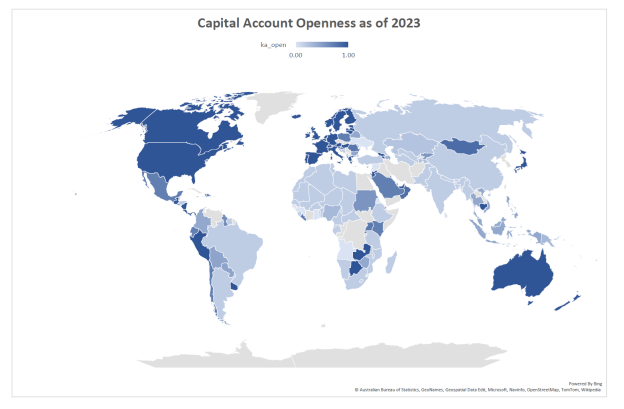

Just published, Chinn-Ito index, available here. Normalized to [0,1], with 1 being most open, here’s the world.

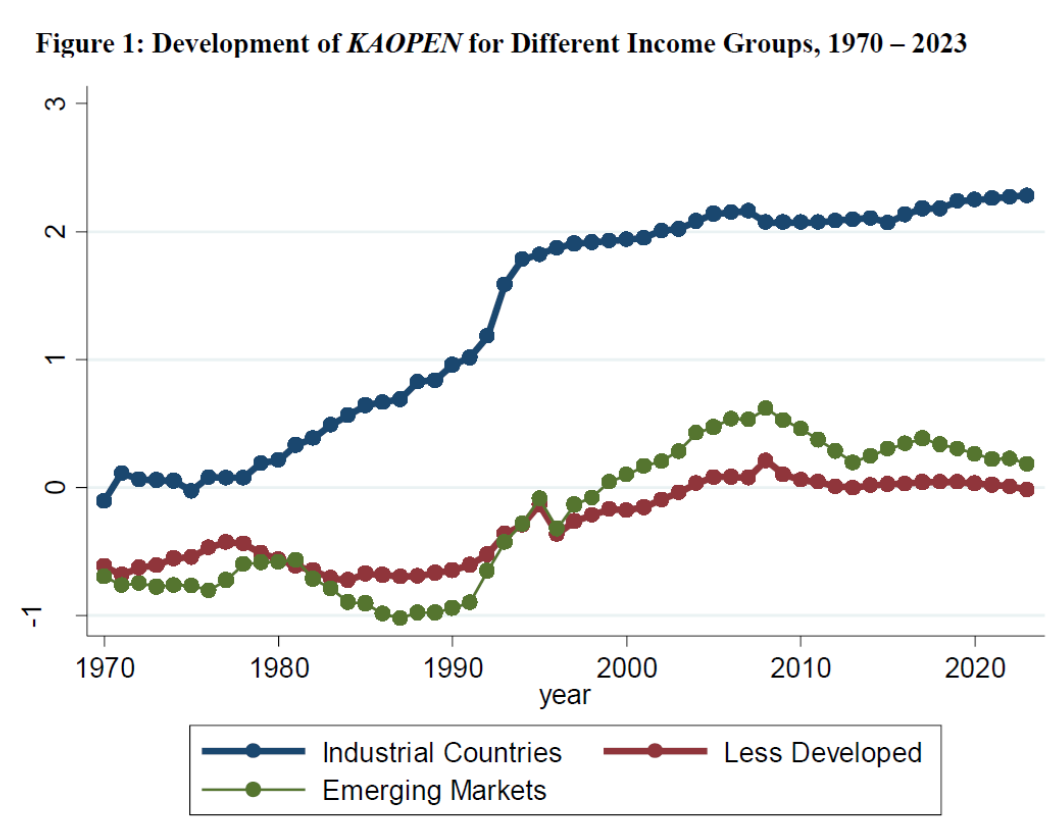

Here’re average values for country groupings.

The description of the current dataset is Ito and Chinn (2025).

Hiro Ito and I constructed the index because there were few, widely available and consistently updated measures of financial openness at the time, with the exception of Quinn’s (APSR, 1997) measure, which at the time was more limited in coverage. Individual dummy variables based on the IMF’s (old) de jure classification of controls (on exchange rates, export proceeds, capital account, current account) didn’t prove informative in one of my early empirical analyses of financial development (Chinn, 2004, ungated version here). The Chinn-Ito index, based on the aforementioned IMF de jure classifications, was converted into a single index using by taking the first principal component (essentially — the capital account component is smoothed), and was developed for a project to assess how financial openness correlates with financial development, published in JDE (2006) (with lots of help from friends, including Ashok Mody, Antu Panini Murshid).

The most recent work of ours using the index is “Measuring Financial Integration: More Data, More Currencies, More Expectations,” Chapter 2 in Handbook of Financial Integration, edited by Guglielmo Maria Caporale, Edward Elgar, 2024.

Quinn, Schindler and Toyoda (IMF Econ Rev 2011) provide an early comparison of measures. More recent comparisons are in Graebner et al. (2021) and Erten et al. (2021). In the aggregate, the measures move together.

I see Greenland is not covered. That’s why we need to take it over.

Off topic – Looks like maybe talks to end Russia’s war on Ukraine are making progress:

https://globalnews.ca/news/11637930/united-states-ukraine-security-agreement/

Here’s a fuller Zelenskyy quote, not from the link:

“For us, security guarantees are first and foremost guarantees of security from the United States. The document is 100% ready, and we are waiting for our partners to confirm the date and place when we will sign it.”

Zelenskyy says Congress will hold a vote for security guarantees, which would be a good thing. Even so, a U.S. security guarantee is only as reliable as the president responsible to enforce it.

Russia is, if course, bombing Ukraine’s power grid intensively at mid-winter to pressure Zelenskyy. Not sure how much influence that will have on the terms of a deal.

If the war is about to end, Ukraine will still be on Russia’s border and Russia will still be Russia, but an troublesome peace is almost always better than war.

The NYT careies the suggestion that Russia is just stalling for time:

https://www.nytimes.com/2026/01/26/world/europe/russia-ukraine-war-peace-talks.html

If so, it’s because they need time for some specific goal. We should not allow them whatever it is they are trying to gain by stalling.

There were reports today that Treasury called fx desks to check yen rates. Usd/Jpy fell by 1.7% from Friday’s close. Speculation is that Treasury’s real concern is that yen weakness is putting upward pressure on U.S. interest rates. Even so, U.S. Treasury rates were pretty steady today, despite the big response in Usd/Jpy.

There is still a sizable spread between U.S. and Japanese overnight rates, but there was an even larger spread in 2024, and still there was a massive carry-trade unwind as U.S. rates came down and BoJ rates rose:

https://fred.stlouisfed.org/graph/?g=1QVhZ

One big difference is that in 2024, the yen strengthened as the rate differential narrowed – classic carry trade unwind – while these days the yen is weakening. So far, Treasury has managed to strengthen the yen for one day with some fx rate checking, but done little for interest rates in the U.S. or Japan.

So here’s just a bit of wild speculation in my part. Remember when Treasury gave Argentina billions to prop up its currency ahead of legislative elections? Well, the yen is weak and the new PM has called early elections. Maybe Bessent is thinking short term. Volatility is bad, and it can spread. U.S. long-end interest rates have risen along with Japanese rates, and a sudden shock in Japan’s markets could spill over to the U.S. So instead of trying to buffalo markets into lower rates, Bessent, at Japan’s request perhaps, is trying to buy some calm into the election. He has done it before.