That’s the title to today’s article in Reuters. I’ve been surprised that the Russian economy has taken as much a hit as it has, partly in response to sanction and spillover effects onto confidence from those sanctions. I think the skeptics of the efficacy of sanctions for hitting the Russian economy will have to re-assess.

From the Reuters article:

Russia’s central bank shifted the ruble’s trading band the most since the incursion into Ukraine started as it burns through almost $2 billion of reserves to stem the world’s worst depreciation since June.

The monetary authority sold $442 million on Oct. 7, data on its website show today. That excludes any interventions yesterday as the ruble slid 0.5 percent versus the target dollar-euro basket. The bank said it moved the upper band by 20 kopeks to 44.85 yesterday, a level the currency has since crossed to trade at 44.9126 by 4:09 p.m. in Moscow today. The ruble closed at 40 per dollar for the first time yesterday.

The boundary shift was the biggest since March 4, when President Vladimir Putin kicked off the incursion into Crimea that triggered a standoff with the U.S. and its allies and sent the nation’s assets tumbling. Central bank Governor Elvira Nabiullina has stepped up her defense after the ruble lost the most among global peers since June, hurt by a drop in oil prices and a domestic dollar and euro shortage stemming from sanctions.

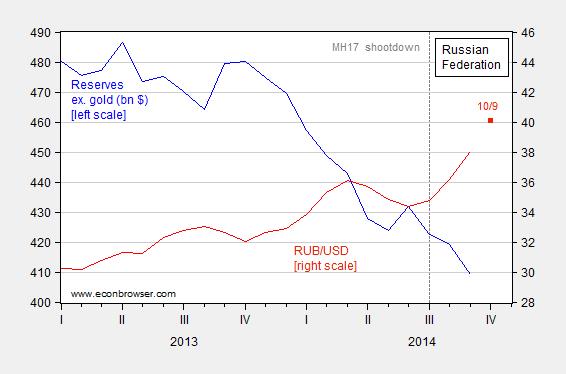

The depletion of reserves through end-September and the ruble depreciation are shown in Figure 1.

Figure 1: Russian Federation international reserves ex.-gold, in billions USD (blue, left scale), and RUB/USD exchange rate, monthly average of daily rates (red, right scale); October observation is for 10/9. Vertical dashed line at shootdown of MH17. Source: IMF, International Financial Statistics, and Central Bank of Russia (for September reserves), Pacific Exchange Services, and author’s calculations.

Reserve depletion occurs when current account plus financial account < 0, so most of the recent run-down in reserves shown in Figure 1 is due to capital flight (as the recent intervention occurred over the last four days).

Interestingly, the counter-arguments to imposing sanctions have morphed over time; originally, assertions were that the sanctions would have little impact on the Russian economy; now, the view is that even with the economy tanking, there will be little impact on Russian foreign policy (e.g., Zachmann/Breugel) (or that the sanctions are too effective!). For a review of the debate, see this survey.

For now, I’ll merely note that the IMF has 2014 q4/q4 growth rate tagged at -0.8%. This is somewhat less than posited in some worst-case scenarios, e.g., IIF, discussed in this post, World Bank in this post. But, as they say, it is still early days. (I’m still waiting for the 225 bp rise in the policy rate to fully percolate throughout the economy, and higher food prices to further depress consumer confidence).

Count me as wrong; I underestimated the effect on reserves. I also underestimated the moves made in Europe to cover themselves. Winter is coming and we’ll see.

The author seems to mix the effects of low oil prices on the Ruble (which is the strongest by far) with the effect of sanctions , which so far has been mainly positive since it spurred import substitution and managed to keep the industrial production up

http://www.tradingeconomics.com/russia/industrial-production

The lower the oil price will go due to the global crisis, the more the Ruble will do down. In this regard, we are very close to see a remake of 2008-2009.

P.S. If you want to see a good Lehman event , keep track of this ETF which is a summary of all shale oil and gas related companies

http://finance.yahoo.com/echarts?s=FRAK+Interactive#symbol=FRAK;range=5y

the shale bubble is near to pop.

Economy in a number of exporter/resource dependent nations seems to be slowing. So how much of the Russian slowdown is due to the sanctions.

I think the sanctions may have been somewhat effective in limiting further Russian actions. However if people are expecting the Russians to leave Crimea there will be a very very long wait.

The sanctions were signals to the Russian rich that they could turn poor at any moment. So the sanctions did not do much other than the reaction to them:

1) Russian rich start moving investements to other countries.

2) Foreign investors stay out.

3) Russia import sanctions on Food hit consumer prices Day 1 and causes a lot of pain.

In 2000 the Swiss government in an effort to “modernize their monetary system” introduced a referendum to remove gold controls from the Swiss franc. The people were only allowed three days to debate the issue; the fix was in. The referendum passed and gave the Swiss monetary authorities the right to sell Swiss gold reserves and print currency. In 14 years over half of Swiss gold reserves have been sold at well below today’s market price and the Swiss Franc.

Buy 2011 the Swiss franc has fallen significantly and the SNB attempted to stop the bleeding. Here is how Wikipedia explained it.

In 2013 the SVP got the required 100,000 votes for a referendum and on November 30, 2014 the Swiss people will vote to return currency and gold controls to the Swill monetary system. The Swiss franc has always been a safe haven because of its relation to gold. The experience since 2000 has proven that the removal of controls weakens a currency and harms an economy. If the Swiss pass the referendum gold will flow into Switzerland. If they turn down the referendum expect a new decline in the Swiss franc.

The SNB buys euros and sells francs. That is not an effort to strengthen the franc. It ‘s an effort to weaken the franc. You have the whole issue backwards. Not sure what this has to do with Russia, but jeez.

Ricardo,

me feeling is that you do not know what you are talking about – even your Wiki source contradicts your claim. 🙂

Swiss industry was in severe trouble after 2009 because of the cheap Euro, which lost around 30% against the Franken, and the fact that most Swiss products could be substituted with European products, usually Germans. Therefore, the Swiss Nationalbank deceided not to led the Franken slip under 1.20 SFR/EUR, this was achieved by buying huge amounts of EUR and selling selling Franken, i.e. weakening their currency in respect to the Euro.