From BBC:

Russia’s central bank has unexpectedly raised its key bank interest rate over concerns about inflation and “geopolitical tension”.

The bank’s board decided to raise the interest rate by 50 basis points, or half a percent, to 8% per year.

…

The Central Bank of Russia said on Friday that it will raise the interest rate on Monday to ease inflationary pressure.

“Inflation risks have increased due to a combination of factors, including, inter alia, the aggravation of geopolitical tension and its potential impact on the rouble exchange rate dynamics, as well as potential changes in tax and tariff policy,” the bank said.

In June, core inflation grew to 7.5%, well above the bank’s forecast of up to 6.5% for the year.

This is the third rate hike within the last half year.

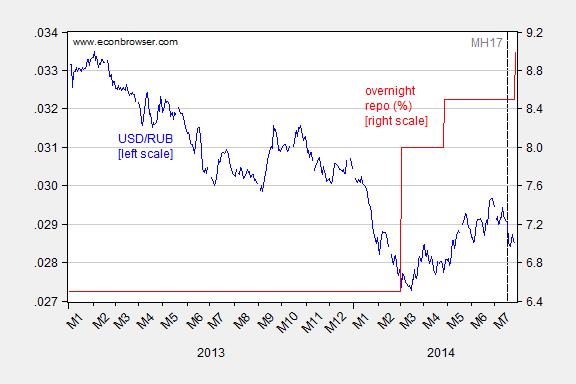

Figure 1: USD/RUB exchange rate (blue, left scale), overnight repo rate, % (red, right scale). Vertical dashed line at 17 July 2014. A rise in the exchange rate is a rouble appreciation. Source: Pacific exchange service, Central Bank of the Russian Federation.

Previous posts on sanctions and Russia, see here, here, and here. The IMF yesterday released updates for the WEO; the July forecast for Russian growth in 2014 (y/y) is fully 1.1 percentage points lower than the April forecast.

Update, 7/26, 12:15PM Pacific: From Reuters, reading the tea leaves:

“Basically … we can expect the key rate to go higher if new risks materialise (for, example, introduction of level III sanctions on Russia and the rouble getting seriously hit), which is not beyond imagination,” analysts at Gazprombank said in a note.

The decision indicates Russia is preparing for what may lie ahead, analysts said. “Maybe the central bank has been given the nod by their political masters in the Kremlin that this crisis is still going to get worse before it gets better,” Ash, of Standard Bank said.

What kind of capital controls do they have? Other than the threat of brute force.

Again, this is not the actual sanctions, this is fear of more serious sanctions, of a bigger war, and of stricter dictatorship. If no serious sanctions materialize, there will be a relief rally. The stupidest thing Obama and the Ds could do here is pat themselves on the back for a job well done. The war is intensifying as they dawdle. Now is the time to lead.

Obama limited his options. He didn’t want a military confrontation after Syria crossed his “red line,” and took military options off the table in Iraq.

Putin knew he could get away with taking Crimea, causing many deaths, including about 300 innocent people on that flight.

Putin should take Ukraine and the other former Soviet bloc countries, because more sanctions will hurt Western Europe more than Russia.

A new Soviet Union, with the help of China, can better deal with the weakened U.S. and E.U..

What makes a credible deterrent is your adversaries know you’ll do what you say.

We lost that recently.

Peak Trader: Given that logic, the Bank of Russia should not have felt the need to raise rates, and should be lowering them to counter the recession.

Russia annexing its former Soviet bloc countries will raise its GDP.

what about gdp per capita?

Did the U.S. care about per capita GDP when it made Arizona and New Mexico states?

What about the E.U.?

Russia’s per capita real GDP has done well under Putin:

Economically, Russia Is Roughly Where the United States Was In The 1950’s

Forbes

4/26/2013

“This chart shows US GDP per capita from 1948-58 and Russian GDP per capita from 1998-2008 (the last year available in the dataset).

http://b-i.forbesimg.com/markadomanis/files/2013/04/USRussiaGDPPerCapita1.png

The Russian economy grew much more rapidly than the American economy did in the decade from 1948. But…in 2008, at the peak of the energy boom and after a decade of run-away growth, Russia’s GDP per capita was still lower than the United States had been back in 1950.”

1. Peaktrader, everybody knows, that you can not trust the whole Obama administration one word.

2. To the data, I think it is helpful for you US folks to understand this somewhat better, I put some data together of USD(ollar) denominated bonds

ISIN Country Currency Duration Years Yield

XS0504954180 Russia USD 0.75 1.60%

XS0767469827 Russia USD 2.7 1.92%

XS0089375249 Russia USD 4 2.95%

XS0971721377 Russia USD 4.5 3.28%

XS0971722342 Russia EUR 6.2 3.34%

ES00000122T3 Spain EUR 6.3 1.54%

XS0895794658 Spain USD 3.6 2.35%

^TNX US USD 5 1.68%

^FVX US USD 10 2.47%

That means that for you in the US, holding Russian debt is within bid/ask spreads the same as Spanish bonds, (Spain 3.6 year example and interpolating Russian data

For me in the EuroArea the Gold Standard is of course German debt, and Spain , USA, Russia then roughly increasing linear with risk (simple meaning half Spain and Russia is equivalent to the USA) Got it?

3. Can somebody of you tell me how you would look up data like this as a non-pro in USA and how you would trade them in your TD-ameritrade account?

In Germany every retail investor can do this in his Sparkassen account (equivalent to the US Credit Unions)

4. With respect to the horrible list of people and institutions to be banned:

http://eur-lex.europa.eu/legal-content/EN/TXT/?qid=1406354888099&uri=OJ:JOL_2014_221_R_0001

please take a look. This is equivalent to your CIA boss not allowed for private travel to Russia, and your local village college in Kansas not recognized outside the US.

50 bps to 8%

Strikes me as an indication that sanctions against Russia have worked, assuming the Ruble required shoring up, and additional capital flight was a strong possibility.

“The “Budapest Memorandum on Security Assurances” is a diplomatic memorandum that was signed in December 1994 by Ukraine, Russia, the United States, and the United Kingdom.

Under the memorandum, Ukraine promised to remove all Soviet-era nuclear weapons from its territory, send them to disarmament facilities in Russia, and sign the Nuclear Nonproliferation Treaty.

Ukraine kept these promises.

In return, Russia and the Western signatory countries essentially consecrated the sovereignty and territorial integrity of Ukraine as an independent state…promised that none of them would ever threaten or use force against the territorial integrity or political independence of Ukraine…(and) pledged that none of them would ever use economic coercion to subordinate Ukraine to their own interest.”

http://www.rferl.org/content/ukraine-explainer-budapest-memorandum/25280502.html

My comment: The U.S. and U.K., along with the E.U. should’ve made it clear, early on, to Russia, in addition to sanctions, because of Crimea, they will neutralize all military assistance from Russia with their military assistance.

Peak Trader The U.S. and U.K., along with the E.U. should’ve made it clear, early on, to Russia, in addition to sanctions, because of Crimea, they will neutralize all military assistance from Russia with their military assistance.

First, you should never issue a threat or ultimatum that you are not or cannot back up if your threat goes unheeded. I don’t believe the Russians would consider such a threat as credible and would have strong reasons for calling our bluff. And let’s be clear, it would be a bluff and everyone knows it.

Second, the US has been very active in signaling joint training exercises with the Baltic states, who are part of NATO. Over the last couple of months the 173rd Airborne Brigade has held large training exercises with just about all of those countries. I believe Russia understands that unlike Ukraine, warnings about Russian aggression against Baltic NATO states is not a bluff. Aside from the visibility of training exercises, the 173rd represents a tripwire (i.e., sacrificial lambs) that would guarantee a US military response.

Third, as Menzie’s chart shows, the economic sanctions against Russia are having an effect on the Russian economy. The Kremlin is essentially a gangster government, and like all gangster governments the top gangster has to keep his lieutenants happy if he wants to remain the top gangster.

Finally, I’m an ORSA guy with the Army, so sometimes I tend to forget how little the man-on-the-street knows about military operations. But I would have thought it was rather obvious that supplying the Ukrainian military with US/NATO weapons when the Ukrainians only know and understand Russian/Soviet era weapons would be an invitation to disaster. The US Army has an 4-star major command (the Training and Doctrine Command [TRADOC]) whose sole mission is training US troops on very complicated weapon systems. It took years just to train the Iraqis how to drive US tactical vehicles (i.e., trucks, HMMWVs, etc.), nevermind actual combat systems. And keep in mind that these are weapon “systems”, not just weapons. They have to operate within a well-trained and complicated combined arms doctrine. How complicated? Just to give you a flavor, a typical combat mission plan for a single blue-on-red battalion level mission pulse takes 3-4 hours to run on a 3 GHz computer. A brigade action takes 84 hours. This is not Revolutionary War days when citizen soldiers could just pick-up Ol’ Bessie and march off to war. Even after 13 years in Afghanistan we still have not been able to train that army in how to use US weapons. That’s why we are still buying helicopters from Russian defense contractors to be supplied to the Afghanistan military. Russian systems and tactics are all they understand. Why would we expect it to be any different with the Ukrainian armed forces?

2slugbaits. why should it be a bluff?

And, economic sanctions will have an effect on Western Europe too.

Why give up any ground at all, including Crimea, to a “gangster government?”

The killing and hardship of innocent and peaceful people and the destruction of economies are unnecessary.

Peak

“2slugbaits. why should it be a bluff?”

if not a bluff, are you signing up to be on the front line of that battlefield?

baffling, it may take a battle to deter other battles.

And, I’d fight for what’s right.

You sound like a coward.

Also, I may add, I said nothing about training Ukrainians in U.S. military systems.

Western intelligence and drones, for example, may be enough to stop Russian weapons flowing into Ukraine.

And, I agree, Russia either can’t or won’t take all former Soviet bloc countries.

However, Russia can take Ukraine and other former Soviet bloc countries, to create a new Russian “empire.”

Peak Trader I’m sorry, but none of this makes any sense. On the one hand you said they will neutralize all military assistance from Russia with their military assistance. I understood the referent in those two pronouns “they” and “their” to be the US and NATO. So if the US and NATO are to provide “military assistance,” to the Ukrainians, just what does this mean exactly if not equipment? You mentioned intelligence. Okay, but that’s already being provided…and besides, it’s not like the Ukrainians don’t already know what’s happening along their own border. Even assuming that the Senate and the Administration agreed to provide the Ukrainian government with ground and air combat systems, there is no chance that the Ukrainians could be trained to use that equipment. And by now I would have thought that the downing of the Malaysian jetliner would have been argument enough as to why it’s not a good idea to just hand over advanced equipment to ill-trained troops. In any event, there is zero chance that Germany would go along with any of this.

As far as Russia reconstituting its old empire, there is no chance of that happening west of the Urals. I suppose it could happen in some of the various Godforsakenistans in central Asia, but quite frankly, who cares? It’s not like those are vibrant liberal democracies. Meet the new boss, same as the old boss.

@ peak trader, all

1. You spelled it out very clearly, promises were made by the US and UK, and nobody else in Europe. It is your obligations, you have to think about.

It has been made clear repeatedly that Ukraine and others, like Georgia, will not become any time soon member of NATO or the EU, most likely not as long as I live, creating obligations for people like me.

2. In contrast to all the desk warriors and armchair strategists here (anybody with military experience?, please speak up) I did serve my fatherland, proudly and devoted, with many years on call afterwards. The places I did internships, worked, had the Air defense up every single second, during peacetime, in the center of a million people city, Munich.

3. We now get to the 100th anniversary of the begin of WWI, when Germany was drawn into conflict by some stupid, trigger happy ally, Austria, issuing stupid ultimatums. This will not happen to us again. Ukraine was, is, and will not be NATO obligation. US and UK have zero prokura to speak in my name.

4. People babbling about the dramatic consequences of a cumulative 2% repo rate increase, should be aware, that Germany did not give up in WWII before 20% of the workforce was dead, and Russia sacrificed 10% of theirs to achieve that, to put things into perspective.

5. Ronnie Reagan was no pussy, and he had career diplomats guiding his policies very successfully, see e.g. http://jackmatlock.com/2014/03/ukraine-the-price-of-internal-division/

It is time to get rid of the community organizers and ambassadors selected by the amount donated to the election campaigns, and get trustworthy, knowledgeable folks like Jack back, until they can sort it out.

6. to put the financial data a little bit more into perspective:

a) when the Fed used some slightly imperfect words in June 2013, the bottom fell out of the barrel http://www.etftrends.com/2013/06/etfs-face-scrutiny-amid-market-turbulence/2/

for long muni bonds, the mark to model value by 8.8% on 6/25/2013, and an additional 7.6% market NAV value

b) now let this compare to similar long russian bonds (priced in USD, not subject to russian inflation) http://www.comdirect.de/inf/anleihen/detail/uebersicht.html?ID_NOTATION=61905346

Peak Trader: Since you mention drones, I take it you advocate armed US drones firing on separatists. Is that the level of intervention you would like to see? Intelligence is already being provided. Providing equipment seems a lot less risky than having US aircraft firing on targets within a few kilometers of the Russian border, which is why I believe 2slugbaits assessed the equipment option (it’s what I thought you were advocating).

Menzie Chinn, yes, however, the flow of Russian arms continue, which allowed the separatists to take Ukrainian weapon stockpiles.

Off topic – Meanwhile, back in Kansas…things not going so well in their capital.

“United Airlines will end service to Topeka in September, dropping service to Kansas’ capital city just nine months after it began flying there. The carrier’s two daily round-trip flights to Chicago O’Hare will end Sept. 2.

The move is a blow for the Topeka Regional Airport, which will be left without regularly scheduled passenger service once United departs.”

and why would somebody want regular transportation to topeka in the first place? 🙂

FYI,

from a Reagan ambassador respected abroad, especially in Europe

http://www.foreignpolicy.com/articles/2014/06/30/epiphanies_from_jack_matlock

The fundamental problem is simply,

US folks, especially politicians and economists, even more pronounced for nobel price winners dont know sh*t, but have lots of silly opinions.

I do now how to trade stuff, how to calculate real rates, specifics about US muni markets.

I know better about US markets than any US economic professors, who runs an active blog, or ……. give me a counter example to this pretty damning statement !!

WHO ?

even the nobel prize winners need education on elementary facts:

http://de.slideshare.net/genauer/irish-bonds-for-paul-krugman

does this boy look more intelligent : ?

http://de.slideshare.net/genauer/stollen-11956034

From Prof. Mark J. Perry :

US energy boom in spite of Obama.

And what about Russia’s oil production? Here’s an analysis from a source that’s preternaturally pessimistic, but interesting nonetheless:

“Bottom line, there is no doubt that Russia is now in decline and with the political problems there now the problem is likely to get worse, perhaps a lot worse. Here is what Ambrose Evans-Pritchard writing in The Telegraph says, bold mine:

The proposed sanctions will target both the debt and equity of Russia’s major banks, effectively severing access to global capital markets. It also targets the technology for drilling in the Arctic and for opening up the Bazhenov shale basin, both needed to replace Russia’s depleting oil reserves.

Russia has a lot of gas, but gas trades at an oil-equivalent price of $60bn a barrel in Europe. It is not very profitable. Analysts suspect that Gazprom’s pipeline deal with China is at or below the break-even cost of production, assuming it ever happens.

The International Energy Agency says Russia needs $750bn of fresh investment over the next 20 years just to stop oil and gas output declining. This has already become unthinkable. Who is going to wager so much money, for such questionable returns, in the face of so much political risk?

http://peakoilbarrel.com/anticipating-peak-world-oil-production/#more-3938

My post on the linked thread, regarding Russian net oil exports:

Russian net oil exports (so far, through 2012) stopped increasing in 2007. Here are 2002 to 2012 Russian net oil exports and their ECI ratios (ratio of total petroleum liquids production + other liquids to liquids consumption). At an ECI of 1.0 a country is no longer a net exporter.

Russian Net Exports & ECI Ratios (EIA):

2002: 5.0 mbpd & 2.9

2003: 5.8 & 3.2

2004: 6.5 & 3.4

2005: 6.7 & 3.4

2006: 6.9 & 3.5

2007: 7.2 & 3.7

2008: 6.9 & 3.4

2009: 7.0 & 3.4

2010: 7.1 & 3.4

2011: 7.1 & 3.3

2012: 7.2 & 3.3

Based on EIA production data and BP consumption data for Russia, for 2013 we have production of 10.5 mbpd, consumption of 3.3 mbpd, and net exports of 7.2 mbpd, with an ECI Ratio of 3.2.

Russian production in 2007 was 9.9 mbpd, with consumption of 2.7 mbpd, and thus net exports of 7.2 mbpd (total petroleum liquids + other liquids), with an ECI Ratio of 3.7.

Production in 2012 was 10.4 mbpd, with consumption of 3.2 mbpd, and thus net exports of 7.2 mpbd, with an ECI Ratio of 3.3.

Based on a simple mathematical model and based on the empirical Six Country Case History, a declining ECI ratio correlated with a rapid rate of depletion in remaining CNE (Cumulative Net Exports).

Based on the 2007 to 2012 rate of decline in the Russian ECI ratio, I estimate that post-2007 Russian CNE are about 72 Gb (billion barrels), with 13 Gb having been shipped from 2008 to 2012 inclusive, implying that Russia shipped about 18% of post-2007 CNE in only five years (through 2012).

The extrapolation of the observed 2007 to 2012 rate of decline in the ECI Ratio could be the result of a continued increase in production (unlikely, IMO) + a continued increase in consumption, or a combination of declining production + at least a slowdown in the rate of increase in consumption or a decline in consumption. Note that the 2007 to 2012 rate of decline in the ECI ratio would put it at about 2.6 in 2022.

As a scenario, if consumption continued to increase* for 10 years at the 2007 to 2012 rate of increase (3.4%/year), Russian consumption would be up to 4.5 mbpd in 2022. If we assume a modest 2.0%/year decline rate in production, Russian production would be down to 8.5 mbpd in 2022, resulting in net exports of only 4.0 mbpd in 2022, with an ECI Ratio of 1.9. An extrapolation of a decline in the ECI Ratio from 3.3 in 2012 to 1.9 in 2022 would put Russia in the vicinity of zero net exports around the year 2034.

*BP shows a 3%/year rate of increase in Russian liquids consumption from 2012 to 2013