From Reuters today:

Russia’s economy is stagnating as data showed on Wednesday that capital worth $75 billion has left the country so far this year following sanctions on Moscow over its involvement in Ukraine.

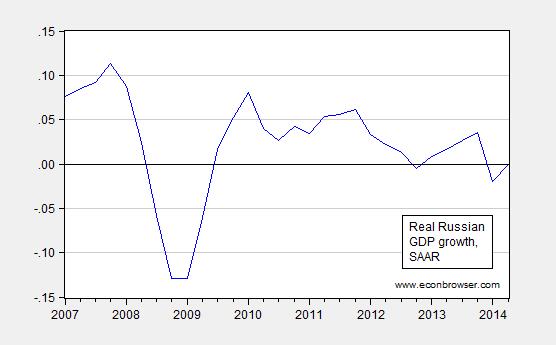

“We have for now a period of stagnation, or a pause in growth,” Deputy Economy Minister Andrei Klepach was quoted as saying in an interview where he also said that GDP was flat from April to June after shrinking 0.5 percent in the first quarter.

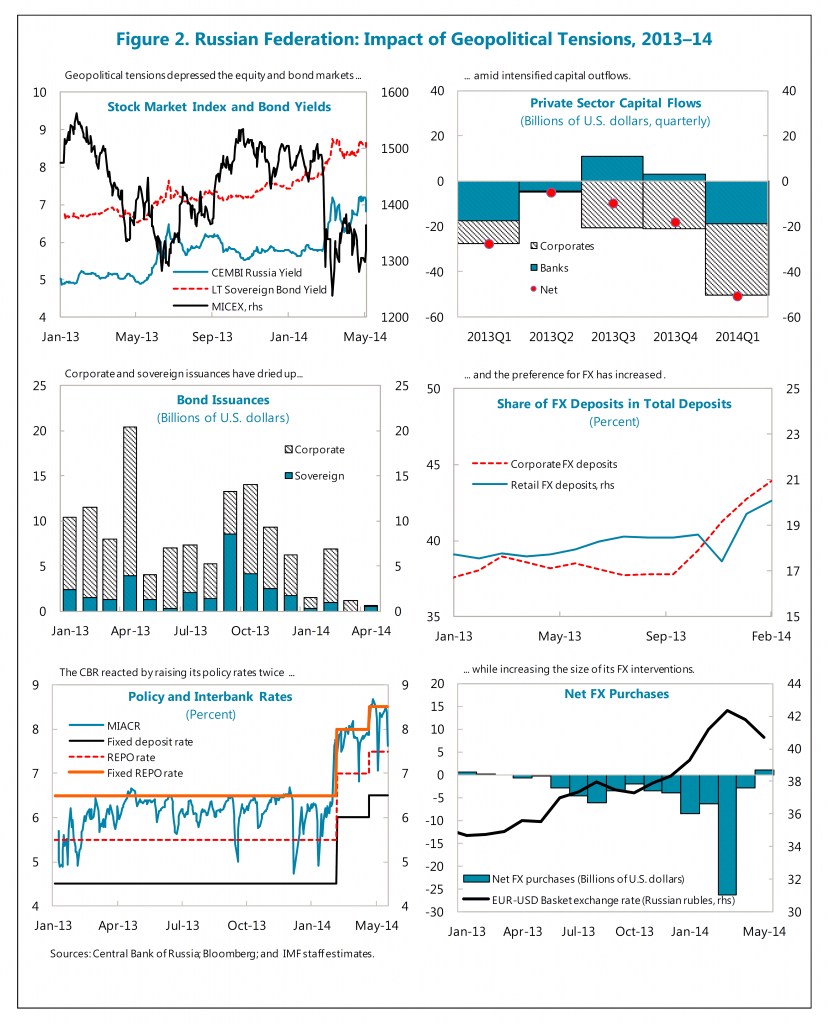

Here are some indicators of stress from political uncertainty, from the IMF’s recent Article IV report on the Russian Federation.

And here is an updated version of GDP growth.

Figure 1: Russian q/q annualized GDP growth, in 2000 prices. Source: OECD via FRED through 2013Q4, Reuters for 2014, and author’s calculations.

From the report:

Net private capital outflows increased significantly in the first quarter of 2014 to US$51 billion (Figure 2 and Box 3). Reserves at the CBR experienced additional downward pressures following the sharp increase in FX intervention in early March. The increased level of FX swaps and correspondent accounts between the CBR and domestic banks has temporarily cushioned the level of reserves, which have not declined by the total amount of interventions. While FX swaps were used to access CBR liquidity, the increase in the level of correspondent accounts at the CBR has reflected increased foreign assets repatriation by domestic banks amidst increasing geopolitical uncertainties.

Geopolitical tensions are negatively weighing on the cost and access to financing. Since March, sovereign and private issuances have declined very sharply, with borrowing rates increasing by an average of 100–150 basis points (Figure 2). The government has also cancelled a number of domestic auctions. Moody’s and Fitch revised the outlook on Russia’s sovereign BBB rating from stable to negative while S&P downgraded the sovereign rating by one notch to BBB-, its lowest investment grade category. This downgrade forced similar ratings cut on major Russian corporations such as Gazprom, Rosneft, and VTB bank, as well as subsidiaries of international banks. The geopolitical uncertainty has also given rise to dollarization pressures.

The outflow of $75 billion means that $24 billion worth of capital left Russia (on net) in the second quarter. While this means the pace of outflows is declining, it also means that the first half of the year witnessed a greater outflow than in the entirety of 2013. For certain, Russia seems on the way to the $100 billion outflow for 2014 that some had warned of.

How much of this outflow, and hence weakness in growth, is due to the imposition of sanctions, or the uncertainty associated with the possibility of additional sanctions? From Reuters:

Deputy Finance Minister Sergei Storchak said on Tuesday that sanctions were having a serious indirect impact” and warned of retaliation against further measures by the West.

…

“The real damage to the economy is potentially much more serious and comes from the voluntary self-sanctions taken by foreign investors, credit providers and some foreign companies active in Russia,” Chris Weafer, a partner of Macro-Advisory, a consulting firm in Moscow, said in a note published by the European Leadership Network.

“While not compelled legally to restrict activities in Russia it is clear that many investors and big international companies have suspended new deals in Russia and have cut risk exposure.”

In other words, the impact has been greater than some skeptics have asserted, and perhaps more in line with my earlier views [1]

I don’t think this is too surprising. The question is rather the expected impact on behavior.

I think it may blunt further ambitions in Ukraine. I doubt it would make Russia cough up Crimea at this point. The question is, therefore, what price Crimea? The Germans were willing to put up with a drag on their economy for 20 years to absorb East Germany. I think the Russians want Crimea enough to swallow the bitter pills that come with it. I believe Putin is playing the long game; success will not be measured here in months, and I believe the west will ultimately acquiesce in the annexation.

But I do think, as you suggest, that Russia is likely to be quiet for a time. When’s the next Russian invasion? We’ll, that’s easy to forecast: late summer 2018, when the next World Cup will be played there.

The sanctions will only exacerbate the effects of demographics and “Dutch Disease” on the Russian economy, pushing Russia closer to a regional alliance with China.

In this context, the West cannot afford China developing a naval power that permits the Middle Kingdom’s generals in Beijing to project economic, political, and military power in the Pacific and beyond that to Africa and the western hemisphere.

War is inevitable between Anglo-American empire and China for the remaining resources of the planet and control of vital shipping lanes, if human nature and the history of imperial hegemonic competition is a guide. The battlefield is likely to include cyberspace, however, where the financialized and digitized West is more vulnerable than is China, with the Anglo-American empire in military overstretch and with unprecedented debt to wages and GDP.

Neither the Anglo-American empire nor the Middle Kingdom can afford a shooting (or cyber-) war, but that has never stopped elites from rationalizing expansionism, squandering imperial treasure, and mass destruction in the past.

Yes, resource wars would be irrational – it’s far cheaper to develop substitutes for whatever resource is in question, especially oil.

Of course, substitutes imply losers and winners: those who are invested in oil will be hurt, while others will benefit. Just like the Koch brothers, the losers will fight to prevent that, and try to make others pay the cost of the war.

The Anglo-American rentier militarist-imperialist corporate-state cannot rule the world, secure the seven seas, and protect the interests of its US, UK, and European Power Elite owners using solar, wind, and batteries.

Empire, will to power, and realpolitik requires war and a massive state to tax and exact tribute to pay for the imperial military machine to expand and defend empire to its maximum extent.

Economics is politics. War is politics by other means. War is the business of empire. War is good business (for the imperialists).

Therefore, economics is politics is war is business is empire.

Economics is the political rationalization for the business of empire: war.

Most economists, admit it or not, are intellectual apologists and self-serving sophists for the values, motives, actions, and system of rewards and distribution of income and wealth to the top 0.01-0.1% owners of the Anglo-American rentier militarist-imperialist corporate-state.

All empires peak, decline, and collapse, disintegrating into racial/ethnic/religious tribalism and sometimes warlordism. The US is particularly vulnerable to a disintegration of “multiculturalism” into regional racial/ethnic/religious competition, conflict, and violence.

Self-satisfied Ivy League and other well-positioned establishment economists and like-mind intellectuals are either clueless or they assume they are protected. History suggests that they are particularly vulnerable to threats from below and detachment and lack of concern from above. When the wild-eyed angry peasant rabble come calling with pitchforks and torches at the academy’s gates, the self-satisfied priests will find few protectors among the rentier Wall St. oligarchs and Power Elite top 0.01-0.1%.

The Anglo-American rentier militarist-imperialist corporate-state cannot rule the world, secure the seven seas, and protect the interests of its US, UK, and European Power Elite owners using solar, wind, and batteries.

Sure they can – and they plan to.

“Georgia Power, the state’s biggest electricity supplier, is planning to build three 30-megawatt PV solar installations for the U.S. Army for a remarkably low cost.

The Army’s Georgia 3×30 initiative will build installations at Fort Stewart, Fort Gordon and Fort Benning. The forts will supply land for the arrays and distribution lines. The Army will be the offtaker through an existing contract with Georgia Power.

The utility will work with the U.S. Army Energy Initiatives Task Force to get the solar into commercial operation before the end of 2016. The projects will bring the renewables share of the Army’s Georgia energy consumption to 18 percent.

More importantly, the utility sees the projects as “cost-effective,” according to Renewable Development VP Norrie McKenzie. “The three projects will be brought on-line at or below the company’s avoided cost, the amount it is estimated to cost the company to generate comparable energy from other sources.”

————————————————————————————————

All empires peak, decline, and collapse

Well, they did before they modern era. But things have changed. For instance, I don’t really any sign of the British Empire “disintegrating into racial/ethnic/religious tribalism and sometimes warlordism”. Canada, Australia, and Hong Kong all seem to be doing pretty well. And the UK is far more prosperous than it was before WWII, when the Empire was still strong.

I believe that there will be limits to Russian cooperation with China. China is a rising power with nearly 10 times the Russian population and a very long, unprotected border with Russia. At the end of the day, Russia is a European power. Putin knows that. He’s not going to want to be exposed to the Chinese all alone. So there are limits. Russia does not have that many cards to play, and Putin is no fool. He can add.

I think China is the much more interesting and important power. A number of historical forces are coming together. From the Chinese perspective, they are going through a stage where they expect some respect and that historical injustices (viewed from their perspective) should be righted. For example, in the American mind, the view of the line of control between the US and China falls halfway between Manila and the Chinese coast. That’s pretty far from California. The last time the US allowed a comparable line of control was 1812. If I were Chinese, I would want that line pushed back to, say, Hawaii.

More interesting, though, is the question of whether China has lost faith in the growth model that brought them here and has decided to turn to an antagonistic military model, that is, switched from a liberal to a socially conservative objective function. That would be a disaster for all of us, but very possibly for China, for in effect, China would be re-clothing itself in the style of governance which brought it the Century of Humiliation. There is no such thing as an open trading economy at war with its trading partners. If China wants to be a global leader, it has to remain engaged. A war is the very opposite of that.

It is an interesting question as to whether the US must have a resource war with China. Personally, I don’t think so. It is in all of our interests that the oil should flow, and China has already demonstrated that it can bid it away from the US through commercial means. Moreover, just about half of all US shale oil production is being consumed (indirectly) in China.

But I am not sure that peace can be maintained during a transition period, and I am not sure that China wants peace.

I think this administration has allowed the Great Unraveling. The Middle East is a mess and may be descending into chaos. Does the US have good relations with anyone? Germans: Kicked out station chief. Saudis: Doubt US support. Iraqis: Allowed the country to self-destruct. Iran: Who’s winning that spat? Israel: Not really. Borders: Completely out of control.

If I’m China and looking at the mess in the Middle East and US paralysis there, I have to be thinking about how I’ll secure Gulf supplies in an era when the US thinks shale oil is a panacea. That requires a formidable Navy and all the opportunity in the world to get tangled up in a physical confrontation with the careless, condescending and oblivious Americans.

how I’ll secure Gulf supplies in an era when the US thinks shale oil is a panacea. That requires a formidable Navy

A navy can only protect against another outside country’s intervention – it can’t prevent or suppress civil wars (without genocide). So I don’t see much value in a bigger Navy for China right now.

Russia didn’t invade the Ukraine. Stop repeating that lie.

http://rt.com/news/crimea-defense-russian-soldiers-108/

putin admits to sending in troops to crimea, a legal part of Ukraine. but according to some people on this blog, russia did not invade the Ukraine. Unwelcome foreign troops would constitute an invasion for most folks.

Godfree: Yes, and the various divisions that crossed the Yalu into Korea in 1950 were all composed of Chinese volunteers, too.

Brilliant policy by the administration. No big blustering declarations but an effective squeeze. Hurt the Russian economy and scare the oligarchs. Now the Russians have begun softening on their approach to Ukraine. This crisis was heading for a total clusterf*** of tribalistic fighting – now there is actually a realistic way out of it.

Great, Russia will become more equal!

Well, if you’re a Russian I suppose things could be worse. Afterall, there’s always Kansas.

Why were sanctions on Russia necessary?

Because Obama drew a line in the sand that Syria crossed, and while Obama fiddled, Putin took control.

History repeats itself, like Nero followed Claudius, Obama followed Bush.

Slug – LOL!!!!

OT: A question for Jim or Menzie:

Weekly initial unemployment claims are now at 304,000. This level is consistent with the troughs of unemployment for other expansions. Can we draw any conclusions from the level of initial claims for where we are in the business cycle, and the outlook going forward. (BTW, JPM is floating a recession for 2017.)

http://www.calculatedriskblog.com/2014/07/weekly-initial-unemployment-claims.html

I second the question.

Last May James did an analysis of the market’s P/E – could we get another article like that, perhaps with some emphasis on the low interest rate environment?

Steven, the “speed limit” of real final sales per capita is 0% post-2007 and an average of ~1% for the cyclical trend rate since 2009-10, evidenced by real non-residential investment to private employment hitting the equivalent real final sales per capita stall speed in Q3-Q4 2013, implying a cyclical effective demand constraint with mfg. capacity utilization well below the historical level of constraint. This further suggests that growth of investment, employment, and production will decelerate (is decelerating):

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=Fpt

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=Fpq

The demand constraint and stall speed is implied by the initial claims figure you mention reaching the historical level at which growth of employment begins to decelerate and the U rate bottoms, as you correctly state. But, as with mfg. capacity utilization, the cyclical demand constraint is occurring with the total U rate well above the cyclical lows in 2000 and 2007, indicating significantly more labor underutilization, which arguably is contributing to the much slower speed limit for real final sales per capita and the production capacity slack:

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=Fpr

And recall that the decline in the U rate since 2009-10 is largely attributable to the simultaneous decline in the labor force participation rate from 66% to 62%. Had the labor force continued to grow (it has effectively not grown since 2008) and the participation rate average that of the 1990s-2000s, the U rate today would be closer to 10% than 6%, and U-6 would be 16% instead of 12%:

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=FpF

GDP “nowcasts”, including my own, imply q-q real GDP annualized at ~2-2.6% (mine at the lower end, FWIW), owing primarily to the weak q-q annualized investment, income, and spending for the quarter, which likely is being dragged lower by the mini-oil shock YTD with oil consumption to GDP at the historical recession level and the price of oil having accelerated YTD, q-q, and yoy.

http://www.philadelphiafed.org/research-and-data/real-time-center/gdpplus/

http://www.philadelphiafed.org/research-and-data/real-time-center/gdpplus/GDPplus_plot.pdf

http://macroblog.typepad.com/macroblog/2014/07/introducing-the-atlanta-feds-gdpnow-forecasting-model.html

https://chicagofed.org/digital_assets/publications/economic_perspectives/2014/1Q2014_part2_brave_butters.pdf

Using the data series used by the NBER with the highest R^2 suggests the risk of q-q annualized Q2 real final sales as slow as ~1%, again, owing to the mini-oil shock hitting net exports and real spending. In either case, this would imply little or no annualized growth of real final sales per capita YTD, whereas the 2- to 3-qtr. rates are at levels that have only occurred after a cyclical peak coincident with the onset of recessions since 1950, including Q1 2008 and Q1 2001.

I would add a caveat to the initial claims situation. Since the 2000s, there has been an increase in seasonal, temporary, and independent contract employment, some of which is of rather short tenure. As this phenomenon of permanent labor undertulization continues as the speed limit for effective demand slows, there will likely be a growing marginal share of the labor force that is not eligible for unemployment payments because of periodic self-employment, contingency independent contracting, or insufficient contiguous quarterly hours worked to qualify for payments. This development will likely skew initial claims lower over time with high labor underutilization and falling participation, resulting in the U rate being lower and employment appearing stronger than it is.

The overwhelming majority of economists do not expect any risk of a recession or bear market until a year or so after the Fed begins tightening bank reserves and raises rates and after the yield curve inverts. However, historically, the yield curve does NOT invert prior to recessions and bear markets during debt-deflationary or deleveraging regimes following secular financial crises, as occurred during the 1830s-40s, 1880s-90s, 1930s-40s, and Japan since the 1990s. In the US, the yield curve did not invert after 1838 to 1843, 1885 to 1900s, after 1931 to 1954″, and not since 1992 in Japan to date.

Rather, recessions occur during debt-deflationary regimes because real GDP per capita decelerates to secular speed limit at or below 1% with coincident demographic drag effects, making the economy and financial markets much more vulnerable to periodic shocks of various kinds, including energy, financial, and geopolitical.

Moreover, the economy during debt-deflationary regimes does not suffer from insufficient credit but from growth of real business and household income after tax AND debt service with high levels of debt to profits, wages, GDP, and gov’t receipts.

Therefore, 75% of the global economy–US, EZ, and Japan–is at or below stall speed and at an ongoing risk of a q-q annualized contraction as occurred in Q1. Eventually some clever economist will resurrect the euphemistic terms “growth recession” or “soft landing”, but for most of us it feels like recession.

Dave Malpas gives a warning

Excerpt:

China’s GDP will top $10 trillion this year–double Japan’s and growing fast. In contrast, Prime Minister Shinzo Abe’s structural reforms have fizzled, and Japan is pursuing a Fed-style monetary policy (more government, less growth). This means Japan’s national wealth is dissipating. Household net financial assets ($15 trillion) have been growing more slowly than the national debt ($14 trillion), leaving no cushion for the aging population or interest rate increases.

Currencies play a key role in all of these developments. For 20 years the yuan has matched or been stronger than the U.S. dollar, creating stability and growth. China defied the 1997–99 devaluation crisis in Asia, with then premier Zhu Rongji declaring that the yuan would be “strong and stable.”

Following China’s lead, Vladimir Putin adopted ruble stability in 2000, when he became Russia’s president. From 2002 through the bankruptcy of Lehman Bros. in 2008, the ruble was stronger than the dollar and yuan, a track record that solidified Putin’s rule and has helped the ruble withstand the recent U.S. and European sanctions.

In contrast, the yen has undergone wild swings in value that discourage investment. It lost 40% against the dollar and yuan during the Asia crisis and has swung back and forth across a wide range ever since. Japan is missing the opportunity for structural reforms from Shinzo Abe’s election as prime minister in December 2012. To restart the recovery Mr. Abe should set a ceiling at 100 yen per dollar to stabilize the yen’s value, as Switzerland has done with its franc, boosting growth.

Ricardo: Is this the same David Malpass who predicted recession in 2012, and predicted no recession in 2008? Why, yes it is!

I’ve never really understood Putin’s motive for invading and annexing the Crimea. I understand that historically Crimea was part of Russia for 300 years and was only attached to the Ukrainian Soviet Republic in 1954 after some bizarre (and perhaps kinky) escapades involving Nikita K. and his lover. So maybe the Crimea never should have been part of Ukraine. Whatever. But what was the point in annexing it to Russia? Putin’s supposed concern about wanting a warm water port for national security reasons is laughable on its face, unless Putin is truly deluded about the capabilities of the Russian navy. The Crimea was and always would be open to Russian warships, so they didn’t gain anything that they didn’t have before. And seriously, what would they even do with that warm water port? Sail around the Black Sea like Jason and the Argonauts looking for some golden fleece? The Mediterranean is NATO’s lake, so it’s not like a puny, run down Russian navy is going to project any power even if their navy passed through the Bosporus.

Steven Kopits suggested that Putin might be biding his time with an eye towards annexing some other country (eastern Ukraine?) at a later date. The problem is that Russia’s military is a wasting asset. Today the Ukrainian army is probably the only European military force that the Russian army could defeat; but even that may not be true 10 years from now. Today’s Russian army is not your dad’s Soviet army.

So why did Putin invade and annex the Crimea? Perhaps Putin really is utterly deluded about the Russian armed forces. And I suppose that is scary.

2slugbaits says: “…why did Putin invade and annex the Crimea?”

To maintain its status as a regional and world power.

Why Crimea is so important to Russia

March 18, 2014

“In 2008 the Ukrainians said they would not renew the lease when it expired in 2017. But they buckled under the pressure of a gas-price hike and, in 2010, extended the Russian navy’s lease until 2042.

Sevastopol (in Crimea) has been an important hub to project Russia’s naval power on a global platform. The Black Sea Fleet has seen a flurry of activity since 2008: during the war with Georgia that year, the fleet staged blockades in the Black Sea. The Russian navy was actively engaged with Vietnam, Syria and Venezuela (and up until March 2011, Libya) “for logistics and repair services in their principal ports”. It has also been alleged that Sevastopol has served as the main source in supplying the Assad regime during Syria’s civil war and proved useful with Russia’s role in dismantling Syria’s chemical weapons last year.

After Syria’s civil war forced Russia to stop using its naval base in the Syrian port of Tartus last year, Sevastopol became even more crucial.”

http://gulfnews.com/news/world/usa/why-crimea-is-so-important-to-russia-1.1305604

Although, the new lease expires in 2042, Putin saw an opportunity, since the U.S. is pulling-back and limiting its options.

However, the U.S. should prevent or deter crises rather than react to them.

Peak Trader Thanks. Those are all reasons, but they don’t strike me as convincing reasons. Having a warm water port so that you can provide year round logistics support to some militarily insignificant countries hardly seems like a strong enough reason to justify the economic costs that Russia is paying. After all, the Russians were able to do all of the things mentioned in the article under the terms of the basing agreement. The only thing they’ve gained is the ability to continue doing these things after 2042.

You’re not an eastern European, Slugs. It’s tribal, guy.

In our hearts, there’s probably not one of us who would not like to see some borders moved around, and if push comes to show, would not mind spilling some blood to do so. I am saying this is as an emotional, not intellectual, matter.

Imagine, for example, that Canada invaded Maine, and we could not recover it by force. How do you think US maps would show Maine to school children a hundred years hence? Do you think they would show a flag with 49 stars and Maine as part of Canada? Or do you think the US flag would still have 50 stars and Maine be shown as “occupied Maine”? Do you think a century hence there would still be a large number of Americans willing to fight to recover Maine? Would we call them irredentists? Or patriots? Could you understand why the US might be willing to endure sanctions and a recession to recover Maine? Can you see why such a war might not be primarily calculated on a cost-benefit basis?

If you understand that, then you understand the Russians…and the Hungarians, and the Serbs, and Greeks, Albanians, Germans, Kosovars…I could go on. The Europeans have done things to each other that no one has ever done on US soil.

That’s the piece of the puzzle you’re missing.

Steven Kopits In our hearts, there’s probably not one of us who would not like to see some borders moved around

Fair enough. I wouldn’t mind seeing a few states from the Old Confederacy give it another try; but this time no one will be trying to stop them.

How do you think US maps would show Maine to school children a hundred years hence?

Reference the War of 1812.

The Europeans have done things to each other that no one has ever done on US soil.

Well, we did have a Civil War, but I’ll grant you nothing quite like WWI or WWII.

What confuses me about your post is that the Russians gave Crimea to Ukraine…and not all that long ago. So it’s not like the Ukrainian Soviet Republic rose up and seized it from Russia back in 1954. The transfer was, quite literally, an “act of love” so to speak. So I don’t understand the Russian outrage at losing Crimea. I know that I certainly wouldn’t feel any outrage if Obama decided to give Texas back to Mexico. In fact, that would be grounds for amending the Constitution and giving him a 3rd term.

we did have a Civil War, but I’ll grant you nothing quite like WWI or WWII.

hmmm. Really? The US South suffered enormous, more than comparable costs.

The South lost the first modern war of total destruction. 30% of all white males aged 18-40 were killed (http://en.wikipedia.org/wiki/American_Civil_War) – there are usually more injuries than deaths. Very likely only 20% of the white adult males were left healthy at the end of the war. Both ex-masters and ex-slaves were left without financial, industrial or technological capital with which to rebuild. Transportation, industry and even agriculture were laid waste – think of Sherman’s march to the sea: everything was systematically destroyed.

A related thought: the impact of slavery on human capital may have been even worse: slavery left a cultural heritage of passivity and violent authoritarianism (classism, racism, sexism, domestic violence, etc, etc) for both ex-masters and ex-slaves that cannot be underestimated (as discussed above regarding West Point traditions). To work (expecially with your hands) was dishonorable for ex-masters, and to think and take responsibility for oneself was terrifying for people who had been publically tortured and killed for centuries, and who now faced a similar lynching campaign. The lack of more practical human capital can’t be underestimated: ex-slaves didn’t know how to read and write, how to run their lives (handling money, land titles, etc), how to raise their children or relate to spouses, etc, etc.

Actually, I think Nick is right. The Civil War is a good example. I should have said, “The Europeans have done things to each other that no one has ever done on northern US soil.”

Note that, 150 years after the end of the war, we still have issues with the Confederate flag. It still represents a point of resistance, a symbol of allegiance to a different political entity. And keep in mind that the South was an integral part of the United States from the start, and existed as a separate political entity for only four years. And yet, the Confederate flag is still an issue a century and a half later.

Now, project these feelings on to, say, any part of the former Hapsburg Empire, where there are much longer historical divisions and much clearer national identities, and well, you understand the emotional mindset.

2slugbaits, Russia gained territory and influence.

It’s a setback to the U.S. after winning the Cold War.

And, would Texas been better off remaining part of Mexico or Spain?

Giving Texas away to Mexico is like giving away the dreamhouse you spent decades building to a stranger on the street.

Of course, Texas may not be your dreamhouse. However, should we hold people’s tastes against them? 🙂

2slugbaits,

one reason could be that the economic issues were not correctly assessed before the invasion.

IMHO Putin had to choose between two evils, either he invested into Crimea and eastern parts of Ukraine after their occupation, or he faced the loss of a naval base, some important industry (weapons and pipeline stuff) and a strategic buffer. He decided to occupy the interesting regions, where he could assume support by the Russian population.

It looks for me that Putin then was kind of surprised by the economic problems this caused, problems in the occupied territories and problems caused by western countries. Now he is stuck somewhere in between with the interesting situation, that some industry is located in territory, that was turned hostile by Russian operations and a Crimea that can only be supplied with water and electricity from Ukraine in the next years.

Re: Russian Net Oil Exports

Russian net oil exports (so far, through 2013) stopped increasing in 2007, not exceeding 7.2 mbpd (million barrels per day, total petroleum liquids + other liquids, EIA) for 2007 to 2013 inclusive. Here are 2002 to 2013 Russian net oil exports and their ECI ratios (ratio of total petroleum liquids production + other liquids to liquids consumption). At an ECI of 1.0 a country is no longer a net exporter.

Russian Net Exports & ECI Ratios (EIA Data, BP data for 2013 consumption):

2002: 5.0 mbpd & 2.9

2003: 5.8 & 3.2

2004: 6.5 & 3.4

2005: 6.7 & 3.4

2006: 6.9 & 3.5

2007: 7.2 & 3.7

2008: 6.9 & 3.4

2009: 7.0 & 3.4

2010: 7.1 & 3.4

2011: 7.1 & 3.3

2012: 7.2 & 3.3

2013: 7.2 & 3.2

Based on a simple mathematical model and based on the empirical Six Country Case History (the major net oil exporters, excluding China, that hit or approached zero net exports from 1980 to 2010), a declining ECI ratio tends to correlate with a rapid rate of depletion in remaining CNE (Cumulative Net Exports).

The Six Country Case History shows that as their production increased slightly from 1995 to 1999, they had a significant decline in their ECI Ratio, with flat to declining net exports, and in only four years they shipped 54% of their post-1995 CNE:

http://i1095.photobucket.com/albums/i475/westexas/Slide2_zps55d9efa7.jpg

Based on the 2007 to 2013 rate of decline in the Russian ECI ratio, I estimate that post-2007 Russian CNE are on the order of about 70 Gb (billion barrels), with 15.6Gb having been shipped from 2008 to 2013 inclusive, implying that Russia shipped about 22% of post-2007 CNE in only six years (through 2013).

Of course, many things are possible, such as increased production from frontier areas and from shale oil plays, but it’s also possible, and in fact very likely, that Russia will show a significant ongoing decline in overall production.

In regard to shale oil plays, the Bakken Play is instructive. 2013 Bakken data show that the average crude oil production rate in 2013 was a little over 100 bpd, with a median production rate of less than 100 bpd, with a very rapid per well decline rate, while the overall production is still on an upslope. I could of course be wrong, but I have a hard time believing that production profiles like this will work in higher cost operating areas around the world, and in any case as the Monterey Shale case history illustrates, not all US shale plays will be commercially productive in meaningful quantities.

Based on the 2007 to 2013 rate of decline in the Russian ECI ratio

uhmmm…the Russian “ECI” is rising. A linear regressioin gives a small increase (.01 per year) which isn’t really statistically significant (r squared of only .04). but the ratio of exports to consumption (ECI) certainly isn’t falling.

Let me clarify: I analyzed 2002 to 2013. The 07-13 period does show a very small decline (.06 per year).

If we want to look at just 2007-13, we still see rising exports. So, to suggest that Russia has an exports problem, we have to hang our hat on a very minor increase in the share of domestic consumption vs exports.

Now, if we want to argue that Russian output and exports have plateaued, we’re on pretty solid ground.

If we want to argue that we should transition away from unreliable oil imports ASAP, we’re also on very solid ground.

Perhaps we are looking at different data bases, but the EIA data base shows that Russian net exports were at or below 7.2 mbpd for 2007 to 2013 inclusive (total petroleum liquids + other liquids, using BP consumption data for 2013).

And I don’t view a decline in the ECI Ratio (Ratio of production to consumption) from 3.7 in 2007 to 3.2 in 2013 to be trivial. It’s 19% of the way to an ECI Ratio of 1.0, when net exports would be equal to zero.

Based on the 2007 to 2012 rate of decline in the Russian ECI Ratio, I estimated that post-2013 Russian CNE (Cumulative Net Exports) were about 54 Gb.

If Russian production were to fall by only 1%/year from 2013 to 2023 and if consumption continued to increase at the 2007 to 2013 rate, it would imply that 2023 production would be down to 9. 5 mbpd (total petroleum liquids + other liquids) and that consumption would be up to 4.6 mbpd, putting net exports at 4.9 mbpd, with an ECI ratio of 2.2.

Based on this scenario, and based the implied rate of decline in the Russian ECI ratio (3.2 in 2013 to 2.2 in 2023), estimated post-2013 Russian CNE would be about 33 Gb, versus the previous estimate of about 54 Gb.

Note that the 2007 to 2013 rate of decline in the Russian ECI Ratio (from 3.7 to 3.2) would put the 2023 ECI Ratio at about 2.5.

Well, we have several analytical problems here.

First, your table above shows the following for Russian exports:

2007: 7.2

2008: 6.9

2009: 7.0

2010: 7.1

2011: 7.1

2012: 7.2

2013: 7.2

A quick glance tells us that there’s no decline here.

Second, I don’t think it’s really robust analysis to simply draw a line from the first value in a timeseries to the last value. It’s better to do something like a linear regression. In this case, that gives us the following:

Exports = 0.025 x year + 7 (R² = 0.2188)

In other words, exports are going up per year up by 25k bpd.

Similarly, a linear regression of “ECI” gives

y = -0.0643x + 3.6429 (R² = 0.7788)

which means that “ECI” is going down by -.386 over 6 years, or about -10.4% (instead of -19%).

3rd, the period from 2007 to 2013 is pretty arbitrary, and the 2007 number looks rather like an outlier. Get rid of 2007, and all of these numbers get even smaller. Use 2002 to 2013 and it changes much more.

4th, ECI doesn’t really make sense. It’s like MPG: it should be inverted, and simply be “percent of total production going to exports”. That gives more robust analysis, and is much easier to understand.

The exponential rate of change in Russian net exports from 2007 to 2013 was zero percent per year. Perhaps your calculator gives you a different answer.

The exponential rate of change in the Russian ECI Ratio from 2007 to 2013 was -2.4%/year. Again, perhaps your calculator gives you a different answer.

Finally, the ECI Ratio is the ratio of production to CONSUMPTION, and it is analogous to an income to expense ratio. At an income to expense ratio of 1.0, net income = zero. At an ECI Ratio of 1.0, net exports = zero. As noted in the following article, an extrapolation of the initial rate of decline in the ECI Ratio produced an estimate for post-1995 CNE (Cumulative Net Exports) that was too optimistic:

http://www.resilience.org/stories/2013-02-18/commentary-the-export-capacity-index

Here is what I did to estimate post-1995 CNE for the Six Country Case History*, based on the seven year 1995 to 2002 rate of decline in their ECI Ratio:

Estimated number of years to the ECI Ratio hitting 1.0, and thus zero net exports: 20 years.

Annual net exports at net export peak (not the actual production peak) in 1995: 1.0 Gb/year

Estimated post-1995 CNE:

1.0 Gb/year X 20 years X 0.5 (to get area under a triangle) less 1.0 Gb (net exports in 1995) = 9.0 Gb.

Actual post-1995 CNE were 7.3 Gb.

*All major net exporters, excluding China, that hit or approached zero net exports from 1980 to 2010

Note that the 19% decline refers to how far Russia has fallen, on their current path to a an ECI Ratio of 1.0. As it dropped from 3.7 in 2007 to 3.2 in 2013, it fell by 0.5, which is (0.5/2.7) X 100% = 19%. When Russia’s ECI Ratio falls by 2.7 units, production = consumption and net exports = zero.

Incidentally, the key point about the ECI Ratio concept is that it provides an early warning signal regarding net exports.

For the Six Country Case History, in simple percentage terms, from 1995 to 1999 their production was up by 2%, their net exports were down by 6% and their ECI Ratio was down by 6%. But here’s the kicker: Even as their production increased slightly from 1995 to 1999, their remaining post-1995 CNE (Cumulative Net Exports) were down by 54%. So, rising production, but a declining ECI Ratio, corresponded to a huge post-1995 CNE depletion rate (about 19%/year).

This is the chart showing the normalized SIx Country values for 1995 to 2002, with 1995 values = 100%:

http://i1095.photobucket.com/albums/i475/westexas/Slide2_zps55d9efa7.jpg

Again, these are ALL major net exporters, excluding China, that hit or approached zero net exports from 1980 to 2010. If I had included China, it would have looked even worse, since China, like the US, “Ran out” of net exports prior to production peaks.

In my opinion, post-2005 we are only maintaining something resembling Business As Usual because of almost totally unrecognized huge rates of depletion in Global CNE and in Available CNE (Global GNE less Chindia’s Net Imports, CNI).

The exponential rate of change in Russian net exports from 2007 to 2013 was zero percent per year. The exponential rate of change in the Russian ECI Ratio from 2007 to 2013 was -2.4%/year. Again, perhaps your calculator gives you a different answer.

Don’t use a calculator. Just copy the data into Excel, create charts (insert linechart), and add trendlines (click on the data line, right click, choose “add trendline” and in the “trendline options” choose “Linear” and “Display equation on chart”).

You’ll see that the trendlines aren’t as simple as drawing a line from the first point to the last point.

Discussion of recent Russian data and forecasts:

OPEC Update also Moscow Confirms Russian Oil Production in Decline

http://peakoilbarrel.com/opec-update-also-russia-peaked/#comments

But did you try the Excel analysis? It’s pretty straightforward to do, but if you have questions, please ask.

Menzie,

Repeating the same old ignorance I see. Malpass actually makes forecasts and gives his reasons and then explains why he was or was not correct. You never forecast; you only post what others say and imply you agree but it begins to smell you point to the dog and say “it was him not me.” The only thing you have really embraced is stating you want SNAP for everyone in the US and you have even tried to “mysticize” that away.

So in answer to your question, yes, it is the same Malpass you couldn’t understand then and can’t understand now.

On the contrary the sanctions have been pathetically ineffective. Putin is increasingly nagly in sending heavy machinery – tanks, APCs, artillery – over the border. There would have been a pull-out of capital from Russia even with no sanctions at all. Would you want to be invested in an anti-Western warmonger?

The only thing that has been somewhat effective is the threat of more serious sanctions in case Russia launches a full-on invasion. But Putin’s counter-threat to launch a full-on invasion in case of serious sanctions has kept serious sanctions off the table, even as Putin gradually escalates. Because, having ruled out force, Obama has no counter to Putin’s threat.

The main results are two:

The US has abandoned principled support for democracy and freedom in Europe. What is left is only treaty-based support. If you’re in Nato, the US is at least still promisig to protect you. If you’re not, “this isn’t our fight.” The Caucasus, Moldova, Belarus and central Asia will all see increased pressure.

The US has de facto abondoned the principle that borders can’t be redrawn, even while continuing to pay it lip service. Revisionists around the world will be emboldened.

maybe a useful word from the outside.

What you do in this thread very much looks like reading the tea leaves of data noise.

Maybe you take a look at the real signal.

Russia started an intercontinental rocket during the reintegration of the crimea.

Germany is now busy hunting american agents.

The last guy willing to do some invasion together with the US, French Hollande, is extremely pissed over BNP.

British BP and Austria have signed in recent weeks multi-billion contracts with Gazprom.

Polands Sikorski is on tap for calling the US a “worthless ally”, for whom it makes no sense to give a b…-job

Putin is on his round trip in Latin America, meeting Castro and in Argentina Kirchner and Chinese Xi, has tonight a joint (football) meeting with Rouseff and Angela Merkel. To a part of it, Ukraines Poroshenko was invited. US and UK are not invited.

I think it is time that Sensenbrenner talks some sense into the current washington administration, whom the rest of the world sees as habitual liars and permanent trouble makers.

My Russian investment is up 19% over the last quarter, where is the problem?

As the US declines Russia and China step into the void as world leaders. Putin’s South American tour will more than offset any “sanction” the US puts on Russia.

LOL, looking at the first picture in the telegraph link, and in this historic night,

I think it is appropriate to point out,

that whoever wins tonight in the historic 2-Pope football finale, he will wear Adidas.

The Devil wears Prada,

The loosers (3rd & 4th, incl. the USA) wear (american) Nike, and

The Winners (1st & 2nd) and Fidel Castro (see above) wear (German) Adidas

http://www.bloomberg.com/infographics/2014-06-11/nike-tops-adidas-puma-in-world-cup-jersey-fight.html

: – )

Worth discussing:

A Few Parting Words

Criticizing Capitalism Does Not Make One Anti-Capitalist.

July 13, 2014

This is my last column.

I know what some of you are thinking: Good.

You are sick of this guy named Al, who pretends to run an Emporium, offering barbed criticisms of business, usually with a tinge of sardonic humor, and in The Wall Street Journal Sunday, of all places.

Many other readers, I know, will miss me. Your emails bury me in way too much adulation, but it has been much appreciated.

I never quite got what I did, though, to get some of you so angry. Thousands of articles get published every day. When most people see a piece they don’t like, they turn to the next one. Not you. You send emails that are often longer than the column itself. You hurl names when you can’t form arguments. You suggest that a business columnist shouldn’t have an opinion, especially if it doesn’t align with yours. “Since you have never written a pro-business article, how do you get published as a WSJ business writer?” one reader recently wrote. “You sure have ’em schnookered, don’t you?”

All my articles are pro-business. I love capitalism. I want the economy and our corporate system to run well. I admire entrepreneurs and seek free enterprise for all. Unfortunately, some things stand in the way, including tyrants, idiots and ideologies. And when you’re a columnist, it’s your job to point this out.

If music critics pan a symphony, do you think it’s because they don’t like music? When sportswriters rip on a coach, do you think it’s because they are anti-sports? Why do some people love pointing out flaws in Big Government, but loathe those who point out the shortcomings of Big Business? Business deserves the same journalistic treatment as every other endeavor, from investigative reporting to commentary.

I’ve been writing columns, for various publications, for nearly 14 years. I am quitting because it’s time to chase a new opportunity. On Monday, I become editor in chief of The South Florida Business Journal, where I’ll lead a group of talented journalists. You can read more at tellittoal.com.

Let me reiterate key points with the words I have left:

— Wherever there’s money, there’s someone trying to steal it.

— There are bad leaders in business, just as there are bad leaders in government.

— Nothing grows forever. Why should anyone believe economic thinkers who pretend the economy should?

— Consumption isn’t a virtue to be left unchecked.

— Corporations wield more power than individuals.

— Cheerleading and boosterism aren’t good journalism or good business.

— Businesses externalize costs. They consume. They pollute. They exploit. You aren’t a flaming liberal if you weigh costs versus benefits and make wise choices.

— Bad ideas, and poorly managed businesses, should be allowed to fail.

— Crime should be punished irrespective of the wealth of the perpetrators.

— The free market doesn’t work without referees. There are many bad laws, but wise regulation is critical.

— No one can predict the future.

— Most investors would do better in index funds rather than pay a so-called expert to manage their money. Most of the investment industry is simply unnecessary.

— Some stock traders know how to game others—through technology, insider information and secret handshakes.

— There’s a difference between positive thinking and misplaced optimism.

— There really is a sucker born every minute. Don’t be one.

Thanks for reading, whether you loved my words, or hated them. You have made my career worthwhile.

— Al Lewis is a columnist based in Denver. He blogs at tellittoal.com; his email address is al.lewis@tellittoal.com

victory

Also worth discussing:

BIS chief fears fresh Lehman from worldwide debt surge

http://www.telegraph.co.uk/finance/markets/10965052/Bank-for-International-Settlements-fears-fresh-Lehman-crisis-from-worldwide-debt-surge.html

Total Global Public Debt Vs. the GNE/CNI Ratio

http://i1095.photobucket.com/albums/i475/westexas/Slide2_zps01758231.jpg

Definitions:

GNE = Global Net Exports of oil, combined net exports from the Top 33 net exporters in 2005, total petroleum liquids + other liquids, EIA

CNI = China & India’s Net Imports

ANE = Available Net Exports = GNE less CNI

Debt data from Economist Magazine

The chart shows that as the GNE/CNI Ratio fell from 12.0 in 2002 to 5.0 in 2012, total global public debt increased from about $20 Trillion to $48 Trillion. A declining GNE/CNI Ratio means that the Chindia region is consuming an increasing share of Global Net Exports of oil (GNE).

I’ve called what happens to the GNE/CNI Ratio from 2012 to 2022, and in subsequent years, the $64 Trillion question.

ANE fell from 41 mbpd in 2005 to 35 mbpd in 2012, and I estimate that ANE were down to between 33 and 34 mbpd in 2013 (EIA consumption data not yet released). I estimate that the GNE/CNI Ratio fell to between 4.6 and 4.7 in 2013, as the Economist Magazine shows total global public debt increased to about $51 Trillion in 2013.

In the What It’s Worth department, at the 2005 to 2012 rate of increase in global public debt, we would be up to about $210 Trillion in 2030. At the 2005 to 2012 rate of decline in the GNE/CNI Ratio, it would be down to about 1.0 in 2030, which would theoretically mean that there would be no net exports of oil available to about 155 net oil importing countries in 2030.

An absolutely critical point is that given an inevitable ongoing decline in Global Net Exports of oil (GNE), unless the Chindia region CUTS their net imports at the same rate as the rate of decline in GNE, or at a faster rate, the resulting rate of decline in ANE will exceed the rate of decline in GNE, and the ANE decline rate will accelerate with time (on a year over year basis). It’s a mathematical certainty.

@Jeffrey: “Unless the Chindia region CUTS their net imports at the same rate as the rate of decline in GNE, or at a faster rate, the resulting rate of decline in ANE will exceed the rate of decline in GNE, and the ANE decline rate will accelerate with time (on a year over year basis). It’s a mathematical certainty.”

The US/West cannot permit China to grow oil consumption via oil imports hereafter at the expense of loss of net oil flows to the US and US trading partners, not unlike the situation with Japan, Germany, and Italy in the 1930s to early 1940s.

Growth of China’s economy will necessary decelerate significantly because of a decline in US and Japanese FDI, production, and exports, and an increase in energy and food imports as a share of GDP, as investment, production, and exports decline as a share of GDP.

Those two paragraphs are contradictory. I’d say that the 2nd is more correct: US prosperity will be helped by cutting oil imports, and China’s growth will be hurt by greater oil imports.

The countries which have cut oil imports are, almost without exception, those which experienced fiscal and financial crisis since 2007.

Of course: cutting oil imports is the smart thing to do, and even more so when you’re under economic stress.

On the other hand, we see that Germany and the US have both cut oil imports, even as they’ve done rather better than other countries in dealing with the Great Recession.

China is the major exception, and that’s obviously because their growth rate is high. Secondarily, they haven’t prioritized reductions in oil consumption, largely because it’s mostly by industry. That’s a common mistake – Europe has kept consumer fuel prices high, while allowing industry to continue to waste fuel.

The countries with the fastest growth rates have been commodity exports or in the physical proximity of China. There are a few exceptions: Poland, Turkey, a couple of others.

Who’s done the worst? Since the start of the Great Recession, in terms of constant nat currency GDP (in order, from bottom): Greece, Italy, Ireland, Portugal, Spain, Finland, Ukraine, Denmark (really), Hungary, Netherlands, UK.

Let’s take a look at oil consumption for comparison. The worst since the Great Recession, in order: Greece, Ireland, Spain, Uzbekistan (?), Italy, Portugal, Hungary, Ukraine, Bulgaria, Denmark (on this list, too!), Sweden, Romania, Israel, UK.

No oil, no GDP.

Sorry, the oil consumption list should read, from bottom: Greece, Ireland, Spain, Uzbekistan, Italy, Portugal, Hungary, Ukraine, Bulgaria, Denmark, Netherlands (on this list as well), Finland (on this list as well), Sweden, Romania, Israel, UK.

So, no oil, no GDP.

Obviously, correlation isn’t causation.

In this case, no one stopped the physical flow of oil – those countries had less money and economic activity, so they had less money to buy oil and less economic activity to consume it (fewer deliveries or commutes, less fuel consumption).

If you lose your job, what’s the first thing to go? The fuel bill for commuting, and wasteful utility consumption (you’ll turn out the lights install LED bulbs, and cancel HBO if you’re smart).

And, of course oil exporters will do better when the price of oil goes up – it wouldn’t matter if they were exporting gold, copper or Kewpi dolls – when the price goes up, their export earnings go up.

Now, there is a secondary effect of oil imports: countries like Greece were hurt by their oil import bill going up. What does that mean?

Oil is expensive and unreliable – kick the habit ASAP!

But here’s the thing, Nick. The oil industry has been working flat out. That’s all the oil we could physically produce. So if oil is linked to GDP, and you’re saying that Greece could have consumed more, then by implication, someone else would have had to consume less. And if you follow that logic, you have a kind of lump sum of GDP growth that you can move around, but you can’t increase.

And before you say we can have infinite elasticity of demand without effect on GDP, let me note that both the OECD and non-OECD see similar productivity of oil gains per year, about 2.3-2.5%. That appears to be the speed limit, plus or minus.

So by all means, let’s wean ourselves off oil. But keep in mind, about 1/3 of that adjustment is coming through reduced economic activity.

if oil is linked to GDP, and you’re saying that Greece could have consumed more, then by implication, someone else would have had to consume less…you have a kind of lump sum of GDP growth that you can move around, but you can’t increase….about 1/3 of that adjustment is coming through reduced economic activity.

We’ve discussed this before, and we haven’t seen any good evidence for that. Inflation is low, and the problem is aggregate demand, not supply bottlenecks.

the OECD and non-OECD see similar productivity of oil gains per year, about 2.3-2.5%. That appears to be the speed limit, plus or minus.

Hybrids, EREVs and EVs are already the low cost choice for Total Cost of Ownership (per Edmunds.com), so if cost were the driver….we would have reached the tipping point.

Supply isn’t the problem: Toyota, Nissan, Ford and GM will tell you that they could double production of their hybrids, EREVs and EVs literally overnight, if demand were there.

There are two big problems:

First, the vast majority of people are very slow to move to new things. Individual consumers have to see people around them using this new thing for quite a while to become comfortable with them. For example, online food ordering has overwhelming benefits for parents, but Webvan went bankrupt: they counted on people moving to a new thing too quickly.

Commercial users of heavy duty vehicles face large problems of economy of scale, long-lived investments and operating in a tough competitive market. Large fleet customers have been experimenting with pilot programs, but have been afraid of being first movers (“Pioneers are the ones with arrows in their backs”). That suggests that the early rate of adoption may be deceptive. At a certain tipping point fleet buyers will decide high oil prices are permanent, and that electrified/alt fuel vehicles are clearly cost justified. Then, sales will grow quickly.

Second, the primary reason for EVs is Climate Change, and as a society we haven’t prioritized dealing with CC. We just haven’t. Until we do, with things like carbon and fuel taxes (which even the most conservative economists support) and acceptance by Republicans, it’s unrealistic to expect fast movement by consumers.

So by all means, let’s wean ourselves off oil

Well, that’s great that we’re in agreement. So, we’re in agreement about public policy to support that, like carbon or fuel taxes?

even the traditionally washington and war friendly FT tells you, what I said before, very graphically.

Nobody trusts America and Americans any longer

A farewell to trust: Obama’s Germany syndrome

http://www.ft.com/intl/cms/s/0/f0776136-08ee-11e4-9d3c-00144feab7de.html?siteedition=intl#axzz374RLI046

Impeach now

I am increasingly concerned that China may be choosing the fast track to war with the US, as China is fortifying an island all but south of Vietnam. See the map.

http://pacificsentinel.blogspot.com/2014/06/news-story-us-should-be-worried-about.html

Indeed, Steven. History, human nature, and the imperatives of empire imply that war between the US and China is all but inevitable, and likely sooner than most realize. (Or one might say with more confidence that a point of no return is on the horizon for deterioration of US-China trade and diplomatic relations that historically tends to lead to a collapse in relations and thus the end of the existing trade superstructure and necessary multilateral relations that sustained the system. The incidents of bilateral energy and currency relationships are a warning sign of the eventually unraveling of “globalization” and de facto petro-dollar currency standard, i.e., the Anglo-American imperial corporate-state’s trade regime.)

Note also that the world has been at a similar point at least three times before WRT the West and the Middle Kingdom. About every 50-60 years, westerners have rushed to China to make their fortunes, often exploiting the Chinese in the processing, experiencing economic collapse, social unrest, xenophobia against “western devils”, and expulsions and seizure of assets of foreigners, whereas the Chinese elites crack down on domestic social unrest and turn inward from the rest of the world. Similar episodes occurred in the late 18th century during the White Lotus Rebellion, the Opium Wars of the mid-19th century, the Boxer Rebellion at the end of the 19th century and early 20th century, and Mao’s revolution in the 1930s-40s. The West and China are due yet another falling out, a resulting collapse of int’l trade, and China turning inward to deal with increasing scale of social instability and blaming the crisis on the West, most particularly the US.

https://www.youtube.com/watch?v=5fbvquHSPJU#t=531

Empires historically build up rival regional/global hegemons via investment to expand markets for trade, inevitably creating a competitor against which the hegemon must go to war to sustain its dominance, contain the rival’s ambitions, and to defend imperial elites’ interests at the far-flung imperial frontiers.

The Anglo-American empire is now exhibiting obscene wealth and income inequality; a disengaged, disinterested rentier Power Elite top 0.01-0.1%; rapacious, sociopathic, rentier-financier Wall St. oligarchs; self-satisfied establishment intellectual elites who have fully internalized and affirmed the rentier values of the Power Elite and Wall St. oligarchs; increasing tolerance, even encouragement, of moral and cultural decadence; an emerging secret police-state surveillance apparatus; military overstretch; declining mass-social approval of, and confidence in, the executive, legislative, and judicial branches of gov’t, as well as other major institutions, including large TBTE banks and the Fed; and the secular economic effects of deindustrialization and financialization on the working masses. These characteristics create similar vulnerabilities for the US as existed before the collapse of the Bourbon Ancien Regime coincident with the French Revolution, and prior to the end of the Romanov dynasty during the Russian Revolution.

Empires followed this kind of dynamic before the modern era, when they were primarily agricultural, and had very, very low growth rates. Empires with high growth rates were essentially ponzi schemes, looting their neighbors until they reached a limit and collapsed.

Any analysis of the growth and decline of pre-modern civilizations has very, very limited application to modern times. For instance, I don’t really any sign of the British Empire experiencing “economic collapse, social unrest, xenophobia against “western devils”, and expulsions and seizure of assets of foreigners”. Canada, Australia, and Hong Kong all seem to be doing pretty well. And the UK is far more prosperous than it was before WWII, when the Empire was still strong.

China tells U.S. to stay out of South China Seas dispute

http://www.reuters.com/article/2014/07/15/us-china-usa-asean-idUSKBN0FK0CM20140715

WSJ: Beijing’s Appetite for Engagement Ebbs

http://online.wsj.com/articles/beijings-appetite-for-engagement-ebbs-chinas-world-1405397472?tesla=y&mod=WSJ_World_RIGHTTopCarousel_1&mg=reno64-wsj