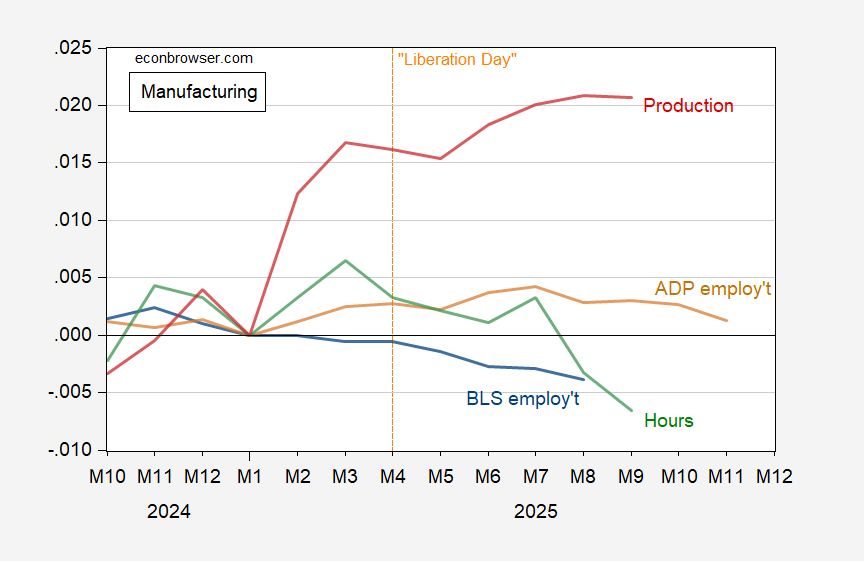

Manufacturing (gross) production up (until September).

Figure 1: BLS manufacturing employment, implied preliminary benchmark (blue), ADP manufacturing employment (brown), BLS aggregate manufacturing hours (green), manufacturing production (red), all in logs 2025M01=0. Source: BLS, ADP via FRED, and author’s calculations.

Employment, or rather wages cost, is a “short term” micro variable, along with inventory, maintenance and marketing expenses. These are the quickest to adjust when market conditions change. Textbook stuff. What we’re seeing is a what one expects to see in a cyclical slowdown. What, in detail, might be driving the decision to reduce short-term costs? The two broad categories from which answers can come are supply and demand.

On the supply side, we have issues of availability and cost. What do we know about these? We know that job opening, overall and in manufacturing, are down considerably from earlier in this cycle and in much closer alignment with hires that earlier in this cycle:

https://fred.stlouisfed.org/graph/?g=1OsIK

So labor availability is less of a problem now than earlier. How about labor costs? Unit labor costs are up from a year ago, though by less that is normally the case during expansion:

https://fred.stlouisfed.org/graph/?g=1OsJI

That’s 2.5% y/y overall, 2.6% for the factory sector. That’s less than the rate of inflation. So neither labor scarcity nor labor cost seem to be the problem; not labor supply.

Demand for labor then? Labor demand is derived from demand for output. Here’s the ISM factory new orders index:

https://ycharts.com/indicators/us_ism_manufacturing_new_orders_index

Not good. Seems like weak demand for output has led to weak demand for labor. That doesn’t explain the divergence between hiring at large and small firms, but we know that small firms are more financially constrained than larger ones. That’s why small firms tend to reducing costs of all kinds before larger ones do.

The data on labor costs are a bit old now. It may be that rising insurance costs have boosted unit labor costs since last time we got data. That would compound the impact of soft demand.