(The can opener reference can be understood by clicking here)

The budget proposed by Representative Ryan touts the pro-growth impacts of deficit reduction ($5.1 trillion over ten years, according to Table S-2). It is instructive to actually read the documents that Representative Ryan’s budget cites (as it has in the past — read about the Heritage CDA previous assessments [1] [2], as well as Representative Ryan’s previous attempt to use CBO documents to lend a patina of respectability to his projections).

From the House budget proposal:

In a report published in February of 2013, CBO concluded that reducing budget deficits, thereby bending the curve on debt levels, would be a net positive for economic growth. According to that analysis, a large deficit-reduction package of $4 trillion, which this budget resolution actually exceeds, would increase real economic output by 1.7 percent in 2023. Their analysis concludes that deficit reduction creates long-term economic benefits because it increases the pool of national savings and boosts investment, thereby raising economic growth and job creation. The greater economic output that stems from a large deficit-reduction package would have a sizeable impact on the federal budget. For instance, higher output would lead to greater revenues through the increase in taxable incomes. Lower interest rates and a reduction in the stock of debt would lead to lower government spending on net interest expenses. CBO finds that this dynamic would reduce budget deficits by a net $186 billion over ten years, including $82 billion in the tenth year alone.

Two observations, regarding the CBO “discussion” of the Ryan budget:

- The “assume a can opener” component is here again — the paths of revenues and spending are assumed to hold, and the plausibility of these were not assessed by CBO.

- Even with the aid of dynamic scoring, there is an “interesting” omission regarding time frame of positive impacts and the degree of uncertainty.

Regarding the first point, here is the quote from the CBO updated discussion.

The projections do not represent a cost estimate for legislation or an analysis of the effects of any specific policies. In particular, CBO has not considered whether the specified paths are consistent with the policy proposals or budget numbers that Chairman Ryan released on April 1, 2014, as part of his proposed budget resolution.

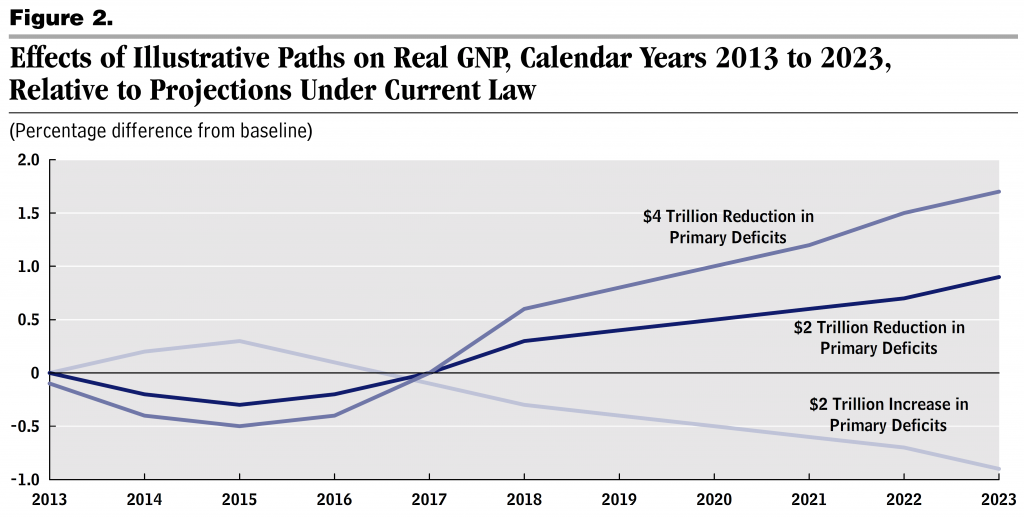

On the second point, the astute observer will note that these dynamic effects are emphasized only when Representative Ryan writes about the long term (2025 onward), as displayed on Page 94, Table S-6 of the House budget. Short run effects are in Table S-2. There is a very good reason for the de-emphasis of short term effects. One discerns this reason when one actually reads the CBO document cited in the House budget, and inspects Figure 2, on page 7.

Figure 2 from CBO, Macroeconomic Effects of Alternative Budgetary Paths, (Feb. 2013).

In other words, for a ten-year $4 trillion deficit reduction, in the subsequent four years, the net impact on GDP is negative. Figure 2 pertains to a $4 trillion plan implemented in 2014. The corresponding impacts for the current incarnation of the current House budget could be approximated by shifting forward the curves by one year. According to the CBO discussion of the Ryan proposal (Figure 4, page 9), if the Ryan budget is implemented, then by 2016, per capita GNP will be nearly a percentage point lower (-0.8% to be specific). Of course, by 2025, using midpoint estimates, output per capita would be higher. However, there is wide uncertainty regarding the impact, as indicated in Table 2: the range is from as little as 0.8 ppts to 2.6 ppts higher than baseline.

Stepping aside from the macroeconomic implications, it is of interest to observe the choices Representative Ryan has made in his cuts; these include $125 billion to SNAP (partly by implementation of work requirements, see page 63). According to CBPP, ten-year cuts to Medicaid and SNAP would constitute $0.9 trillion. This apparently this is his view of the “roadmap out of poverty”.

The CBO discussion of the Ryan budget did not incorporate behavioral responses due to changes in policies (e.g. workhouses implementation of work requirements associated with SNAP), but it also did not incorporate changes in government investment productivity that contributes to future output. For a case wherein supply-side aspects were incorporated into the dynamic-scoring process, see here.

Update, 9:15PM Pacific: Keith Hennessey compares the Ryan budget and the Obama budget, with the caveat:

In this post I’m just going to compare the short-term deficit and debt effects of the two proposals. While I’d like to use comparable numbers, CBO has not yet rescored President Obama’s proposal because the President released his budget six weeks late. So for now I’ll compare Ryan’s numbers to Obama’s. That is suboptimal but the best we can do for now, and I am confident it doesn’t change the overall picture. Let’s start with deficits.

The way this is stated, one gets the impression that the Ryan budget has been scored. I don’t know if this is what Mr. Hennessey intended, but of course, regardless of intent, it is a misleading statement, because the Ryan plan has not been scored either. CBO took at face value Representative Ryan’s spending and tax revenue numbers, and tabulated the macro feedback effects. Hence, it would not be right to compare a CBO-scored Obama budget to Ryan’s numbers, and Mr. Hennessey knows it (or at least should).

Update, 4/4, 11AM Pacific: From the chorus of the data-challenged, Ed Hanson asks:

Can you think of a time or occurrence in US history when The Fed Government drastically reduced its budget and borrowing and yet the economy boomed?

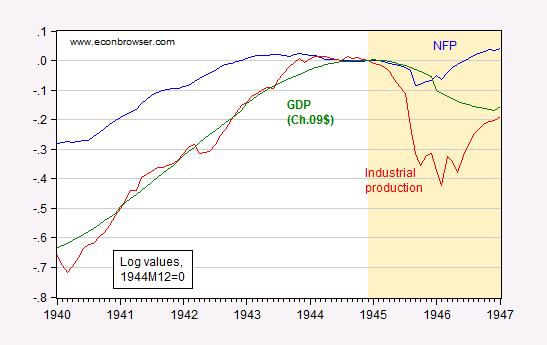

And Patrick R. Sullivan answers: “September 1945”, appealing to the NBER peak/trough dates. Well, a relevant question is what constitutes a “boom”, and these same people who argue that the current expansion is not a boom are happy to tabulate the post post-September 1945 period as a boom. All I can say is that they either must (1) not believe in reading data, or (2) have a radically different interpretation than I do of what a “boom” is. Here is my depiction of data around 1945; I will let the readers decide if post-1945 through 1946 was a “boom” (I’m willing to say it’s a recovery). Just ignore the 15%-odd decline in GDP, and the 20%-odd decline in industrial production (log terms).

Figure 1: Log nonfarm payroll employment (blue), log industrial production (red) and log real GDP measured in Ch.2009$ (bold green), all normalized to 1944M12=0. Real GDP interpolated using quadratic-match-average. Tan shaded area is 1945 onward. Source: BLS and Federal Reserve via FRED, and Measuring Worth, and author’s calculations.

If you say September 1945 through 1946 was a boom, well, you’d better be willing to say 2009M06 ownard was a “boom”.

Menzie,

Did you mean the title of this blog entry to link back to the old “can opener” post, instead of having it’s own unique URL?

Nick G: No. I’ve fixed it now – thanks for flagging.

First things first, everyone should read Hennessey at <a href="http://keithhennessey.com/2014/04/01/rvo-short-term-deficits/". After you have read it, you will understand the purpose of Menzie’s and Hennessey’s posts. It is to disseminate the political talking points about the future of the federal budget for the upcoming midterm elections.

Hennessey’s points are strong, which Menzie, wearing his partisan political hat, realizes. Thus the purpose of his short quote of Hennessey and his strained attempt to slant it. It is the political weapon to attempt to get people to ignore the message by personally attacking the messenger. Anyway, that’s my opinion, read into the posts as you will.

Now for some of the political points in Hennesseys piece. I tend to gravitate toward lesser, more nuanced, points. Hennessey certainly makes stronger ones than I will write about.

Obama’s submitted budget came 6 weeks beyond the date it was due. *** Heck, in his 5th year of the course President 101, he should get a b+ on the grading curve compared to his past performance.

Patty Murray and the democrats in the Senate have reverted to not putting together a budget. *** Heaven forbid those who elect these people should hold them to the idea of doing their job. But then again, it would make sense if the dem Senate simply chose the Obama budget. But there is no doubt that if the a vote on the Obama budget happens, it will again be overwhelmingly nayed.

The Obama budget in its present iteration does not reduce the deficit below historical average until he has left office. *** I have been alive through 12 Presidents. Only two Presidents (one certain, the other probably) were willing to take pain within their term of office if a choice was possible. Thus this is normal, but not what I would want.

Ed

But on the other hand Obama has already reduced the deficit from almost 10% of GDP to under 4% of GDP.

That is a larger reduction than any post WWII president achieved, including Clinton.

Ed Hanson

First, you obviously missed the point of Menzie’s swipe at Hennessey; viz., that Ryan’s budget was never scored despite Hennessey’s pretending otherwise. Second, and related to the first point, Ryan’s deficit reduction path assumes away the problem. Reducing the deficit too quickly also increases the output gap, which means lower revenues than Ryan forecast. In other words, once again Ryan is relying upon a magic asterisk to make the numbers work. Third, why do you (and apparently Ryan and Hennessey) believe that it’s a great idea to achieve a balanced budget as quickly as possible. Not to put too fine a point on it, but that’s just idiotic. Have you learned nothing from Europe’s failed experiment with expansionary austerity?

Paul Ryan provides us with a good example of what happens when political leaders learn just enough about a subject to think that they’re experts in it. Somehow Ryan has appropriated for himself the title of “budget wonk” just because he took a few more lightweight college econ courses than most of his peers in Congress. I think the lightness of being Paul Ryan calls for some soul searching on the part of academics like Menzie and JDH. Can they justify an undergraduate education in economics as a terminal degree? Is a little economics education worse than no education? Can we afford a Congress full of intellectual dilettantes? Just hanging out with finance profs and sharing expensive wines doesn’t make you an economist.

Finally, did you notice that pretty much all of Hennessey’s points about Ryan’s plans were all about how it would sell well in the November elections? No actual economic analysis, just how it will play with the idiot voters who show up in off year elections. Of course, Hennessey also thinks Dubya is a smart, fully engaged guy.

“Ryan’s plans …all about how it would sell well in the November elections.. No actual economic analysis, just how it will play with the idiot voters who show up in off year elections….”

Wow! Something Obama would NEVER do, NEVER EVER. What a hoot you are Richard Simmons.

Slugs,

I’m afraid you’re underestimating the sophistication of the Republican strategy. Sadly, it’s primary intent is to cripple government, in order to protect its wealthy “base” from regulation and taxation. Remember “starve the beast”?

Nick G — Republicans are NOT interested in acting like Democrats…..you know, touting how they care about the downtrodden while endorsing policies that guarantee they remain downtrodden…[this portion edited by MDC for racist language] “down on that Democratic plantation”.

I’m not talking about policies that victimize the poor or minorities (though those certainly exist). I’m talking about policies that protect the wealthy, such as fierce resistance to progressive taxation, health and safety regulation, and dealing with Climate Change.

I’d like to never again be hostage to the Middle East, but the Koch brothers won’t hear of that. The most effective solution to oil dependency and climate change would be fuel and carbon taxes. It’s no coincidence that Republicans have spent decades demonizing “new taxes”.

I’d like to be able to eat chicken and beef without cooking them black, but now meat processing inspections is “self regulated”.

I’d like to have TV and radio media that actually had a legal mandate to be honest…

Again, you’ve heard the slogan “starve the beast”. What did you think it meant?

only a fool would take the ryan budget seriously. he proposes this budget because he knows it will never be implemented-it simply serves for political points. this budget would have the same future as the debt limit threat or obamacare repeal. when the bluff is called, the republicans will cave in. because they do not want to be held responsible for the chaos such a budget would create in the economy. how many years did the bush administration have control of congress-and yet none of these great ambitious conservative agenda items were enacted besides war. why not? they are great for sound bites, but nobody actually wants to take responsibility for the outcomes! at least give credit to obama, he implemented obamacare and is willing to take responsibility for the outcome-and it’s looking good so far.

Actually, Obama and friends are desperate to lie about the failures of the ACA. Millions of people had their health insurance cancelled on them, contrary to the famous promise Obama made to the contrary. Then, as for the horror stories of actual people claiming to find that their medical expenses aren’t covered as well as they were under their old plan, Obama lies and says the stories aren’t true.

https://www.youtube.com/watch?v=kNBpzd2G4-g

A Seattle mother just found out how true that KOMO news story was. To the tune of $18,000 that would have been covered by her old insurance, but wasn’t under Obamacare.

Has Obama stood up and taken credit for that?

baffling,

How can you say Obamacare is going well when young healthy people in their twenties and thirties (and there millions of them) that do not want or need health insurance have to pay $300 per month for insurance, even if they only make $30-40 thousand per year? This is a transfer of wealth from the young to the old, there is no other way to look at Obamacare (at least the mandate part of it). Older people’s unemployment is significantly lower than young people’s as well, which means that liberals, who say they care about the little people, really only care about older people. I am guessing this is because older people vote more than younger people, so gouging the young to put money in older people’s pockets, who can afford healthcare more than younger people, gets Obama-like politicians re-elected.

“…do not… need health insurance.” Do you understand that if you have fire insurance on your home, you are NOT victimized if you do not have a fire? Do you understand that if you have life insurance you are not being cheated if you don’t die this year? Are you saying here that people only need flood insurance when the Weather Service has announced the hurricane will be striking this afternoon?

One story I heard about the origin of insurance was that it was started by owners of cargo boats on the Yangtze River. The river has turbulent rapids, and every year a certain number of boats foundered and sank. So they got together (an old custom in China) and figured out that if all of them chipped in to a pot, those who lost their ships could be recompensed. There was a problem. If some boat owners did not chip in, then either the others had to contribute more or the unlucky ones who lost a boat would get less. Insurance works best for everybody when everybody participates. They persuaded the holdouts by pointing out that eventually almost everybody lost at least one boat, and so everybody “needed” insurance every year. The lucky ones pay in more than they collect. They’re lucky because they have a regular, predictable, small outlay instead of a sudden, unexpected, ruinous disaster.

Besides, the individual mandate was in the original plan proposed by The Heritage Institute because it is so obviously necessary. It was included in Governor Romney’s implementation in Massachusetts because it is so obviously necessary. And as Dean Baker frequently points out, they really need healthy older people to sign up because the costs are no higher for them but they pay premiums that are three times higher.

I made a comment on this blog in 2012 regarding Gov. Walker’s promotion of his jobs projections. I think it applies here:

“I’m also reminded of a Chelm story (by Sholom Aleichem) in which there was a shortage of sour cream. This was “solved” by the elders of Chelm by declaring that water was now sour cream.”

I like the idea of assuming away our problem. I love sour cream.

anonymous: “How can you say Obamacare is going well when young healthy people in their twenties and thirties (and there millions of them) that do not want or need health insurance have to pay $300 per month for insurance, even if they only make $30-40 thousand per year?”

Why do you need to just make stuff up? For example, a 30-year-old in California making $30,000 a year can get an insurance plan for $152 a month, just a few dollars more than pre-ACA, but with much better benefits.

Slug

Can you think of a time or occurrence in US history when The Fed Government drastically reduced its budget and borrowing and yet the economy boomed? It has happened and your assertion that it can’t happen in just plain wrong. It is more likely than not that the output gap you like so much is the result of an over-controlling Federal government in taxation, borrowing and regulation. Less of it and you will get a more vigorous economy I will take a Ryan anytime over Obama anytime.

Ed

I’ll get them started; September 1945.

Patrick R. Sullivan: Your last statement is demonstrably wrong. See the GDP plot in this post. Unless you define “down” as “up”, the evidence seems to counter your assertion.

Year Real GDP (millions of 2009 dollars)

1945 2,215,900

1946 1,959,000

1947 1,937,600

http://measuringworth.com/usgdp/

REAL GDP, during wartime price controls is a pretty silly measure.

How do price controls invalidate “real GDP”? Heck, I should think price controls would make gathering price data (to make inflation adjustments) even easier…

You have two problems that compound; 1. NGDP is something of a fantasy when 40% of it is the govt buying war materiel and employing soldiers, because those are not things purchased in markets (what’s the market price of a B-24 or Sherman tank?).

2. Then, to get RGDP you deflate with a price index. Which index is another fantasy since there are extensive wage and price controls hiding the actual inflation rate. Since the controls were removed mid-1946 and prices were then free to jump up to reality, that deflates RGDP for 1946 by the suppressed inflation from prior years.

Something that the economists at NBER were aware of.

Patrick,

Pricing is quite easy to identify: it’s in the contract, along with sales volumes for each line item. It’s very likely a cost-plus contract, so it’s based on current pricing of labor and materials. I should think those prices would be straightforward to identify and adjust for inflation.

I’m only using the NBER recession dating authority, Menzie;

http://www.nber.org/cycles/cyclesmain.html

You didn’t know that the 1945 recession ended just as the federal govt. was drastically cutting back its spending? The ensuing expansion went on for three years.

Patrick R. Sullivan: You have a strange definition of a “boom” — see the update at the end of the post for a graph of actual data.

You mean the NBER has a strange definition.

Patrick R. Sullivan: No, NBER is identifying an “expansion”. You tried to equate the post-Sept 1945 period as a “boom”. I am merely pointing out the bizarreness of your definition of a “boom”, and I think you will have a very difficult time making that case, despite your desperate attempts to divert attention from the graph (and what is industrial production — chopped liver?) and other obfuscatory gyrations. It is I think pretty pathetic.

hanson,

i know of a couple of presidents who have reduced deficits over their terms-clinton and obama. can’t say the same about the recent republican terms. ryan produces a budget out of fantasyland-there is little to no economic realty in his budgets. he simply states, without proof, revenue will increase and spending will decrease. nothing more! how can you take that seriously?

Menzie-

My opinion is more global in scope: Most OECD economies are in struggling economically because their TOTAL CREDIT/net-GDP ratios are excessively high. IE: Increased liquidity results in diminishing returns of GDP… Debt is rising faster than GDP exacerbating the problem of insufficient surplus to service existing debts. Please note that I am defining net-GDP here as GDP minus (increased government deficit and increased banking liquidity)

There are several factors that can ameliorate this problem:

1. Financial Repression- Keep interest rates very low for an extended period, so that outstanding private and government notes are paid off at term , reducing total credit. (This was post WWII US government policy up to the Nixon/Reagan/Clinton administrations each of which reduced government financial controls).

2. Reduce Government deficit accumulation or better yet, reduce government debt by running a net surplus. (The Libertarian or Ryanesk policy).

3. Reduce central bank and government support of non-performing financial instruments, allowing credit write-downs to naturally occur. (Spanish, and Greek style austerity and depression).

I have no problem with Ryan targeting #2: Government Deficits… My problem involves the priorities concerning what he thinks government should cut or subsidize.

…oops – I should have defined net-GDP as GDP minus (Increased government deficit plus Increased banking liquidity).

Yikes!

I should have defined net-GDP as [GDP – ( Increased government DEBT + Increased banking liquidity )].

What amazes me is that Ben Bernanke kept making the excuse that he couldn’t return to sound monetary policy because his QE was not yet working. Janet Yellen made the same argument this past week. How many years of QE not working do we have to face before it dawns on someone that QE isn’t working?

On Ryan’s plan, it doesn’t even return us to the point when President Obama took office but the inflationists are panicked by anyone who actually would like some sanity when it comes to the debt.

I’m puzzled by the controversy over the post WWII period: how is a 15% drop in GDP a “recovery” from a recession??

I just took a look at post WWII unemployment rates. The first year (1946) it was 3.9%, declining each year of the expansion/boom to 3.4% in 1948.

Then comes the recession year of 1949; the rate rose to all of 5.5%. Yeah, the Obama economy is just like that.

Patrick R. Sullivan: I noticed that you conveniently omitted 1945 unemployment at 1.9%, according to Lebergott (NBER 1957). Hence, unemployment rose in 1946 — consistent with my previous assertions of a slowdown.

The unemployment rate during WWII is meaningless. There were over 12 million Americans serving in the military, out of a total population of about 140 million. Those servicemen were rapidly demobilized back into the civilian workforce–one million in the month of December 1945 alone. Yeah, massive demobilization would tend to have a massive effect on the unemployment rate…TEMPORARILY.

Here’s an interesting suggestion for you, Menzie; go to the UW library and search the NY Times archives for the word ‘boom’. Just the single word ‘boom’, for 1946-48. I.e. see what the people who lived through those years thought about the economy at the time.

Iow, stop searching under the lamppost for your lost car keys just because the light is better there.