Last year’s recap was entitled “Year in Review, 2021: Cleaning Up What Trump Wrought”. This year, with rational policymaking returning, it’s time to erase stupidity.

Category Archives: Uncategorized

“Foreign direct investment under uncertainty” up to 2019

A new paper in the Review of International Economics, coauthored with Caroline Jardet and Cristina Jude (both Banque de France). From the conclusion:

GDP Nowcasts as of 12/10: Growth in Q4

We have Q4 nowcasts and tracking estimates as of 12/9, and implied Q4 from Lewis-Mertens-Stock WEI.

GDP Prospects

Atlanta Fed nowcast at 3.4% q/q SAAR:

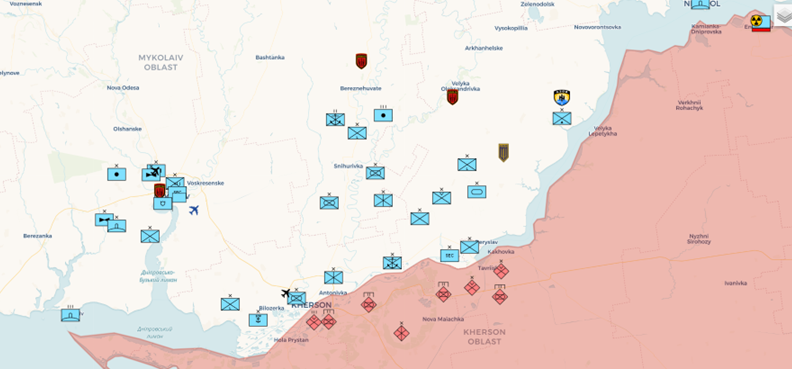

Disposition of Forces in Kherson Oblast, 28 Nov 2022

Here’s a picture from late yesterday:

Source: as of 28 Nov, militaryland.net, accessed 29 Nov 2022.

See latest report from ISW for context.

The “Trap” Closes: Kherson, 11/11/2022

Remember the question a skeptical JohnH asked on 9/2/2022, about the Ukrainian offensive? Here’s the answer:

Prediction Markets on Control of the Senate: 11/11/22

Looks like the betting is on Democratic control.

Prediction Market on Senate Conrol: Democratic at 93%

By simple addition of bets on 50 seats or less for Republicans — at 1030am Eastern Time, from PredictIt:

Balance of Forces, Kherson Oblast on 31 October 2022

As of 23:00 hrs (GMT+2) on 10/31 (Militaryland.net):