The IMF has just released several chapters of its semi-annual World Economic Outlook. One chapter is entitled “Managing Large Capital Inflows”.

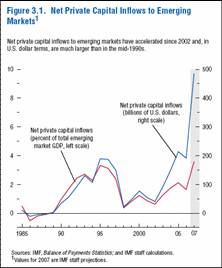

Figure 3.1 from IMF, World Economic Outlook, Chapter 3.

The chapter observes:

…109 episodes of large

net private capital inflows since 1987 were identified;

87 of these were completed by 2006. These

episodes show several interesting patterns, broadly

in line with the stylized facts discussed above:

- The incidence of episodes over time mirrors

trends in net private capital inflows to

emerging markets, with two waves of episodes

of large capital inflows to emerging markets

since the late 1980s—one in the mid-1990s

and the recent one, starting in 2002 (Figure

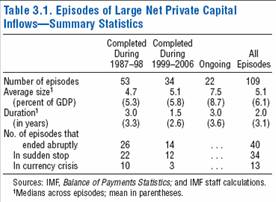

3. , upper panel).- Episodes completed during the first wave

(between 1987 and 1998) generally involved

a smaller volume of flows relative to GDP,

especially compared with episodes that are

ongoing; but they lasted longer than those that

ended between 1999 and 2006 (Table 3.1).- Emerging Asian and Latin American countries

dominated the first wave of episodes,

whereas the more recent episodes have been

concentrated more in emerging Europe and

other emerging market countries (Figure 3. ,

middle panel).- More than one-third of the completed episodes

ended with a sudden stop or a currency

crisis (see Table 3.1), suggesting that abrupt

endings are not a rare phenomenon.12- Late and ongoing episodes are characterized by

larger FDI flows, relative to the episodes completed

in the 1990s (Figure 3. , lower panel).

Table 3.1 shows the summary statistics pertaining to these inflow episodes. It also tabulates the number of ongoing episodes — the average duration of which is 3 years. In other words, large capital inflows is not an issue of the past.

Table 3.1 from IMF, World Economic Outlook, Chapter 3.

Some characteristics of macro aggregates and prices before, during and after these episodes is illustrated in Figure 3.9.

Figure 3.9 from IMF, World Economic Outlook, Chapter 3.

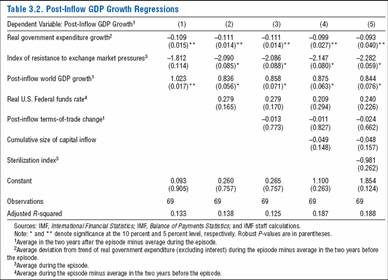

The chapter notes that some dimensions of economic performance depend upon the characteristics of the inflow, but also the policy responses to the inflows. The effects of different policies on post- versus during-episode growth are identified by a reduced form regression approach, with the results summarized in Table 3.2.

Table 3.2 from IMF, World Economic Outlook, Chapter 3.

From the chapter:

Table 3.2 shows that countercyclical

fiscal policy through expenditure restraint during episodes of large capital inflows is associated

with a smaller post-inflow decline in GDP

growth, even after controlling for other factors

that may have had a role in this decline — such

as changes in the terms of trade, world output

growth, and the real U.S. Federal funds rate.

The regressions also present evidence indicating

that greater resistance to exchange market

pressures is associated with a sharper economic

slowdown in the aftermath of the episodes.

I think the table has some interesting results, in addition to those highlighted. First, capital controls don’t seem to have the anticipated effect (although of course, there is always the issue of endogeneity). Second, sterilization seems to have a negative (albeit non-significant) impact on post-episode growth. But by far, the most interesting result, from my perspective, is the fact that fiscal restraint in the face of large capital inflows promises better economic performance after the inflow episode, than fiscal profligacy. (It’s a lesson that many policymakers — not just in emerging markets — might want to heed.)

Disclosure note: As noted in the acknowledgments to the chapter, I was a consultant on this project early in the process of statistical analysis.

Technorati Tags: href=”http://www.technorati.com/tags/capita+inflows”>capital inflows,

emerging markets,

sterilization,

exchange market pressure,

sudden stops,

currency crises,

World Economic Outlook.

Menzie wrote:

But by far, the most interesting result, from my perspective, is the fact that fiscal restraint in the face of large capital inflows promises better economic performance after the inflow episode, than fiscal profligacy. (It’s a lesson that many policymakers — not just in emerging markets — might want to heed.)

Menzie,

Could you help me flesh out what you mean here by fiscal restraint versus fiscal profligacy?

It appears that that the IMF is confirming that currency “rate wars” do exist but that they ultimately end in decline. It would be interesting to see if the boom justifies the bust.

DickF: Rapid growth in real government expenditure is profligacy. The absence of that is fiscal restraint, in this interpretation. I think that definition would put the U.S. post-2000 in the profligate category.

Speaking of the IMF, I would like to alert you to the recent launching of the first IMF blog: the “Public Financial Management Blog” whose address is http://blog-pfm.imf.org.

the purpose of the blog is to disseminate IMF work on public financial management (PFM) but also to disseminate developments in the area of PFM in general.

Michel

Thanks, Michel, we’ve added it to the blogroll.

Thanks Menzie. Got it.