“How Will the Normalization of U.S. Monetary Policy Affect Latin America and the Caribbean?”

That’s the question posed in Chapter 3 of the IMF’s Regional Economic Outlook for the Western Hemisphere, released today. In the analysis, prepared by Alexander Klemm, Andre Meier, and Sebastián Sosa, the conclusions are summarized as follows:

A stronger U.S. recovery will impart a positive impulse primarily to Mexico, Central America, and the Caribbean, whereas the anticipated normalization of U.S. monetary policy will affect all countries in Latin America and the Caribbean (LAC). Traditional exposures to U.S. interest rates have diminished, as governments in LAC have reduced their reliance on U.S. dollar–denominated debt. However, U.S. monetary shocks also spill over into local funding and foreign exchange markets. Spillovers to domestic bond yields have typically been contained over the past decade, but the market turmoil of mid-2013 illustrates the risk of outsized responses under certain conditions. In a smooth normalization scenario, net capital inflows to LAC are unlikely to reverse, although new risk premium shocks could trigger outflow pressures. Countries cannot fully protect themselves against such external shocks, but strong balance sheets and credible policy frameworks provide resilience in the face of financial volatility.

The assessment is based on several statistical analyses. I found the panel VAR analysis of particular interest, given previous discussions of the impact of recent U.S. monetary policy measures on emerging market capital flows, [1], [2], [3], and [4].

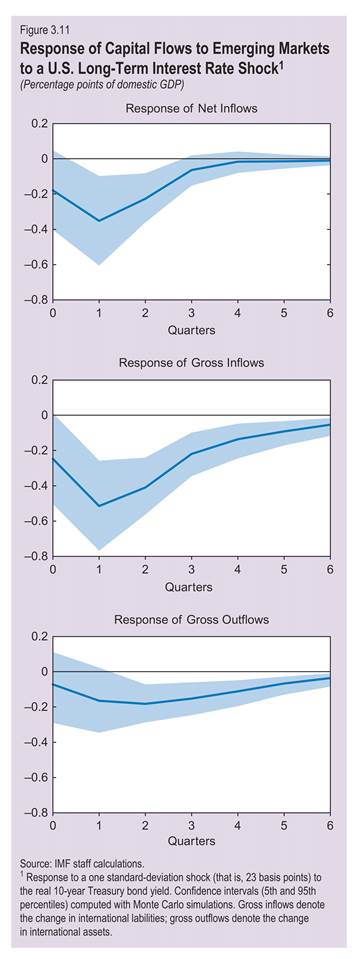

To analyze the response of capital flows to shocks to long-term U.S. real interest rates, we estimate a panel vector autoregression with quarterly data since 1990 for a group of 38 emerging markets. Two alternative specifications are considered, one using net and the other gross capital flows. Besides the capital flow variables, the model includes country-specific fixed effects and a set of global variables, that is, U.S. real output growth, global uncertainty (proxied by the VIX), changes in the real U.S. federal funds rate, changes in the 10-year real U.S. interest rate, and the log difference of a commodity price index.

The impulse response functions (IRFs) are shown below:

The authors argue that in the current exit from quantitative/credit easing, long term US interest rate increases will be more strongly associated with an economic recovery than in the past, and US GDP growth lead to flows to Latin America/Caribbean that will partly offset the outflows. On the other hand, volatility, as proxied by the VIX, appears as a greater threat to capital flows to the region.