Is there a direct relationship running from a change in the dollar’s value and import and export prices and thence to consumer prices?

Numerous commentators have suggested that the declining dollar could lead to increased inflationary pressures. So a declining dollar, in this perspective, could confront the Fed with a particularly unpleasant set of choices. In particular, it might be forced to react to the dollar’s decline in order to squelch imported inflationary pressures at exactly the same time that it has already raised interest rates to cool domestic demand.

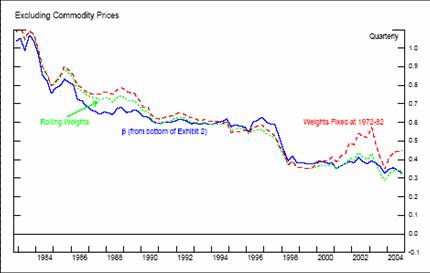

While not denying the plausibility and logic of such a scenario, it makes sense to consider it more closely (following up on a post back in October). First, what is exchange rate pass through, conceptually? There are several definitions floating around, but the most prominent two are (1) the percent change in import (or export) prices for a percent change in the exchange rate, and (2) the the percent change in the CPI for a percent change in the exchange rate. Second, what is the empirical magnitude of this relationship? This is more problematic, since one has to measure the strength of this relationship using regression analysis. Here, one might think we have less to worry about, since there have been several studies that have documented a decline in exchange rate pass through in industrial countries (Fed working paper and BIS working paper, among many others). The figure below presents exchange rate pass through into U.S. import prices ex. commodities.

Figure 1: Exhibit 8 from Marazzi, Sheets and Vigfusson (2005).

Of course, with any empirical work, there is some room for disagreement over interpretation. The “all goods” pass through coefficient from the Fed study has declined from 0.40 to a recent 0.20. However, if one excludes commodities (which are often priced in dollars), then — as depicted above — the coefficient has looked more stable, at around 0.25. Other studies, for instance by Campa and Goldberg, conclude that pass through coefficients have been quite stable over time, and attributed observed time variation in the measured aggregate pass through coefficient to changes in the composition of import bundles.

But here I come to the key question for policy-makers: How much can we rely upon the estimated pass-through coefficients to remain at their current magnitudes, be they 0.20, 0.40, or say at about 0.23 (the Campa and Goldberg estimate for the US in the short run)?

This is where the interpretation of the econometrics can lead to differing policy implications. If there has been decreasing exchange rate pass through as a consequence of increased credibility of monetary policy — as is typically assumed — then we should expect less imported inflationary impulses than in the past, given a dollar depreciation. But that relies upon our estimates of the pass through coefficient being accurately estimated, controlling adequately for the conduct of monetary policy (remember that both import prices — the CPI — and the exchange rate are functions of expectations regarding the current and future stance of monetary policy). This conclusion also relies upon monetary policy actually being perceived as being more credible than say 20 years ago.

If, on the other hand, the reason for the declining observed pass through has been structural in nature, due to the changing composition of import bundles, then we may very well observe less pass through this time, even if the conduct of monetary policy is very similar to what it was over the past 10 years.

Some of these observations are quite pedestrian. But it bears repeating, if only because we often treat estimated parameters as good measures of structural parameters. This might sometimes be approximately true. But one has to take into account our uncertainty regarding our knowledge of the models when actually formulating the appropriate policy response (or predictions of policy responses).

By the way, I don’t have a clear answer to the question posed at the beginning of this post. But I suspect that many market observors will be surprised by the magnitude of the change in import prices and CPI in response to what I see as an incipient dollar decline.

Technorati Tags: dollar depreciation,

pass through,

monetary policy

Could the recente decline in the pass-through have been caused by increasing imports of cheap prodcuts/services from China and India over the recent past?

Because if that´s the case, in the current scenario of increasing commodity prices (invoiced in dollars) and the decline of the dollar, my guess is that the pass-through should be higher now than it was in the recent past. Don?t you agree?

Would a low pass through rate reduce the impact of a fall in the dollar on the trade deficit and therfore possibly suggest a greater fall in the dollar?

Roberto: The impact of China is everywhere, in anecdotes. But it fails to show up in the data; see Kamin et al. (2004), published in Review of International Economics (2006).

jack: If the pass through parameter is structural or quasi-structural in nature, then low pass through might require a larger change in the dollar’s value to hit a given change in import (and export) prices necessary to induce the expenditure switching required for “global rebalancing”.

A change in the exchange rate has to be absorbed somewhere,it’s just math. If the importer isn’t absorbing it then the exporter is. Or his government is by subsidizing exports.

Years ago,in the late 70’s I worked in the international treasury of Carnation (now Nestle). They were exporting in dollars at fixed prices from Europe at a time when the dollar was falling. The importer paid a fixed price and the exporter lost when the dollar fell,but the EEC paid a subsidy on the agricultural products that ensured a profit.

As Jim previously posted, importers and exporters act very rationally –protecting their bottom line.

I would assume there’s some dirtiness in transitioning prices; importers confronted with a lowering USD, will hold down their (foreign currency) prices so long before they raise their prices… and so on…

But, I have the feeling that the low pass-through has a much stronger relationship with the composition of the basket of currencies used to determine the USD rate of exchange; –not all countries dealing with the US have appreciated their currencies while the USD has declined, for instance.

The USD decline of the past few years has favored considerably China while hurting Europe and others. China’s pegged CNY to the USD, allowed China to undercut the rising USD goods prices of its European competition; shifting a substantial share of US imports to Chinese made goods, –and as a consequence, lowering the pass-through index..

jim miller: Agriculture is different (since it is not subject to GATT and WTO), and only has become a subject of central negotiation in the Doha round. For manufacturing, the “hit” is taken in the profit margin.

Joe Rotger: What you mention gets to the issue of local currency pricing, producer currency pricing, or something in-between. Local currency pricing is sometimes linked with “pricing to market”, which would be consistent with less than full pass through.

On the issue of the invoicing currency and the degree of pass through, my attention has recently been brought to this paper by Goldberg and Tille, which discusses the issue.

On the composition issue, you may be right insofar as the aggregate pass through coefficients are concerned. But bilateral pass through coefficients have also exhibited some decline.

On a separate matter, you should note that in 2005, the Rmb rose by about 10% on a trade weighted inflation-adjusted basis because the Chinese currency remain tied to the US dollar.

Menzie,

Thanks for the Goldberg article.

Although I do agree with his “invoice” stickiness of USD prices, I’d like to add a couple of comments which I feel would improve Goldberg’s explanation and fit his findings:

In regards to the smaller pass-throughs in US imports and the larger ones for exports, the “large customer” effect comes to mind, or the preferential effect arising from a larger US consumer purchasing power negotiating base compared to “smaller customers” in other countries.

When the USD drops, producers, exporters, importers and freighters of the foreign goods are more inclined to concede price sacrifices to the high volume leveraged US consumer.

Apart from the mentioned mercantilist motivation, we may also have a downward pressure on the foreign currency when the USD declines due to the following:

– Foreign CB intervention through reverse sterilization by buying US Treasuries; with the purpose of protecting local employment. As in the case of China, Norway, Saudi Arabia, Chile, on and on….

– Or, if exporters opt for a higher USD pricing, the “large customer” effect implies a relatively large reduction of exports for the foreign country; and as a consequence, a corresponding reduction in foreign currency demand.

The “large customer” effect would explain Goldberg’s findings for the EUD area, where pass-throughs trading with EUDs, within these smaller countries, are larger than import pass-throughs to the larger US.

Bottom line, size does matter.

The OECD has warned that the eventual rebalancing of the US current account gap ‘looks increasingly unavoidable’ and will send shock waves across the globe, starting with a slump in the dollar’s exchange rate.

The OECD said in its world economic outlook that the depreciation faced by the dollar could be ‘of the order of one-third to one-half.’

The adjustment in the deficit would ‘need to induce a sharp slowdown in US domestic demand and that this would have adverse spill-over effects on other economies both through the trade and asset revaluation channels,’ it said.

The rebalancing may be accompanied by an increase in risk premiums and a reversal of private capital flows, it added.

Countries with current account surpluses have been accumulating dollar reserves and ‘their willingness to hold dollar assets on their balance sheets may diminish,’ the OECD warned.

It also cautioned that a protectionist response from the US may accelerate the dollar’s falls.

full story

http://www.forbes.com/finance/feeds/afx/2006/05/23/afx2765701.html

Please see:

HON. RON PAUL OF TEXAS

Before the U.S. House of Representatives

February 15, 2006

The End of Dollar Hegemony

http://www.house.gov/paul/congrec/congrec2006/cr021506.htm

and:

Collapse of the Petrodollar Looming

The announcement by President Putin of a Russian bourse trading oil and gas in Roubles threatens the stability of the US Dollar far more than Iran’s bourse alone would do, and continues the slide in relations between the old Cold War foes.

full article:

http://home.austarnet.com.au/davekimble/peakoil/petrodollars.htm

information on exchange rate in agriculture policy