Neil Irwin at the NYT has an interesting article on the localized recession in 2016. One conclusion he makes:

“There is a risk that the intensification of international cross currents could weigh more heavily on U.S. demand directly, or that the anticipation of a sharper divergence in U.S. policy could impose restraint through additional tightening of financial conditions,” she said on Oct. 12 in Washington.

Ms. Brainard was right.

I agree. Here is my take from the end of 2015, in “The Opening of the American Macroeconomy and the Implications for Monetary Policy“:

Or, why I think Governor Brainard is right to say it’s too soon to tighten.

Tim Duy’s interpretation of the last FOMC statement as a dismissal of international concerns as laid out by Governor Lael Brainard is troubling.

The removal of international factors from the statement reminds me that we ignore the external conditions at our peril (see also Krugman’s take). Here’s a cautionary tale from my youth.

Thirty five years ago, I took my first course in intermediate macroeconomics. Professor James Duesenberry, a developer of an precursor to the model of habit formation in consumption theory [1] (the “habit theory”), was the instructor, and on the day after Ronald Reagan’s election, he took time out from the course to discuss the macroeconomic implications of the new president’s program of massive supply-side tax cuts and elevated defense spending on the US economy. He predicted – rightly – that purported unicorn-like (my words) supply side surges in tax revenue would not appear; he also predicted – rightly – that there would be massive crowding due to the collision of fiscal and monetary policy. Where he was wrong was where the crowding out would occur: it occurred in net exports, rather than in investment. I wonder if policymakers — particularly those schooled in thinking of America as a closed economy — are again about to under-estimate the openness of the US economy.

Here are some observations to keep in mind:

1. Trade is an increased share of GDP

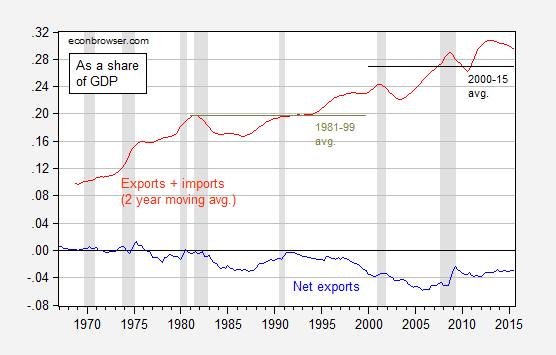

During the mid 2000’s, net exports increased to record share of GDP – nearly 6%, dwarfing the international sibling of the “twin deficits” of the 1980’s experienced under Reagan. More importantly, the economy is more open: exports plus imports as a share of GDP is now around 30%, as compared to 25% between the previous two recessions, as shown in Figure 1.

Figure 1: Nominal net exports to GDP ratio (blue), and nominal sum of exports and imports to GDP ratio, 8 quarter moving average (red). NBER defined recession dates shaded gray. Source: BEA, 2015Q3 advance release, NBER, and author’s calculations.

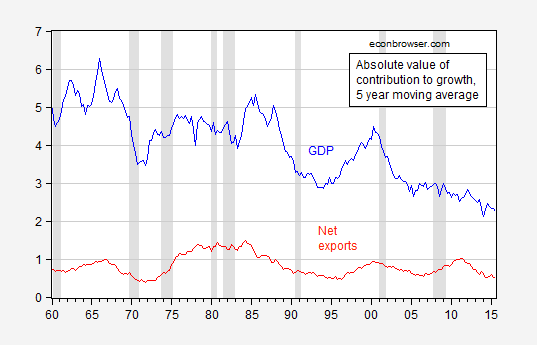

2. The relative importance of the contribution of net exports to growth has increased over time.

Using the decomposition of contributions to growth (in an accounting sense) as reported in Jim’s post on the GDP release, it can be shown that over time the absolute value of GDP growth (SAAR) has decreased, while the absolute value of net export contributions to growth has remained largedly unchanged.

Figure 2: Five year moving average of absolute value of GDP growth (blue), and of net export contributions to growth (red), all SAAR, in ppts. Source: BEA via FRED, and author’s calculations.

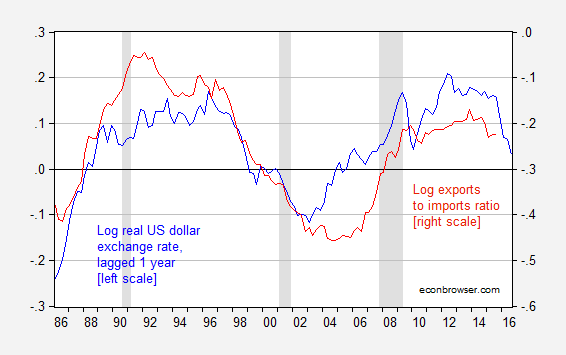

3. The responsiveness of trade to exchange rates has risen

US exports and imports also appear to be more responsive to exchange rates than they were in previous periods. Hence, the observation that the recent appreciation has not reached heights recorded in the early 2000’s and in the mid-1980’s is not necessarily sufficient to dismiss worries. In this post (extended in Chinn (2010)) I report estimates that indicate that export price (exchange rate) elasticities are greater in the more recent period than in earlier; similarly IMF (2007) (Table 3.2) finds that price elasticities are higher over the 20 year period up to 2006 as compared to the entire 33 year period.

In this context, the 15% appreciation in the real value of the dollar, against a broad basket of currencies, shown in Figure 3, takes on greater significance than it might have in times past.

Figure 3: Log real dollar exchange rate against a broad basket of currencies, 1973M01=0, lagged one year (blue, left scale), and log real exports to imports ratio (red, right scale). Exchange rate defined so down is a dollar appreciation, so that the two series should exhibit positive correlation. NBER defined recession dates shaded gray. Source: Federal Reserve Board via FRED, BEA, NBER, and author’s calculations.

The impact of the rapid appreciation is yet to have shown up in exports and imports, if the past is any guide. Moreover, with the continuation of quantitative easing in the euro zone and the continued financial turmoil in China, there is little to suggest the dollar’s appreciated value will disappear anytime soon.

There is some indication of the dollar’s impact in indicators of tradables — approximated by manufacturing — activity.

Figure 4: Log real dollar exchange rate against a broad basket of currencies, lagged one year (blue, left scale), and log manufacturing employment, s.a. (red, right scale), and log manufacturing output, s.a. (green, right scale), all series normalized to 2012M01=0. Exchange rate defined so down is a dollar appreciation, so that the three series should exhibit positive correlation. NBER defined recession dates shaded gray. Source: Federal Reserve Board via FRED, BLS, NBER, and author’s calculations.

With the US economy already exhibiting weakness, and the global economy in flux [2], it hardly seems the right time to appreciate the dollar, which tightening would likely do.

I would add at least one point, import prices are often the marginal price that sets the price that US producers caqn change

So analysis that ignores the impact of higher import prices on the prices domestic producers can charge massively understates the impact of import prices on domestic inflation.

I think this get much too little attention is standard analysis of the US as an open economy.

One of the more interesting and “real-world” importance posts in a very current (here and now) context Kudos to Menzie. And I actually think I grasped about 85% of the post. Am I allowed as someone with only basic macro and micro knowledge to pat myself on the back, for weeks earlier saying that I thought Lael Brainard really had her finger on the pulse??

[ narcissistically pats self on the back ]

@ Menzie When I click on the 2nd habit theory link it gives a “page not found” message from the home site.

I was quite impressed with this Susanne Craig lady, she strikes me as a sharp cookie. I have had a hard time recently getting past the NYT paywall. But I am assuming this will be in tomorrow’s hardcopy NYT, even though it broke Tuesday.

https://www.youtube.com/watch?v=X57xMhi0eBA

WOW man, FINALLY, after 230 years, Australians have an achievement to brag about. I knew they had it in them somewhere:

https://www.theage.com.au/national/cervical-cancer-set-to-be-eliminated-from-australia-in-global-first-20181002-p507dn.html

Nobody share this news with Not Trampis, he’ll start thinking they can beat Texans at barbeque.

How is the US automobile sector doing in the age of Trump?

https://www.usnews.com/news/best-states/michigan/articles/2018-10-02/us-auto-sales-fell-by-4-percent-in-the-third-quarter?int=undefined-rec

Major automakers said Tuesday that their U.S. sales fell 7 percent in September and 4 percent for the June-through-September quarter, compared with the same periods last year. Weaker numbers for September and the third quarter wiped out a 1.8 percent gain during the first half of the year, and left auto sales on pace with 2017.

You can quote those numbers all you want, but in a largely illiterate nation, starving its public schools of more and more funds everyday and becoming more illiterate everyday, the only thing that matters is party losses in the voting booth and job losses. Everything else is hot air. Even job losses don’t matter if you’re Special Ed. level IQ. We got people kicked out on their rear at Harley still pledging allegiance to Trump, and soybean, corn, wheat farmers etc pledging allegiance to Trump after their free market net profits went out the window on retaliatory tariffs. Anyone wonder why Republicans put on their act (such as master thespian Lindsey Graham) and then go back to the Congressional office, drink and laugh themselves to death?? The CoRevs, PeakIgnorances, Ed Hansons and “Princeton” Kopits of the world revel in being crapped on. And the ones who can be led around by the nose comprise a majority of this nation. That was proven long-ago with Reagan.

I still have 60% odds on Trump winning 2020, and some of you watching the MSNBC pompoms glitter on your laptop monitor better wake up to the fact Republicans will still control the Senate post November 2018. I am a Democrat—but I live in the world of reality. Please join me, there’s plenty of alcohol in the tangible world.