From The Hill:

President Trump’s incoming national security adviser John Bolton said Sunday he hopes impending economic tariffs against China could be “a little shock therapy” for the country.

From The Hill:

President Trump’s incoming national security adviser John Bolton said Sunday he hopes impending economic tariffs against China could be “a little shock therapy” for the country.

夫未戰而庙算胜者,得算多也;未戰而庙算不勝者,得算少也。

The general who wins the battle makes many calculations in his temple before the battle is fought. The general who loses makes but few calculations beforehand. — Sun Tzu

Guess which sentence applies to which side in the incipient struggle?

I’ve got new event study examples for my finance course! Trade policy measures that are evaluated to hurt profitability of major US listed firms have definitive effects on the Dow Jones index.

Figure 1: Dow Jones Industrial Average index. Red bold lines at announcement of impending Section 232 national security based trade restrictions on steel, and Section 301 trade sanctions aimed at China. Source: TradingEconomics.

Continue reading

There seems to be some confusion regarding the distinction between trade balance in goods and services (a typical macro variable of interest) and trade balance in goods (more commonly reported, but less and less relevant on its own as countries become more service intenstive). In order help remedy this confusion, I plot below freely and easily accessible data, for those willing to expend a few calories to click.

I was interviewed on the weekly newsmagazine Here and Now today about Mr. Trump’s tariffs on steel and aluminum:

Regarding Wisconsin, cheese was not on the Hit List, but motorcycles and cranberries were.

which should give you pause for thought about national-security-rationalized tariffs. Output stable, real prices up.

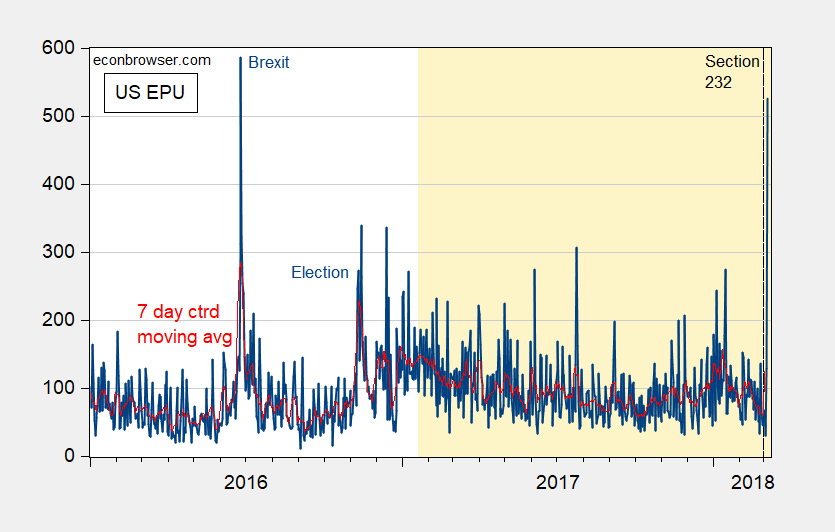

Remember those quaint notions of policy uncertainty holding back growth? Well, what to make of recent moves in uncertainty and risk indices, given all the talk of trade wars?

Figure 1: US daily Economic Policy Uncertainty index from Baker, Bloom and Davis (dark blue), and seven day centered moving average (red). Orange shading denotes Trump Administration. Source: policyuncertainty.com, and author’s calculations.

Figure 1: Dow Jones, 15 minute increments. Source: TradingEconomics.

Mr. Trump has stated his intention of raising tariffs on steel and aluminum, based on national security grounds. See this post on the specious aspects of this argument, and this recent EconoFact column on the hits to the economy that would result from steel tariffs. The EU has hinted at striking at Wisconsin cheese in retaliation (Wisconsin is the second largest state exporter). This makes perfect sense from a strategic perspective – agriculture is America’s comparative advantage, and Wisconsin’s Representative Paul Ryan is Speaker.