From the Daily Herald:

Speaking Tuesday in Arizona, President Obama endorsed the bipartisan efforts of [Senator Bob Corker (R-TN) and Senator Mark Warner (D-VA)] to wind down Fannie Mae and Freddie Mac as a first step in making certain that the nation does not suffer again through a housing finance crisis.

“For too long, these companies were allowed to make big profits buying mortgages, knowing that if their bets went bad, taxpayers would be left holding the bag,” Obama said in Phoenix. “The good news is that there’s a bipartisan group of Senators working to end Fannie and Freddie as we know them. I support these kinds of efforts.”

Let me explain why I also endorse these recommendations.

Fannie Mae and Freddie Mac were both originally created by acts of the U.S. Congress, and have had an ambiguous and varied status as quasi-private, quasi-public entities ever since. The GSEs (for “government-sponsored enterprises”), as they are referred to, engage in two types of activities. First, Fannie and Freddie borrow money which they use to buy up mortgages and hold them on their own account. The debt they issue is not officially recognized as obligations of the U.S. Treasury, but is instead part of a group of securities known as “agency debt” which historically paid a lower interest rate than would have been the case if creditors did not perceive some degree of implicit federal backing of this debt. As of the end of 2009, Fannie and Freddie between them owed over $1.5 trillion in debt (Hamilton, 2013). Second, Fannie and Freddie would issue guarantees on securities they created out of bundles of individual mortgages. In return for providing these guarantees, the GSEs received fees on the basis of which they earned a profit. As of the end of 2009, the combined mortgage guarantees issued by the GSEs and other federal agencies came to an additional $5.4 trillion (Flow of Funds, Table L1).

Mortgages held outright or guaranteed by GSEs and federal agencies increased by a factor of 22 over the last 30 years, growing from 9% of GDP in 1982 to 40% last year, and from 17% of all mortgages in 1982 to 47% last year. Agency and GSE debt and guarantees came to $7.5 trillion as of the end of fiscal year 2012, or 2/3 the size of the entire stock of U.S. Treasury debt held by the public.

|

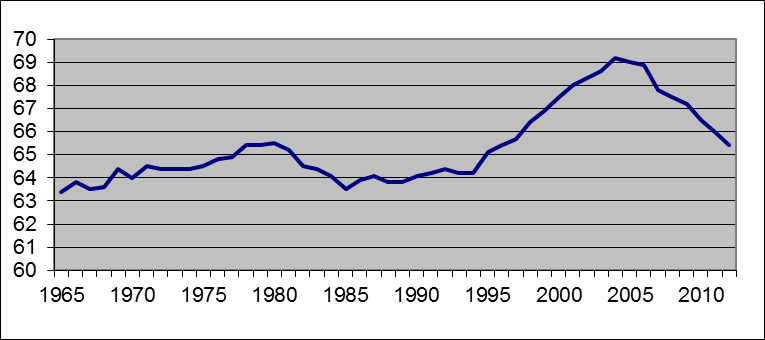

What did the public gain from the growing role of these institutions in the housing market? Some argue that increasing rates of home ownership might increase society’s welfare in a number of ways. Home ownership rose from 64% in 1994 to 69% in 2004, though much of those gains were subsequently wiped out.

|

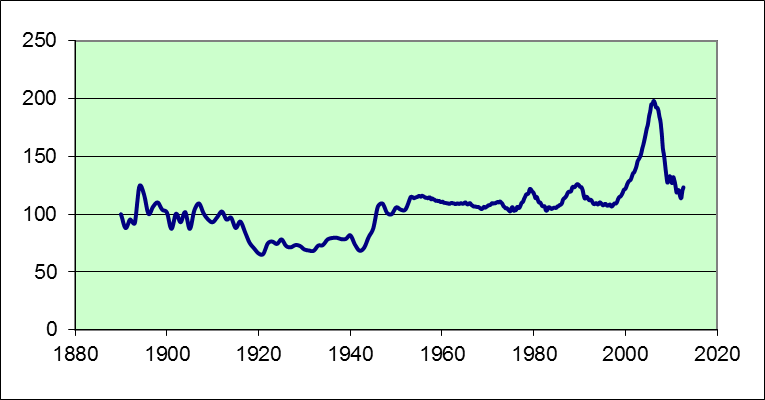

The goal of making housing more affordable can also be elusive. Insofar as improved terms for mortgages increases demand for housing, real estate prices may rise as a result.

|

I have not seen the details of the specific proposals favored by Senators Corker and Warner or President Obama. If the suggestion is to return Fannie and Freddie to the status of supposedly non-governmental entities, insisting that this time the government really, truly would not bail them out if they get into trouble, I would not support the plan. We tried that idea, and it’s just not operational. The notion that a truly private company could plausibly earn its profit by guaranteeing trillions of dollars in mortgages is on its face implausible, because there is no private strategy that could truly diversify or hedge away the risk associated with major aggregate disruptions. What Fannie or Freddie really did was “guarantee” the loans as long as times were good, and count on federal assistance when times were bad.

If instead the proposal is to keep Fannie and Freddie in government receivership, and with that authority gradually slow and eventually stop the GSEs’ issuance of new debt and guarantees, then I am all on board.

Exactly. And with that we can get the governments and central banks to focus on a broad recovery instead of a housing recovery.

As a millennial, I can say that most of us don’t really care to become carpenters with large mortgages.

The problem is that when housing turns really bad the choice is between a government backstop (preventing a free fall) or collapse of the economy and the credit system. So the reality (in spite of all the testosterone poisoned rethoric about “let them fall”) is that society will have no other choice than backstopping a housing market that enters a free fall. The first question is who government will bail out and what pain they should be suffering as punishment (homeowners, bankers, mortgage investors). The second question is what laws, rules and regulations government should install to make sure that the above entities do not wreck the economy with irresponsible and gready behavior. Lets not forget that during the last housing crisis the only entities that would provide loans for housing were the (by then) government owned GSE’s. So in a large housing crisis private housing credit evaporates and the government has to take over whoever is the issuer of most mortgages (even if they are not called Fannie or Freddie).

Alas, I agree with DeDude’s Gortonesque observations: during a crisis the government will have no choice but to backstop the banks and guarantee new mortgage issuances.

The point is that the Fed should never have let the bubble grow. Once you’ve done that, the government will pretty much be on the hook.

In any event, we’re back to the Taylor rule discussion. Rules are fine and good, until the s**t hits the fan, and then it’s all improvisation.

The problem is these implicit guarantees will simply flow to the rest the our too big to fail banks which will still have to be bailed out. We can wind down the gses but no one is willing to wind down the banks which will become even larger and impossible not to save. It is an illusory solution to an even larger problem.

The problem with Obama’s comment is that it suggests Fannie and Freddie caused the problem, which they clearly didn’t. Fannie and Freddie were latecomers to the big mortgage party, and they certainly made a bad problem worse; but the likes of Countrywide and others did a pretty good job of creating toxic waste without any help from Fannie and Freddie.

If the suggestion is to return Fannie and Freddie to the status of supposedly non-governmental entities, insisting that this time the government really, truly would not bail them out if they get into trouble, I would not support the plan. We tried that idea, and it’s just not operational.

Well, the GSEs had been around for a long, long time without any problems. The problems started with lax regulation, crooked ratings agencies and corrupt lenders who didn’t do their due diligence, which somehow became the fault of unworthy borrowers. (Since when has it been the borrower’s responsibility to determine his or her credit risk???)

And just to be clear, I’m not a big promoter of widespread home ownership, so throttling back Son-of-Fannie/Freddie to what they looked like 40 years ago is fine by me. If Corker, Warner and Obama really want to do something useful, then how about eliminating the mortgage interest deduction?

Don’t forget that Fannie and Freddie were/are useful places to park political insiders who needed to make a buck or two.

Follow the money…

This seems completely wide open. Endorsing “these kinds of efforts” isn’t much of an endorsement and borders on damning with faint praise. It doesn’t tell us much about what Obama would actually be willing to sign.

Lord only knows. Consider BoA or JPM carrying a book the size of the GSEs. Would the Feds let them fold? Über market maven Hank Paulson didn’t.

There are some questions, however. Do the GSEs need to help homeowners of well above median homes? Above median at all? If you reduced the conforming limit and took away the geographic increased limits you would start to reduce their new issuance. You can’t count on lower rates spurring refinancing to clear the book. The GSEs will be around for at least 30 more years and so the discussion should be how best to run their business.

Fannie and Freddie will be reborn with a different name. For sure. “We need a housing boom”, said Krugman. “This time, everything is different, cause we have the CDSwaps” said Greenspan. “The notion that a truly private company could plausibly earn its profit by guaranteeing trillions of dollars in mortgages is on its face implausible, because there is no private strategy that could truly diversify or hedge away the risk associated with major aggregate disruptions.” says J. Hamilton. Oh, yes.

The next time house prices start falling or banks start failing, who will take mortgage credit risk? Because in 2009 the private mortgage credit system stopped working at any price.

That doesn’t sound so bad, until you realize that you could only sell your house at the price a buyer would pay in cash if they can’t get a mortgage. That would produce much, much lower house prices and a vicious cycle.

Fiercely free market ideas sound good, until there’s a crisis in confidence. Then the market stops and the government must step in to prevent disaster. The question is how to design that system where it can’t be gamed. When we move from ideology to practical implementation, most bloggers have nothing to add.

All: I am talking not so much about what to do after the crisis begins– I agree there are no good options at that point. But please let me call your attention again to the first graph above. My question is, was that a good policy for the two decades before the crisis? If so, why?

One way to look at home ownership is that it locks in one’s housing payments at a largely fixed rate, with the potential of paying only maintenance costs later. As one approaches retirement age, the prospect of living in a rented unit raises the fear of massive price increases (assuming no rent control). In short, purchasing a home has many of the qualities of purchasing an annuity – except that it is locking in a guaranteed cost rather than promising a set amount of income.

Charles Calomiris has been touting the Australian model of housing policy for a few years now. Instead of the poor policy of the mortgage interest deduction (which encourages interest only loans and doesn’t actually help low to moderate income households afford homes), the government could match dollar-for-dollar up to a certain amount of the down payment. It would be cheaper to do, promote equity in the home, and actually benefit the people that home policies were designed to in the first place.

But the lobbyists at the NAR and other realtor associations will never le that happen.

Looking at only GSE debt to GDP is an inaccurate measure. Were Ireland’s banks GSE’s? Was AIG? How different would it have been if in 2009 there was a wink & nod agreement and the too-big-to-fail banks picked up the lending that the GSEs picked up in reality? So the debt would be on the ‘books’ of JPM, Wells Fargo, Citi, BoA, but would it really be completely off the books of the US gov’t?

GSEs are not going anywhere. Either they operate within explicit rules or an implicit guarantee. However, you can re-write the GSE rules to help. Their higher standards for loans has been a good start. They could also tier interest costs based on size of loan and % down. You can also ramp down the conforming limit to reduce the subsidy to richer borrowers.

That no one is proposing small steps, merely engaging in ideological rhetoric is telling.

winstongator: So it sounds like you think the relevant measure would be the third panel, not the second, in the first figure. Why then do you comment on the second panel, and not the third?

And why do you lament that “no one is proposing small steps”, and ignore the principal recommendation above, namely to “gradually slow and eventually stop the GSEs’ issuance of new debt and guarantees”?

Yes, someone here has an ideological filter that prevents them from hearing what others say. But I don’t think it’s me.

So you wouldn’t support keeping them around in some form but basically putting them back to the status they were in 1968, before LBJ tried to take them off the books? Or is that what you referred to when you said, “If the suggestion is to return Fannie and Freddie to the status of supposedly non-governmental entities…”?

Getting rid of Fannie and Freddie will be a windfall for the TBTF banks, no? They will take over the business of creating the MBS that were previously handled by Fannie and Freddie. And there is zero reason to think they will do an honest and responsible job via Greenspanian self-regulation and fiduciary care.

Just turn Fannie and Freddie into full state-run mortgage banks. Then do a better job regulating the mortgages they generate. Staff it with boring salaried employees instead of the fast-buck, type A predators who flock into the private financial system.

From the very beginning Fannie and Freddie were slush funds for the Democrat party. The largest direct donations are listed below.

#1. $165,400 Chris Dodd

#2. $126,349 Barak Obama

#3. $111,000 John Kerry

But then that does not count the amount that was funneled to Democrats from the top executives of Fannie.

James Johnson, campaign manager for Walter Mondale, became chairman in 1991. Fannie reported that his compensation was $6-7 million, a huge amount in itself. The Office of Federal Housing Enterprise Oversight (OFHEO), tasked by congress with audit and oversight of Fannie, issued a report in 2004 that reported that Johnson actually deferred over $200 million in expenses to pay top executives enormous bonuses. They reported that Johnson actually personally received $21 million. It was also discovered that Johnson changed the compensation base from quality to quantity allowing the executives to claim huge broker’s fees brokering virtually worthless paper.

It is interesting that the head of OFHEO, appointed by Bill Clinton, issued his report, warning about the mortgage crisis 4 years before it happened. The Democrats attempted to force him from office, and he actually offered his resignation in 2003 but was retained in office until his term expired in 2005. In July 2008 the Democrats, who took control of congress in 2006, disbanded the pesky OFHEO by rolling it into the Federal Housing Finance Board, only 3 months before the stinky stuff began to hit the fan.

No one actually knows how much Franklin Raines, Johnson’s successor, pocketed. What is known is the OFHEO report demonstrated Raines received at least $90 million due to over-inflated earnings. It was found that Fannie violated the law by not filing financial statements and was in gross violation of GAAP. Raines pled ignorance of GAAP rules. Ultimately Raines was assessed a fine of $3 million for fraudulent activities during his tenure, he also gave up $1.8 million in stock that was given to him in compensation and he gave up stock options valued on paper at $15.6 million but which actually had no value due to the crash in Fannie stock. Raines bragged that he actually paid nothing. Fannie’s insurance companies paid all his court costs and attorney’s fees. So what we do know is that Raines pocketed at least $91 million.

And now after the horses, cows and chickens have all left the barn, President Obama calls on the Republicans to close the door.

Professor, I agree with you that it is well past time to wind down Fannie and Freddie, but it is a meaningless gesture. Dodd, Obama, Kerry, Johnson, Raines and a host of others have already received and spent their filthy lucre.

Ricardo From the very beginning Fannie and Freddie were slush funds for the Democrat party.

“From the very beginning…” Really? Do you know how long those two institutions have been around? Hint: A lot longer than the Presidential ambitions of Kerry, Dodd and Obama. None of the three was even born when Fannie was created and Obama was a 3rd grader when Freddie was created.

JDH My question is, was that a good policy for the two decades before the crisis? If so, why?

For the decade before the crisis, no. For the decade before that…ehh, maybe. If you want to go back to the Fannie and Freddie of the 70s and 80s, then yes. There is a legitimate public purpose in the government accepting risk that the private sector would not accept, as long as that risk is within reason. I think there’s a public purpose in assisting low income families with starter homes. So GSEs make sense on a small scale.

But the question going forward is whether borrowers will have a choice between a GSE or a Too Big To Fail Bank. The day of George Bailey’s small savings and loan is long gone. And the S&L experience of the 1980s should remind us that you don’t have to be a GSE to have an implicit government backing.

We could just retitle them Bank of Freddie and Bank of Fannie and let the Fed save them. There would be no discernable difference.

I’m not sure because you omit the shadow banking system, securitization & ineffective regulation, including pathetic risk limits and capital requirements. It may be that tighter control of Fannie & Freddie would be better in the long run.

The GSEs of the decade before the crash were private companies run like control frauds just like the rest of the private sector financial companies. Their goal and purpose was for the CEO and leadership and top management to get as much money out of them as possible, without any concern for the company, shareholders or society at large. They would bribe any politician that they needed in order to get their way – just like all the other sociopathic Wall Street finaincial companies. Basic housing and basic (survival) pensions are essential for a functioning modern society and, therefore, should be keept away from the Wall Street sociopaths. For a large number of people social security and a paid down house is what allows them a decent retirement when they have become so old that they cannot get, or handle, a job. The original GSEs worked great and are what we need to get back to. They required responsible downpayments combined with an income high enough to pay down the loan and handle ownership of the home. Most importantly because they were non-profit (government owned) they had no incentives to swindle people into thinking they could afford a home that they couldn’t. If you didn’t qualify you simply had to save up more money and/or find a home you actually could afford. I blame democrats for not realizing that you do not do poor people any favors by getting them into houses they cannot afford. I blame republicans for the idea that it would be a good thing to unleash sociapathic, predatory capitalist forces on those who were least able to understand and defend themselves against them.

There’s nothing inherently wrong with private organizations bearing credit risk on behalf of banks and other loan originators. If there is a credible policy commitment that the federal government would not provide assistance to FNMA and FMCC, their outsized role (and thus systemic risk) in the mortgage market would likely diminish as their creditors no longer give them favorable terms. Ultimately, it comes down to whether this can be resolved by explicit policy choices or that the institutional factors will forever allow FNMA and FMCC to have an outsized role.

deniers and revisionistas…if you can’t see the damage starting in 1995 from these graphs then there are serious issues. Oooops coincidentall with Jimmy Johnson (not of the impeccable hair and football prowess) having his big designs…No no nothing to see there. Gosh, appologists for F&F are just too much. Get over it…it was wrong, they were wrong, we were wrong…lets not do it again.

DeDude said: “The GSEs of the decade before the crash were private companies run like control frauds just like the rest of the private sector financial companies.”

Yes, and it turned out it wasn’t just Fannie and Freddie that were GSEs. All of the big banks had government guarantees (except Lehman).

I’d like to see simple rules to keep mortgage underwriting standards up, like requiring 20% down payments on all mortgages.

If they decide to have a federal mortgage bank, maybe they could limit it to say 20% of mortgages per year.

What I read here is not that bad:

http://www.corker.senate.gov/public/_cache/files/f6951d82-1a9c-40d2-9291-dcdd5c153cbe/06-25-13%20GSE%20reform%20Summary.pdf

Having banks hold the first 10% loss position is a positive, although perhaps a little complicated. Also, will these equity loss positions be tradable? Couldn’t the existing GSE framework require equity positions by the contributing banks? What happens if this provision gets axed by the bank lobby?

It does however continue the goal of complete elimination of the system, which I think is misguided. You shoul look to the GSE market share graph. There are two questions that should be answered – why did it fall in 2003 and why did it rise again in 2008? GSEs and crises are by design linked. What would have happened to the housing market in late 2008 – now without them? Do we think that banks will not accumulate tail risk even without the presence of the GSEs? AIG had no formal backing and still accumulated huge liabilities.

In a perfect world, I do prefer an insurance program to a dividend paying corporation. Had the GSEs not paid dividends, they would have had pretty solid capital cushions. However, you can look to the FDIC to see how prevalent this system would become. What percentage of individual deposits are FDIC insured?

Slug,

I know the history of Fannie and Freddie very well, and they have always been a slush fund for Democrats from the creation of Fannie as part of FDR’s New (raw!) Deal to Freddie Mac created by the Progressive Republican Richard Nixon (Democrat in Republican clothing). By the way, if you love Freddie Mac please take Richard Nixon also.

One thing that is interesting is that of the top three listed as receiving direct payments from Fannie Mae Barak Obama had the shortest tenure. Also note that this includes all the payments all the way back to the 1980s. No one, let me repeat that, no one from the 1980s until today received over their entire tenure as much as Barak Obama.

The raping of the America taxpayers with Fannie Mae is one of the biggest swindles in US history, especially since 1990.

Now that Obama has belatedly come around to Sarah Palin’s point of view, will Menzie mock him too?

So when will interest on mortgages no longer be tax deductable?

http://www.nytimes.com/2013/08/13/opinion/nocera-dont-kill-fannie-mae.html?src=recg&_r=0

“For too long, these companies were allowed to make big profits buying mortgages, knowing that if their bets went bad, taxpayers would be left holding the bag,” Obama said in Phoenix.

I remember that all agency securities prior to 2008 used to prominently state that the US Government does not guarantee their safety.

The only reason that FANNIE and FREDDY management “knew” that the taxpayers rather than their investors would be left holding the bag was because the entire government regulatory apparatus, courts, executive, and legislature had been captured by the financial industry.

The same type of control fraud that resulted in the Savings and Loan meltdown was duplicated in the mortgage securitization industry and was magnified by laws subordinating bonds to derivative securities.

“”From the very beginning…” Really? Do you know how long those two institutions have been around? Hint: A lot longer than the Presidential ambitions of Kerry, Dodd and Obama. None of the three was even born when Fannie was created and Obama was a 3rd grader when Freddie was created.”

You don’t seem to get that BIG GOVT PROGRAMS always morph into this. They always change from their original intention into something far larger and more encompassing, and consequently more wasteful and corrupt. Yet libs keep pushing for new and dumber programs. If Obamacare is starting as a joke, what kind of monstrocity will it morph into?

“The problems started with lax regulation, crooked ratings agencies and corrupt lenders who didn’t do their due diligence, which somehow became the fault of unworthy borrowers. (Since when has it been the borrower’s responsibility to determine his or her credit risk???)”

Are you mentally ill? Lax regulation? You mean the regulation that forced lenders to borrow to people who weren’t going to pay back known as the community reinvestment act?

The lenders did not fail to do their “due diligence.” There was a market for the loans they were originating. They didn’t keep the loans. The people who failed to do the due diligence were the ones who bought the paper from the originators. And of course they did do their due diligence, they merely operated on the faulty premise that housing doesn’t go down.

It is the shallow mind that blames “lax regulation” and “corruption.”

There simply is no way that a government would ever be able to just let the financial system crash and burn. Even the “free market” conservative Bush II administration only had the nerves to let one little piece (Lehman) suffer the consequences of its greed and mistakes. After they realized what this minor failure did to a scared financial market, all that commitment to free markets folded – and they went full force into a total bailout of everybody in the financial industry (public and private). The one thing that is sure is that regardless of who is in charge and what the rules and laws say – housing and the financial system will be bailed out if it spins into a crisis situation. We know that “we the people” will carry the down-side (even worse if they actually allowed a collapse) – the question is who should have the upside? Shold it be “we the people” harvesting the profits also, individual people getting lower rates on mortgages, or the sociapathic blood sucking scumbags on Wall Street harvesting the upside and then handing the bag to the fools who believed that big guys get to suffer the consequences?

I agree that Fannie and Freddie should be wound down, but Corker-Warner suggests a NEW government insurance company. Without proper controls put into place, we will have another blow up. Guarantees are dangerous. http://confoundedinterest.wordpress.com/2013/08/14/dueling-housing-reform-bills-the-houses-path-bill-versus-the-senates-corker-warner-bill/

The explanation for the increase of GSE debt since 1982 is very simple – just think S&Ls. The September, 2011 New York Fed Staff Report pretty much explains the 2000’s housing price bubble shown in graph of Shiller’s price index.

http://www.newyorkfed.org/research/staff_reports/sr514.html.

Just to echo thoughts expressed above, perhaps without even improving them. As long as the alternative to the GSE’s is “too big to fail” banks, what is to be gained by transferring from the former to the latter? Government generally does not do a good job of providing goods or services that could be provided by the private sector, but the TBTF banks are a loathsome alternative. I would favor our host’s recommendations if we could get the TBTF banks to pay the true costs of their insurance. The next best alternative would be to turn the agencies into full federal operations. At least you’d get rid of the political contributions and the high incomes.

@anonymous the CRA has nothing to do with the subprime crisis.

“My question is, was that a good policy for the two decades before the crisis? If so, why?”

Mr. Hamilton, something is missing in this conversation. It’s not how good or bad they were. It’s how great they worked “after” the crisis.

Without the GSEs the US would have entered a depression. They absorbed the full impact via Treasury’s aid. The mechanism set in place worked wonders. As it has been envisioned. Including making the implicit guarantees, explicit. So what is the big surprise?

Briefly, the importance of the GSEs doesn’t show up in the decades they operated in a normal market. Their splendor only showed up in the role they played throughout the Great Recession!

Those thinking Fannie and Freddie should die, go ahead and good luck during the next downturn.

And, if I may, whatever the outcome is the administration must still follow the rule of law and respect the 20.1% of the company (each) owned by shareholders whether it political unpalatable or even suicidal. It is the law!

One thing that is interesting is that of the top three listed as receiving direct payments from Fannie Mae Barak Obama had the shortest tenure. Also note that this includes all the payments all the way back to the 1980s. No one, let me repeat that, no one from the 1980s until today received over their entire tenure as much as Barak Obama.

The fiasco of Fannie & Freddie surfaced in 2008 not because of the very existence, but the complete lack of ability to identify & manage risk. Congress has a risk to mismanage, Fed can create nonparallel catastrophe in economics, but we don’t say its existence is the problem, we just say let’s manage it finely. President Obama’s endorsement to wind down Fannie & Freddie is not against Fannie and Freddie’s existence, but against their ability to manage them.