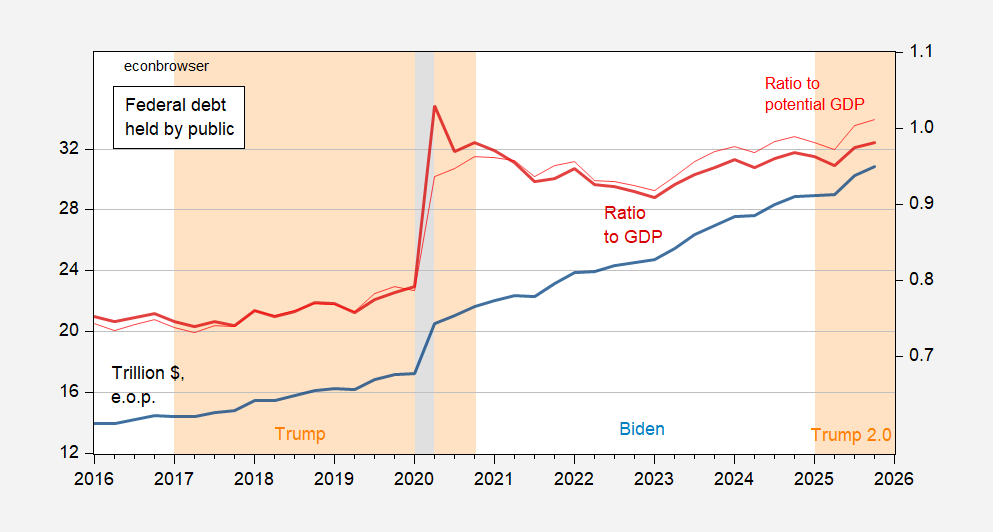

The graph says it all.

Figure 1: Federal debt held by the public, trn $, end-of-period (blue, left log scale), ratio to nominal GDP (red, right scale). 2025Q4 nominal GDP uses September CBO Economic Outlook projection growth rate. Source: FYGFDPUN from Treasury, BEA via FRED, Treasury, CBO and author’s calculations.

Total increase in debt 2017Q1-2020Q4: $7.3 trillion, 22.5 ppt of potential GDP

Total increase in debt 2025Q1-2025Q4 (only 3 quarters): $3.2 trillion, 3.1 ppt of potential GDP

Total increase in debt 2021Q1-2024Q4: $6.9 trillion, 2.8 ppt of potential GDP

Trade theory question – Is this a big deal?:

https://archive.is/cZnth#selection-505.0-505.68

Are European and Latin American economies sufficiently complimentary, whatevrr “complimentary” means, that lowering of trade barriers will make a big economic difference? I don’t know.

We are obviously not in a Ricardian situation. Probably not in a Hecksher-Olin situation. Are we Stolper-Samuelson? Under S-S, Europe’s rich get richer, Latin America’s not-rich get richer, and everybody else gets poorer, in relative terms. The bigger the trade flow induced by lowering barriers, the greater the shift in relative income.

New trade theory? Dunno. I don’t know enough about the similarity of technology and production between the two regions to figure it out.

Gravity? Distances and shipping costs are greater than with North America. Seems like Canada and Mexico are in line to benefit more than Latin America ftom U.S. trade policy mistakes. That doesn’t mean no gains from the new LatAm/Europe trade deal, just a limit due to cost.

Anybody?

Macroduck: In new trade theory with monopolistic competition, gains from trade arise even if countries don’t have comparative advantage with respect to each other (from either Ricardian or factor endowment motivations). See these slides.

Gracias.

Off topic – more signs of a possible attack on Iran:

https://www.msn.com/en-us/news/world/middle-east-on-edge-as-embassies-close-citizens-flee-and-us-military-surges-into-region/ar-AA1TSoBn

When governments begin evacuating their diplomats from and advising citizens to leave a country or region, it is an indication violence is about to erupt, or to get worse. In the case of India and Australia advising their citizens to leave Iran, street demonstrations and violent retaliation against demonstrators may be the proximate concern.

Russia withdrawing its diplomatic mission from Israel is another matter. Russia has maintained and strengthened ties with Iran during its war against Ukraine and heightened in both countries, but that hadn’t led to evacuation flights till now. The worry is unlikely to be an Iranian attack on Russian diplomats, but retaliatory bombing might be indiscriminate.

And there’s this:

https://caliber.az/en/post/media-dozens-of-us-military-planes-head-to-middle-east-iran-boosts-air-defence

More reports of U.S. military assets heading for Mideast bases, mostly aircraft and support equipment. Bombing, not boots.