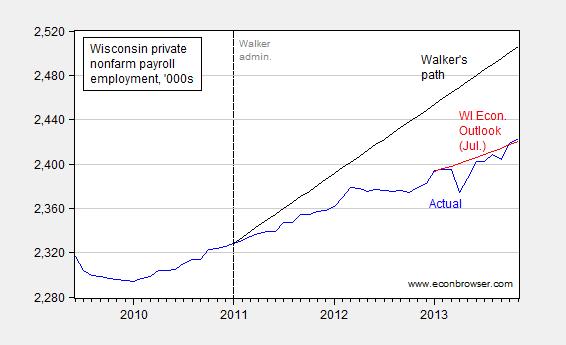

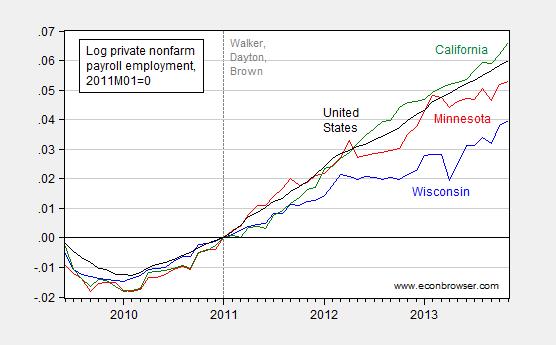

Figure 1 shows private employment relative to trend implied by Governor Walker’s pledge of August 2013 to create 250,000 net new jobs; Figure 2 shows employment normalized to January 2011 for Wisconsin, as compared to Minnesota and the Nation.

Figure 1: Private nonfarm payroll employment for Wisconsin, seasonally adjusted (blue), July 2013 Wisconsin Economic Outlook forecast, interpolated from annual data using quadratic match (red), and Walker’s promised path for private NFP (black). Source: BLS, Wisconsin Economic Outlook, and author’s calculations.

As of November, private nonfarm payroll employment in Wisconsin is 83 thousand below the trend consistent with the 250,000 net job creation target recommitted to by Governor Walker back in August of 2013.

It is useful to compare employment trends, against a regional comparator, as well as a state pursuing a different fiscal policy.

Figure 2: Log private nonfarm payroll employment for Wisconsin (blue), for Minnesota (red), for California (green), and for the United States (black), all 2011M01=0. Source: BLS, and author’s calculations.

Wisconsin continues to lag, with the gap opening up between Wisconsin and Minnesota starting in 2011, in this graph.

Isn’t it a bit premature to assess Gov. Walker’s promise made 4 months ago?

Rich Berger: If he first committed to the goal in August, yes; but he first made this promise before his election in 2010.

It is going to be very interesting to see how voters react in the 2014 elections. It seems that more than one politician promised future outcomes that seem not to be happening on schedule.

Menzie: Thank you for this helpful chart. I think it would also be helpful to see a plot of projected vs. actual new enrollees through healthcare.gov. Or do you only care about broken promises from one side of the isle?

No need to look at healthcare.gov (unrelated to employment), just look at the President Obama’s unemployment projections in 2009, though he was able to be reelected even with much higher unemployment.

Politicians always promise lots of jobs during recessions. What this shows is that they don’t have that much control over the economy. Job growth can be promised, but barring the government directly hiring masses of people (ala job guarantee proponents) the government can’t magically reduce unemployment.

During The 2012 Campaign Obama Promised 1 Million New Manufacturing Jobs By The End Of 2016.

The Bureau Of Labor Statistics Estimates Over 549,000 Manufacturing Jobs Will Be Lost Between 2012 And 2022. (“Employment Projections – 2012-2022,” U.S. Department Of Labor Bureau Of Labor Statistics, 12/19/13)

January 2010-We will double our exports over the next five years, an increase that will support two million jobs in America,” Obama said in the text of his first State of the Union speech to Congress

January 2010-Exports in millions: 143622.

October 2013 – Exports in millions 192673.

3/4 of the way through the 5 years Obama has increased exports of goods and services by 1/3.

LOL!

http://research.stlouisfed.org/fred2/graph/?s%5B1%5D%5Bid%5D=BOPTEXP

Why doesn’t Menzie have the same obsession with Obama’s promises?

I don’t post much anymore because the left is imploding. Most of the posts by JDH are politically unbiased and a joy to read. Many of the posts by Menzie are politically biased and a waste of his time and talent.

Merry Christmas to all, regardless of your political views, and I hope the new year brings happiness and contentment to you and those you hold dear.

A further interesting exercise is to look at the components of the nonfarm payroll numbers. There, it’s hard to discern a clear picture of who has a better policy mix. Comparatively, California’s recovery seems to be driven by a rebound in Mining & Logging; Trade, Transport, & Utilities; and Other Services. The good fortune of being coastal? Minnesota’s recovery looks to be driven by a broad group of Mining & Logging; Construction (tepid); Trade, Transport, & Utilities; Information; Financial Activities; and a little bit of Manufacturing that seems to be slowing. Wisconsin’s is seeing a much stronger rebound in Manufacturing than the other 2 states (California was in a long decline prior to the recession, and there is no sign of recovery), but did not see the Trade, Transport & Utility bump the others saw. Of course, I’m just eyeballing the data.

I have ask this question before and have received no answer – why the selection of these two other states, Professor Chinn.?

Why such a narrow focus?

It is unwise for anyone to make forecasts which are beyond their control, including Gov Walker, whom I support..

http://walker.wi.gov/newsroom/press-release/wisconsin%E2%80%99s-economic-growth-ranked-3rd-nation

http://www.deptofnumbers.com/employment/wisconsin/

What was the growth rate under the previous Demco governor?

Doyle vs Walker

The former governor job creation in 2010 was less than stellar.

http://www.jsonline.com/blogs/news/142860605.html

http://www.jsonline.com/business/us-adding-jobs-while-state-loses-ll4c8qp-141333083.html

I have been to Wisconsin more than I can count and I love the state, however, I would never move there for either employment or to expand my business..

UW-James Madison, is an exceptional shcool better than our UoM – Minnesota..

Anther disincentive would be the levels of taxation placed not only business but also individuals.

High levels of personal income tax

High levels of property tax

Above average corporate tax

And let’s not forget, that the state has some of the highest welfare costs in the union.

http://www.tax-rates.org/

I think this shows that the policies enacted by Walker and his allies in the state legislature have failed when compared to both the national and regional states. So this does show that policies matter. Instead of meaningful policies we get laws passed to make it harder to change team mascot names, laws designed to funnel state money to cronies, and a governor spending more time promoting himself than doing anything meaningful.

School workers in Wisconsin voted to decertify 70 teacher’s unions in the state saving millions of taxpayer’s dollars. Obviously the teacher’s unions were not for the good of teachers or students but Democrat government creations for state slush funds. The Wisconsin government is bloated with crony socialism and before real employment can blossom the dead wood must be pruned away.

In January 2009, Obama claimed that he would create 3 million jobs by the end of 2010. Yet another Obama whopper, as he apparently forgot to put ‘minus’ in front of his 3 million jobs claim. Between Jan 2009 and Dec. 2010, total non-farm payroll employment fell by 3.236 million!

An even bigger howler was his promise to create 500,000 jobs in green energy by the end of 2010.

From the NY Times. official stenographer for the White House:

http://www.nytimes.com/2009/01/11/us/politics/11radio.html?_r=0

Anonymous: You might like to read the title of the article you link to. The phrase “created or saved” is in it. Governor Walker made no corresponding caveat; he just said 250K new jobs.

Can economists test the condition of “saved jobs”?

AS: One can try. See this post.

Professor Chinn,

Thanks for the response. As a learning point, after reading the cited post, I was not able to see what number of jobs were “new” versus “saved”. Can you help clarify my confusion? Also, what number of saved jobs are you comfortable with as an estimate.

Thank you!

Menzie: you might like to READ the article I linked to. The Obama stenographers at the Times add the ‘save’ part, not Obama.

From the article: “In the campaign, Mr. Obama vowed to CREATE one million jobs, and after winning election he put forth a plan to CREATE up to three million. The report now puts the figure at roughly 3.7 million, the midpoint of an estimated range of 3.3 million.”

Or this: “The jobs we CREATE will be in businesses large and small across a wide range of industries,” Mr. Obama said. “And they’ll be the kind of jobs that don’t just put people to work in the short term, but position our economy to lead the world in the long term.”

Obama didn’t start pushing the “saved jobs” meme until it was obvious his stimulus was a complete bust….

Anonymous: Well, returning to the language in the original transition document, we find: “Table 1 shows that we expect the proposed recovery plan to have significant effects on the aggregate

number of jobs created, relative to the no-stimulus baseline.” That is how I understood (and how Mankiw similarly understood in an earlier context) the mechanics of stimulus.

There is no corresponding language that I can find in the Walker case; in an email exchange with the Chief of the Office of Economic Advisors in the Wisconsin DWD, I did not read anything which indicated a disagreement with the fact that the 250K number was relative to levels in January 2011.

Don’t sweat the politics which Menzie continues to stress. Neither Dayton of Minn. nor Walker of Wisc. enacted their tax legislation until 2013, that’s this year. Both continue to be high tax states. But the difference is Walker and the legislature are attempting to change, with reduction of cross the board tax rate decreases and moderation of the budget, while Dayton and his legislature passed a 530 some page tax bill which increased taxation, promising 2.3 billion in expanded government spending. I mention the size of the bill because who knows what mischief is hidden in the pages.

This year and subsequent years will show which policy gets better results. As of now, just note the gap between the two states per Menzie’s charts quit expanding at the start of 2013 (both states new taxation began on Jan 1st) and now looks like it is narrowing. It will be interesting to watch the charts through the nest year.

What are your thoughts on the 3.6 billion deficit he eliminated??

http://www.politifact.com/wisconsin/statements/2012/jan/29/scott-walker/gov-scott-walker-says-he-eliminated-wisconsins-36-/

The rated it half true because he did “raise taxes.”

Ed Hanson- Nice try, but Walker has been implementing tax cuts for the rich and austerity policies since he and the GOP Legislature took office in 2011. And you can see on Menzie’s chart how miserably it failed.

And Hans- Wisconsin’s best 12-month period of private sector job growth since the end of the Great Recession (according to the QCEW “gold standard” report) was from March 2010- March 2011, under the budget of Jim Doyle and the Dems. You know what happened in March 2011? Walker’s pet project of Act 10 was passed, cutting the take-home pay for hundreds of thousands of public workers, and removing collective bargaining rights for many of them.

Walker’s austerity budget followed soon after. And the “uncertainty” of the recall election holding back hiring was also proven to be a lie, as private sector job growth fell by nearly 40% in the year AFTER Walker was retained in June 2012.

By the way, the Wisconsin county with the lowest unemployment rate (at 3.8%)? St. Croix County, 10 miles east of the Twin Cities metro area. It’s not a coincidence.

P.S. For Anonymous 6:17am, that “$3.6 billion budget deficit” figure is also a lie, based on unrealistic “here’s what we’d spend if we got everything we wanted” submissions from state agencies. The real number was probably closer to $2 billion, once you looked at revenue growth in early 2011 (before Walker’s budget was in effect). And the structural deficit is back on the rise for 2015-17, along with an increase in the state’s debt of more than 11%

You righties may live in your little bubble-world, but you are not entitled to your own facts on this subject. I live here in Wisconsin and have had to put up with this buffoonery. You haven’t

Jake

I don’t live in Wisconsin or Minnesota, so all I can do is get what information I can from afar. Unfortunately, I get little (as in none) economic policy information from Menzie’s posts, as he has decided to concentrate on a political one liner.

As best as I can see, Walker has methodically attempted to reduce the problems within the state. Initially he concentrated on state mandates which caused distress on the small local tax districts. He then began to put in place budgetary policy which reduced the stress on the state budget as a whole. Finally, with the budget under better control was able to pass major legislation to reduce taxation across the board in 2013. Walker has made great strides to accomplish what he campaigned on.

I know less about Minnesota. Again I learn essentially nothing from Menzie’s interest in the state. However it is my impression that Dayton campaigned with the promise of higher taxes and bigger government. The electorate approved of this policy. He too has made great strides to accomplish what he campaigned on. The final result is the major legislation in 2013 enacting the large increase in taxation.

I do not expect Menzie to suddenly begin to make actual economic listing of policy changes within each state. His purposes are his own.

I would make a simple request though. I would have Menzie add a chart, call it Figure 2a, normalized to the beginning of 2013. This would put a picture to each administration’s major tax policy. I have no idea what this new chart would lead to, but would help, I believe all, to understand what taxation policy means, as compared to the 2011 chart which helps to explain what elections can mean. How about it Menzie?

P.S. For Anonymous 6:17am, that “$3.6 billion budget deficit” figure is also a lie, based on unrealistic “here’s what we’d spend if we got everything we wanted” submissions from state agencies. The real number was probably closer to $2 billion, once you looked at revenue growth in early 2011 (before Walker’s budget was in effect). And the structural deficit is back on the rise for 2015-17, along with an increase in the state’s debt of more than 11%

Posted by: Jake formerly of the LP at December 23, 2013 05:19 PM

Sorry, Jake, you sound pretty biased. Politifact is far more objective than you are. Sorry Walker balanced the budget bro.

Ed Hanson: When one talks about fiscal policy, I believe taxation and spending (on goods and services, and transfers) is what is usually considered — not just taxation. And I do seem to recall, having lived here at the time, actual tax bills being passed in 2011…So, in other words, would it kill you to do a little googling before writing about what you don’t know about?

Menzie

Thank-you for taking the time to respond. For one thing it gives me a chance, I had previously but forgot to write. I wish you the Merriest of a Christmas and hope that you have the best of a New Year.

Now back to your post. Such a short response you made but responsible for so many questions.

Menzie, usually when a reader of your blog asks why you didn’t give or comment on such and such actual economic matter, you are quick to respond with links to your blog, I note none have been made.

I have no doubt that real tax bills being passed earlier, but are you saying they had the same significance as the 2013 tax legislation? Either Wisconsin’s or Minnesota’s? My google and I say no.

But you do indeed live in Wisconsin, and because I am interested in EconBrowser, and your posts, I have become interested in Wisconsin although I live far from it. But I simply expect your interest to be greater than mine and am surprised to see the lack of economic facts from an economist instead just read what are essentially politically motivated posts. Surprised because you are without question more expert in economics that I, but as for politics, your opinion as well as mine are just ones of millions,and we each get just one vote.

Your formulation of new employment from the beginning of Walker’s and Dayton’s provides certain information about a politician tenure, I am simply asking for the same formulation timed to their most significant tax policy enactment. After all each should say the same facts just illustrated differently. Menzie, this is just a small request, but your blog, your time.

Ed

P.S. If you have some interest in Colorado, please feel free to ask a resident for a more local perspective. Sometimes it is superior to a google.

Oops

Sorry Menzie, to be clear, the above anonymous with the P.S. should have been listed as from Ed Hanson.

Ed Hanson: For tax measures implemented in 2011, see here. For spending measures in 2011, see here.

I feel confident I know something of the states examined; I lived in California, and have family there. My friend Louis Johnston follows the Minnesota economy. I haven’t followed Colorado, but should I need to, fear not, I have plenty of friends there too.

Menzie, you wrote in part, “When one talks about fiscal policy, I believe taxation and spending (on goods and services, and transfers) is what is usually considered — not just taxation.”

I agree but will make my case for that the 2013 tax policies of Wisconsin and Minnesota are significant. I will deal some with spending in a subsequent post.

Thanks for the links, I will use them to make my case for you to include a Figure 2a normalizing to the beginning of 2013. All direct quotes.

First Wisconsin, from the Wisconsin Budget Project An Initiative of the Wisconsin Council on Children and Families.

From your link to May, 2011.

“Wisconsin’s deficit grew earlier this year when the Legislature approved $117 million in new tax breaks for businesses and higher-income residents during the Special Session. In addition, the Governor’s budget bill proposes another $83 million in tax breaks for multistate corporations and investors.”

From WBP An Overview of Taxes and Revenue in the 2013-15 Budget in July 2013

“The budget includes a significant income tax cut and new resources for tax enforcement. For many people, property taxes will stay relatively flat due to limitations on the ability of local governments to raise money through the property tax. The budget includes several different ways of increasing revenue available for highways at the expense of other important programs, such as education and health care.

As a result of a total of about $1 billion of new tax cuts and previously enacted cuts that are gradually being phased in, General Fund spending will significantly exceed new revenue in 2013-15. A Fiscal Bureau analysis indicates that there will be a hole of roughly $500 million at the start of the 2015-17 biennium.” (emphasis in bold mine.)

So accordingly, in 2011 at most 200 million in tax cuts, 2013 1 billion + in tax cuts. Five times the amount. The tax legislation creates significant across the board tax rate cuts.

Minnesota.

From the column of your friend Louis Johnson, 11/09/12, titled Why do we have a state budget mess? Think Ventura years and baby boomers

“What should we do?

So far, we’ve ignored these problems. The 2011-2012 Legislature started from the premise that tax rates could not change and did nothing to reform the system to increase revenues. This meant that the permanently lower revenue stream created by the 1999 budget deal remained unchanged. The governor and Legislature then patched together budget fixes based on draining endowments (tobacco settlement funds), shifting school funding from one biennium to the next and reducing allotments to higher education.”

I read this as no significant tax changes in 2011

As I previously posted beginning 2013 a 530 something page long enacted tax legislation allows for a 2.3 billion dollar increase in the budget. The legislation calls for a significant tax rate increase.

Conclusion:

Wisconsin’s tax policy creates reductions in tax rates estimated 5+ times greater in 2013 than in 2011.

Minnesota had no significant tax changes in 2011, and a very significant tax rate increase in 2013.

I respectfully renew my request for inclusion of a new Figure 2a, normalized to the beginning of 2013.

As always I recognize that this is your blog and your time.

A merry Christmas to all,

Ed

Menzie,

As promised I will comment on other fiscal matters such as spending, including taking responsibility for spending. I will again make the same quote from Louis Johnson from 11/09/12. Let’s face it, its so good, and so demonstrative of the difference between Walker and Dayton. I will keep this short.

“What should we do?

So far, we’ve ignored these problems. The 2011-2012 Legislature started from the premise that tax rates could not change and did nothing to reform the system to increase revenues. This meant that the permanently lower revenue stream created by the 1999 budget deal remained unchanged. The governor and Legislature then patched together budget fixes based on draining endowments (tobacco settlement funds), shifting school funding from one biennium to the next and reducing allotments to higher education.”

So it went in Minnesota and Dayton. You can disagree all you want will Walker policy, but he took reigns, managed and cut his budget with real changes, making the hard choices, to deal with his large projected deficit (3.6 billion according to the Wisconsin Budget Project). Dayton punted.

The result is clear. Walker was able to responsibly allow tax payers to keep more of their hard earned income, by across the board tax rate cuts. Dayton had to push a huge tax rate increase to fund his inaction the previous two years.

Ed

My apology to all and especially Louis D. Johnston.

I misspelled your name. It is Louis D. Johnston. Here is how the MinnPost describes him.

“Louis Johnston writes Macro, Micro, Minnesota for MinnPost, reporting on economic developments in the news and what those developments mean to Minnesota. He is Joseph P. Farry professor in the Eugene J. McCarthy Center for Public Policy and Civic Engagement at Saint John’s University. He is also associate professor of economics at the university and a frequent commentator and featured expert on economic issues for Minnesota Public Radio. Besides family and economics, his passions are music (especially big band jazz) and trains.”

I only read a few of his columns, but he is most impressive. Mostly concise, fairly even-handed, and always informative. An excellent resource whether you agree or disagree with his take.

Ed

Gutless Anonymous at 5:19- Most of us in Wisconsin know Politi-crap goes out of its way to stay in Walker’s good graces, like a lot of the state’s media, frankly. All you have to do is read a budget document to see that all that was really done was shifting payments onto employees, and imposing mandates onto local governments without giving them the funds to maintain the same level of services.

Take a read on where our structural deficit stands today ($725 million and counting), and then remember that this doesn’t take into account the increased debt service payments due in the next two years.

http://legis.wisconsin.gov/lfb/publications/Miscellaneous/Documents/2013_10_15%20Structural%20Deficit.pdf

And here’s the debt info, as part of the state’s CAFR. Please flip to pages 39, 236, 237, and 238 to see for yourself.

ftp://doaftp1380.wi.gov/doadocs/2013%20CAFR_Linked.pdf

I am indeed biased, toward economic facts, history, and the world as it is. You not having the guts to do the same and accept that you’ve hitched your wagon to a losing ideology isn’t a reason to rip on those of us in the above-ground, adult world.

Have a nice Holiday, kiddo.

Ed Hanson: Hah, you are a true believer. Read instead this post. And you can bet the tax cuts are regressive that blow the hole in the structural budget balance, just like the previous spending cuts.

Menzie

I do not think I anywhere near a true believer compared to you.

Have you been on sabbatical out of state again? Your link was dated March 4, 2013 and it referred back a to Legislative Fiscal Bureau estimate made Jan 24 2013. It gave zero information how the WBP massaged and calculated its numbers, from the LFB report. But to follow your lead, the WBP projected something they call a 2013 structural budget balance of 146 million to a structural imbalance near 350 million at the end of 2017.

Need I say again that outdated, unknown calculations do not impress me. But as I often say your blog your time. So I suggest we move forward in time and continue to use your WBP source.

Wisconsin Receives Positive Fiscal News

Dec 13, 2013 Opening paragraph:

“There were a couple of pieces of positive fiscal news for Wisconsin late this week. Most noteworthy is that the latest tax collection numbers from the WI Department of Revenue (DOR) are very encouraging. Tax revenue was up 4.6% over the first five months of the fiscal year (through November), but that’s before making an adjustment relating to the timing of collections, so the 2013 and 2014 figures can be compared more precisely. After DOR makes that correction, General Fund tax revenue is up a little more than $400 million or 8.4% in the current fiscal year.”

Not as important but interesting to are discussion is the third paragraph.

“In a blog post last week, I discussed the very strong revenue growth recently projected in Minnesota, and I wondered if Wisconsin would enjoy similar revenue growth when new tax estimates are released for WI early next year. Though I expect the next batch of Wisconsin data to be less rosy than the latest Minnesota numbers, the November figures released today make me far more optimistic about the revised 2013-15 estimates that will be unveiled in another month or two.”

What can I say but HMMMMM, maybe belief is a good thing? And just maybe tax cuts do not blow a hole in structural budget balance.

Ed Hanson: Your comment makes me suspect that you don’t understand what a structural budget balance is… You should look it up sometime. It’s different than the GAAP actual. (I did know about increase in revenues, believe it or not; it just isn’t relevant to the point I was making.)

Further, you didn’t quote this from the same post:

Menzie

No, I do not know the ins and out of structural balance, but I can read that original projection estimating state revenues were lower than what actually occurring. Since you are more knowledgeable, how do you see the structural balance projection when the LFB reports come out in a couple of months? Higher, lower, or about the same?

The increase of revenues above estimates (dare I say Keynesian estimates) when supply-side type tax rate cuts are enacted is straight out of the supply-side handbook. I will go further with my expectations, also from the handbook, Wisconsin will continue to do better, and Minnesota will, in the short future, find that its revenue projections were too rosy. Gee, I guess I am a true believer. But it is comforting when the facts have bared fruit so far. You, too, should be happy for your state.

I did not leave out the paragraph you quoted out malice. I linked directly to the WBP because I expect anyone interested to directly check my sources. I am not surprised that a state increases its bond debt at this time. And did not think it a big deal one way or the other. Two major reasons, when coming out of a long, deep recession I would expect a need for catch up on normal state needs which commonly use bonds, secondly to take advantage of the current low interest environment. The questions is better asked, has the new bonding lowered Wisconsin’s bond rating, and are the terms of the bonds relatively better or worse than other states. But my interest is not high with this issue, not my state, so I did not intend to delve in bonds any deeper. It’s your debt, not mine.

I have made my case. Figure 2 and my proposed figure 2a use the same data. They are both, however, graphic in nature. Figure 2 pictures a story from the first day of the governors’ terms, my Figure 2a pictures a story from the first day of each governor’s major tax initiative. Both Figures tell their story. Please include mine starting your next post from unemployment release.

Ed Hanson: The very fact that you don’t understand what a structural budget balance is means your argument about rising revenues is beside the point. Read a bit about structural budget balances (also known as cyclically adjusted budget balances) and you’ll see why; in other words, don’t be so proud of your ignorance.

Joint Committee on Taxation analyses, as reported by CBO, don’t use “Keynesian” analysis in generating their revenue estimates for the US. JCT allows for micro revenue effects, but not macro (so no dynamic scoring). I believe that a similar practice is in effect at the Wisconsin state level. So I don’t understand your crack about “Keynesian” estimates.

Jake, the sad thing about your opinion piece, is that you can not admit that your state has over spent for years and now you make the fake claim of austerity…

Did you forget how “your” Demco Senators fled to Illinois to impede the will of the people?

Not to mention the national disgrace of “your” recall elections because officials did not vote your way…

The people on the left have always been very poor losers – see Hairy Reid…

You have a lot of remedial work to fully restore your historical perspectives…

Menzie

I did not say I did not understand the term structural budget balance, I said I did not know all the ins and outs. But I very much noted you used that tack to avoid answering my question of your projection of its direction. I recognize the argument tactic, never answer a question which may tend to give the other side a point in their favor.

Of course, you do not understand my crack about “Keynesian” estimates. You have vested your philosophy, your education, your career, and your ambition into it. Nothing wrong with that (except for the fact that Keynesian macro theory does a poor job describing the real world), you are very good at it. You can teach at a high level, converse intelligently with others about it, and do original research with its methods. But like everyone, you often fail to recognize your bias toward others who approach the question of economics from a different direction.

To explain the crack, the static analysis may or may not be directly found in your brand of Keynesian theory. But it gives cover to it. Keynesian Theories are very weak on incentives. Too much of it is invested in the idea that people will work just as hard and take the same risks at higher levels of taxation. Add to this that how difficult it is, in the theoretical world, to model how people will restructure their wealth and income to changing tax regiments. It becomes too easy, to normal to assume “all other things being equal.”

Whether the following is an example of my point and projection, only time will tell. Minnesota is likely to see an increase in revenues to the state above early projection of 2%. Wisconsin 8.4%. A large difference. Nobody could possibly tell the whole story of all the factors contributing to revenue increase or the difference in percentage. Certainly a major part is the generally improving economy above projections. But I maintain a substantial part explaining the difference is changing tax policy.

Ed Hanson: Keynesian analysis would suggest using dynamic scoring, on both tax and spending sides. So too would a RBC. Think about it for a couple of minutes. So to whom is static analysis giving cover to? Geez.

By the way, you don’t need to know the ins and outs of the calculation of structural budget balances to understand your argument was besides the point. Double geez.

A quick two points.

It is not whom the static analysis is giving cover to, but those who made the static analysis, linked first by you as a source to be dealt with. I just attempted to deal.

You still will not answer the simple question. Beside the point? No.

ed hanson

you deride keynesian economics by saying

“except for the fact that Keynesian macro theory does a poor job describing the real world”

actually the keynes approach has been pretty darn accurate anticipating the world we live in and effects of certain policies since the recession took hold. it is the alternative approaches which have been completely unable to handle a world in the zero lower bound. you are letting your ideology blind you to reality again!