how many of the felon’s cabinet members (campaign contributors, meme-coin buyers, relatives) got rich working in finance? Oh, and how many top bank execs lost their jobs, or their fortunes, when they crashed the global economy in the mid-2000s?