That’s the title of a conference that took place at USC this weekend, co-organized by Joshua Aizenman, Menzie Chinn and Robert Dekle, and cosponsored by the USC Center for International Studies, USC School of International Relations, Journal of International Money and Finance, and the Federal Reserve Bank of San Francisco.

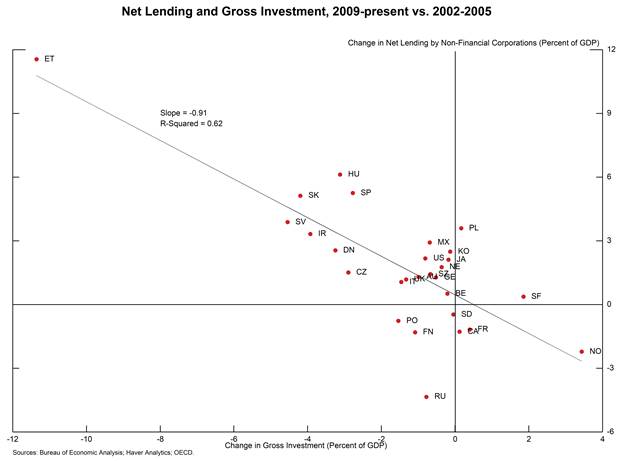

The papers focused on new international trends and developments in the wake of the global financial crisis, including the role of corporate saving/investment/net lending (figure 7), and official flows, in the global saving glut, the behavior of cross-border banking, the size of fiscal multipliers, fiscal rules and business cycle volatility, the implications of foreign exchange reserve accumulation, monetary aspects of Abenomics, and the competing options of macroprudential regulation and financial repression.

Figure 7 from Gruber and Kamiin (2014).

The agenda is here. I’ll discuss some of these papers at greater length in a subsequent post, but for now, here are links to the papers, and their abstracts:

“The Corporate Saving Glut in the Aftermath of the Global Financial Crisis” (paper)

Presenter: Steven Kamin, Boards of Governors of the Federal Reserve System (co-author Joseph Gruber)

Abstract: We examine the increase in the net lending (saving minus investment) of nonfinancial corporations in the period following the Global Financial Crisis. We consider whether this increase in net lending is an endogenous reflection of the current weak pace of growth or rather an outcome of firms’ desire to cut investment and hoard assets, and thus an exogenous drag on growth. Looking at G7 economies, we find that the increase in net lending (and its components) is in line with historical norms, given the path GDP growth, interest rates, and other relevant determinants. Moreover, we identify no pronounced reduction in the return of corporate earnings to shareholders through dividends or equity buybacks. As such we conclude that this is little evidence to support

the hypothesis that an extraordinary desire by corporations to save is hindering investment and thus the economic recovery.

Discussant: Michael Devereux, University of British Columbia

“Drivers of Structural Change in Cross-Border Banking Since the Global Financial Crisis” (paper)

Presenter: Marcel Fratzscher, DIW Berlin-German Institute for Economic Research (co-author Franziska Bremus)

The paper analyzes the effects of changes to regulatory policy and to monetary policy on cross-border bank lending since the global financial crisis. Cross-border bank lending has decreased, and the home bias in the credit portfolio of banks in the euro area has risen sharply, but not among banks outside the euro area. Our results suggest that expansionary monetary policy in the source countries has encouraged cross-border lending in euro area and non-euro area countries. By contrast, while increases in financial supervisory power or independence have encouraged credit outflows from source countries, tighter capital regulation has lowered cross-border lending since the crisis. However, these effects have largely been driven by euro area countries. The findings thus underline the importance of regulatory arbitrage as a driver of cross-border bank flows since the global financial crisis.

Discussant: Mark Spiegel, Federal Reserve Bank of San Francisco

“Fiscal Multipliers in Expansion and Recession: Does It Matter Whether Government Spending is Going Up or Down” (paper)

Presenter: Carlos Vegh, John Hopkins University (co-authors Daniel Riera-Crichton and Guillermo Vuletin)

Abstract: Using non-linear methods, we argue that existing estimates of government spending multipliers in expansion and recession may yield biased results by ignoring whether government spending is increasing or decreasing. For industrial countries, the problem originates in the fact that, contrary to ones priors, it is not always the case that government spending is going up in recessions (i.e., acting countercyclically). In almost as many cases, government spending is actually going down (i.e., acting procyclically). Since the economy does not respond symmetrically to government spending increases or decreases, the true long-run multiplier for bad times (and government spending going up) turns out to be 2.3 compared to 1.3 if we just distinguish between recession and expansion.

Discussant: Yuriy Gorodnichenko, University of Californa Berkeley

“Liquidity Risk and US Bank Lending at Home and Abroad” (paper)

Presenter: Linda S. Goldberg, Federal Reserve Bank of New York (co-authors Ricardo Correa and Tara Rice)

While the balance sheet structure of U.S. banks influences how they respond to liquidity risks, the mechanisms for effects and consequences for lending vary widely across banks. We demonstrate fundamental differences across banks without foreign affiliates versus those with foreign affiliates. Among the non-global banks (those without a foreign affiliate), cross-sectional differences in response to liquidity risk depend on banks’ shares of core deposit funding. By contrast, we show that differences across global banks (those with foreign affiliates) are associated with ex ante liquidity management strategies of the banks as reflected in their internal (intra-firm) borrowing across the global organization. Internal borrowing serves as a shock absorber and affects lending patterns to domestic and foreign customers. Use of official sector emergency liquidity facilities by banks tends to reduce the importance of ex ante differences in balance sheets as drivers of cross-sectional differences in lending by non-global and global banks in response to market liquidity risks.

Discussant: Katheryn Russ, University of California Davis

“The End of the Great Moderation? Challenges to Economic Stability in Emerging Markets in the Post-Crisis Era” (paper)

Presenter: Michael Hutchison, University of California Santa Cruz (co-author Michael Bergman)

Abstract: This paper investigates the efficacy of fiscal rules in reducing the procyclical nature of fiscal policy. Fiscal rules have been an increasing popular mechanism by which to frame fiscal policy, but relatively little cross-country empirical work has investigated its effectiveness, especially in emerging and developing economies. We investigate whether fiscal rules help to reduce the extent of policy procyclicality—how government expenditure policy responds to GDP– in a panel framework with 81 advanced, emerging and developing countries over 1985-2012. We develop unique fiscal rule indices and investigate whether rules help to dampen procyclical policies. We condition our empirical specifications on the degree to which governments appear able to manage and enforce fiscal rules. We find that national fiscal rules are very effective in reducing pro-cyclicality of policy once a minimum threshold of government efficiency/quality has been reached. Government efficiency alone is not enough to reduce procyclicality of fiscal policy, but high government efficiency combined with fiscal rules is a potent combination that greatly reduces procyclicality and, at a particular threshold levels of rules and government efficiency, may induce counter-cyclical policy responses to GDP movements. We also find evidence that supranational rules are mainly effective in reducing procyclicality in countries with quite weak government efficiency.

Discussant: Ken Kasa, Simon Fraser University

“Major Financial Events and the Composition of Cross-Border Banking Exposures” (paper)

Presenter: Galina Hale, Federal Reserve Bank of San Francisco (co-authors Eugenio Cerutti and Camelia Minoiu)

Abstract: We examine the composition of cross-border bank exposures between 1995 and 2012, focusing on the role of the international loan syndication market. Compared to other bank loans, syndicated loans are larger, have longer maturities and complex lender structures, and are extended to relatively safer borrowers. We show that on-balance sheet syndicated loan exposures account for almost one third of total cross-border bank loan claims and about half of the variation in these claims, suggesting that they are an important vehicle for cross-border lending to advanced and emerging market borrowers. We find that the share of syndicated loan exposures increased during the global financial crisis, mainly due to large credit line drawdowns and long maturities on outstanding loans extended in the pre-crisis boom.

Discussant: Viktoria Hnatkovska, University of British Columbia

Keynote Address: “The Political Economy of Adjustment and Rebalancing”

Presenter: Jeffrey Frieden, Harvard University

“Japanese Monetary Policy and the Yen: Is There a ‘Currency War’?” (paper)

Presenter: Robert Dekle, University of Southern California (co-author Koichi Hamada)

Abstract: The Japanese currency has recently weakened past 100 yen to the dollar, leading to some criticism that Japan is engaging in a “currency war.” The reason for the recent depreciation of the yen is the expectation of higher inflation in Japan, owing to the rapid projected growth in Japanese base money, the sum of currency and commercial banking reserves at the Bank of Japan.

Hamada (1985) and Hamada and Okada (2009) among others argue that in general, the expansion of the money supply or the credible announcement of a higher inflation target does not necessarily constitute a “currency war”. We show through our empirical analysis that expansionary Japanese monetary policies have generally helped raise U.S. GDP, despite the appreciation of the dollar.

Discussant: Takeo Hoshi, Stanford University

“Official Financial Flows, Capital Controls, and Global Imbalances” (paper).

Presenter: Joe Gagnon, Peter G. Peterson Institute for International Economics (co-authors Tam Bayoumi and Christian Saborowski)

From the introduction:

Government-directed, or official, financial flows (dominated by purchases of foreign exchange reserves) have exploded over the past 15 years and are now running at more than $1 trillion per year. Current account imbalances also reached record levels in recent years and they remain a major source of tension in international economic policy, despite a partial retrenchment since 2007. Advanced economies see emerging ones as frustrating needed current account adjustment via reserve accumulation aimed at holding down the values of their currencies. Emerging economies see their advanced brethren as trying to export their way out of recession via loose monetary policies that tend to weaken their currencies. Hence the much publicized talk of currency wars. This paper explores the first of these two arguments: Are official flows frustrating current account adjustment? Of particular interest is the extent to which official flows have a greater impact on current accounts in the presence of capital controls or other barriers to capital mobility. In addition, we explore whether there is a longer lasting impact of official flows on current accounts through the portfolio balance channel.

Discussant: Zheng Liu, Federal Reserve Bank of San Francisco

“For a Few Dollars More: Reserves and Growth in Times of Crises” (paper)

Presenter: Matthieu Bussière, Banque de France (co-authors Cheng, Chinn, and Lisack)

Abstract: Based on a dataset of 112 emerging economies and developing countries, this paper addresses two key questions regarding the accumulation of international reserves: first, has the accumulation of reserves effectively protected countries during the 2008-09 financial crisis? And second, what explains the pattern of reserve accumulation observed during and after the crisis? More specifically, the paper investigates the relation between international reserves and the existence of capital controls. We find that the level of reserves matters: countries with high reserves relative to short-term debt suffered less from the crisis, particularly if associated with a less open capital account. In the immediate aftermath of the crisis, countries that depleted foreign reserves during the crisis quickly rebuilt their stocks. This rapid rebuilding has, however, been followed by a deceleration in the pace of accumulation. The timing of this deceleration roughly coincides with the point when reserves reached their pre-crisis level and may be related to the fact that short-term debt accumulation has also decelerated in most countries over this period.

Discussant: Helen Popper, Santa Clara University

“Institutions and Central Bank Norm Diffusion: Abenomics and the Delayed Break with the Monetary Orthodoxy” (paper)

Presenter: Saori Katada, University of Southern California (co-author Gene Park)

Abstract: Since 1998, Japanese economy has experienced consistent deflation and the

Japan’s government had responded to two economic shocks – first the global financial crisis of 2008-2009 then the devastating earthquake, tsunami, and nuclear crisis in March 2011 (henceforth 3/11). Somewhat surprising, though, it was not until early 2013 that the government took the most radical actions to reflate the economy with the inauguration of the new LDP cabinet led by Shinzo Abe.

Informed by the role of Central Bank Independence literature and the impact of ideas on domestic politics, this paper analyzes the factors that drove the Bank of Japan responses to the country’s economic challenges of the last 15 years to explain how and why the BOJ failed to adopt an aggressive monetary policy during this period. Our analysis hinges on the important role of international norms in Japan’s economic policy making.

Discussant: Brock Blomberg, Claremont McKenna College

“Goodbye Financial Crash, Hello Financial Repression: Latin American Responses to the 2008-09 Global Financial Crisis” (paper)

Presenter: Manuel Pastor & Carol Wise, University of Southern California

This paper is meant to commemorate the thirtieth anniversary of Carlos Díaz-Alejandro’s classic article, “Good-Bye Financial Repression, Hello Financial Crash” (1985). Writing in the wake of drastic financial blowups in the Southern Cone, Díaz-Alejandro nonetheless argued that “a believable alternative system could be designed, avoiding many of the inefficiencies of financial repression…and blending both public and private financial agents”. It would take nearly three decades since the publication of this prescient work, but there are credible signs that such an arrangement is now emerging within some Latin American emerging economies (EEs).

We track the thinking on financial repression from the early 1970s up to the current period and note how this concept has come to encompass interventionist financial policies in both OECD and EE settings. We then turn to the era of financial liberalization in Latin America from the 1980s up through the 2000s, with an emphasis on Argentina, Brazil, and Mexico. We suggest that Latin American EEs like Brazil and Mexico have indeed proved capable of implementing the more “macro prudential” financial policies that have been much-discussed in the wake of the global financial crisis; on the other hand, the Argentine case confirms that the bad old days of financial repression, replete with credit allocation, exchange controls, and the inflation tax, are not entirely behind us. We close by noting that while achieving better financial balance and intermediation is key, the real goal for all three countries should be to address the structural and political economy challenges that limit investment, growth and a more equitable distribution of income. Fortunately, the sort of pragmatic and eclectic approach Díaz-Alejandro called for is a useful guide for the bigger challenges ahead.

Discussant: Sebastian Edwards, University of California Los Angeles

“International Reserves Before and After the Global Crisis: Is There No End to Hoarding?” (paper)

Presenter: Hiro Ito, Portland State University (co-authors Joshua Aizenman and YW Cheung)

We evaluate the global financial crisis (GFC) and the structural changes of recent years that have been associated with new patterns of hoarding international reserves. We confirm that the determining factors of international reserves are evolving with developments in the global economy. From 1999–2006, the pre-GFC period, gross saving is associated with higher international reserves in developing and emerging markets. An outward direct-investment effect is consistent with the view of diverting international assets from the international reserve account, the “Joneses’ effect” lends support to the rivalry hoarding motivation, and commodity price volatility induces hoarding against uncertainty. During the 2007–2009 GFC, those variables became insignificant or displayed the opposite effect, probably reflecting the frantic market conditions that prevent a normal economic relationship to hold. Nevertheless, the propensity to continue to trade displays a strong positive effect. The 2010–2012 post-crisis results are dominated by factors that have been mostly overlooked in earlier decades. While the effects of swap agreements and gross saving are in line with expectations, we find a change in the link between outward direct investment and international reserves in the pre- and post-crisis period. The macro-prudential policy is found to complement international reserve accumulation. Developed countries display very different demand behaviors for international reserves. Higher gross saving has been associated with lower international reserve holding because developed countries are more likely to deploy their savings in the global capital market. The presence of sovereign wealth funds is associated with a lower level of international reserve holding in industrial countries. Our predictive exercise affirms that if an emerging market economy experienced a deficiency in international reserves holdings in 2012, that economy tended to experience exchange-rate depreciation against the U.S. dollar during the recent adjustment to the news of tapering quantitative easing (QE) in 2013.

Discussant: Yu-Chin Chen, University of Washington

The Univ. Of Wisconsin, Madison, has gone off the deep end.

UWM recently hosted the ‘White Privilege Conference’.

And even that is relatively mild, compared to the fact that UWM wants to contaminate science departments with ‘feminism’, and now has a course in ‘Feminist Biology’.

“As colleges are beginning to fail around the US, instead of doing the sensible thing and eliminating useless departments like gender studies altogether, some are apparently choosing to wreck the legitimate disciplines by dumping contaminants like feminist biology into them.”

Menzie better keep an eye on the future of universities in general, and UWM in particular.