Treasury Secretary Bessent says housing is in recession because of high interest rates. Might not high policy uncertainty have some effect?

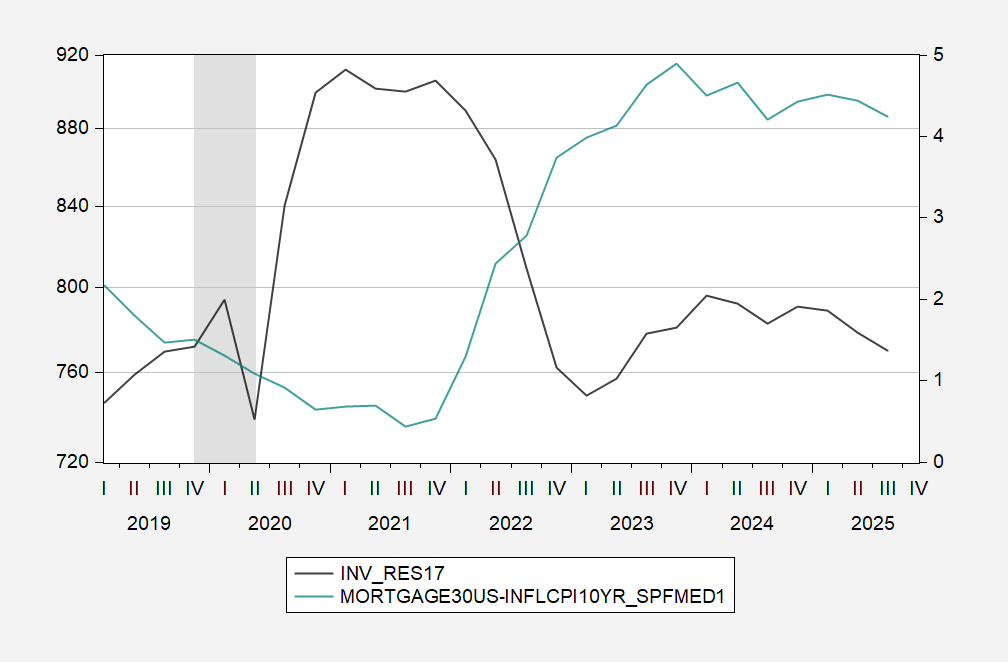

First, the 30yr mortgage adjusted by expected 10yr inflation:

Figure 1: Real residential investment, in bn.Ch.2017$ SAAR (black, left scale), 30 year mortgage rate adjusted by 10 yr SPF median inflation, in % (blue, right scale). 2005-2012 data is in Ch.2012$, rescaled into Ch.2017$. Q3 real residential investment is nowcast from GDPNow. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, Fannie Mae via FRED, Philadelphia Fed, NBER, and author’s calculations.

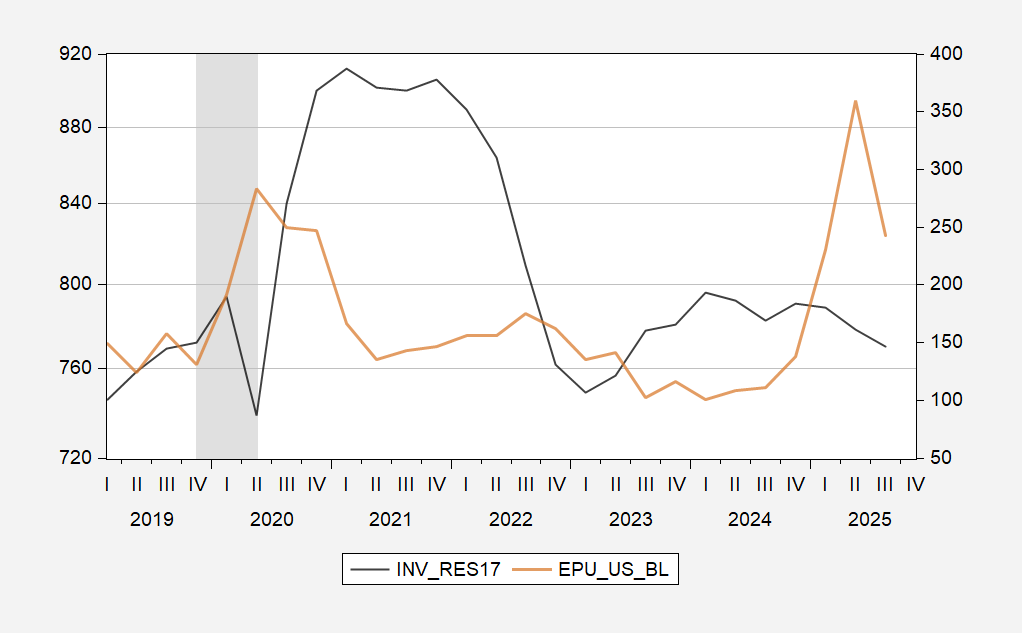

Now compare against Economic Policy Uncertainty (baseline):

Figure 2: Real residential investment, in bn.Ch.2017$ SAAR (black, left scale), Economic Policy Uncertainty, legacy series (tan, right scale). 2002-2012 data is in Ch.2012$, rescaled into Ch.2017$. Q3 real residential investment is nowcast from GDPNow. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, Fannie Mae via FRED, Philadelphia Fed, NBER, policyuncertainty.com, and author’s calculations.

Seems to me that policy uncertainty is at least as plausible as an explanation for the decrease in residential investment as high interest rates.

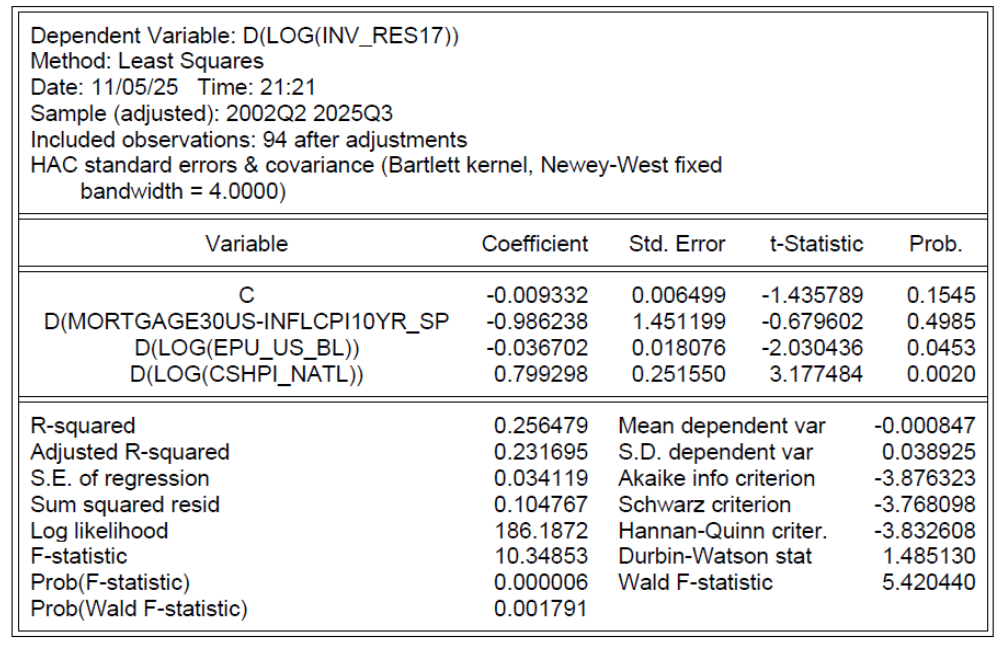

To verify this, I estimate a regression over the 2005-2025 period, in first differences, relating growth in real residential investment to changes in the real interest rate and EPU, and appreciation in house prices (from Case-Shiller national house price index).

I estimate the relationship in first differences because residential investment and house prices are unit root processes.

How to assess the relative importance of real interest rates vs. policy uncertainty? I refer to standardized coefficients, aka “beta” coefficients. The coefficent for policy uncertainty is twice the magnitude of that for the real interest rate (although the largest coefficient is for price appreciation): -0.08 vs -0.17 vs. 0.46. To the extent that house price appreciation depends on interest rates, the real interest rate effect could be larger.

Sandwich guy found not guilty. DC citizens are not going to just stand by and take it from the Puppy Killer’s goons.

Another loss, among many, for Fox News talking head Jeanine Pirro as US Attorney in DC.

The sand which trial encapsulates all that is wrong with the trump administration. Not serious about the world and incompetent decision making.

Off topic – Topple Maduro to topple Cuba?:

https://archive.is/20251104221916/https://foreignpolicy.com/2025/11/03/military-buildup-venezuela-us-cuba-trump-maduro/#selection-3363.0-3363.67

Cut Cuba off from Venezuelan oil and poof! Little Marco, following the thinking of John Bolton.

Who would govern? Who would pay? Who would profit? Times two.

A short-term deal to fund government is under discussion in the Senate. The idea is to re-open government while negotiating a full-year budget deal. Duh…

Looks like the threat of limited flights for Thanksgiving was scary enough to freak out the Senate majority. If there is a time limit on the short-term deal, we may end up doing this all over again soon.

The House would have to return to work, risking release of the Epstein files. So we might find out that a convicted felon and adjudicated rapist is also a statutory rapist. Quelle suprise. This is the guy who wandered through the dressing room of a teenage beauty pagent to gawk at naked under-age girls. Anyhow, Squeaker Johnson has by now had time to think of some other way to prevent the truth from coming out.

The Epstein files might have some nasty financial disclosures that make Trump’s pedophilia seem relatively unimportant. That wouldn’t surprise me a bit.