The answer is faster…so contra the arguments of the Wisconsin Restaurant Association, and Wisconsin Manufacturers Association, it seems unlikely that there are large negative employment impacts from minimum wage increases. Oh, also contra Sabia for the Employment Policies Institute (who has still not responded to my repeated requests for his data, after six months).

From the COWS-EPI study, Raise the Floor Wisconsin:

[T]he 13 states that raised the minimum wage at the beginning of 2014 experienced subsequent job growth equal to or better than states that did not.

The entire report documents what is required to “live” in Wisconsin (relevant to this issue).

See here for documentation, and here for an analysis of why employment and/or the low income wage bill might increase in the wake of a minimum wage increase.

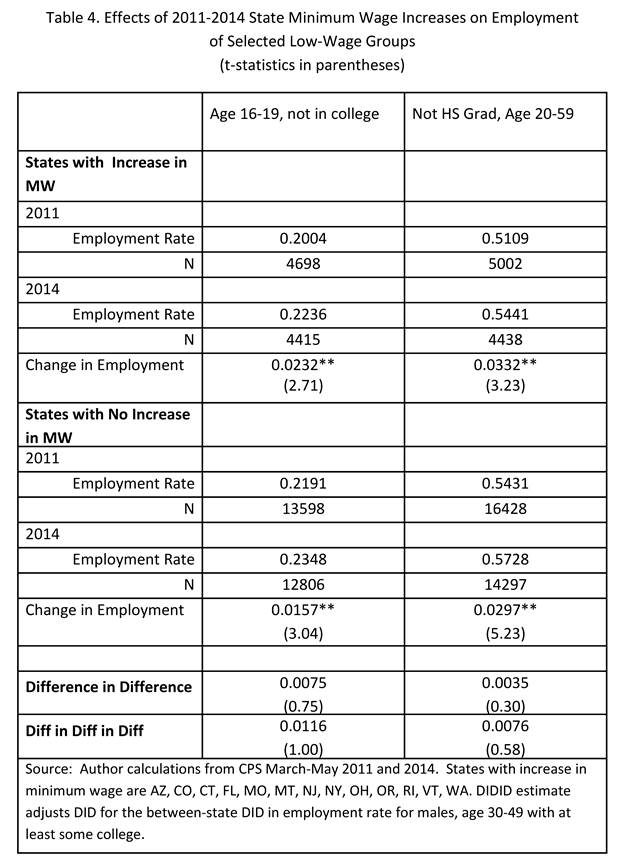

Update, 5:50PM Pacific: Reader xo apparently couldn’t be bothered to click on the link to the Hoffman-Shum results, so here are the key results, from their Table 4.

Well, this post is a bit data thin. Any chance we can get one of your graphs that plots job growth in states that raised versus states that did not raise the minimum wage? Maybe even a regression model?

xo: I have added Table 4 from Hoffman-Shum, at the end of the post.

Yes, much better now, sorry for the laziness! Thanks!

Some people cite the standard textbook model of supply and demand to explain the labor market.

However, prices don’t equal wages and widgets don’t equal workers.

A wage is more than the price of labor. It’s also an input and income.

A partial equilibrium model doesn’t fully explain the labor market.

Menzie, how do you feel about the way this analysis was set up? I’d be curious to hear your run down of the pros & cons of the choice of variables, the date range, etc.

No kidding, Kevin. The sophistry in ‘states that raised the minimum wage’ couldn’t be more obvious.

How did states that raised the minimum wage enough to push it above the market clearing rate for unskilled labor, fare?

Also, here’s my preemptive strike against Menzie’s sophistry re; Canada v. Scotland;

—————-quote———-

Well, Menzie links to Krugman saying;

‘But Canada has its own currency, which means that its government can’t run out of money, that it can bail out its own banks if necessary, and more. An independent Scotland wouldn’t. And that makes a huge difference.’

Canada didn’t have a central bank until sometime in the 1930s, and had a less severe depression than the USA. As far as I know Canadian banks have never been bailed out by their central bank (because they don’t have crises). Their banks more or less regulate themselves, as could Scotland’s, whatever currency unit they choose to use.

True, Scotland would not be able to inflate its way out of a recession, but that might have a sobering effect on its politicians. Or maybe not, but Zimbabwe did put an end to some of its miseries by eliminating its currency a few yaars ago. The Rand, Euro, Pound and USD circulate there now.

———-endquote———-

Patrick R. Sullivan: I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

Pat

“As far as I know Canadian banks have never been bailed out by their central bank (because they don’t have crises).”

you should not refute your wrong statement about the canadian depression with another wrong statement about canadian bank bailouts. those banks were provided a significant amount of government support during the financial crisis. two wrongs dont make a right.

So baffling, do you consider it a legitimate scholarly exercise to ignore the central argument, to instead obsess on an aside to that argument. And to continue to so like a pit bull with his jaws locked onto a mailman’s ankle?

Patrick R. Sullivan: I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

By the way, I didn’t ignore your central point. I pointed out that one could get into trouble in a currency union sans fiscal union even without a banking crisis. What I’m asking for is that you admit you made an error of fact.

I’ll keep on posting as long as you keep on twisting.

patrick, the exercise you are now participating in is the lesson in when to stop digging the hole. if you continue to argue with incorrect “facts” then the beating will continue i would imagine. or is it ok to let an ideologue continue to argue with false “facts”? at some point you need to learn that “truthiness” should not form the evidence of your argument.

Kevin Erdmann: The DIDID approach seems reasonable. I myself would’ve probably done a panel analysis with aggregate data, as discussed in this post, given my time-series training (handling micro data involving thousands of individuals is non-trivial) . But my guess is similar results would’ve obtained.

I don’t understand the choice of dates. They chose a 3 year period, and almost all of the mw hikes were implemented within a few months of the end of the time frame. And all but a few of the mw hikes were just inflation adjustments, but they just lumped all mw hikes together, regardless of scale. I don’t understand why they would do any of these things.

Kevin Erdmann: Well, there you need to ask them. What period would you suggest? There might not be any adjustments after 2009 and before 2011, given the last increase in the Federal minimum wage in July 2009, so including those earlier years would not add any information. As for the differences in the magnitudes of the adjustments, well, there I’d say one might want to allow for variation in the effect. But then you would need to move away from the pure DID approach toward a more conventional panel approach, with its attendant problems.

And as I say, then you get results that vary from small negative to small positive effects, usually not statistically significant.

Didn’t bring your hard hat and lunch pail for this one. You say that they grew faster, which if you completely ignore anything but the summary statistics, would be true. However, how did that hold up in the diff-in-diff model or DDD? (rhetorical question Cyril) It didn’t once you begin to take into account other factors. The only thing you can conclude is that there is no evidence that suggests the opposite is true. I’m not sure if you are familiar with this: http://www.appam.org/pointcounterpoint-minimum-wage-policy/

Another large issue with the idea of using the minimum wage to act as some psuedo-living-wage (hyphen-craze) is that it is ineffective at targeting the exact kind of people, those living in or near poverty, that the policy is supposed to.

We are just a smidgen from having a booming economy.

http://www.calculatedriskblog.com/2014/10/weekly-initial-unemployment-claims_9.html

Is there a difference between correlation and causation? Do most theives eat hamburgers? Want to play Sudoku? What is the mechanism of increasing labor costs and lowering price? Increasing price and increasing sales? Who you gonna believe, me or your lying eyes?

First of the bullish employment articles.

Manufacturing wage growth in Texas, up 25% since 2011 (vs. 4% national, 6% Washington, 9% Oregon). But strong elsewhere as well:

http://online.wsj.com/articles/manufacturing-wages-rise-fast-in-some-states-amid-skills-shortages-1412802098?mod=WSJ_hp_RightTopStories

One thing our neoliberal and austrian libertarian friends neglect to think is the “supply side” effect of raising the minimum wage. A higher minimum wage may make it worth while for someone to come into the work force to work part time or to go from part time work to full time rather than spend their time on school, taking care of kids or elders, or working in the “black” economy (such as day labor, handy man, etc. where payment is made in cash and no taxes paid.) If you raise the price of something, you get more of it.

So here’s an interesting topic. If you take the R&R view that economic growth is slowed by deleveraging, then it’s worth noting that such deleveraging looks to largely conclude (leaving aside the PIIGSH) in 2014.

Discuss the implications.

Well, the implication that I draw is that Larry Summers was premature to declare a new period of secular stagnation in the USA. Looking at the above links that you posted, plus all the other data, it is clear that we are moving ever closer to being out of the great recession.

There are a lot of underlying strengths in the USA. And the impact of new technologies such as solar, 3D printing and so on has not even really begun. How many construction jobs would be created by a boom in residential solar energy? That plus gains from other green energy jobs alone would lead to real full employment, I guess. The clouds are parting….

Progressive economists should readily admit — shout — that a “moderate” federal minimum wage increase, typically 10% cited in conservative studies, should indeed have little or no effect on poverty rates. Why would an extra 1/4 of one percent of GDP added to low wage pay checks be expected to clear a broad swath through poverty? That is what a $1 an hour increase in the federal minimum wage equates to — about $40 billion out of a $16 trillion economy. (E.I.T.C. shifts $55 billion.)

A $15 an hour minimum wage OTH would send about 3.5% of GDP the way of 45% of American workers — about $560 billion (much of it to bottom 20 percentile incomes who today take only 2% of overall income).

Excellent point, Denis. As Deirdre is fond of asking, ‘How big?’

Patrick R. Sullivan: I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

Wow, the economy is really simple to model if there is no risk of variable omission bias going on here.

I am currently a Bcom Accounting Sciences student studying towards becoming a Chartered Accountant. I have Economics as a subject and find it quite interesting as to how the economy works with regards to fiscal and monetary policies. I would expect the raise in minimum wage to actually decrease the employment growth as less producers will be willing or able to afford their employees the increase. Perhaps the increase serves as a motivation for the unemployed to improve their skills and education in order to earn this improved wage and hence the faster employment growth.

Yeah, or there are equilibrium effects. For example, Walmart workers will have more money to spend at Burger King with higher wages, so Burger King can afford to keep more workers even at higher wages, Eventually increases will drive up inflation, but at moderate levels empirically that does not seem to be an issue. Some version of price stickiness probably would apply here.

With just eyeballing the numbers, isnt it fair to say that nothing can be determined from the above numbers? With such a low t-score on the differences of the differences (im thinking it is like a 2 proportion t-test), the null of no significant difference would not get rejected. Especially with how most data is collected on employment numbers. So at best we should just say no significant difference between raising or not. Or am I missing something?

Ed Cruz: I think it would be fair to say that the difference in growth rates is not statistically significant, in this sample. This finding is at variance with the many of the commentators on this blog who have argued that an increase in the minimum wage would result in an economic apocalypse.

Nevermind, I read the link. The author states there is not a statistical difference in the first page.