That’s the point of a Bloomberg article:

Anyway, that Jeep plant? It didn’t move to China. And it’s actually doing quite well. No, scratch that: It’s going gangbusters. Demand for Jeeps is so high that Chrysler workers are clocking 60 hours a week and still can’t keep up.

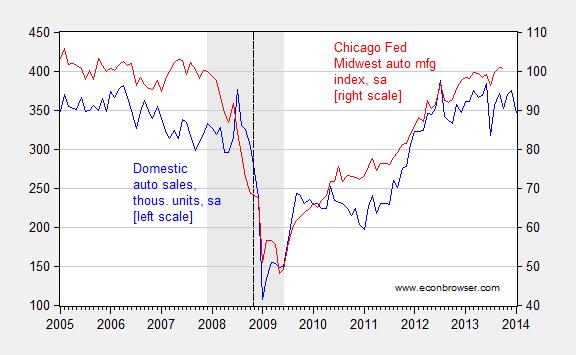

Figure 1 illustrates the context.

Figure 1: Auto and motor vehicle sales, thousands of units (blue, left scale), and Chicago Fed motor vehicle manufacturing index, 2007=100 (red, right scale), both seasonally adjusted. NBER defined recession dates shaded gray. Vertical dashed line at “Let Detroit Go Bankrupt”. Source: FRED.

Update, 3/16, 6PM Pacific: Reader Patrick R. Sullivan writes:

Looking at Figure 1, I’d say that sales of cars are pathetic. Only back to the level of 2005. And that after years of far below normal sales figures, which should have resulted in pent-up demand. This is nothing to brag about for this economy.

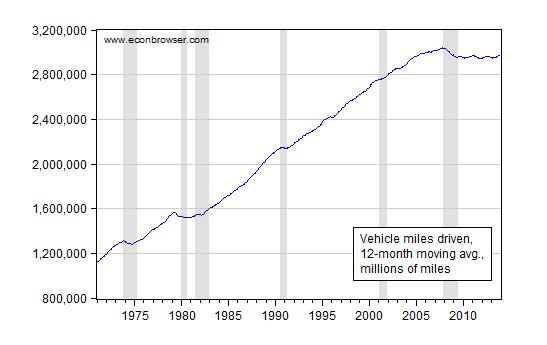

I think it is useful when thinking about production trends to consider the end-use of the product. One interesting point is that vehicle miles driven has declined, and is essentially flat, despite the fact that GDP has exceeded pre-recession peaks. This is shown in Figure 2.

Figure 2: Vehicle miles driven, 12 month moving average, in millions. NBER defined recession dates shaded gray. Source: Federal Highway Administration via FRED.

Part-time because of Obamacare?

Since when does anyone believe anything that any politician says?

No, part-time because they hire people as temps and then convert to full time the ones they want for the jobs they want.

But seriously, the rules about FT and PT for Obamacare apply to companies orders of magnitude smaller than Chrysler. THINK!

Politicians tend to make statements that are incorrect. Some are more important than others.

http://www.mrctv.org/videos/nbc-shows-flashback-obama-mocking-romney-labeling-russia-us-foe-abc-and-cbs-ignore

Looking at Figure 1, I’d say that sales of cars are pathetic. Only back to the level of 2005. And that after years of far below normal sales figures, which should have resulted in pent-up demand. This is nothing to brag about for this economy.

Also, that the factory is relying on excessive overtime to meet demand tells me that they don’t expect it to continue. If they did, wouldn’t they hire more employees.

Patrick R. Sullivan: A relevant question is whether we need so many vehicles, given trends in vehicle miles driven. See Figure 2 which I have added for your benefit.

Isn’t the flatness of vehicle miles drive more evidence of the anemic recovery?

or a trend toward more urban living which requires fewer automobile miles driven. i purposely live close to work in a more urban setting as a convenience to be around things i like to do, such as museums, restaurants, etc.

look at urban landscapes like miami. tens of thousands of new condo’s in urban cores reduces the use of automobiles tremendously.

China…Mexico, whatever;

http://www.usatoday.com/story/money/cars/2013/10/11/chrysler-mexico/2964595/

‘Chrysler will invest $1.3 billion at two Mexican factories to build more engines and commercial vans, a project that will add 1,570 jobs.

‘It’s just the latest in a series of big investments in Mexico by major automakers.’

One of those plants will build the engines going into the Jeep Cherokee.

anybody looking at that chart and still arguing the auto bailout was a bad thing must be blind! how many more jobs would have been lost-all linked to the auto industry-if mitt had allowed the auto makers to go bankrupt!

Another example of the conservative brain in action:

they don’t expect it to continue

And in the very next post by the very same author (Patrick R. Sullivan):

Chrysler will invest $1.3 billion at two Mexican factories to build more engines ….One of those plants will build the engines going into the Jeep Cherokee

The very definition of cognitive dissonance. Apparently Patrick R. Sullivan believes Chrysler is both confident enough in the sales boom that they are investing $1.3B to support the feeding of final production lines, but they aren’t equally confident in the sustainability of the final production line. Amazing. Simply amazing.

I’m tempted to just quote Keynes to the effect that, when I encounter new information I change my mind. What do you do, sir?

But, doesn’t the Mexico investment partly vindicate Romney?

And while we are on the subject of bullcrap: do you remember when Crowley and Obama debated Romney? And Romney pointed out the dangers of Russia. And smug Obama said the 80s called and they want their Russian foreign policy back.

Now as Russia settles into Crimea they even, for good reason, mock the sainted one and almost literally give Obama a one fingered salute. Even most Americans think Obama is a joke on his 21st handling of the situation while the rest of the world does good old 20th Century real politik. Guess the 80s called and the Dark Doofus didn’t know what to do.

Another example of a liberal brain in action.

V,

do you even know the history of the Crimea? you are aware historically it is Russian territory, and has been a part of Ukraine for only about 60 years as a gift. so should obama embark on a war between nuclear powers to keep that territory away from russia? what exactly do you propose. are you willing to go to battle for this land? are you willing to send your own kids to the battlefront for this land? this obama bashing over crimea is nuts. you are simply looking for a reason for a reason to complain. or are you simply looking for another war?

Interesting. The car industry seems to be improving as US austerity increases.

Indeed. Many economists have been discussing the US manufacturing renaissance, due largely to our energy cost advantage with cheap domestic natural gas.

As a prophetic woman once said, “Drill, baby, drill!” This was also around the time some guy was mocking her for saying that Fannie Mae and Freddie Mac had gotten too big and too expensive to the taxpayers.

“Some Guy” does a lot of political mocking.

W.C. Varones: Regarding the sources of the manufacturing increase, please consult this post for assessing the relative importance of the shale revolution, fracking, etc.

If you still believe the GSE’s were the primary reason for the financial crisis of 2008, then I believe that you and Sarah Palin belong together. If you are unable to read an entire book, then I suggest you just read this short article highlighting what types of MBS’s and CDO’s went under (hint: they weren’t GSE issued).

Menzie,

Who said anything about the GSEs being the primary reason for the financial crisis?

You have a fantastic penchant for straw men.

varones,

you are the one who elaborated how we should not fault palin for saying the gse’s were too big for the taxpayer. during that time frame, the argument from the right was the gse’s were a primary driver of the financial crisis. please do not rewrite history. it was (and is still) important for the right to reconstruct the financial crisis as a fault of government, not a failure of the private sector. conservatives were wrong then, and they are still wrong today by pushing that falsehood. but their ideology can never allow for a private sector failure to occur-it would turn their world upside down!

Baffling,

I see you are a master of the straw man as well.

Who on the nebulous “right” made that assertion? The evil Koch Brothers? It certainly wasn’t me and it doesn’t have anything to do with what Palin or Menzie said. If Palin said that at a different time, why didn’t Menzie take issue with that instead? That would have been a legitimate point for Menzie to make.

It’s incredibly intellectually lazy and dishonest to ascribe a view supposedly held by some on “the right” to all who you perceive as being in that group. Wise up and deal with the actual argument.

varones

“As a prophetic woman once said, “Drill, baby, drill!” This was also around the time some guy was mocking her for saying that Fannie Mae and Freddie Mac had gotten too big and too expensive to the taxpayers.”

your words. what are you implying by bringing palin into the discussion along with fannie and freddie? you are going to deny the right took the view that fannie and freddie were the major culprits of the financial crisis? that is why there was an uproar to shut them down from the right. or were you out there defending the gse’s? doubtful but feel free to produce your quotes in support of fannie and freddie if they exist.

varones you are the one who built the strawman!

It’s not still 2011, Menzie. Konczal’s analysis;

‘Some argue that the GSEs had huge subprime exposure if you create a new category that supposedly represents the risks of subprime more accurately. This new “high-risk” category is associated with a consultant to AEI named Ed Pinto, and his analysis deliberately blurs the wording on “high-risk” and subprime in much of his writings. ‘

Is ‘inoperative’ now that the SEC has accepted Pinto’s numbers in its settlement with Fannie and Freddie. It’s now official government policy that the GSEs lied about their subprime portfolio. There just happens to be a new book by a couple of legitimate scholars, Columbia’s Charles Calomiris and Stanford’s Stephen Haber, “Fragile By Design’, that further demolishes the Konczal-Krugman Housing Cause Denial argument;

http://www.amazon.com/Fragile-Design-Political-Princeton-Economic/dp/0691155240

Read it, and learn. Or, weep, as you prefer.

Just curious how much the present demand still represents “pent-up demand.” With domestic production running at 300-350K per month and then dropping like a rock for three years, it would seem that just getting back to the old “normal” still represents “behind the curve.” There are plenty of anecdotal accounts of small fleets being run into the ground because owners are afraid to spend money on replacement vehicles.

I’d suggest there is still a story behind the chart that is not being told.

Is this article about M.R. or vehicle production? The board of Fiat

would like to know.

This chart going back to about 1976 puts recessions and automotive output into a better perspective. Based on the early 80s recession and recovery and 2000-05 levels, one might reasonably expect automotive production to have quite a bit of run in the recovery. If it doesn’t happen, it might also be reasonable to ask what has fundamentally changed in the economy… and what domestic policies are needed to address that.

http://2.bp.blogspot.com/-zElR73szWXQ/UXu9utZLpiI/AAAAAAAActU/wkh4INFXbBs/s640/ALTSALES_Max_630_378.png

Amusing this joy on the left at a resurgence of assembly line work in the US.

Oldies like me can remember when the PC posture on the US left was to despise assembly line work and to hail small team experiments at places like Saab – bankrupt – and Volvo Cars – sold to the Chinese.

Work was supposed to be fulfilling and fun…

I think you’re thinking too much in terms of a monolithic “left”.

My observation is that when people start talking in terms of “us” and “them”, they tend to start thinking less clearly.

C Thomson: Well, I think you have your stereotypes well in place. For my part, I don’t recall disparaging production lines in favor of Scandinavian auto production methods, although it did seem to me the Japanese were able to produce cars more efficiently than Americans did. I’ve always had respect for hard work, and can say I worked on a production line, worn a hard hat (at least when management remembered to enforce…).

I’m talking about the 1960s left, guys – long ago and far away and the past is another country.

My point was – be careful what you wish for.

If, for example, you want this manufacturing resurgence to last, hope that traditional American unions remain dead and buried. Ditto meathead management of the GM mode. Or the steel industry ‘leaders’ in the 1960s.

I seem to recall that both Mitt Romney and Sarah Palin correctly predicted Putin’s aggressive actions towards Ukraine.

WC Varones said :

“If that’s what passes for professoring in Wisconsin, the people of Wisconsin are being ripped off. I would have hoped for more comprehension from a “Professor of Public Affairs and Economics.””

Heh.

“One interesting point is that vehicle miles driven has declined, and is essentially flat, despite the fact that GDP has exceeded pre-recession peaks.”

Very interesting, and suggests to me that the economy hasn’t actually grown, it’s just financials.

http://economix.blogs.nytimes.com/2014/03/14/people-think-were-in-a-recession-dont-blame-them/?module=BlogPost-Title&version=Blog Main&contentCollection=Business Day&action=Click&pgtype=Blogs®ion=Body

baffling

March 15, 2014 at 8:28 pm

anybody looking at that chart and still arguing the auto bailout was a bad thing must be blind! how many more jobs would have been lost-all linked to the auto industry-if mitt had allowed the auto makers to go bankrupt!

How many jobs were lost when Obama let hostess (twinkies) go bankrupt?

Hint: only the ones that needed to be

anonymous,

please give me an account of what would have happened to the us economy if the automakers had all been allowed to go bankrupt? first, there needs to be funding for somebody to reorganize and emerge from bankruptcy. at that time, there was NO money available in the private sector. hedge funds, private equity, banks were all squeezed-the money market system was frozen. so you advocate letting the 10% of the us economy associated with the auto industry to shut down and liquidate-but with no buyers available! you cannot even seriously compare the shutdown of twinkies to 10% of the us economy! do you understand how many one industry towns in the midwest would have simply shut down? this was bigger than simply letting a competitor overtake a weaker firm.

Toyota and other car companies pushed hard for the bailout. GM would have been liquidated, not reorganized under new ownership & management, and that would have created chaos in the industry: the loss of GM would have bankrupted many large suppliers, and Toyota and other car companies relied on those suppliers.

“I think it is useful when thinking about production trends to consider the end-use of the product.”

Which said end use appears to be sitting in inventory…..

Bail-out Enthusiasts

Whether one is enthusiastic about an auto bail-out may depend upon one’s economic status and perceptions. Some perceptions that may exist are: (1) Bankruptcy means liquidation vs. bankruptcy means a more efficient management and ownership team may buy the auto assets and continue to manufacture vehicles more efficiently, perhaps in a non –union environment. (2) “Working people” who are not union members may hold the perception that union workers and union pensions are being protected when their own jobs would not be protected in similar circumstances. (3) Non-union members may have the perception that the bail-out was done to gain favor with unions and union members for political election purposes. (4) Some auto- bond investors may have the perception that union pensions are being protected at the expense of the bond-holder’s principal, instead of both bond-holders and union pensions getting a hair-cut in bankruptcy.

If administrations could be honest, it could be said by the administration that almost everyone got a bail-out. Unions, bond-holders (other than auto-bonds), and equity investors, all got bail-outs. Union pensions have been protected, bond-holders of intermediate and long-term bonds saw tremendous capital gains, equity holders have seen close to doubling in the value of holdings since the great recession. Food stamp recipients have doubled in number and perhaps many unemployed have improperly retired on Social Security Disability. It seems that a couple groups, however, have not been bailed-out. Those who rely on short-term investments for income and those who have lost jobs that seem may never return. These later two groups may be the ones who question bail-outs, since they may perceive little personal benefit.

Menzie –

Do you have a definition what they are considering “Sales” – either delivery to the dealer or dealer sales? If its not sales to the end users, do you think the units sold might not be the best measure to determine the robustness of that sector of the economy?

It also appears that the data set you are using is only from a handful of states – “Chicago Fed Midwest Manufacturing Index (CFMMI) is a monthly estimate by major industry of manufacturing output in the Seventh Federal Reserve District states of lllinois, Indiana, Iowa, Michigan and Wisconsin.” I’m not sure if the entire US Auto industry mimics the 5 states above but I don’t think it’s a given.

Exactly. I took students to a supplier last spring, meeting with their CFO who took them through the history of that period, the 300 person plant we were visiting down to 3 people, and the company as a whole not knowing at the start of the day whether they’d have cash to make it to the end of the day. There was no DIP financing so if they’d not been able to make it through the day, they could not have taken Chapter 11 for granted, and in any case would not have been able to keep producing. And they supplied everyone. I won’t name the company, but I know others that were in a similar position. So Toyota would have shut down – and Just-in-Time (JIT) production systems meant this would have occurred in 48 hours. Things would have unravelled very quickly. Ford would have been pushed into Chapter 7 as well – they’d already mortgaged everything, Mullaly’s first job as CEO was to pitch Ford assets to banks because they saw a downturn coming and had no cash. Again, this was from the then-Ford-CFO who spent a couple hours with students. mike smitka, at Autos and Economics on blogspot

I thought the above would appear as a reply to an earlier comment …. read them all?!

One challenge of interpreting short-run data (miles driven down) is that autos are a durable good. With roughly 250 million vehicles on the road, how much lower should less driving push the target vehicle stock? During the prelude to our Great Recession auto sales [or more precisely, light truck sales] boomed, and then were slammed by higher gas prices and by unemployment and by people underwater on their mortgages. Sales fell 40%, an amplification to be expected of durable goods. Sales then remained low, below depreciation [scrappage]. And now they’re rebounding, particularly for the vehicles that depreciate the most rapidly (work trucks = Ford F-150), again something to expect after any period when sales of a durable good are pushed to low levels by exogenous forces.

Sorting out those forces!! – desired vehicle stock [# jobs rather than miles driven], depreciation of the vehicle stock, and preferences for new vs old, with the complication that recent vintage vehicles really are better and last longer … I can set up the problem conceptually, and I get someone from the Chicago Fed to talk through it for my students, but I don’t have the time and data to actually try other than back-of-the-envelope calculations.