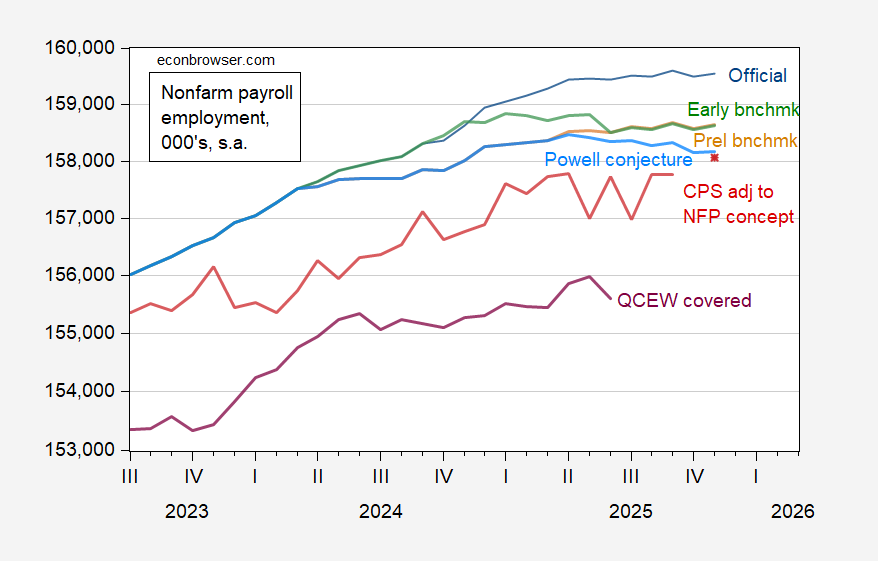

Early Benchmark suggests a downturn, as does QCEW, Powell conjecture:

Figure 1: Official nonfarm payroll (NFP) employment (blue) ,implied preliminary benchmark (tan), Powell conjecture applied to implied preliminary benchmark (sky blue), early benchmark (green), CPS adjusted to NFP concept (red), and QCEW total covered seasonally adjusted by author using X-13/log transform (purple), in 000’s. Source: BLS via FRED, BLS, BLS, BLS, Philadelphia Fed, and author’s calculations.

Implied benchmark calculated by wedging in the preliminary benchmark between April 2024 and March 2025, and using reported changes thereafter. The early benchmark is calculated by applying the ratio of sum of early benchmark state employment to sum of CES state employment to official BLS NFP employment, and reported changes thereafter. The Powell conjecture applies the 60K overcount estimate cited by Jay Powell to April-November NFP changes.

QCEW total covered series is seasonally adjusted in log terms using Census X-13, with X-11 ARIMA default.

Off toopic – As pointed out earlier, big U.S. oil companies have told the felon-in-chief administration for some time that they aren’t interested in investing in Venezuela:

https://www.politico.com/news/2025/12/17/trump-oil-venezuela-return-00695292

So how does the felon think he’s going to turn Venezuela into an oil bonanza? By bullying oil companies into investing:

https://www.politico.com/news/2026/01/03/trump-venezuela-oil-us-companies-return-00709782

It appears that the felon is offering a recovery of abandoned physical capital on the condition of major financial investment. I kinda have the impression that’s the same as his initial plan, but now with the explicit condition that there will not be no recovery of assets for those who don’t invest. Not sure that’s going to appeal to oil companies.

So look for some additional carrot, or stick, to avoid egg on the felon’s face.

By the way, I’ve seen the claim that it’s really the financial industry that is howling for Venezuelan oil assets. Oil in the ground can become financial collateral, more collateral means more financial asset – more financialization – so a bonanza for the financial sector. Not sure how that works under conditions of high political and business uncertainty. Highly speculative paper assets based on physical assets with a dubious net present value don’t make good collateral.

Wall Street DOES have plans for Venezuela:

https://www.wsj.com/livecoverage/venezuela-strikes/card/finance-industry-eyes-investment-opportunities-in-venezuela-CmtLevzMTXEvRLkADjbG?mod=author_content_page_1_pos_1

Funny how the recent issue of The Economist is all gung-ho on the U.S. economy in 2026. It’s easy to look at some of the numbers from 2025 and conclude that Trump hasn’t been that bad. And if you’re someone with cash on hand it feels good to pour it into crypto and AI and watch the numbers go up. These are people who seem to have forgotten the dot com bust, or the militant profligacy of the Bush era, or the Great Recession, or heck—the Pandemic.

The music is about to stop, but when and for how long?

Oh, and let’s not forget that Guyana and, to a lesser extent, Suriname now represent investment opportunities in the same region, without all the drama, and without the risk inherent in the felon-in-chief’s make-it-up-as-you-go relationship with the law. Why roll the dice in Venezuela when there’s a glut of oil, Venezuela’s political and legal circumstance are sketchy and there are big fields opening just down the coast?

Venezuela is a decade, at best, to reenter the global oil market on any large scale. you don’t rebuild an entire oil industry, which is what they need to do, in the middle of a war zone, in the course of a few months. and the prospect of reopening one of the largest oil reserves on earth does not bode well for future oil investments in other parts of the world. with the maduro crowd, you had certainly that the oil would never really make it to market on a large scale. now you have a lot of uncertainty on whether the oil will produce big time, or actually produce nothing at all. those are probably equal probability events. if you are an oil producer, how to you plan the future with such a dichotomy?