…then a balanced budget is far off.

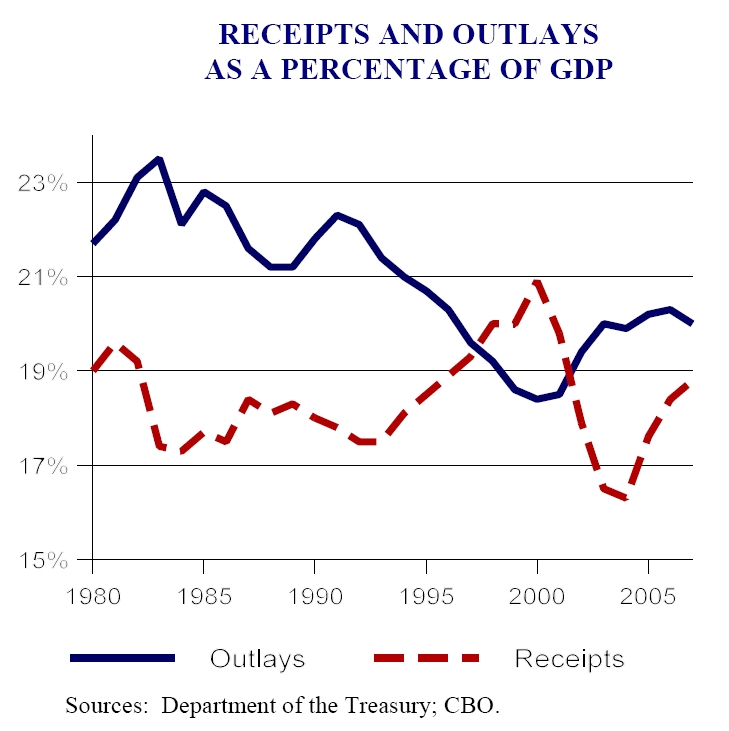

The CBO released its November budget review yesterday. In this figure, the red dashed line (receipts) is slowing its ascent. Expenditures are falling, but to the extent that transfers rise in slowdowns, one knows the likely trajectory of the blue line.

Note: Blue line, expenditures; red dashed line, receipts. Source: CBO, Monthly Budget Review, November 6, 2007; improved image, courtesy of J. Teter.

One quote:

“Outlays for net interest on the public debt equaled 1.8

percent of GDP in 2007, the same level recorded last year.

The government’s net interest costs rose 6.3 percent in

2007 primarily because of growth in federal debt and

higher short-term interest rates.”

Thought experiment: What happens to net interest as a share of GDP, and the debt-to-GDP ratio if nominal growth slows? Here’s a partial answer.

What slowdown?

3.9% growth isn’t a slowdown.

Oh, I know. That was last quarter, right?

Menzie, didn’t we just recently have discussion about the validity of estimates? I’ll just wait for the FMS report to see what happened in Oct. A LOT MORE meaningful than anything the CBO reports. Real numbers versus guestimates, don’cha know.

Buzzcut — he did not say anything about a slowdown — he said at full employment and did not make a forecast.

Spencer,

It may not be a prediction, but if not, what is it?

CoRev: You’ll excuse me if I don’t recall a specific debate about forecasts. I’ve seen nothing in the past year to make me re-evaluate the relative forecasting ability of organizations versus consensus forecasts versus macroeconometric models.

3.9% growth isn’t a slowdown.

Nominal growth was 4.7%. Inflation was more than that, unless you wish to believe the fairytale 0.8% deflator offered by the MiniTru.

menzie, maybe I made more of the discussion re: estimates/estimating organizations. But, clarify for spencer and me, was this a predictions

As to the balancing the budget issue, what will it take to convince you we are on that path? A positive number? Even the charts predict a balanced budget if we don’t change, dramatically.

Over at the Skeptical Optimist a Deficit Watch Chart is posted routinely using federal tax receipts and federal outlays. Take a look at:

http://www.optimist123.com/optimist/2007/10/index.html

Say as compared with:

http://www.optimist123.com/optimist/2007/06/index.html

Be patient you have to scroll a bit to get to the graphs. A balanced budget does seem possible But then again he is an optimist, huh?

The forecasts for a balanced budget are misleading, at least on the tax side, because they assume present law. Under this forecast, the number of AMT-payers increases from approximately 4 million in 2006 to nearly 30 million in 2010. As a political matter, these tax increases will not happen.

Nonetheless, receipts as a % of GDP are above the 40-year historical average. We don’t have a tax problem — we have a spending problem (unless we are entering a new phase of larger government, in which case we do need higher taxes).

That’s not the easiest graph to read, but it appears that spending decreased starting in ’06.

Maybe there is something to this “divided government” thing.

CoRev: Well, to be honest, it’s not my prediction, it’s the consensus prediction. You’ll note my use of the word “slowdown” versus “recession”.

As I have observed on a number of occassions (e.g., here), the glide path to surpluses in the OMB projections relies on some interesting assumptions, while CBO’s projections, per statute, use a current law baseline. I explain in this post what I think is more likely, and why this implies no balanced budget given the current Administration’s preferences.

it’s not my prediction, it’s the consensus prediction.

Backed up by Bernake this morning. Slower growth into ’08 was the headline of his speech.

But does slower growth imply rising federal expenditures?

… and the 10 year is at 4.29% today. Consensus indeed! Bond traders must think that there’s a full blown recession coming.

RD, Menzie, I subscribe to the Skeptical Optimist’s view of the budget, as referenced above by macquechoux. His rolling average has been an interesting exercise for me and many others. It predicts a much earlier balancing of the budget than any of the other (?consensus?) predictions. The slow down this year has extended the projected date by several months, but still projects a balanced budget in FY 2009, well before the Bush tax cuts end.

The turn up in revenues after the 2003 tax cut is quite amazing.

Rich Berger, now you’ve done it. Why did you bring up that sudden up tick in revenues, AND INCLUDE A COMMENT ON THE TAX CUTS. You must know there is no relationship. We’ve been told this so long and so loudly, it just has to be true.

Rich Berger and CoRev: Re tax receipt surge, please see this post.

Menzie, thanks for the reference. It will take some time for me to fully understand it’s meaning(s).

I realized you did that debate thing about changing the subject. I was talking about balancing the budget, and Rich was talking about about revenues going up. Not the Laffer Curve, or the highest revenues on record, or even revenues higher than any other (pick your own) administration. Tsk, tsk, tsk.

CoRev: Not certain what you mean. Well, in any case, as Hundertwasser said, “Nature abhors a straight line”, and I think straight line extrapolations calculated by the Skeptical Optimist alluded to a little dicey (I’d certainly treat nominal revenues and expenditures at the minimum as I(1) variables, and think about the corresponding standard errors when backed into levels). One way to investigate the plausibility of these trends is to investigate how much the trends change with increments of a few observations. Estimated linear trends applied to I(1) series (or highly persistent series) will exhibit substantial sensitivity to sample.

Menzie, your previous reference had little to do with both Rich and my subjects. That was my point about changing the subject.

As far as Steve’s straight line analysis, as I said earlier, I prefer simple math versus the multi-variant best guesses we are seeing, especially when it comes to predicting when or if the budget will be balanced. What I reacted to was your comment/analysis

Said statement is not even supported by the chart included.

CoRev: I think if you take the totality of the posts I’ve put up recently, you’ll see all the parts of the argument. I decided not to replicate what I’d said before, to avoid redundancy. But take a look at what the private sector is guessing, as noted in this post. But I invite you to come back in a year’s time, and we can compare who was closer to the mark.

An aside — why eschew multivariate analysis? And even if we stick with univariate analysis conducted on each side (revenues, expenditures), why assume trend stationarity? A standard ADF test (trend, 4 lags of first differences) on Federal government expenditures (1967q1-07q2) fails to reject the unit root null. Even the first difference fails to reject the unit root null.

Ah, yes, that ole post on bond market predictions versus the reality train. Indeed, it was your comment re: the quality of CBO and OMB predictions in that comment string that I was referencing earlier about predictions. Anyway, it’s time for us to move on to the next issue and wait out the clock. Next year will tell on the deficit. When it is below $100B near elections time, that should make for interesting discussion.