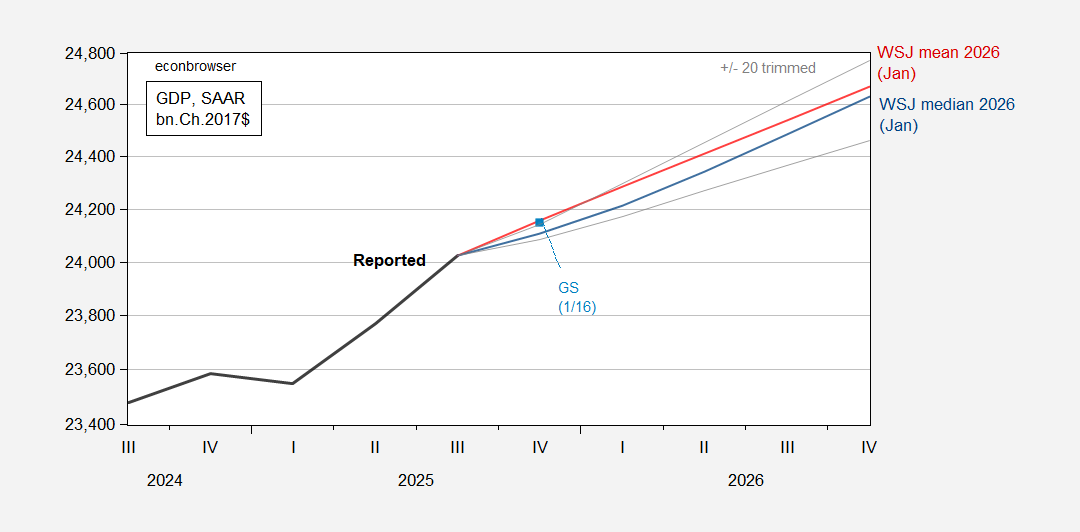

While the mean forecast is for around 2.2% growth in 2026 (see this post), the trimmed 20% band suggests some downside risks.

Figure 1: GDP as reported (bold black), WSJ January mean (red), WSJ January median for 2026 (blue), 20% trimmed high/low band (gray lines), and Goldman Sachs 1/16 tracking (light blue square), all in bn.Ch.2017$ SAAR. Source: BEA, WSJ January survey, Goldman Sachs, and author’s calculations.

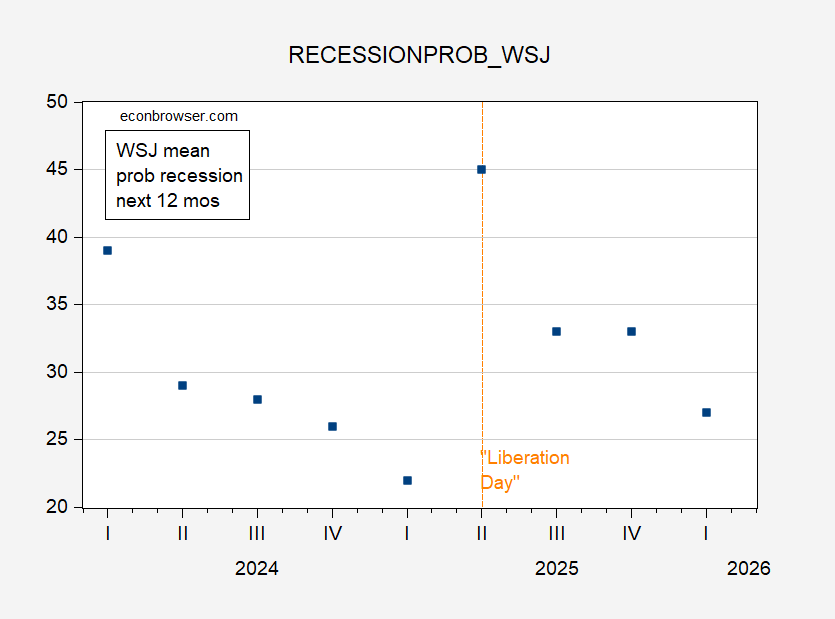

That being said, the mean response to the probablity of recession in the next 12 months dropped from 33% in the October survey to 27% in the current.

Fgure 2: Mean probability of recession in the next 12 months, % (blue squares). Source: WSJ survey.

Only two out of 74 respondents (AC Cutts and Joel Naroff) predict two or more consecutive quarters of negative GDP growth.

Sweden has sent troops to Greenland along with Germany, France, the Netherlands, Norway and Finland.

Who would have guessed that Sweden would wait 80 years to join NATO, not to fight Russia but the US of A.

And today Trump said he will impose 200% tariffs on French wine if Macron doesn’t give him $1 billion for Trump’s “Board for Peace” in Gaza.

He’s just running a Mafia shakedown organization. It’s up to the Supreme Court whether they go along with this demented Roman emperor.

When are Europeans going to learn that there are no deals with Trump. There are only temporary concessions until Trump decides otherwise.

Europeans know what they are dealing with – they are just biding for time while they try to mitigate the potential damage from a complete melt down in relations. As you mention below the Danes had one of their pension funds pull out – and we are seeing a nervous reaction in the US treasury markets. Europe know how to get TACO for dinner. They also know that tough theatricals are for the weak – the strong just give you a look.

Baffling says: ” European countries do not own those bonds. they are held by European companies for private entities, for the most part. the governments do not control those funds (outside of Norway and its sovereign wealth fund). if they tank the treasuries market, they will take a large loss themselves-the private market that is.”

Then we have this: Danish pension fund to dump US treasuries. “The US is basically not a good credit and long-term the US government finances are not sustainable,” says chief investment officer.”

That is how a classic bank runs occurs. Someone makes a small move and prices drop. Sure, others know they will lose if they dump their Treasuries, but they will lose even more if they wait while others get out first. So there is a stampede for the exit as everyone tries to get out before it goes even lower.

Its an issue of magnitude. $100 million? We are talking trillions of dollars in treasuries here. Where else u gonna put that cash? Rubbles? Unless trump threatens nonpayment. That is a whole new ball game. How much yield do think dumping will add?

Trumps bet is that the world will not blow up financial stability over greenland. If trump threatens nukes, will Europe dare him over greenland? Putin is watching closely.

There will be enough dumping to hurt. Then too weak taco will get reined in by business interests. At least I hope that’s what happens. Congress sure isn’t doing its job.

Europeans don’t need to sell. The U.S. rolls over billions in debt every week. All that would have to happen is for the foreign bid at weekly auction to dry up, and yields would jump. Yes, there’s a huge trade in secondary markets, but auctions ARE the primary market. Auction results have a massive benchmarking effect for fixed income prices. That includes mortgages prices, by the way. If the GSEs buy $200 billion in MBS but the cover at Treasury auctions collapses, Treasuries will win the tug-of-war over mortgage rates.

By the way, we shouldn’t ignore what’s happpening in Japan. Big whoopsie 8n the bond market:

https://www.bloomberg.com/news/articles/2026-01-20/japanese-bonds-may-rebound-after-katayama-calls-for-market-calm

That adds risk to fixed income markets in general.

“Europeans don’t need to sell. The U.S. rolls over billions in debt every week. All that would have to happen is for the foreign bid at weekly auction to dry up, and yields would jump.

Exactly. Because of rollovers, refusing to buy rolled-over debt is effectively the same as selling. Prices go down, yields go up. This increases the US debt burden and further weakens trust in Treasuries, leading to a death spiral.

So where will they put those large sums of money? What were to happen if trillions in risk free (or close to it) bonds disappeared?

Off topic – I’m not the only one:

“Gretchen Whitmer says it’s not ‘paranoia’ to fear Trump using homeland security personnel in elections”

https://www.npr.org/2026/01/20/nx-s1-5675187/gretchen-whitmer-trump-midterm-elections

Target a majority Democratic city in a swing state with ICE goons (check). Send them to polling places on the pretext that illegal immigrants will try to vote. Intimidate voters. Suppress voting by Democrats and Democratic-leaning voters.

That’s just one approach. ICE goons couls also be used to suppress Democratic get-out-the-vote efforts.

Violations of voters’ rights are never redressed by reversing the outcome of elections. Steal an election and it’s yours to keep.

And what does Cory Booker think we should do to prevent ICE abuses? Body cameras. Schumer seems to think a stern warning will do the trick. CUT FUNDING! It’s an immediate tool to reduce ICE abuses. It’s what the felon-in-chief does every time he sees a program he doesn’t like.

Politics is about power. Money is power. Democracy is at stake. Seems pretty simple.