From AOL:

… I think the average Americans, they are hearing a lot from media coverage. And I will tell you that affordability has two components, there is inflation, and then there is real incomes. Real incomes are up about 1% and what we’re not going to do is say that Americans don’t know what they’re feeling. We’ve been working on it every day. I was on your show on March talking about affordability. The- we’ve made a lot of gains, but remember, we’ve got this embedded inflation from the Biden years, where mainstream media, whether it’s Greg Ip at the Wall Street Journal, toxic Paul Krugman at New York Times or former Vice Chair, Alan Blinder, all said it was a vibecession.

In some sense, I agree with the proposition that the level of consumer discontent, as measured by the U.Michigan Sentiment index or the Conference Board Confidence index, seems disconnected from aggregate economic activity. And, in general, median usual weekly earnings are up (slightly) relative to inflation:

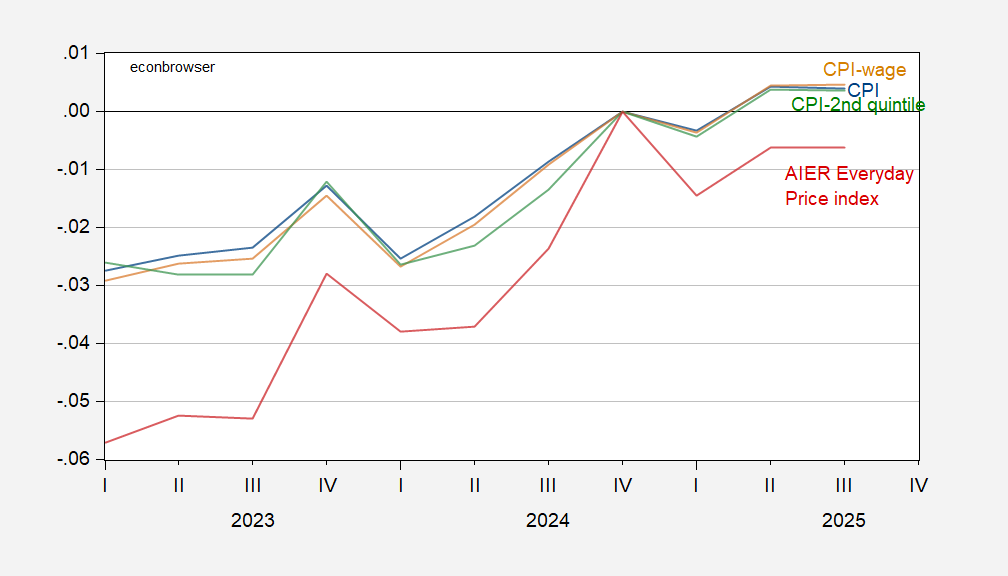

Figure 1: Real median weekly earnings, deflated by CPI-all (blue), by CPI-wage earners & clerical workers (tan) by CPI second quintile (green), and by AIER Everyday Price Index (AIER EPI) (red), all in logs, 2024Q4=0. 2025 Second quintile CPI extrapolated using regression first differences CPI 2023-24. Source: BLS via FRED, BLS, AIER, and author’s calculations.

The American Institute for Economic Research Everday Price Index (EPI™) suggests that real earnings are 0.6% below 2024Q4 levels.

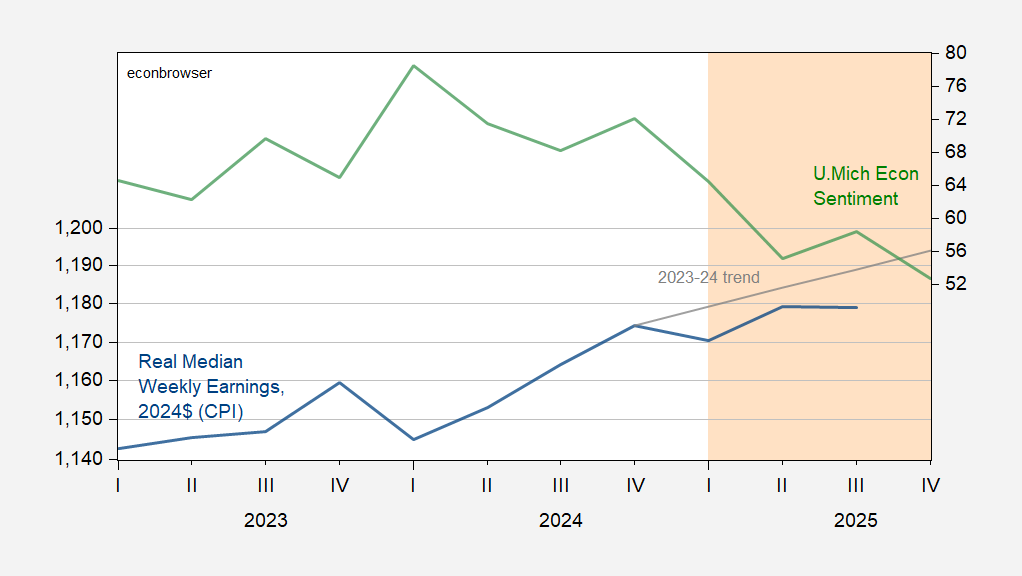

On the other hand, it’s not just the absolute level of income that matters; so too does the deviation from expectations. While we don’t have a direct measure of what people expected in 2025, we know what the trend growth rate was over the 2023-24 period.

Figure 2: Real median weekly earnings, deflated by CPI-all (blue, eft log scale), 2023-24 stochastic trend (gray), and U.Michigan Consumer Sentiment (green, right scale). Source: BLS via FRED, U.Michigan Survey of Consumers, and author’s calculations.

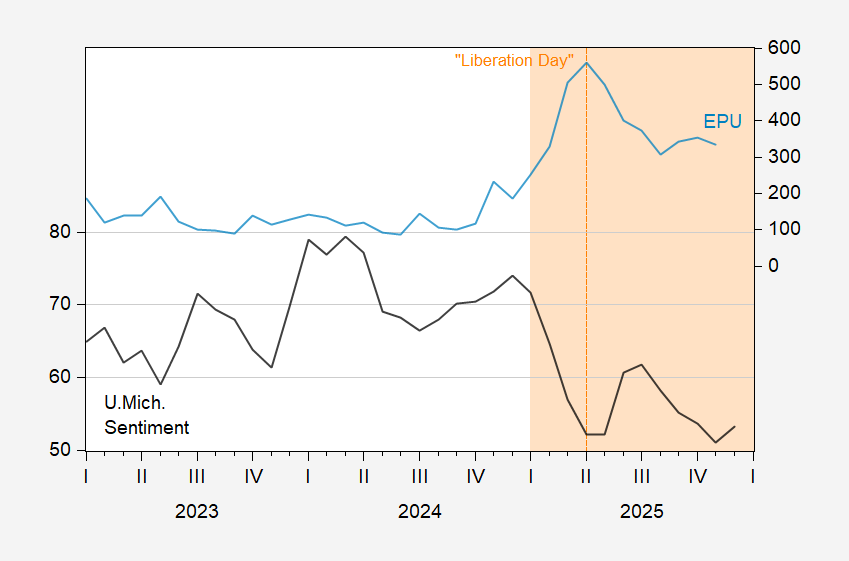

It’s also the case the economic policy uncertainty likely weighs on sentiment, and this the Administration has much to answer for.

Figure 3: U.Michigan Consumer Sentiment (black, left scale), EPU (news) (blue, right scale). Source: U.Mich. via FRED, policyuncertainty.com.

So, yes real median weekly earnings are up (in Q3, up 0.4% relative to 2024Q4), but presumably below expectations, accompanied by lots of uncertainty (In a world with risk averse agents, a wider distribution of states of nature will reduce welfare).

It’s too soon for the renewed deviation of labor compensation from labor productivity to be Bessent’s fault – or the fault of his felonious boss – but it’s something they ought to be aware of:

https://fred.stlouisfed.org/graph/?g=1OyKq

The obvious result of this deviation is that profits are sky high:

https://fred.stlouisfed.org/graph/?g=1Pik

With employment taxes providing the bulk of federal revenues, this pattern is not only bad for workers, but also bad for the budget. Somehow, I don’t think Bessent is going to do anything about it.

the wealthy certainly are doing great. there is no disputing that item. if you have money and already invest in the magnificent 7, you are making fistfuls of dollars. but inflation has been high all year long, and wages have not kept up. so those not on the wealthy side of the spectrum are struggling. but bessent is not talking to you, because you are not part of his world. trump is not concerned about those that are barely getting by.

If you really want to know what kind of person Scott Bessent is, here is a little story in two parts.

First you have Defense Secretary Pete Hegseth giving his Christmas greetings by posting a perverted mock up of Franklin the Turtle blowing up people in boats with a rocket propelled grenade. Note that Franklin the Turtle is a beloved Canadian character from children’s books and animated TV series for toddlers. See below:

https://www.npr.org/2025/12/02/nx-s1-5628269/hegseth-boat-strikes-franklin-turtle

Canadians were rightly upset at this desecration of a beloved children’s character and politely asked the US to please refrain from using him in their political warfare.

So in response, what did Bessent do but say “FU Canadians! You can’t tell me what to do!” and then posted his own rendition of Franklin wearing a MAGA hat. See below:

https://cdn.bsky.app/img/feed_thumbnail/plain/did:plc:t6ubj2wlhc34awzcymh3qpur/bafkreif2vqncywisqid5vvrdyy5kizdm6qh3qi33nvdzxqc6ureua4fm5e@jpeg

Criminy! What kind of psychopath behaves this way, let alone the Secretary of the US Treasury? Deliberately insulting a neighboring country using a toddler’s cartoon character? After being politely asked not to. Can you imagine any other Treasury Secretary in history behaving in this manner? Bessent is a twisted, disgusting, lying degenerate.

Any conversation that takes anything he says seriously is a waste of time.