Today we are fortunate to have a guest contribution written by Doug Campbell, assistant professor at the New Economic School (Moscow).

The 2000s began with the Federal Reserve narrowly missing the zero lower bound on short-term interest rates. Then the US needed a housing bubble to attain full-ish employment in the mid-2000s, a decade that ended with the US and other major economies falling into liquidity traps, where they have been ever since. The causes of this sustained shortfall in demand, termed secular stagnation, was the topic of a recent VoxEU.org ebook. In this post, based in part on my job market paper, I argue that one of the main sources of this economic “time of troubles” has to do with relative prices, trade, and the rise of China.

A Theory of Secular Stagnation: Trade and China

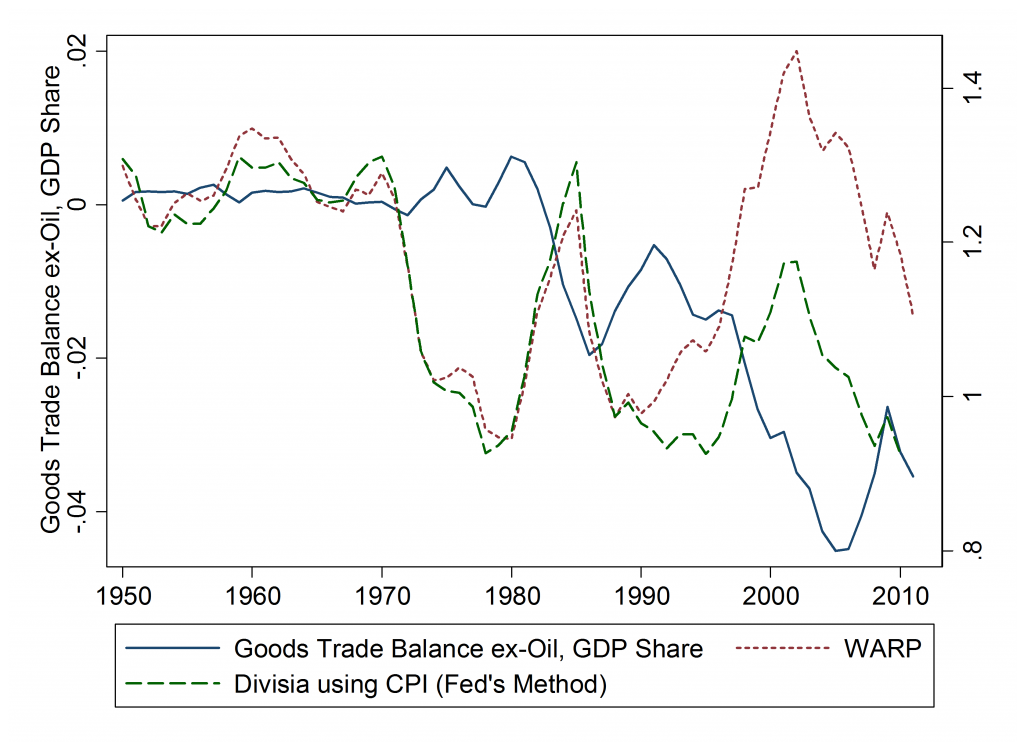

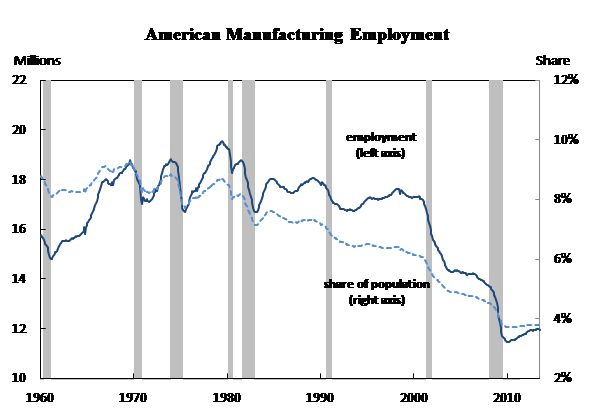

This thesis is not new. Ryan Avent, Acemoglu et al. (2013), Autor et al. (2013), Dean Baker, and Pierce and Schott (2014) all tell stories in which trade and the rise of China have had left marks on the US economy. In my preferred version, there were two factors, the rise of low-wage China and a sharp appreciation of the US dollar in the late 1990s (Figure 1, the green line shows the Fed’s RER index; WARP will be explained later) fueled in part by the Great Reserve Accumulation. These two events led to a persistently large trade deficit (Figure 1, blue line) and a collapse in US manufacturing employment (Figure 2). This collapse caused the Fed to keep interest rates very low in the 2000s just to attain investment levels consistent with full employment, contributing to the housing bubble. The flip side of a trade deficit is a capital inflow, which, via an accounting identity, implies that domestic savings is less than investment. Less savings means more debt, and thus the trade deficit could itself have caused Americans to become overleveraged, leading to a balance sheet recession once the housing bubble collapsed. Finally, due to hysteresis and balance sheet effects, an overvalued dollar in 2002 can continue to effect aggregate demand today. Historically, temporary appreciations of relative prices have lead to persistent trade deficits and persistently smaller tradable sectors. In addition, households are still trying to replenish their balance sheets by reducing spending. Fortunately, US relative prices no longer appear to be much higher than our trading partners as a whole (not so for much of Europe). On the other hand, the “Rise of China” is still far from complete.

Figure 1: Real Exchange Rate Measures vs. the Goods Trade Balance, Ex-Oil

Figure 2: American Manufacturing Employment

The Evidence

What is the evidence that a temporary appreciation of US relative prices led to the surprisingly sudden collapse of US manufacturing employment? In my paper, “Relative Prices, Hysteresis, and the Decline of American Manufacturing”, I try to get at this question by studying the impact of relative price (or real exchange rate) movements on manufacturing. There are two key difficulties with answering this question.

The first difficulty, surprisingly, was to design a theoretically appropriate measure of the real exchange rate. Longtime readers of Econbrowser, of course, know from this post that commonly-used real exchange rate measures produced by the Federal Reserve and the IMF suffer from an index numbers problem. This problem is almost identical to “outlet substitution bias” in the CPI, the bias that arises when new stores, such as Walmart, open and offer lower prices than existing stores. This effective price reduction does not get reflected in the CPI. In the case of real exchange rate indices, China is essentially the new giant low cost entrant, wreaking havoc on various government statistics including the Fed’s widely used Broad Trade-Weighted RER index. In Figure 1 (green dashes), the Fed’s index is compared to a simple Weighted-Average of Relative Prices (WARP), which adequately reflects the growing role of trade with China, computed using price level data from version 8.0 of the PWT.[1] In my research, I extend WARP back to 1820 for the US, and find that the US price level in 2002 had not been that high relative to trading partners since the worst year of the Great Depression.[2] WARP, however, does not take productivity into account (Bangladesh may have low wages, but since it also has low productivity it may not be a competitive threat), and so I introduce two new series, a Balassa-Samuelson adjustment to WARP and Weighted Average Relative Unit Labor Costs (WARULC), both of which I use as my main measures of relative prices in my dissertation.

The second problem is ubiquitous in economics – how to identify a causal relationship as opposed to correlation. One strategy I use is to look at disaggregated, sectoral data. In the early 2000s, the manufacturing sectors that did the worst were those who were the most exposed to trade (and not just to China), and their worst years were when the dollar was the most overvalued (controlling for the most likely potential other factors, such as recessions and interest rates). Secondly, I look at several natural experiments, periods in which we can plausibly identify the cause of movements in relative prices. Several of the episodes I study are the US experience in the 1980s, when the Reagan deficits led to a sharp dollar bubble, and Canada’s experience since 2000, when a weak US dollar and rising oil prices led to an appreciation of Canadian relative prices. In each case, I find that relative price appreciations have a large adverse impact on trade, productivity, output, and employment concentrated in those sectors most exposed to trade. (I also found that productivity growth has not resulted in more jobs lost since 2000 than in previous decades when aggregate manufacturing employment was flat, a finding supported by others.) That the results appear to hold up out of sample in different time periods and countries give reason to believe that the relationship is causal.

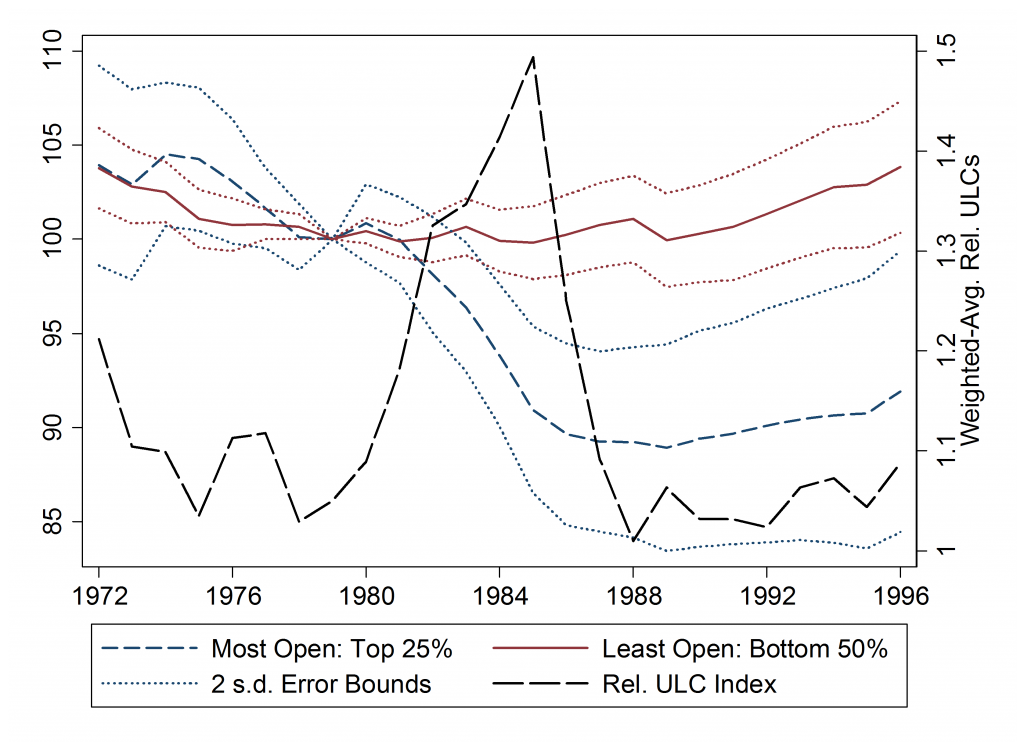

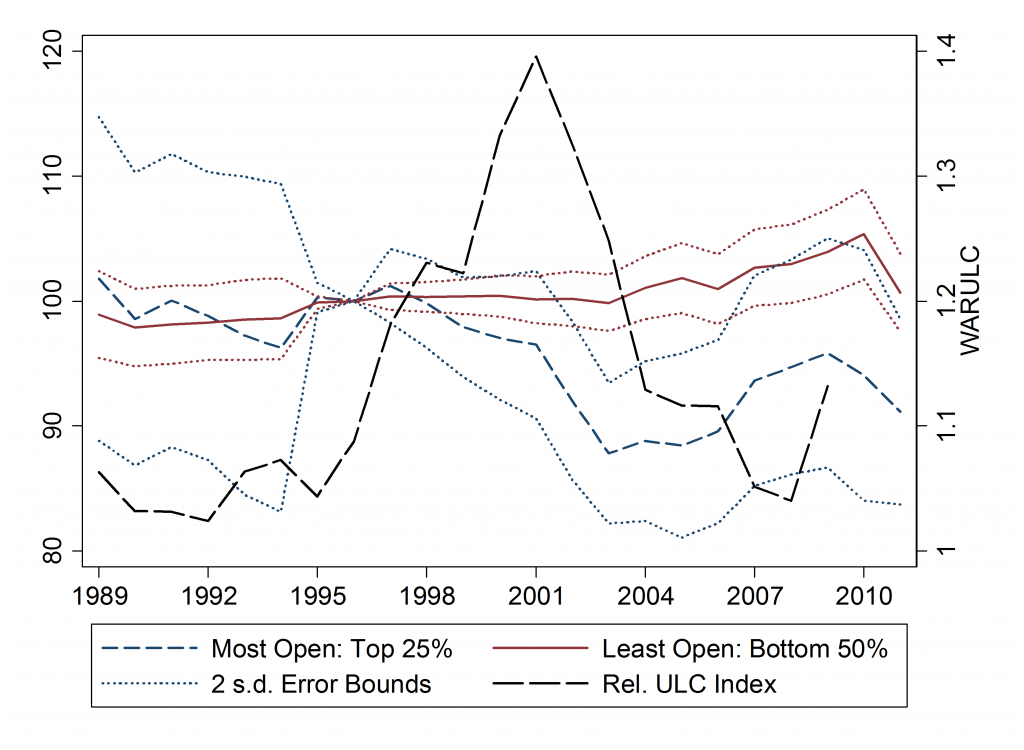

The methodology in my study on manufacturing is readily apparent in Figure 3 below. In panel (a), I compare the most open manufacturing sectors in 1972 (where openness is the trade share of output) with the least open sectors. In the 1970s, when US relative unit labor costs were similar to our trading partners, there was no difference in employment (or output) performance of the most open sectors relative to the least open sectors. However, when US RULC’s appreciated sharply in the mid-1980s, the more open sectors lost ground relative to the sectors which were less exposed, controlling for other factors. Interestingly, once US RULCs returned close to fundamentals, the jobs lost in the most open sectors did not return – a striking example of hysteresis. Panel (b) of Figure 3 shows that much the same thing happened in the early 2000s. The finding of hysteresis is important, because the implicit model most economists assume when they think about trade policy, particularly vis-à-vis China, does not incorporate the potential for hysteresis.

Figure 3a: Employment Growth by Initial Openness – 1980’s Dollar Bubble

Figure 3b: Employment Growth by Initial Openness – The 2000s Manufacturing Collapse (NAICS)

The Trade Deficit and the Rise of China: Big Enough to Matter?

Was the collapse in manufacturing large enough to lead to secular stagnation? My panel estimates imply that two million jobs were lost directly due to the appreciation of US relative prices through 2008. However, the input-output tables tell us that every dollar of manufacturing output requires 60 cents of input (a bit more than half of this is direct, the rest indirect) from other manufacturing sectors. This could seemingly put the actual number of jobs lost in manufacturing due to trade closer to three million. Additionally, manufacturing also consumes input from other sectors of the economy in a proportion similar to which it consumes other manufactures, and affects local labor markets and local government revenue. While we might not know what elasticity to apply, exactly, we do know that areas which lose manufacturing jobs typically struggle to attract other industries. If these areas were totally unable to attract other tradable sectors, then the long-run elasticity would simply be the inverse of the share of tradable employment in the economy. Defining tradable sectors very generously, I get a number of perhaps 3 or 4 to 1 for the US as a whole. Thus it isn’t hard to wind up with a total long-run shock to employment, in the absence of a central bank response, of more than 10 million. This is easily large enough to be the primary cause of secular stagnation, even if other factors, such as demography, are also at play.

Policy Implications: A Return to Free Trade

Now that we know one of the chief causes of the poor growth since 2000, how does this change our knowledge of what needs to be done? Certainly one implication is the necessity of encouraging China to let the free market determine the value of its currency, particularly as manufacturing sectors which compete with China continued to shed jobs through 2011 even as overall manufacturing employment increased. And there are still millions more US manufacturing jobs which could eventually be relocated. Unilateral attempts by the Fed and/or Treasury to weaken the dollar directly or via fiscal policy may have been helpful in the early 2000s, but they wouldn’t work against China with its capital controls, and would (rightfully) meet with international opposition. I favor an indirect approach: the Fed should aim for higher inflation, which functions as a tax on China’s estimated 2.5 trillion in dollar-denominated foreign reserves. This policy makes sense for other reasons given that US inflation has been extremely low for years and prime aged employment has only just started to recover. Can the Fed achieve higher inflation? In short, yes. All recent evidence points to the conclusion that, for better or worse, the limits of monetary policy in a liquidity trap lie in the minds of FOMC members rather than in their policy tools. One strategy the Fed and the ECB might want to consider is to stop tightening monetary policy when core inflation is well below target and there is mass unemployment – something both central banks have done repeatedly since 2009 (in emulation of the Bank of Japan during its lost decades?). And, the lesson of hysteresis tells us that the legacy of continued slow growth as the world waits for the Fed (and the ECB) to discover their wits will be diminished economic possibilities for years to come.

Notes

[1] It is worth mentioning that the PWT is being revised in a way in which WARP for the US could be more comparable to the PWT v7.1, in which case the relative price shock in the early 2000s would have been about as large as the appreciation in the 1980s. This likely would not change the basic story.

[2] In addition, I found that Japan’s price level was on average nearly twice that of its trading partners during its two decades spent in a liquidity trap.

This post written by Douglas Campbell.

This is pretty much the same drum Dean Baker has been banging for years. High unemployment and low savings are caused by the trade deficit. The trade deficit is due to an overvalued dollar caused by the reactionary hoarding of dollar reserves by countries that were previously pummeled by Robert Rubin and friends when he imposed severe austerity on impoverished countries while simultaneously bailing out his banking buddies. China’s manipulation of the exchange rate just makes the trade deficit worse. Nice to see some data for confirmation.

reactionary hoarding of dollar reserves by countries that were previously pummeled

This post only discusses China. What countries do you have in mind?

As the Doug points out the “stagnation” of the US is in some senses simply a reflection of the shift from domestic manufacturing to imports. As services have grown as a proportion of national income, so productivity has declined in the US in large part due to the simple fact that service sector employees produce less value added than manufacturing ones.

Other factors also contribute to the myth of stagnation, as manufacturing productivity has risen so the cost of machinery has fallen, so the same amount of investment can produce more stuff, similarly while wages have stagnated for all but the super rich, what they can buy has increased as the unit cost of domestic consumption goods has fallen, and their quality has markedly increased.

And so on.

In the economic contest between Russia and the US this is the best news I have heard in a long time. When the USSR fell apart Russia actuall looked at the success of US economy of the 1980 and adopted many of the Reagan supply side policies, most significantly a flat tax. Russia actually began to see real economic growth and wealth creation. Recently with the autocratic moves by Putin Russia has become stagnant. Now with such a strong Keynesian incluence in the heart of Moscow in the form of the NES Russia accepted our “Trojan Horse,” a weapon that will destroy their ecconomy, and – provided the US does not fall apart first – prevent any kind of Russian economic world leadership.

Well, Ricardo, in that case you’ll be happy to discover that, during the crisis, Russia was easily the most Keynesian country in Europe. While Greece and Portugal were busy tightening their belts, Russia (and China) went on a Keynesian spending binge.

Can you guess how Russia’s economic performance faired relative to the rest of Europe?

http://research.stlouisfed.org/fred2/series/LMUNRRTTRUQ156S

vs.

http://research.stlouisfed.org/fred2/series/LRHUTTTTEZM156S

Well, Q2 GDP was revised to 4.2%, so I’m not sure where the “slow growth” comes from.

Remember, oil production is, in a very material way, “manufacturing”, in that all–all–of increased US oil production is import substitution, that is, all of US shale oil production functionally has been, in fact, net exports. This and iPhones are the big story since the Great Recession.

Decreased US oil consumption, down 10% since 2005, and increased oil production, up 5 mbpd since 2005 (equal to 25% of US 2005 consumption), are the big drivers of the current account. Reduced oil consumption and increased oil production represents a swing of $300 bn annually since 2005. Nary a mention, Doug. Nor any mention that the Europeans have had to make this adjustment without the benefit of increasing oil production (just the opposite for the UK, for example). And the effect on a European economy would be what, Doug? How would, say, Denmark look if it were forced into a secular reduction in oil consumption?

As I have said before, oil is not constraining US growth on the current account side, and Brent is now $5 / barrel below the US carrying capacity price. So, the US economy has some room to run, at least from an oil markets perspective.

All this may be for naught. With the now explicit invasion of Ukraine by Russia, I think Europe has little choice but to mobilize within a very short period of time. Merkel has stated that Germany stands behind Ukrainian territorial integrity. There really is no choice but to fight the Russians. (It would have been cheaper to fight a proxy war in Syria.)

Whether current conflicts morph into a world war depends entirely on China, which has really lost the thread recently. In my forecast, Iraqi oil production goes down along the lines of Libya (-2 mbpd). Where is that oil going? China. What are the Chinese thinking? That global chaos somehow serves Beijing’s interests? That the Saudis bombing the Qataris is a good idea? That Iran lobbing a nuke into Saudi oil fields is good for China?

I wish I could tell you that we don’t have a braindead administration in Washington, and instead had one which understands how to cooperate more deeply with China. But we don’t. Here GM Professor Mark Katz, to appearances an apologist for President Obama:

KATZ: Yes, I think for President Obama in particular he has a different vision of what are America’s real interests. In other words, up until recently, the Middle East has been considered vitally important because of oil, etc. We’re now in an era where we don’t need Middle Eastern oil to the same extent that we used to. So why do we need to spend so much effort in an area that’s very difficult to manage?

You know, President Obama has been criticized for being naive, for being utopian. In fact, I think there’s a prospect that he’s actually far more Machiavellian than we’ve seen in American leaders. You know, who wanted to do right and, you know, America should step up and get involved. But I think that for him it’s that, well, if it’s not vitally important for us, then why should we get involved?

GREENE: And of course some of his critics would say that that makes the United States look weak.

KATZ: But even that isn’t necessarily the worst thing I think for President Obama because if in fact our adversaries become convinced that we are weak, what are they going to do? These are not the kinds of people who cooperate very easily with others. So if they think we’re no longer a factor in the picture, they’re going to turn on each other. And that, I think, is what we have been seeing, you know, with ISIS having killed a journalist. And then we see the al-Nusra Front releasing a journalist. It’s like there competing – no, no, we’re the nice guys, we’re the nice al-Qaida – that this is a message that they’re sending.

So it strikes me that when others feel that the United States is no longer a factor, they’re not going to cooperate with each other. They’re going to turn on each other. In other words, that this aphorism when the purpose of an alliance comes to an end and the alliance comes to an end, it doesn’t just apply to our alliances. It applies to the bad guys alliances as well.

So, Katz is arguing that the President is deliberately fomenting chaos in the Middle East and undermining the security of China’s oil imports. That’s US policy. Unbelievable.

Nevertheless, it will be China which determines whether all this devolves into World War III. Russia cannot move without China. And if Russia is quiet, then the US will do the right thing in the Middle East, once it has tried everything else.

http://kawc.org/post/have-us-russia-policies-helped-rise-islamist-extremists

Re: “Well, Q2 GDP was revised to 4.2%, so I’m not sure where the “slow growth” comes from.”

OK, I’ll agree that we’ve seen some signs of a better economy, but what was Q1 GDP growth at again? -2.1%?

Thanks for your other comments — I’ll have to think more about them.

True enough, US growth has been below both historical trends and more recent expectations. I think there’s a tendency to take longer term trends and attribute structural causality to them, when in fact it’s just a longish downturn.

As for oil, we’ll see. If oil is an important contributor, then we should see the US do better now. Assuming we can avoid war with Russia, which I personally doubt.

steven

“In other words, up until recently, the Middle East has been considered vitally important because of oil, etc. We’re now in an era where we don’t need Middle Eastern oil to the same extent that we used to. So why do we need to spend so much effort in an area that’s very difficult to manage? ”

this quote by katz is probably pretty accurate. perhaps you listened too much to the pundits who complained the Obama alternative energy policies (batteries, wind, fuel cells, …) was nothing more than a ploy to pay off his supporters. that faux news line was really foolish. Obama has been working to make the middle east irrelevant for our energy needs, but he has not fallen into the trap that we simply replace middle east oil with our oil shales. that new source has helped, but he has shown a history of desiring broader energy independence. hence the alternative energy initiatives. then we can let others worry about the middle east oil protection costs.

Baffs –

Read this week’s Economist essay on China. http://www.economist.com/news/leaders/21613263-after-bad-couple-centuries-china-itching-regain-its-place-world-how-should

The No. 1 foreign policy priority for the United States, as far as I am concerned, is to insure that China has enough energy to grow. If you look at China’s oil import dependence, it is high now and going to be much higher. If you’re Chinese and not worried about energy security, you’re being foolish. And the Chinese are not a foolish people.

So what has the US done? Underwritten chaos in the Middle East–exactly, exactly what China has most to fear. I understand you’re a “Little Englander”, that the breadth of your vision is defined as your immediate needs in your proximate world. A lot of Republican politicians are like that, too. Nevertheless, some of us look at the world from a systemic point of view, understanding that the perpetuation of the current world order depends upon the balancing of our own self-interest with that of others. If China cannot gain satisfaction in the current structure of things, it will do so unilaterally, through military means. That’s the lesson of Fiery Cross. http://www.defensenews.com/article/20140614/DEFREG03/306140014/Beijing-Continues-S-China-Sea-Expansion

So, it’s about more than just what we want, in the narrow sense.

steven

“I understand you’re a “Little Englander”, that the breadth of your vision is defined as your immediate needs in your proximate world. ”

you could not be further from the truth. in fact, i would argue you fill the role better than i do. i want us to be energy independent, and the focus of this is on alternative energy such as solar, wind, water, etc that are renewable and local to our country. we should develop technology that enables this to occur. have i said anything about keeping that technology from china, or any other country? no. the first to embrace this approach will reap the greatest benefits. but by all means let china enjoy our technological success-and perhaps they may even make advances that we can utilize. and this leads us to the loss of oil dependence, not only here, but around the world. why do you insist on wanting a world in which oil is a central player? you need to see the big picture. i want a world where conflict due to oil, and china, does not exist. if you continue to support a major source of this conflict, oil, then you continue to embrace future conflicts.

You are aligned with the President, Baffs.

And for it, we have a Russian invasion of Ukraine; chaos in the Middle East and the rise of an ISIL openly committed to destroying the United States; and China building facilities at Fiery Cross Reef, which is south of the Saigon (Ho Chi Minh City).

I take it as a given that a broader European war is no longer avoidable. Had Europe and the US firmly deterred Putin in Syria or after Crimea, he could have stopped without loss of face, because there was no ‘war’ to speak of. With the invasion now acknowledged, Putin is committed to it. His prestige in on the line (something about which I warned on other occasions). I think Merkel’s prestige is now also on the line. And if not now, very soon. Putin will not stop until he is stopped.

Whether this transforms into a world war depends upon the motivations behind the construction at Fiery Cross. If President Xi follows your line of thinking, Baffs, he would conclude that the US is impotent and unwilling to rise to its international obligations. China, thus, has both the necessity and opportunity to exercise unrestricted power, at least power unconstrained by the United States. For Xi to pull back from this, he must conclude that China’s interests lie more in stability than chaos.

You, Baffs, like the President, believe that US interests are served by chaos, and that Xi would be right to blow up the existing order.

steven,

myself, obama and china all understand that alternative energy which reduces the need for oil would be a more stable long term solution. so is china better off continuing down a path towards renewable energy, or starting a war to protect oil in its geographic sphere of influence? you think war. i think you are wrong. and at this point we have no war from china. steven, your desire for war is worrisome.

Well, this is not really about sec-stag, at least not the doomsday version that Summers presented. Nothing in what you describe means that we HAVE to have a long painful period continue for many more years. It just explains the length of the Great Recession up til now. Summers’ point was that the recession is here to stay, and that is not what your data show or imply. I would edit out the sec-stag part, and just let your interesting research stand on its own without trying to tie it in to a trendy buzzword.

This is a fair point. As Barry Eichengreen wrote, SecStag means different things to different people. Something did happen to the US economy which caused slow growth from the early 2000s — a prolonged period of weak demand. But my analysis doesn’t necessarily point to the conclusion that slow growth is the new normal, absent more dollar over-appreciation or more premature Fed tightening…

Too much nominal macro and not enough real macro. Though there clearly was a bubble in key consumer capital goods (houses and autos).

Blaming China for US policy-driven economic woes is getting tiring.

The low Federal Reserve rate in the early 2000 decade came on the heels of the Sept. 11 attacks. It was part of the mass hyper vigilant hysterical reaction to the Sept. 11 attacks on the world trade centers and the Pentagon.

Blame the failed Oslo Peace Accords and US support for the resettlement of diaspora Jews in the former Palestinian mandate.

>reactionary hoarding of dollar reserves by countries that were previously pummeled

>This post only discusses China. What countries do you have in mind?

If you read closely the article above you will see ” In my preferred version, there were two factors, the rise of low-wage China and a sharp appreciation of the US dollar in the late 1990s fueled in part by the Great Reserve Accumulation.”

The Great Reserve Accumulation refers to the aftermath of the Asian Financial Crisis in the late 90s.

Dean Baker explains it well: “The harsh treatment by the I.M.F. of the countries in the region (yes, this was the bailout led by the Committee to Save the World [Rubin, Greenspan, Summers on the cover of Time]) led to a sharp increase in the accumulation of foreign exchange reserves (i.e. dollars) by developing countries. Countries in Latin America, Asia, and Africa suddenly began to accumulate as much reserves as possible with the idea that this would protect them against ever being in the situation of the East Asian countries.

That led to a large rise in the value of the dollar and a big increase in the size of the U.S. trade deficit. The trade deficit in turn led to a big gap in demand that was filled at the end of the 1990s by the stock bubble and in the last decade by the housing bubble. (A trade deficit means that income generated in the United States is being spent in other countries instead of the United States.) There may well be a problem of secular stagnation even if trade were closer to balanced, but the huge expansion of the trade deficit in the last 15 years clearly aggravated the problem considerably.”

Joseph, trade deficits didn’t cause “secular stagnation.” Too little money circulating in the economy caused it.

Foreigners exchanging valuable goods for worth less dollars isn’t our “problem.” It’s their problem.

The U.S. had a steeper rise in living standards in the mid-2000s, and with less effort, than in the late-1990s.

Tax cuts, particularly for the “middle class,” and less restrictive monetary policy would’ve allowed the spending to go on.

Milton Friedman:

“The “worst case scenario” of the currency never returning to the country of origin was actually the best possible outcome: the country actually purchased its goods by exchanging them for pieces of cheaply-made paper. As Friedman put it, this would be the same result as if the exporting country burned the dollars it earned, never returning it to market circulation.”

PeakTrader says: “trade deficits didn’t cause “secular stagnation.” Too little money circulating in the economy caused it.”

And how exactly do you expect to get money “circulating” if you are sending it all overseas? My spending is your income and your spending is my income. Except if you are spending it overseas you are creating demand and jobs over there, not in the U.S. What good do cheap foreign t-shirts do you if you don’t have a job to buy them. Well it turns out that trade deficits are great for the 1% who have the jobs and the money to buy all that cheap stuff. They’ve got good jobs. What do they care if anyone else does? One of the reasons trade deficits are ignored is because it is good for upper class spenders.

PeakTrader says: “The U.S. had a steeper rise in living standards in the mid-2000s, and with less effort, than in the late-1990s.”

Apparently you are not a member of the middle or lower class because the last decade has been the worst since the Great Depression for them. They’ve lost their raises, lost their jobs, lost their homes, and lost their retirement savings. Apparently you are speaking for the 1% for whom the last decade and more has been spectacular. That and all the cheap foreign goods they can buy.

A strong dollar functions as a subsidy for foreign produced goods and a tariff on domestic produced goods. Why do you want to subsidize foreign workers and penalize domestic workers?

PeakTrader says: “Tax cuts, particularly for the “middle class,” and less restrictive monetary policy would’ve allowed the spending to go on.”

Well, we tried a payroll cut which was good for both lower and middle classes, but that got axed by conservatives at the end of 2012. But I have no idea what you are talking about regarding less restrictive monetary policy. Given your poor understanding of trade deficits, I’m guessing you don’t have any idea either.

Apparently you didn’t even read the posted article because the analysis shows a loss of at least 4 million jobs and as many as 10 million jobs due to strong dollar policies and large trade deficits.

Joseph, the U.S. offshored older industries, imported those goods at lower prices and higher profits, and shifted limited resources into high-end manufacturing and emerging industries. Real manufacturing output increased (and remained roughly constant as a share of world manufacturing output, although trade deficits increased foreign output), and the U.S. not only leads the world in the Information and Biotech Revolutions, it leads the rest of the world combined (in both revenue and profit).

At full employment, e.g. in the mid-2000s, trade deficits were much higher, which benefited the masses tremendously, not just the rich.

U.S. consumers bought foreign goods and foreigners bought U.S. Treasury bonds. Not enough dollars were “refunded” to U.S. consumers, in the form of tax cuts, by the U.S. government, to allow the spending to go on.

It’s better to trade worth less dollars for valuable goods than to trade valuable goods for valuable goods. Income = output. Do, you believe the U.S. is better off sending more output overseas or keeping more? If foreigners want to sell their goods too cheaply and lend their dollars too cheaply, to increase or maintain output and employment, why is that our problem?

So, we lost some manufacturing jobs and gained lots of retail jobs, along with manufacturing productivity and market power. Would you rather produce more and consume less instead to reduce your standard of living? Tax cuts and less restrictive monetary policy allow the U.S. to produce at a high level and consume at an even higher level.

It should be noted, high taxes, e.g. capital gains and the AMT, contributed to the 2001 downturn, although it was a recession so mild per capita real GDP fell very little at worst on top of the huge gains of the 1995-00 boom, thanks in large part to the Bush tax cuts and the Greenspan Fed. The 2001-07 expansion was the fourth longest in U.S. history with a very steep rise in living standards, in part, from the up to $750 a year trade deficits. In 2007, monetary policy was restrictive for too long, which caused the 2007 recession initially. The Bush tax cut in early 2008 allowed the Fed to catch-up easing the money supply and the U.S. was on a path towards a mild recession, until Lehman failed in September 2008. Large tax cuts, rather than the small and slow tax cuts, would’ve closed the output gap much faster, and the Fed would’ve completed a tightening cycle long ago rather than extending the easing cycle.

Meant to say up to $750 billion a year trade deficits and the current account deficit reached 6% of GDP. The U.S. was the main engine of global growth, pulling the rest of the world’s economies. It was able to expand, in spite of huge trade deficits. The U.S. economy was a “black hole,” in the global economy, attracting imports and capital, and even attracting the owners of that capital themselves.

The US and IMF response to the Asia financial crises in 1997 can causally explain the savings glut in China and south-east Asia since then. It increased the demand for US$ and depressed local currencies (over-valued US$) which made imports into the US cheaper, the imports replacing US manufactured goods, and it repressed US interest rates below optimal levels, encouraging credit induced consumption and inflating US assets, incl. housing.

@Peak Trader.

Careful with the stat that real manufacturing output stayed steady in the 2000s. As linked in the article, the official statistics are also fraught with the same index numbers problem as the Fed’s RER index: https://www.aeaweb.org/articles.php?doi=10.1257/jep.25.2.111. As much as a fifth to a half of the gains in real value added from 1997-2007 may not have actually happened.

Secondly, the overall job market from 2000 to 2007, despite a massive housing bubble, was not actually that impressive: http://research.stlouisfed.org/fred2/series/LREM25TTUSM156S

So, the story that everything was fine until the financial crisis hit isn’t quite right. Yes, had regulators done a better job inspecting loans, then there would have been no financial crisis. But with no housing bubble, the labor market performance would have been even worse in the mid-2000s, although I agree we’d have been better off without a fiscal crisis. And I fully agree more monetary and fiscal policy could have gotten us out of the “Lesser Depression” much sooner.

Doug Campbell, I’m using the official statistics. For example:

Chart real manufacturing output: http://research.stlouisfed.org/fred2/series/OUTMS

If there’s bias to one side, there may also be bias to the other side. Here’s a related article:

http://www.businessweek.com/stories/2006-02-12/why-the-economy-is-a-lot-stronger-than-you-think

Anyway, there’s not much value in low-end manufacturing production:

The hidden downside of Santa’s little helpers

The Irish Times

December 21, 2002

“An investigation into the price of a Mattel Barbie doll, half of which is made in China, found that of the $10 retail price, $8 goes to transportation, marketing, retailing, wholesale and profit for Mattel.

Of the remaining $2, $1 is shared by the management and transportation in Hong Kong, and 65 cents is shared by the raw materials from Taiwan, Japan, the US and Saudi Arabia. The remaining 35 cents is earned by producers in China for providing factory sites, labour and electricity.

Toy factories hire the least-skilled workers…Sixty per cent are young women between 17 and 23 years old who live cramped in company dormitories, 15 to a room, earning just 30 cents an hour and often inhaling spray paints, glue fumes and toxic dust.”

Moreover, I may add, China, for example, doesn’t compete much with the U.S. in high-end manufacturing.

Furthermore, the U.S. economy produced above potential output and beyond full employment in the 1995-00 boom. So, employment growth wouldn’t look impressive in the 2001-07 expansion, because of the mild 2001 recession.

Kissinger’s take: http://online.wsj.com/articles/the-assembly-of-a-new-world-order-1409328075

@Peak Trader: Sharp comments.

Even taken as-is, the Real Manufacturing Output you linked to already doesn’t look great since 2000. I agree there could be biases in both directions, but the biases in the article you linked to could well apply to all of the past half-century (though likely more pronounced in recent decades), while the biases from the rise of intermediate inputs from China would have only impacted the official statistics since the mid-1990s. This would make this period even more of an historical anomaly.

But, you raise a good point — there’s a widespread view that the manufacturing jobs lost are all low wage jobs, and therefore don’t matter. (I think this is wrong, since even if these jobs were low wage, there still could have been a macroeconomic effect and still could have hurt these workers’ employment prospects.) On average, it is true that the manufacturing jobs lost in the 2000s were below average wage for the manufacturing sector. But, perhaps surprisingly, the jobs lost were in sectors with average wages only 2% lower than average according to my quick and dirty calculations using BEA data. It could be that low wage jobs in high wage sectors were disproportionately lost, but then we should expect to see average wage gains in the sectors that lost the most jobs — we don’t. What’s more, since manufacturing jobs are on average high wage for the economy as a whole, these were likely to have been relatively high wage jobs lost.

Lastly, China has increased its market share in a relatively broad base of manufacturing sectors. In 1995, China had a 2% US market share in just a quarter of sectors, by 2007, it had captured a 2% market share in over 60% of manufacturing sectors… Which sectors in the US have done well in the 2000s? Think wineries. Think concrete manufacturing. Think cheese and tortilla manufacturing (and thank NAFTA). Think tank building, and armament manufacturing. These are all sectors where the US doesn’t compete with China. Sectors not nailed to the floor did less well.

Doug Campbell, I think, U.S. real manufacturing output hasn’t been great, since 2007, rather than 2000 (it should be noted, the U.S. began a structural bear market in 2000, after the spectacular structural bull market from 1082-00).

Also, offshoring low-end manufacturing likely puts downward pressure on U.S. wages in those sectors, because of greater competition.

Moreover, I would expect China to gradually move into higher-end manufacturing.

The U.S. leads the world in the Agricultural-Industrial-Information-Biotech revolutions. An economy has to become more efficient in prior economic revolutions to move into new economic revolutions, because of limited resources. Offshoring helped facilitate the U.S. Information and Biotech revolutions.

Should have said structural bull market from 1982-00, which followed a structural bear market from 1965-82.

PeakTrader, who pretends to support lower taxes for the middle class, also supports an over-valued dollar and high trade deficits. An over-valued dollar is a tariff on domestic goods and a subsidy for foreign goods. An over-valued dollar causes higher unemployment for middle and lower class domestic workers. Why is PeakTrader in favor of taxing the middle and lower class to subsidize cheap foreign imports. Is it because he is not affected by the tariff and likes buying cheap goods subsidized by the middle and lower class?

If his concern is to improve the lives of poor foreigners, why does he favor taxing the middle and lower class to do it? Why isn’t he in favor of taxing the 1% to help foreigners.

Joseph, why do you favor lower living standards for Americans?

Why reduce U.S. “gains-in-trade?”

The U.S. has benefited enormously from free trade, open markets, and unrestricted capital flows, along with the world’s predominant reserve currency.

Article by James Fallows:

James Fallows studied American history and literature at Harvard, where he was the editor of the daily newspaper, the Harvard Crimson. From 1970 to 1972 Fallows studied economics at Oxford University as a Rhodes scholar.

January/February 2008

Through the quarter-century in which China has been opening to world trade, Chinese leaders have deliberately held down living standards for their own people and propped them up in the United States. This is the real meaning of the vast trade surplus—$1.4 trillion and counting, going up by about $1 billion per day—that the Chinese government has mostly parked in U.S. Treasury notes. In effect, every person in the (rich) United States has over the past 10 years or so borrowed about $4,000 from someone in the (poor) People’s Republic of China.

Any economist will say that Americans have been living better than they should—which is by definition the case when a nation’s total consumption is greater than its total production, as America’s now is. Economists will also point out that, despite the glitter of China’s big cities and the rise of its billionaire class, China’s people have been living far worse than they could. That’s what it means when a nation consumes only half of what it produces, as China does.

Neither government likes to draw attention to this arrangement, because it has been so convenient on both sides. For China, it has helped the regime guide development in the way it would like—and keep the domestic economy’s growth rate from crossing the thin line that separates “unbelievably fast” from “uncontrollably inflationary.” For America, it has meant cheaper iPods, lower interest rates, reduced mortgage payments, a lighter tax burden…The average cash income for Chinese workers in a big factory is about $160 per month. On the farm, it’s a small fraction of that. Most people in China feel they are moving up, but from a very low starting point.

This is the bargain China has made—rather, the one its leaders have imposed on its people. They’ll keep creating new factory jobs, and thus reduce China’s own social tensions and create opportunities for its rural poor. The Chinese will live better year by year, though not as well as they could. And they’ll be protected from the risk of potentially catastrophic hyperinflation, which might undo what the nation’s decades of growth have built. In exchange, the government will hold much of the nation’s wealth in paper assets in the United States, thereby preventing a run on the dollar, shoring up relations between China and America, and sluicing enough cash back into Americans’ hands to let the spending go on.

PeakTrader, you are seriously confused if you think James Fallows is supporting your view. He is instead criticizing your point of view. The over-valued dollar and trade deficit means that Americans have lower wages and must base their consumption on increasing debt. You think that is a good thing? Consumption based on rising household debt is unsustainable. Do you think that the recent years of painful deleveraging of that household debt have been fun?

The trade deficit occurs because Americans are living above their means through debt. An over-valued dollar suppresses domestic jobs and wages. Don’t you think it would be better to increase jobs and wages so they have the means for consumption instead of debt?

Joseph, you’re still “seriously confused” about the real economy.

We need larger tax cuts and accommodative monetary policy to raise income = GDP = output, and raise income = consumption + saving.

When the output gap closes, and trade deficits increase, tax revenue rises, and taxes can be raised to slow growth to a sustainable rate.

The Japanese yen appreciated from 360 to 100 and the Chinese yuan appreciated 15%, since 2010.

You don’t know if the dollar is really overvalued.

Chart: http://1.bp.blogspot.com/-2KbQDFClYR4/Ujpnhdi9S6I/AAAAAAAAtGo/6qYpd68CttQ/s1600/DXVeryLongTerm0913.PNG

The World’s Reserve Currency

October 3, 2007

“A reserve currency is money that’s held by many countries as their foreign exchange reserves. It’s also the currency that’s typically used to price commodities, such as oil and gold, that are traded between countries.

A country whose currency is the predominant reserve currency benefits tremendously. In the case of the dollar, the U.S. benefits from the increased demand for the dollar that the reserve currency status creates.

Other countries give the U.S. valuable goods in exchange for dollars issued by the Federal Reserve. They also lend the dollars they’ve accumulated back to the U.S. at low interest rates. Most significantly, the U.S. benefits from importing these goods and exporting its inflation to other countries in the form of depreciating dollars.”

****

Income Flows from U.S. Foreign Assets and Liabilities

Federal Reserve Bank of New York

November 14, 2012

Foreign investors placed roughly $1.0 trillion in U.S. assets in 2011, pushing the total value of their claims on the United States to $20.6 trillion. Over the same period, U.S. investors placed $0.5 trillion abroad, bringing total U.S. holdings of foreign assets to $16.4 trillion. One might expect that the large gap of -$4.2 trillion between U.S. assets and liabilities would come with a substantial servicing burden. Yet U.S. income receipts easily exceed payments abroad.

As we explain in this post, a key reason is that foreign investments in the United States are weighted toward interest-bearing assets currently paying a low rate of return while U.S. investments abroad are weighted toward multinationals’ foreign operations and other corporate claims earning a much higher rate of return.

U.S. investors earned a much higher rate of return on multinationals’ foreign operations and similar corporate holdings than did foreign investors here, 10.7 percent versus 5.8 percent, respectively.

The superior U.S. rate of return on FDI, as well as the greater tilt in U.S. foreign investments toward FDI, accounts for the $322 billion income surplus recorded in this category in 2011…The United States has earned a substantial premium on FDI investments at least since the 1960s.