Some thoughts on how choices between monetary autonomy, exchange rate stability and capital account openness — and reserve accumulation/decumulation — relate to macro outcomes.

By now, everybody is aware of the turmoil in emerging markets. Several emerging market currencies have come under severe pressure, with fresh blows coming fast and furious [0]

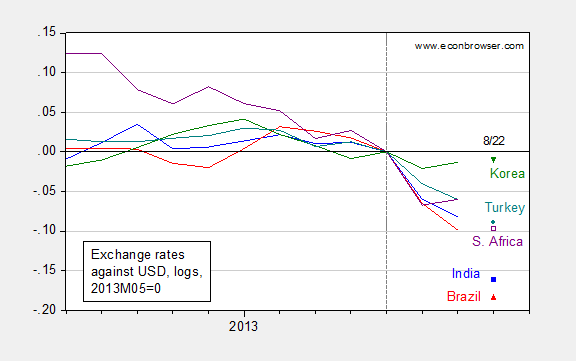

Figure 1: Log exchange rates against US dollar for India (blue), Brazil (red), South Korea (green), Turkey (teal), and South Africa (purple), normalized on 2013M05=0. August data for 8/22. Source: St. Louis Fed FRED, IMF International Financial Statistics, and Pacific Exchange Service for August data, and author’s calculations.

At the same time, several countries have witnessed their foreign exchange reserves decline, partly due to intervention, partly due to an outflow of financial capital.

Source: FT.

A Framework, and Some Empirics

The current stresses are a manifestation of the trilemma, or the impossible trinity: the proposition that a country cannot simultaneously pursue full exchange rate stability, full monetary autonomy, and complete financial openness. In a series of papers, Joshua Aizenman, Hiro Ito and I have evaluated empirically the extent the trilemma has held [1] [2]. (And I recently discussed Klein and Shambaugh’s paper on the subject.)

In Surfing the waves of globalization: Asia and financial

globalization in the context of the trilemma (JJIE, 2011), we conclude:

Greater

monetary independence is associated with lower output volatility

while greater exchange rate stability implies greater output volatility,

which can be mitigated if a country holds international

reserves (IR) at a level higher than a threshold (about 20% of

GDP). Greater monetary autonomy is associated with a higher level

of inflation while greater exchange rate stability and greater financial

openness could lower the inflation rate. We find that trilemma

policy configurations affect output volatility through the investment

or trade channel depending on the openness of the economies.

Our results indicate that policy makers in a more open

economy would prefer pursuing greater exchange rate stability

while holding a massive amount of IR. Asian emerging market

economies are found to be equipped with macroeconomic policy

configurations that help the economies to dampen the volatility

of the real exchange rate. These economies’ sizeable amount of IR

holding appears to enhance the stabilizing effect of the trilemma policy choices, and this may help explain the recent phenomenal

buildup of IR in the region.

The usefulness of reserves is notable. Referring to Figure 1, the reader will see that the Korean won is one currency that has not been subject to substantial downward pressure. That’s likely attributable in part to the relatively large stock of foreign exchange reserves.

The results in Aizenman, Chinn and Ito (2011) pertain to the first and second moments of inflation, and the second moment of output growth. What about output growth in times of crisis. In another paper, Bussiere, Cheng, Chinn and Lisack (2013) (in the process of being revised), we find that higher reserves to short term debt ratios on the eve of the global financial crisis of 2008-09 are associated with higher growth rates in non-advanced economies. From the abstract:

…we can make a three-fold conclusion. First, the

pre-crisis level of foreign reserves has a positive and significant impact on the real GDP

growth during the most recent financial crisis. Although the explanatory power of foreign

reserves is sensitive to the scaling variable, we provide evidence that international reserves

may act as a buffer during crises. In line with the existing literature on early warning

signals, the reserves-to-short-term-debt ratio works best as a reserve indicator.

Second, countries that have accumulated foreign reserves before the crisis have actively

used them either to defend the domestic currency from massive devaluation, to finance

domestic firms which experienced credit crunch or to maintain the market confidence

about the solvency of the country. It suggests that foreign reserves are not only ‘nuclear

weapons’ but also ‘barrels of gunpowder’ which can be actively mobilized during a crisis

period.

In the paper we note that India was one of the countries that did not rebuild their reserves in the wake of the global financial crisis. Combined with a current account deficit, it’s not terribly surprising that the Indian rupee was so vulnerable.

Some Observations

The reader will note that I have not appealed to special conditions due to the fact that the advanced economies are perceived to be withdrawing unconventional monetary stimulus, rather than conventional stimulus (i.e., raising policy rates). That’s because I’m somewhat old-fashioned in my views: easing or tightening monetary policies in core advanced economies forces difficult decisions on emerging market economies, regardless of whether it’s done via policy rates or via quantitative easing and/or forward guidance. It’s true that the magnitude of effects is less understood, but the impact is conceptually the same. After all, there were similar concerns about push and pull factors in capital flows to emerging markets in the 1990’s. (I trace out this argument in this paper presented at the BIS annual conference, and discussed at Free Exchange (Avent)).

I agree with Ryan Avent that one key danger is over-reaction on the part of emerging market policymakers (of course, one only knows that one’s over-reacted after the fact…). Our results in Aizenman, Chinn and Ito suggest that exchange rate stabilization should not be slavishly adhered to (in this context, would entail raising policy rates). Of course, our cross-country time series study could not incorporate all sorts of important factors that have to be incorporated into the decisionmaking process — the most important I think is balance sheet effects. Paul Krugman has noted in the Indian case, it’s not clear that this is a big worry, given the relatively small amount of external debt (which is mostly denominated in foreign currency). For some other indicators for the East Asian economies, see here. Currency depreciation will also help offset the negative impact of diminished capital inflows.

Finally, a digression. My research suggests that holding large foreign exchange reserves is beneficial for some aspects of macroeconomic performance, and particularly helpful in sustaining growth in times of financial crisis. However, this does not mean that it’s always better to have more and more — after all there are costs to holding large stocks of low-yield foreign exchange. And the (rational on an individual basis, in this context) accumulation of reserves has imposed distortions in the global economy. So, the foregoing should not be taken as a prescription for unrestrained reserve accumulation.

That is a great post and far more interesting and meaningful than when you launch one of your Wisconsin tangents. Thanks for the post which is quite relevant to what is currently roiling markets.

Print their way to prosperity. Perhaps some targeted QE. Change their labor laws to give the middle class a living wage. Mandate everyone get free health care.

Menzie wrote:

…the trilemma, or the impossible trinity: the proposition that a country cannot simultaneously pursue full exchange rate stability, full monetary autonomy, and complete financial openness.

I am always amused that no one seems to discuss that the “trilemma” only exists with a floating currency. If currencies are all anchored to gold there will be “full exchange rate stability.” That means that a nation can have “full monetary autonomy” and “ocmplete financial openness.” But equally amusing is that no one discusses that by having a floating currency a nation has to surrender either monetary autonomy or financial openness.

It seems that the current crises in economics are all manifestations of flawed economic theories. Economists thrive with huge salaries by arguing how many angels can dance on the head of a pin.

Thank you, Menzie.

Ricardo: You are so totally wrong it’s not even worth discussing. There’s a reason for the term “cross of gold.”

You need to look at not only international financial flows but also domestic credit dynamics. Each country’s a different story but some have had big domestic credit binges where valuations of collateral came to rest on presumptions of continued international inward flows. Now such countries have a choice between which debt to let fail, the foreign currency debt, concentrated among big borrowers and banks, or the domestic borrowers, concentrated among small borrowers. Tightening rescues the former, devaluation rescues the latter. It’s basically a political decision and generally the bigger borrowers and banks have more political weight.

“Ricardo: You are so totally wrong it’s not even worth discussing. There’s a reason for the term “cross of gold.”

Posted by: benamery21 at August 23, 2013 08:07 AM”

This is the guy who forgot the greatest nation in the history of time was built, founded, and came to power under a gold standard. Then, in 1971, the gold link was broken and nearly overnight all the problems arose.

benamery,

Two things. There is a reason William Jennings Bryan lost his elections.

Second, you need to review what has happened to our economy since 1971 and Richard Nixon. The only periods of prosperity are periods when the price of gold found stability.

Consider the disaster of the Great Inflaton of the 1970s, then the disaster of the current Great Recession. Both were periods of massive monetary destabilization as indicated by the price of gold.

Check out Paul Krugman today. These currencies all inflated as bubbles when investors piled into them to get away from dollars and euros. Now they’re pulling their money out and the bubbles are deflating. The culprit is financial deregulation, including “the removal of most controls on the international movement of capital. Banks gone wild were at the heart of the commercial real estate bubble of the 1980s and the housing bubble that burst in 2007. Cross-border flows of hot money were at the heart of the Asian crisis of 1997-98 and the crisis now erupting in emerging markets — and were central to the ongoing crisis in Europe, too. . . the main lesson of this age of bubbles — a lesson that India, Brazil, and others are learning once again — is that when the financial industry is set loose to do its thing, it lurches from crisis to crisis.”

^Lol at Anonymous. Gold standard ended in 1933. Was the economy really perfect at that point?

The Bretton Woods system ended in 1972. So basically you are against the free movement of capital and goods, rather than being for the gold standard.

Warren,

Dig a little deeper. You will find that each of the crisis you mention as well as the bubbles were created by central bank errors. The financial industry was simply responding the the CB incentives or restrictions.

Alexander Hamilton,

If less than a year after FDR confiscated all the gold he then sets the price of gold at $35/oz either you don’t know what a gold standard is or you are smoking some funny stuff. And for your edification the dollar remained at $35/oz through Bretton Woods until Nixon destroyed the international currency market.

“^Lol at Anonymous. Gold standard ended in 1933. Was the economy really perfect at that point?

The Bretton Woods system ended in 1972. So basically you are against the free movement of capital and goods, rather than being for the gold standard.

Posted by: Alexander Hamilton at August 23, 2013 02:54 PM”

Foreign countries could still redeem dollars for gold, hence the dollar was still effectively tied to gold. Foreign countries being able to redeem dollars for gold WAS THE REASON NIXON ENDED IT.

Check out Paul Krugman today.

Posted by: Warren at August 23, 2013 01:31 PM

WORST ADVICE EVER

So basically you are against the free movement of capital and goods

Posted by: Alexander Hamilton at August 23, 2013 02:54 PM

This is what Warren is arguing.