Updated 3/4 5PM

Here are some immediate consequences of Russia’s intervention in the Ukraine. From Reuters:

Russian stocks and bonds plummeted on Monday and the central bank hiked interest rates, burning its way through as much as $12 billion of its reserves to prop up the rouble as markets took fright at the escalating tension with neighboring Ukraine.

Investors were ditching all Russian assets alike – the rouble, stocks and bonds. The market capitalization of the Russian rouble-denominated MICEX stock index fell some $60 billion since Friday, more than the $51 billion Russia spent on the Winter Olympics in Sochi last month.

…

Russia’s central bank unexpectedly raised its key lending rate – the one-week repurchasing agreement – to 7 percent from 5.5 percent, in an attempt to stem capital flight.

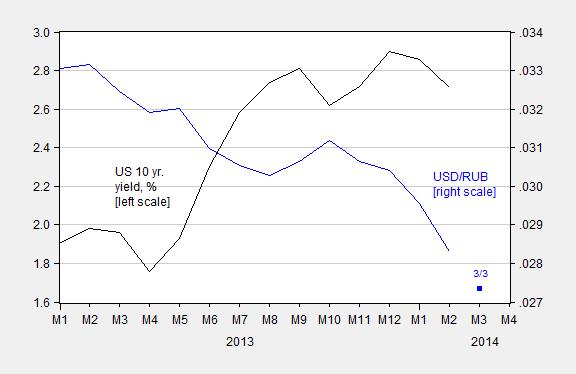

Here is a longer term view of the evolution of the ruble, in the context of perceived tightening in US monetary policy.

Figure 1: US ten year constant maturity yields, % (black, left scale), and USD/RUB exchange rate, monthly averages (blue), and value for 3/3 (blue square), January 2013-April 2014. Source: Federal Reserve via FRED, Pacific Exchange Services, and author’s calculations.

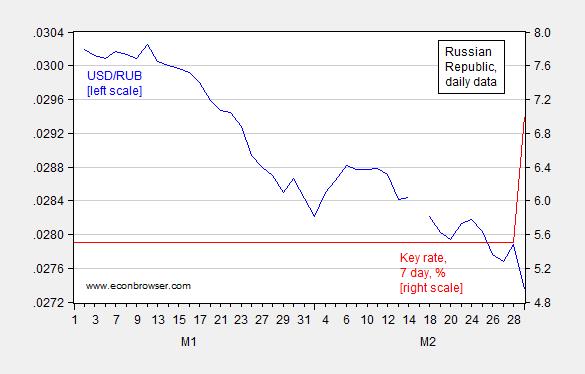

The ruble has been depreciating since the beginning of 2013, but the decline has accelerated in 2014, as depicted in Figure 2, using daily data. The depreciation in the ruble today has occurred despite an increase in the seven day policy rate from 5.5% to 7.0%, and the expenditure of roughly 2% of Russia’s foreign exchange reserves.

Figure 2: USD/RUB exchange rate (blue, left scale), and seven day repo rate (red, right scale), January 1-March 3, 2014. Source: Pacific Exchange Services and Russian central bank.

It will be interesting to see if this interest rate defense coupled with intervention in the forex markets prove successful. It surely must depend upon expectations — both of the central bank’s willingness to defend the currency (a central bank official indicated there is “big room” to increase rates further), the sensitivity of the economy to interest rate hikes, and anticipated Western responses. At the moment, there seems to be some bravado on the part of some market participants.

“Is Russia going to be cut off from the world? That is very unlikely given what Russia provides to the world, which are oil, gas, raw materials,” Alexis Rodzianko, president of the American Chamber of Commerce in Russia, said.

“Sanctions are less than absolutely likely because sanctions hurt both sides, maybe even the side applying the sanctions more than the side being sanctioned.”

The credibility of the interest rate defense is in my mind a little strained, given that growth was already forecasted by the IMF in January to decelerate from a modest 1.9% to 1.5%, going from 2013 to 2014 (q4/q4) (and y/y growth had been marked down a whole percentage point for both years, going from October to January WEO‘s).

I am a little more skeptical that there are some sanctions that could impose real pain on Russia. These include freezing individuals’ assets in the US [1]. Allowing exports of US crude in order to influence world prices (as sugggest by the CFR’s Richard Haass) seems unlikely — to me — to have a sufficiently large impact on global oil prices to have punish Russia noticeably. However, if the mere announcement of sanctions signals to market participants an extended period of financial turbulence, then the markets might nonetheless impose substantial pain on Russia.

Addendum: The ratio of short term debt to reserves is fairly low at the end of 2013Q3, at 16%. In comparison to some ratios shown in Chart 8 in this post, the ratio is fairly low. The Economists‘s capital freeze index in September placed Russia barely in the “orange” range,and outside the green range. [2]

Update, 3/4 5PM Pacific: From IDEAGlobal Asian Regional Markets 3/5:

…We feel that the biggest restraints for Russia are actually Russia’s economy and financial markets as well as the Russian people. Significant military action would destabilise Russia’s weak economy with acceleration in capital flight and dollarisation likely to prove increasingly difficult to combat despite the huge currency reserves (which are being drained at quite a clip), external debt hard to roll over, especially if the EU/US impose sanctions. …

See also Bloomberg/BusinessWeek, and BeyondBRICs/FT.

Deja vu 1998 , i.e., Russian default, Ruble devaluation, LTCM implosion, Asian Crisis, and the onset of Japan’s debt-deflationary regime.

“However, if the mere announcement of sanctions signals to market participants an extended period of financial turbulence, then the markets might nonetheless impose substantial pain on Russia.”

Sounds like a prescription for a lot of pain all ’round. Not sure a good dose of ‘financial turbulence’ would be welcomed here.

In a totalitarian state that supplies much of the world’s oil, expecially Europe, do they really care?

I think we have to see how it plays out. I would think it will put a major chill on Russian FDI and increase capital flight, but I think it’s going to take some time for the western democracies to get their thinking in order.

don: I agree heightened financial uncertainty doesn’t improve matters overall. However, the US is better positioned to withstand elevated levels of uncertainty given the US dollar’s role as the safe haven currency.