As of yesterday (discussion in WSJ):

CBR estimates 0.9% growth for 2025 y/y. It also estimates y/y December inflation at only 5.6%, so take that as you will.*

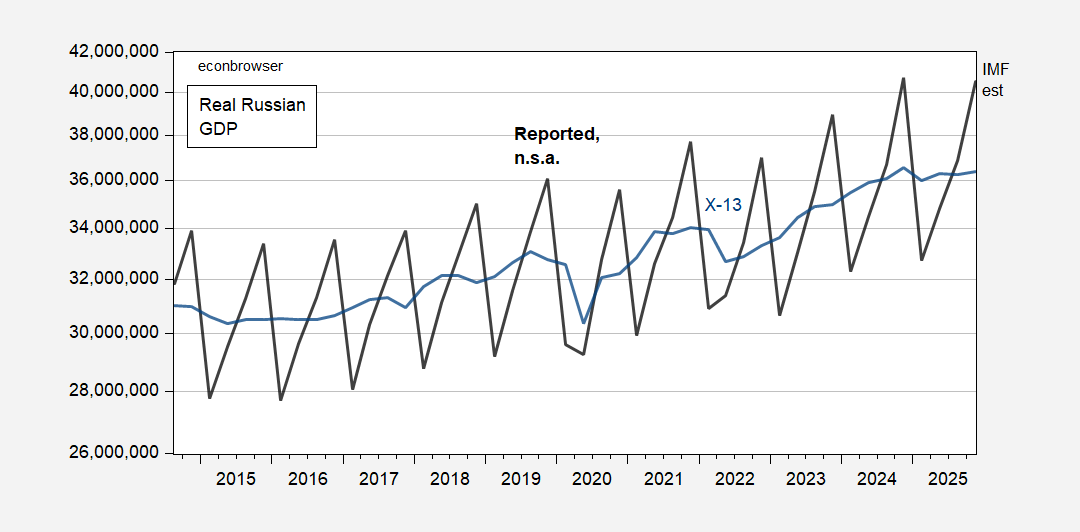

Here’s reported GDP:

Figure 1: Russian real GDP, n.s.a. (black), seasonally adjusted by author using X-13 (log) (blue), all in mn.Rub. 2025Q4 figure is from January WEO. Source: IFS via FRED, WEO (January), and author’s calculations.

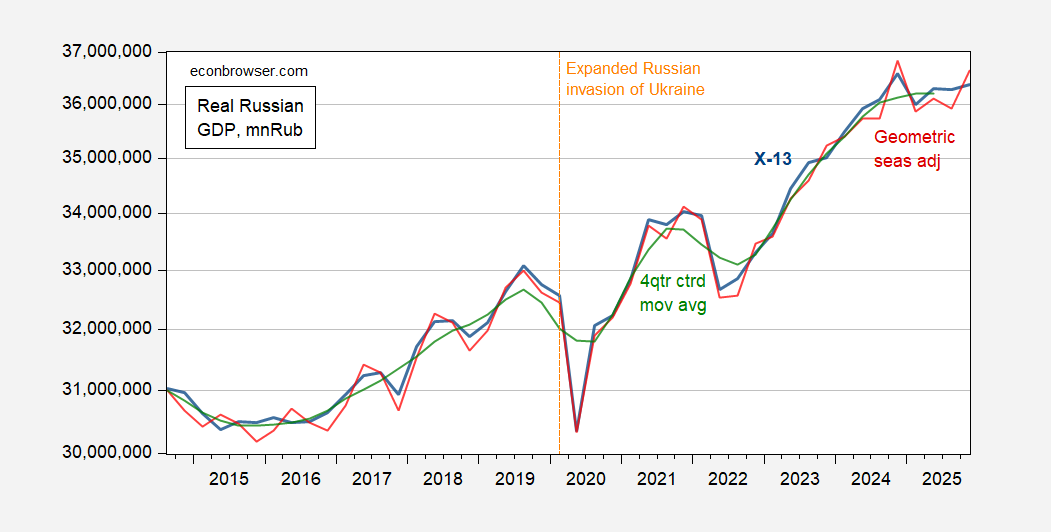

I add in a seasonally adjusted series, using X-13 to show the slowdown since 2024Q4. Discussion of what is more likely the path of GDP is in this post. Taking the reported as indicative, we consider alternative seasonally adjusted series.

Figure 2: Russian real GDP, seasonally adjusted using X-13 (blue), using geometric moving average deviations (red), and 4 quarter centered moving averages (green), all in mn Rub. 2025Q4 figure is from January WEO. Source: IFS via FRED, WEO (January), and author’s calculations.

BOFIT‘s assessment, based on reported data:

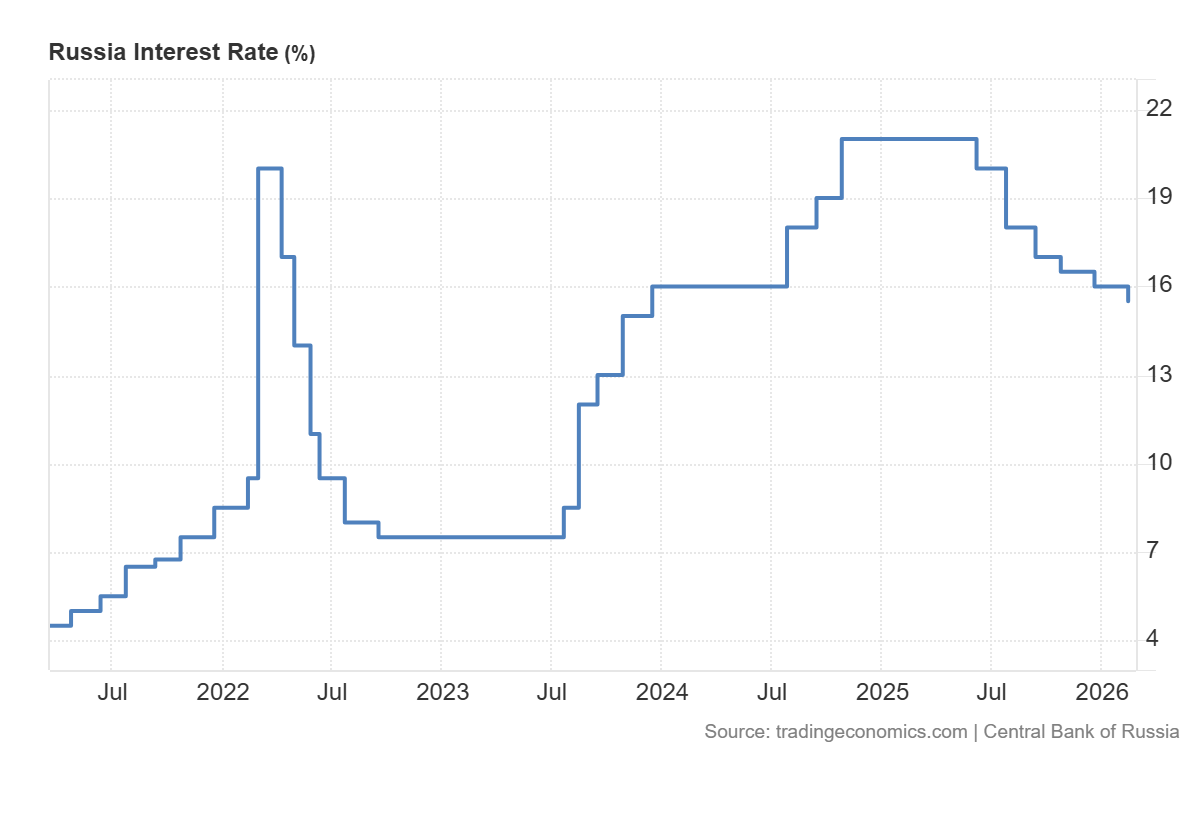

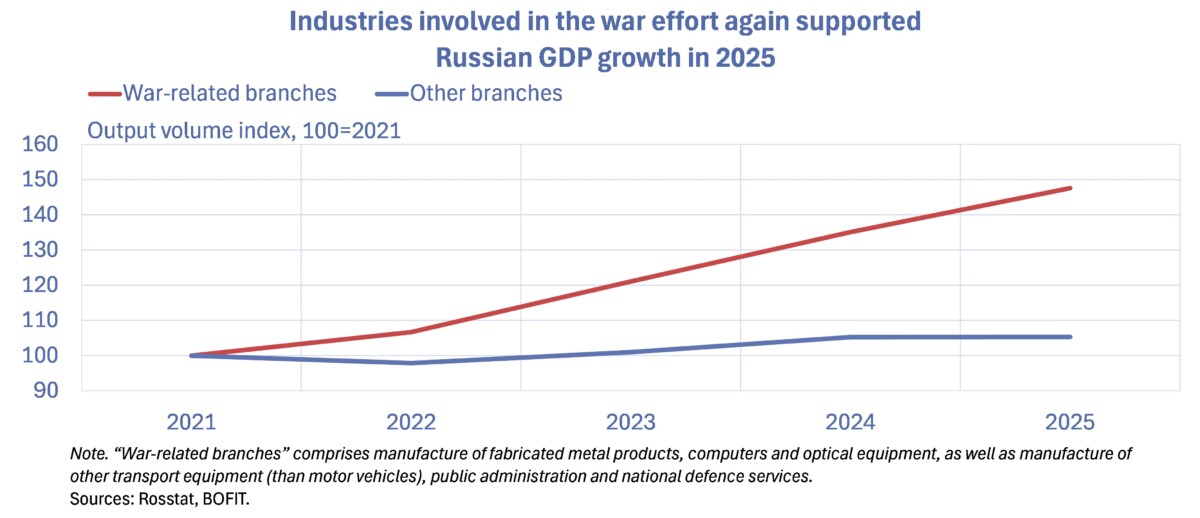

Russia’s economic growth slowed sharply in 2025 with on-year GDP growth of only 1 %. Growth faded last year despite a rapid increase in government spending and widening government deficit. Labour shortages and strained capacity utilisation limited the possibilities for further increases in output and increased inflationary pressures. Inflationary pressures were restrained through severe monetary policy. Even if the Central Bank of Russia (CBR) started last summer to gradually cut its key rate it was still high at 16 % in end-December. Although inflation slowed towards the end of last year, consumer prices on average were still up 9 % for all of 2025.

Broad-based slowdown

Preliminary Rosstat figures show Russian GDP grew by 1 % in 2025. The slowdown in domestic demand growth was broad-based. Household consumption grew by about 3 %. Growth was slightly slower than in pre-pandemic years (2017–2019). Growth in public sector consumption also slowed. Most of the increase in public sector spending last year apparently went to fixed investment. Investment growth overall slowed sharply last year to around 2 %, implying weak private sector fixed investment.

BOFIT assesses that all the growth since 2021 is accounted for by “war related” activities.

Source: BOFIT, 13 Feb 2026.

While many have predicted a more severe decline in output, particularly in the immediate post-sanctions period, several observers have argued that the slowdown has finally arrived.

From the Atlantic Council:

In the first two years of the full-scale war, the Kremlin was not forced to face the trade-offs it is facing today. Military-led economic expansion was not at odds with broader economic growth for a number of reasons that no longer hold true.

First, high inflation has forced the CBR to raise interest rates substantially as it attempts to pump the brakes on the overheated economy. With a key policy rate of 16.5 percent (down from a high of 21 percent), fewer businesses can afford debt-fueled growth. Furthermore, a significant share of economic actors receive subsidized interest rate loans; one-sixth of all new loans issued in 2023 were subsidized at below-market rates. Russia’s subsidized mortgage program made up a majority of these funds and was more distortionary than preferential loans to the corporate sector, but it ended in July 2024. The remaining portfolio of subsidized loans, held primarily by large banks, ranges from innocuous recipients—the agricultural sector, small and medium-size enterprises, and strategic industries—to defense contractors and the military-industrial complex writ large, which the Kremlin funds with “hidden war debt.”

…

Second, the external environment has deteriorated significantly. In Russia’s case, this is first and foremost a question of oil and gas exports. Soaring energy prices—and the delayed application of key measures such as the G7’s oil price cap—supported the Russian economy, the ruble, and the government budget in 2022. … Now, three and a half years into what was envisioned as a three-day war, energy revenues have structurally changed (see the analysis above). Depressed oil prices amid a global oil glut, China’s unwillingness to import more Russian natural gas via stalled projects like the Power of Siberia 2 pipeline, the EU’s measures targeting India’s refining of Russian crude oil, and Washington’s sanctions against Rosneft and Lukoil all represent real challenges for Russia’s economic prospects.12 Regular Ukrainian strikes on hydrocarbon processing facilities have also hit Russia’s bottom line and show no sign of letting up.

Third, Russia has burned through the reserves that it built prior to its full-scale invasion. Russia’s most important buffer has been the NWF, its sovereign wealth fund. Moscow has heavily relied on the NWF for budget financing—withdrawing more than 7.5 trillion rubles ($93 billion) for fiscal financing, while more than $300 billion of CBR reserves were immobilized in sanctions coalition countries. The NWF’s liquid funds, holdings of foreign currency and gold, have dropped by nearly 60 percent and now consist of just renminbi and gold, as Russia sold all hard currency assets in 2022. Once again, this is not an existential threat to the Russian economy, as the government’s ability to fund its deficit with debt issuance has been consistent. However, the depleted NWF is a lost buffer that creates new trade-offs for the Kremlin. If Moscow continues its war-related spending spree, it must fund its deficit by selling even more debt to domestic banks; if it does not continue its fiscal expansion, it no longer has the NWF to cushion the fall for the general population.

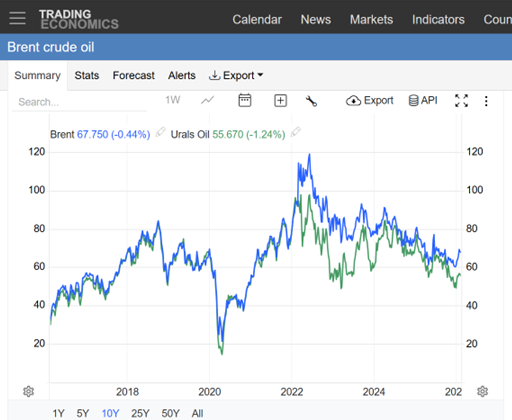

On the second point, see this recent widening of the Brent-Urals spread:

As the Kremlin faces ever more challenging tradeoffs of continued aggression vs. domestic spending and controlling inflation (measured and repressed), it seems that now is not the time to capitulate to a 2026 version of the Munich Pact.

* According to CBR, median perceived inflation over the previous 12 months as of Q4 was 14.4% (official 6.6%), while median expected for next 12 months was 13.2%.

Repeating a link:

https://financialpost.com/news/economy/russia-memo-return-to-u-s-dollar

Russia wants to reintegrate into the global dollar economy and engage the U.S. in an effort to increase fossil fuel use. This plan seems an ackowledgement of the economic weakness Menzie highlights in this post.

The Soviet Union crumbled in part because of low oil prices and had nearly done so once before. Now, a Russia set in reasserting its dominance over former Soviet states faces the lowest oil prices since early days of recovery from the Covid recession, low oil-sector investment and an economy suffering the effects of diverting resources to an illegal war. Time to keep the pressure on.

Russia picked this fight. By all means end the war, but don’t rehabilitate Russia. Doing so is not in the U.S. national interest.