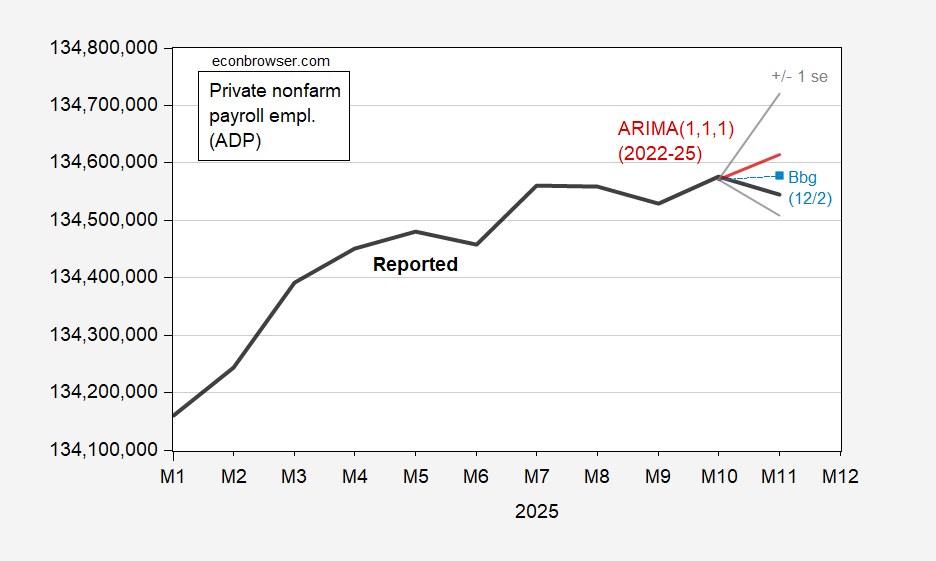

ADP private nonfarm payroll (NFP) employment down -32K vs. +5K Bloomberg consensus. Mfg employment down 6K.

Figure 1: ADP private nonfarm payroll employment, November release (bold black), ARIMA(1,1,1) forecast based on 22M01-25M10 (red), +/- 1 std error (gray), Bloomberg consensus of 12/3 (light blue square), all s.a. ARIMA estimated over 2022-2025M10 data. Source: ADP via FRED, Bloomberg, and author’s calculations.

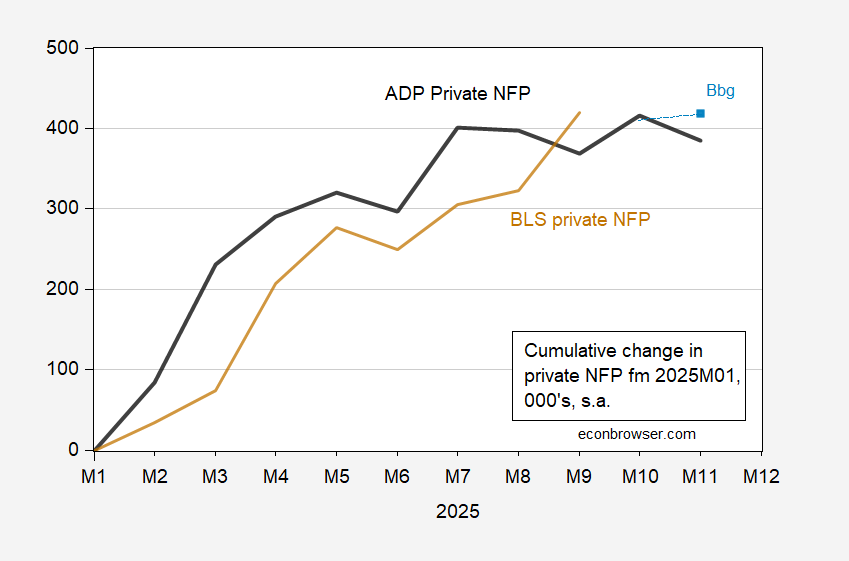

You can do an ocular regression to tease out the implications for the corresponding BLS series (over 2022M01-25M09

Figure 2: ADP private nonfarm payroll employment, November release (bold black), Bloomberg consensus of 12/3 (light blue square), BLS private nonfarm payroll employment (brown), all s.a. Source: ADP via FRED, Bloomberg, and author’s calculations.

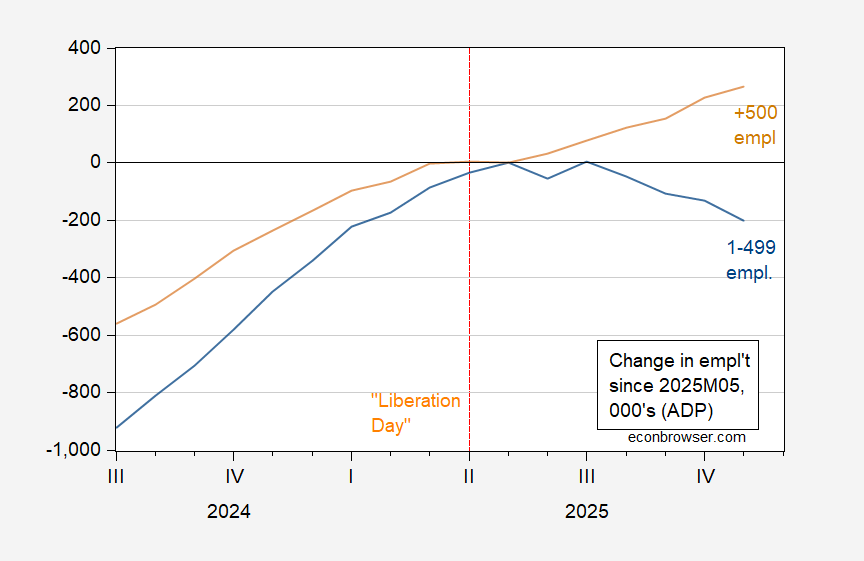

The divergence between small and large firm employment continues into November.

Figure 3: Cumulative change in ADP private nonfarm payroll employment for firms with less than 500 employees (blue), for firms greater than 500 employees (tan), from 2025M01, all s.a. Source: ADP via FRED, and author’s calculations.

Whether this presages a recession as it did in 2008, or not (say due due differential effects of deportations and removals, and/or tariffs for large vs. small firms) remains open.

The deportation raids and the withdrawal from the workforce due to fear is itself a negative as far as economic growth is concerned. Large numbers of people are no longer not working, therefore resulting in a direct decline in the amount of services and products produced by their labor, but they are no longer spending on goods and services, which has multiplier effects with declining sales and business contraction. Licknut, the Secretary of Commerce, actually made that point by accident by saying that affordability issues are not caused by tariffs (a lie since in part they are), but by “deportation.”

So trump wants to gut auto fuel efficiency standards. Atta boy, make cars less fuel efficient while simultaneously increasing gasoline costs with greater demand. Trump continues his assault on affordability for the working class.

From ADP’s Pay Insights report:

“Year-over-year pay for job-stayers rose 4.4 percent, down from 4.5 percent growth in October. For job-changers, pay was up 6.3 percent, slowing from 6.7 percent growth the month prior.”

So while changing jobs on average still gets a pay rise, the gain is getting smaller. Back in Aprill 2022, job switchers got an average 16.1% pay increase vs 7.7% for those who staid put. Pay gains are getting smaller in general.

It probably goes without saying but average hourly eraanings gains typically slow ahead of recession.