From Liz Alderman in the NY Times today:

Germany and France Aim to Avert a ‘Lost Decade’

The economy ministers of France and Germany called on Thursday for urgent overhauls and a series of investments in both countries to help prevent them and the eurozone from falling into a stagnation trap.

This comes as news of increasing unemployment and falling inflation arrives (from WSJ):

…reports Friday confirmed a grim outlook for much of the eurozone’s $13.2 trillion economy, the world’s second largest after the U.S. Unemployment across the region rose by 60,000 last month, keeping the unemployment rate at 11.5%, the European Union’s statistics agency Eurostat said, far higher than in the U.S. Consumer spending fell in France and Spain.

Eurostat also said consumer prices were just 0.3% higher in the eurozone in November on an annual basis versus 0.4% in October, matching a five-year low. The inflation rate has now been below 1% for 14 straight months, while the ECB targets a rate of just under 2%.

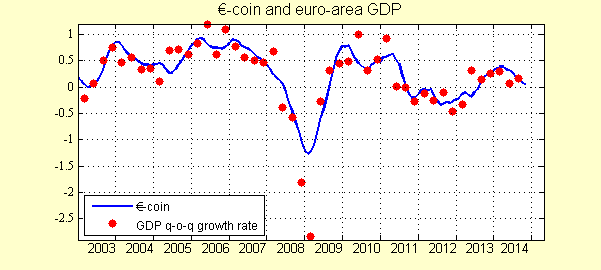

The CEPR/Banca d’Italia eurocoin index also suggests slowing (albeit still positive) growth in the euro area.

Source: eurocoin.

The reference to lost decades reminds me of what Jeffry Frieden and I wrote in Lost Decades (p.203):

In the short term, there was no choice but to act decisively, with temporary tax cuts, spending increases, and transfers to the states. And with the economy growing only modestly as recovery began, too rapid a retrenchment in spending and an increase in taxes could very well be counterproductive, throwing the economy back into recession and further accumulation of debt. However, the politics of countercyclical fiscal policy can be perverse, as the Obama administration found. Recessions hit hardest at poor and working-class families, who would benefit most from stimulative fiscal policy. But attempts to undertake these policies face opposition from upper income taxpayers who are less affected by the recession and more concerned about the impact on their future taxes. This opposition can impede an effective fiscal response to cyclical downturns.

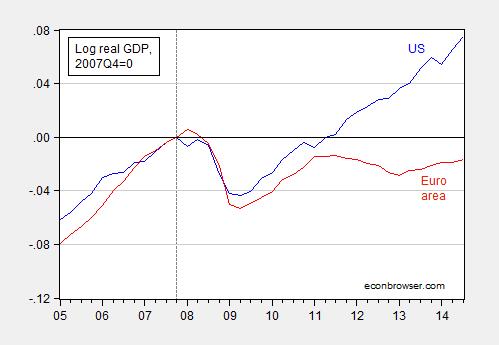

In the case of Europe, part of the reversion to too-rapid fiscal retrenchment was due to German demands for fiscal consolidation, part due to the belief that confidence effects would stabilize debt-to-GDP levels. The impact of relatively expansionary fiscal policy in the US (without hyperinflation so many warned of) as compared to the euro area is shown in Figure 1; per capita series in Figure 2.

Figure 1: Log US real GDP (blue) and euro area 17 (red), both normalized to 2007Q4=0. Source: BEA, ECB, and author’s calculations.

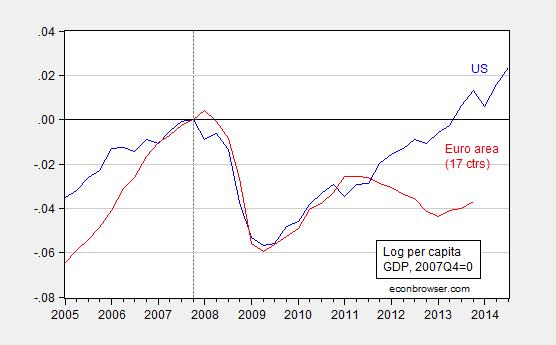

Figure 2: Log US real per capita GDP (blue) and euro area 17 (red), both normalized to 2007Q4=0. US per capita series from BEA via FRED. Euro area per capita series calculated using quarterly GDP and annual population through 2013 interpolated to quarterly using quadratic match. Source: BEA, ECB, and author’s calculations.

For a comparison to the UK, which embarked upon an experiment in expansionary fiscal contraction, only to relent subsequently, see this post. A cross-country comparison is here.

The document referred to in the NY Times article, calling for a “New Deal” and authored by Henrik Enderlein and Jean Pisani-Ferry, is here. They propose:

1. Reforms in both France and Germany. They are not the same, because the two countries are not facing the same challenges. In France, short-term uncertainties reduce long-term trust, but the longer-term outlook looks better. In Germany, longer-term uncertainties reduce short-term trust, but the short-term situation looks relatively good. In France we fear lack of boldness for decisive reforms. In Germany we fear complacency.

2. Reform clusters. Our reform proposals target priority areas where we see urgent need for action in each country. We propose to group actions serving the same aim into ‘clusters’ and to focus on a small number of such clusters. In France, these are (i) the transition to a new growth model, based on a system combining more flexibility with security for employees (“flexicurity”) and a reformed legal system, (ii) a broader basis for competitiveness and (iii) the building of a leaner, more effective state. In Germany, these are (i) the tackling of the demographic challenges, in particular by preparing German society for higher immigration and by increasing female participation in the labour market, (ii) the transition towards a more inclusive growth model based on improved demand and a better balance of savings and investments. Such reforms are not meant to please the respective neighbour, or anybody else, but to create better domestic conditions for jobs, long-term growth, and well-being in each country and in Europe.

3. A European regulatory initiative. Private investment is a judgment about the future. Investments require trust. In many sectors, public regulation plays a major role in the shaping of expectations on the long-term. In energy, transport and the digital sector, to name just a few, regulators must set the parameters right and ensure predictability. Investors need to know with certainty that Europe is committed to accelerating its transition to a digital, low-carbon economy. To lift uncertainty about the future price of carbon or the future regime for data protection is a major responsibility of public authorities. This could significantly contribute to increased investments in Europe.

4. Investment. The well-identified investment shortfall in Germany is largely private. Here again, regulatory clarity and a streamlined legal framework for settling disputes over infrastructure projects have a major role to play to unlock investment. But we also consider that Germany has given itself an incomplete public finances framework that rightly attributes constitutional status to keeping debt under control, but neglects promoting investments within the remaining fiscal space. German assets are not sufficiently renewed. Passing on a worn-down house to future generations is not a responsible way of managing wealth. We think the German government can and should increase public investment. In comparison to other European countries, France does not suffer from an acute aggregate investment shortfall. Business non-residential investment has remained at a relatively high level in comparison to other European countries. The allocation of investment efforts, however, is an area for improvement.

5. European private and public investment boosters. We do not believe that lack of funding is the main obstacle to European investment, but we do consider that new European resources are necessary: in a context where authorities are asking banks to take less risk, it is their responsibility to avoid pervasive risk aversion in the financial system. Building on our regulatory initiative, we propose to inject new European public money into the development of risk-sharing instruments and of vehicles in support of equity investment. Public investment has also been severely reduced since 2007. We propose creating a European grant fund to support public investment in the euro area that would support common aims, strengthen solidarity and promote excellence.

6. Borderless sectors. France and Germany should promote deepened integration in a few industries of strategic importance where regulatory borders severely constrain economic activities. Building “borderless sectors”, together with other partners, involves much more than just agreeing on coordination and joint initiatives: it implies going all the way to a common legislation, a common regulatory rulebook and even a common regulator. We think that energy and the digital economy are such sectors and we also propose a similar initiative to ensure the full portability of skills, social rights and social benefits.

7. Rediscover our common social model. Europe is more than a market, a currency or a budget. It was built around a set of shared values. It is time for France and Germany to join forces to rediscover and reinvent the social model of core Europe, starting with concrete initiatives in the fields of minimum wage standards, labour market policies, retirement and education. In these fields, convergence on the basis of effective joint action is needed to transform the Franco-German space into a true union based on economic integration and shared social values.

Of course, there are reports, and there are reports, and there is no guarantee of implementation. My particular worry I have is that structural reforms proceed without additional spending on infrastructure (or other means of stimulating the economy). Structural reform in the midst of recession is doomed to failure. This is a concern highlighted by Marcel Fratzscher, head of DIW, as reported by Bloomberg:

Germany needs to spend more on infrastructure to support high wages that depend on exports of high-quality manufactured goods, Fratzscher said. Finance Minister Wolfgang Schaeuble’s plan for a 10 billion-euro ($12.5 billion) investment boost starting in 2016 is too little and came late, he said.

While Fratzscher said policy makers aren’t focusing enough on the risk of financial or political shocks in the euro area reigniting the crisis, Merkel regularly says it’s too early for Europe to relax fiscal rigor and that balancing the budget will help future generations.

…

“We need decisive action in overcoming the sovereign debt crisis,” she said in a speech in Berlin two days ago. “We have it under control, but we haven’t overcome it yet.”

Germany’s balanced-budget plan is “a fatal signal,” Fratzscher said. “It says: we don’t care what’s happening to the economy.”

Update, 11/30 1:50PM Pacific: Reader genauer asserts that plotting in per capita terms would yield a drastically different picture. This assertion is easily falsifiable using readily available data. I have added a Figure 2 above.

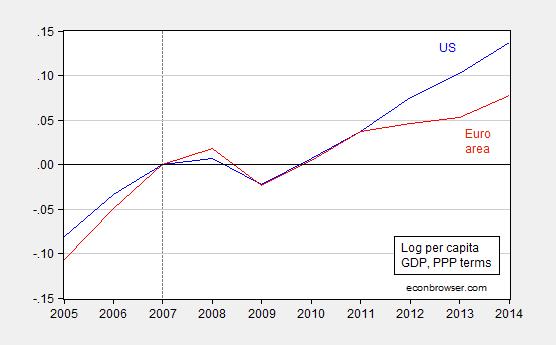

Update, 12/1 2:15PM Pacific: Reader genauer argues we should examine PPP per capita GDP. Here is the graph. Once again, I do not see a change in pattern. The euro area lags the US substantially.

Figure 3: Log US per capita GDP in PPP terms (blue) and euro area 17 (red), both normalized to 2007=0. Source: IMF World Economic Outlook April 2014 database, and author’s calculations (corrected US series, 4PM).

Note that the 2014 estimated gap in per capita terms is 10% 6% (in log, current PPP, terms).

Stronger monetary and fiscal stimulus would help a lot even without structural reforms. I’m a little dubious on what reforms would really help, too – probably the best would be those that encourage new business formation, especially capitalization and technical/business assistance for startups and new firms.

France suffers from economic constipation. Anyone who has done serious business there knows this.

As individuals, the French manage to circumvent many of the regulations and cultural hang-ups that cause the economy to be anal retentive. Call this systeme D. The bright young just leave for London.

Collectively though France is in a bind. Structural reforms are certainly not enough but investment without social change may achieve little. Consider the French problem as micro-economic. Macro-economics fixes are necessary but not sufficient.

Just as a change in diet and more exercise may be the long term cure for constipation, in the short run a strong laxative may be needed.

” In France, short-term uncertainties reduce long-term trust, but the longer-term outlook looks better. In Germany, longer-term uncertainties reduce short-term trust, but the short-term situation looks relatively good.”

It would have been nice of the authors had elaborated their claims. My “gut feeling” is exactly the opposite. France is when we are talking about reforms where Germany was around 1997, discussing solutions. After implementation it took still five long years until we observed a turnaround in 2006.

Some related posts:

Causes of low growth in Europe: stagnation, Russia, or GDP. http://www.prienga.com/blog/2014/11/14/q3-euro-gdp-stagnation-russia-or-oil

Those countries with significant Russian exposure are taking a hit. The PIGS are looking much better. France and Italy are looking like, well, France and Italy. They are primarily in need of structural reforms, notably in labor markets and vastly reduced government spending.

Deficit spending and GDP growth. No correlation that I can find. http://www.prienga.com/blog/2014/11/28/deficit-spending-and-gdp-growth

Impact of labor reforms on Germany v France: arguably 5% of GDP since 2005. : http://www.prienga.com/blog/2014/11/23/the-hartv-iv-reforms-germany-vs-france

I wonder how this will be remembered. Just part of the 1970’s became known as “stagflation” and that experience justifies and enables much of the worst ideas of the past 6 years. Think of that: the past 6 years, which is longer than the stagflation period, marked by negligible inflation, the inability to expand the circulating money supply (as the largest measures of money have grown in huge amounts), no cost push wage demands, falling demand in many sectors. Do you think this will have the same impact on economic discourse as the few years of inflation + stagnation did?

From Lost Decades: “Recessions hit hardest at poor and working-class families, who would benefit most from stimulative fiscal policy. But attempts to undertake these policies face opposition from upper income taxpayers who are less affected by the recession and more concerned about the impact on their future taxes.”

Why would upper income taxpayers be more concerned about the impact on their future taxes if stimulative fiscal policy creates jobs for the poor and working class families, unless the result is more progressive taxes – e.g. more workers receiving larger tax credits and more middle and upper class workers paying more taxes?

If expansionary fiscal policy fails to generate enough new taxpayers, then middle and upper income taxpayers will be responsible for the additional federal debt. There’s already a mountain of federal debt. If interest rates rise, the federal government will have to raise taxes and reduce spending, which will slow economic growth.

Since institution of FED, average 10% treasury yearly yield has been 4,91%. Not sure if average yield of all debt notes is the same, but could be close ( depends on yield and share of bond in total debt).

Assignats which were backed 100% with liquid current assets of France and were used to finance wars lasted very much exactly 6 years:

According to Thomas Paine , who correctly predicted in 1796 that Britains currency will collapse in 1797 , average life time of paper currency ( with or without fractional gold support) is (since its based on FUTURE liquid assets to be bought with it- it has leverage built into system as only 4,91% of current liquid assets serves as base for total 100% high power money supply=USA debt) :

(100%/Average interest rate)* 6 =x

Since Britain was forced off gold standard in 1797, and Bank of England was established in 1694, one can calculate back that average interest rate England paid on its bonds over 103 year period were ( x=103) :

100%*6/103= 5,82%

Given 4,91%, if no dramatic changes in average rate happens, USD can last

(100%/4,91%)*6= 122 years or till 1913+122= 2035 or another 20 years.

If with latest financial techniques rate suppression will continue and stay below 4,91%, it could last approximately 10 years more or till 2045.

This all indicates that its premature to write down USD already now; but that in 2035-2045 we are going to see battle- most like;y between USA and China ( Rocks and Roths into final stretch) about the monetary ( and so total) dominance over the world.

It could be, as in England’s case, that USA wins and USD stays; but history tells that once power has started to move in one direction its unstoppable, so China will win.

In any case total demise of USD is still far away; of course, according to Rock Roth agreement in the meantime it will share part of monetary reserve sphere with yuan since 2021, later-about 2026- also with Germany ( EUR?) and India, so there will be a temporary Tetrarchy of monetary centers which will be swept away by China latest by 2050.

1. The Figure is misleading.

Please present the data in “per capita” and you will not see any difference between the US and the EuroArea.

2. The Problem with the French socialists is , that they didnt do ANY structural reform, like:

a) marginal tax rate of 75% is just too high

b) minimum wage of 66% average is just too high

c) tolerating hostage taking of foreign managers is not good for attracting foreign capital and personell, micromanaging the switch of a single blast furnace of an indian owned factory by French national government either

d) 35 hour week is a nice thing, IF you can afford it

3. Marcel Frtatzscher is male(not “she”) and stupid.

He just released a book with 200 pages , and zero references, making all kinds of wild claims, especially the Krugman style strawman type.

If Germany has a tiny infrastructure problem according to Fratzschers arguments, then the US & UK would be very deep in trouble.

4. There is ZERO, zilch, de nada chance that Germany will not stick to the balanced budget

5. France needs no “stimulus” beyond a kick in the behind. They have signed the fiscal compact, are violating it now, and get cited, scolded, and fined by the European Commision, if they continue to do so.

genauer: I have added Figure 2, in per capita terms. I don’t see much of a change in the pattern. Do you?

The “she” in the article refers to Merkel.

You characterize Dr. Fratzscher as stupid, and yet provide no evidence to that effect. However, he has over 4000 citations in Google Scholar. Maybe time for an appeal to some metrics (appeal to data in general might be useful, too).

Menzie,

the first thing is my shortcoming, I should have added not only GDP “per capita” but also “in PPP”

The difference is the currency effect. The Euro skyrocketed after 2005 from a fair value of about 1.21 that time up to 1.5 and is now back to fair value of .123 – 1.25)

In your present plot you can eyeball that with Euro about 2.5% below end of 2005, and at the end of 2013 3.5% below.

This 1 % difference (same for me working from the IMF 2014 WEO data) divided by 8 years is well within uncertainties (especially delay in the business cycle, with US unemployment peaking in Jan 2010, and southern Europe just peaking now, not before 2014)

the appeal to data with respect to Fratzscher:

first the cheap reply shot , to your count 4000 Google citations for him (I ll get some 2063 for Marcel Fratzscher, and 2710 for “M Fratzscher”, surprisingly few, for somebody who spend most of his life in the paper publishing business (even I have a count of > 1000, spending ca 5 years in academia)

I already have mentioned that his book “Die Deutschland Illusion” with many wild claims, but no references is bollocks in economics, and an embarrassment.

When you take a closer look at the basic DIW publications (in German language) he derives wild underinvest numbers from choosing a particular starting year (1999, and not 1992, which was the begin of vast “overinvest” in East Germany, fails to make the proper comparison to “saturated” countries like the US&UK, but to some OECD average, which contains a lot of catch-up countries)

I could provide this in pretty significant numerical detail.

In contrast to fair wind theories, the required deep structural change never happens during the “good times”. That was no different for Sweden or Germany (Agenda 2010) as well.

Only when the pain is large enough, people change, and that is true for most corporations as well.

Some people and countries only move, when they are days or weeks away from bankruptcy.

We have reached the end of patience now in Europe. The balanced budget is the law,

and people like the French socialist get cited, humiliated, and fined by the EU commision for their endless treaty violations. They have now 3 months time to correct their budget.

Low growth in European countries is because of low population growth. The entire financial-economic system of the western world is predicated on perpetual economic growth (impossible) fuelled by perpetual population growth (unsustainable) and perpetual credit expansion (undesirable). Also, it assumes limitless availability of resources.

Doing QE America style is just enriching the rich America style. Look at the median wage in the USA, minus 15% over 6 years. More temp, less permanent jobs. More part time less full time and so on. And yet these clowns still want more free trade treaties that will only move more jobs to low wage countries (good for rich CEO’s, bad for the middle class). And clueless economists and analysts will continue to be baffled why there isn’t 3% growth a year because QE-ing should be a recipe for success…

“flexicurity”???…. please explain how this works. Is that making it easier to fire people and pair with a much larger welfare state? Seems very unlikely to improve France’s fiscal situation.

The only thing that is going to materially change the situation in France is divestment of state owned (or controlled) assets and that’s not going to happen because that’s the powerbase of all the elite technocrats in France.

Germany’s investment is lagging because their energy policy is killing the industrial sector in the country.

Maybe Europe should try giving capitalism a chance. Nothing else they have tried seems to work.

some more information and references

The former ECB chief economist, the German Issing:

http://online.wsj.com/articles/the-truth-about-germanys-post-reform-deficits-1415215448?cb=logged0.7384850458046751

The absolut last thing Germany needs is more overheating:

AAA individuals like my father, in Germany, at the lowest retail level, get consumer credit at 2.1%

Volkswagen can issue 10-year bonds (e.g. XS1014610254 ) at 1.2 %

Unemployment is at 5.0%, youth unemployment at 3.6% last time I looked, metal worker union (“IGM” , five million marching feet strong and rising, having half the board seats in large corporations) tariffs are rising by 5% by year, 7% Current account surplus.

Marc pointed it out, look at median wages.

Germany has more immigration than the US (relative to size)

systematic structural policies pay off, and short term debt inflation is the way to bankruptcy.

Modell Deutschland works not just for the 47%, but for the > 90% of people, long term sustainable.

And that makes it the better bet for capitalist folks (belonging to the upper 1% of the wealth distribution in East Germany) like me.

And the very last thing Germany or Europe needs, is cheap false advice from people, who know very little detail, do not understand a different culture

genauer,

“The absolut last thing Germany needs is more overheating:”

but you are not simply germany anymore, you are the european union and euro. and the EU does need some overheating. sacrifice is needed throughout the union, not just in the periphery.

“Modell Deutschland works not just for the 47%, but for the > 90% of people, long term sustainable.”

if everybody in the EU could create an export model, great. but the mathematics do not allow this to occur. germany needs to understand it is in a cooperative model with other countries, and one size does not fit all.

baffling wrote: “if everybody in the EU could create an export model, great. but the mathematics do not allow this to occur. germany needs to understand it is in a cooperative model with other countries, and one size does not fit all.”

Could you please provide data for German trade surplus in 2013 with:

1) members of the Euro zone

2) other EU members

3) ROW

Then I would appriciate an explanation why a 8% trade surplus in case of Germany is very bad, while oil exporting countries run much higher ones.

its not the imbalance of 2013 which is the issue. it is the imbalance over the previous decade which is the problem. and you probably understand this as well, which is why you are only concerned about 2013 in your response. again, if you are a part of a european union, you need to begin to think about how that entire union works and not just germany. otherwise what is the point in having a european union?

Baffling,

my problem is, that in the previous years the argument has been that Germany creates a huge surplus mainly because of very unbalanced trade with other Euro zone members.

Now we have the situation that the German trade surplus with these countries becomes very fast smaller and smaller. However, at the same time the German overall trade surplus increases.

For me (as non-economist) this means that some of the simple explanations of the past were very likely wrong. Not more not less. And a important aspect of this discussion is that I can learn and want to learn. Therefore my questions which were only to a small part bait.

Now let’s assume a balanced trade between Germany and the other Euro zone members, would a 6% trade surplus of Germany with the ROW be harmful? What would be in this context the surplus of the Eurozone with ROW?

baffling,

There is no “sacrifice” needed. People just have to live within their means (please see the Issing (former ECB chief economist) WSJ link above.

And that is the LAW (http://en.wikipedia.org/wiki/European_Fiscal_Compact) by treaties, people have signed. That is not optional.

Italy is in its present financial condition not because of some unforeseen housing bubble and crash, but because of decades of overspending, overly generous labor laws (Article 18, which practically guarantees life time employemen, no matter what , with de facto mandatory severance packages of 3 years and more)

France has a minimum wage of 66% average, a marginal tax rate of 75%. Those are not “business cycles” to be smoothed over , 6 years after the event. 2009 brought higher cuts to the investment industry, Germany is catering to, than to most other countries. This year 2009 we smoothered over with a ton of massive stabilisators, like “Kurzarbeit”, “Arbeitszeitkonten”. But look how we came out of it in my slideshare link below.

The Fallacy is, typically for Americans with trade only accounting four about 10% of GDP, to see the European union as a closed and united system.

Neither is true.

a) Fiscal accounts, national debt, social systems, all kinds of policies are national, and all the others fiercely defend their sovereingnity about that

b) We trade & compete primarily on the GLOBAL market, not just with the european neighbors, to the tune of 40% of GDP. One more Euroe given to a german worker will not be spent on whatever a spanish laborer can provide (unemployed construction, agriculture, social worker, whatever). That moeny goes to buy a more expensive cell phone form Asia (with a US name sticker on it or not), vacations on non-Euro destinations. etc, but not hand made shoes from Italy, or more Tomato or some overpriced house from Spain.

c) To waste money, by builting inefficient infrastructure, distorting markets in Germany, just gives you the short term sugar rush, you can see in the 2005 -2007 bubble for the US and Euro Area in the slideshare below. Only systematic structural policy is the key for sustainable long term success.

d) as Eulenspiegel hints below, and with these numbers for him (https://www.destatis.de/EN/FactsFigures/NationalEconomyEnvironment/ForeignTrade/TradingPartners/Tables/OrderRankGermanyTradingPartners.pdf;jsessionid=F2F6442F120D63FE41D10F93BE2EE075.cae4?__blob=publicationFile)

only about one third of our trade surplus) is with the Euro area (and probably even less, when accounted for non-trade current account , like vacations … -)

Danke genauer!

I have found that the trade surplus with other Euro zone members is near zero in 2013:

http://de.statista.com/statistik/daten/studie/77151/umfrage/deutsche-exporte-und-importe-nach-laendergruppen/

Is this correct?

Disclaimer: I do not have problems to include moral arguments in an economic discussion I am a fan of the Soziale Marktwirtschaft, but these arguments should apply for all.

genaeur,

your statements indicate the concept of a european union is not a viable model-too much infighting. perhaps it is time for the union to dissolve? at this point, if i were the peripheral countries, i would view the union as an attempt by germany to impose economic war to keep advantages over italy, greece, etc. why is it in their best interest to continue in a union which demands a deflationary policy in those countries? i myself have no preference for whether the eu dissolves or not, but i am a bit baffled by the willingness of many of these countries to continue to take a beating so that germany need not suffer some inflation.

as you say

“And that is the LAW (http://en.wikipedia.org/wiki/European_Fiscal_Compact) by treaties, people have signed. That is not optional.”

i think you are holding the not optional argument a bit too far. are you willing to wage war to keep them from leaving the union?

Baffling,

your contribution clearly shows that you do not understand how J6P in various European countries ticks and why some of the recipies provided by US/UK economists and politicians have after 5 years of crisis still a very low appeal. But the good message for you is that people like Krugman show the same level of ignorance and waste a lot of time with very bad selling startegy of their ideas. 🙂

First you should answer the question why in none of the affected southern European countries many people would vote for an exit. There is still no official political movement for this. Here it is very helpful to talk to people from these countries and ask them this question, you will learn a lot.

Hint: They do not share your “i would view the union as an attempt by germany to impose economic war to keep advantages over italy, greece” and interestingly the EU/Euro are still the lesser of two evils for them, the same in some of the countries which may join the Euro zone in near future.

“are you willing to wage war to keep them from leaving the union?” shows again certain ignorance on your side. These countries could leave and nobody would wage a war, we had enough and do not need a European conterpart of the ACW.

please check your plot 3

Given that europe has a populatiom growth difference of about 0.6% to the US

plot 1 and plot 3 can not be true at the same time

just motivating this check for the data underlying plot 3 a little more:

for (End of) 2005 the difference in fig 1 is -0.04 – (-0.06) = + 0.02 for the US

for 2013 : + 0.04 – ( – 0.03 ) = + 0.07 for the US

delta 2013 – 2005 = + 0.07 – 0.02 = + 0.05 for the US ( = 5 Percent )

5% divided by 8 years = 0.6 %, the population growth differential.

plot 1 and 2 seem to be good, but not 3

genauer: I have added Figure 3, calculated in PPP terms. I do not see any change of the sort you mention. If you have problems with the series, take them up with the IMF. Note that these are in current PPP per capita terms.

Citation count norms differ among the disciplines; counts in the sciences tend to be higher. I would count over 4000 as quite impressive in economics.

you have a 5% delta US – EA (2013 – 2005) in Figure 1 (just as expected from population growth)

that reduces to < 1% in Figure 2 in per capita, just that the lines inbetween look distorted due to exchange rate

your plot 3 blows that difference up to 10 %, ( = 2 times the 5% from Fig 1), most likely you mixed the divisors, happens to all of us, especially in a rush

This is not a problem of data sources, but of excel sheet calculation.

And this is not about nit picking tiny differences, but about the CENTRAL CLAIM, from the German side, that all that QE etc has ZERO impact on the final real GDP per capita, but just leaves a huge government debt trail.

We could have that also as US vs Sweden 1990 – 2005.

And that issue is the central fighting point.

I already called the google stats , (you started it … LOL) a cheap shot (remember when I was complaining that germans have disadvantages, at least relative to americans, with that ?)

genauer: I apologize; I had the wrong series for the US. Figure 3 now has the correct PPP per capita series.

Still, the pattern is the same — US per capita GDP is 6% higher (in log terms, in 2014) than euro area.

No,

I do not accept the corrected 6%, at max 2%, please look at the 2% difference for 2005, on your left side, you seem to be missing.

Just to verify the data sources:

a) IMF 2014 WEO (April edition)

b) comparing the years 2005 and 2013, since 2014 is a projection

c) the variable PPPPC

d) the GDP weighted by the absolute GDP per nation (in 2013) for the EA18, the delta to your EA17 is a tiny population / GDP

(that corrects correctly for population size AND relative GDP per capita)

and the relative number is 0.675 for 2005, and 0.669 for 2013

The remaining difference of 1.0 % is well within the year to year variation of 1.6 % (for years 2000 – 2013)

and therefore VERY insignificant

(your plot just shifts the business cycle impression a little bit)

And that MEANS :

no visible impact of QE on long term productivity per capita

Normalizing to the pre bubble years 2003 – 2006

http://de.slideshare.net/genauer/gd-pper-capita-in-ppp-us-versus-euroarea-germany

and comparing to folks who know how to eek out over 10% more, Germany,

despite all those many alleged short coming

bad infrastructure investment, low private investment, insufficient regulartory, and whatever else

1. Ulenspiegel

2. baffling

3. Menzie Chinn

1. Ulenspiegel

Unfortunately I don’t think that the statista plot is correct, when I look at the official data in my link.

I like the guys, they do a very valuable service, but nobody (besides me : – ) is infallible, and I sent them this email, but haven’t heard back yet:

(data in Million Euro)

“Auf die Schnelle

Foreign trade balance

France +35961

Austria +19483

Spain +7709

Italy +6317

Belgium+3443

Greece +2941

Und noch ein paar mehr kleine +

Slovakia -1615

Ireland -3319

NL -17709

Das kommt nicht auf einen ausgeglichenen Handel mit der Eurozone heraus, wie es eure Graphik zeigt.”

2. baffling

The Euro and the EU are going through a rough patch in the moment, no doubt, and I believe it will get even uglier, before it gets better.

We already got used to Greece throwing every 3 months a tantrum with the troika. The little Englander Cameron thinks he can get some mileage out of theatrics, before getting defeated by 26/2/0 votes, again.

The English threat of leaving the (European) Union is not accounted for in the treaties, but if they really want it, it will happen.

Leaving the Euro is also not foreseen in the treaties, but if people really want it, they will crash out.

We will not hold them up , and certainly fight no war about it, “This is not America”. Speaking non-officially, my take is that we will at some point even help them out with some deal with partial writeoff of what they owe the european people.

But as long as they are part of the Euro, and have a seat and voting right in the ECB, they have to play by the rules, and those are clear, quantitative, and not negotiable.

Given the substantial transaction costs out of the Euro currency, I actually expect some present members to make a pretty big fuss in the next 3-5 years, but that they will ultimately decide to stay within the big fold.

As I see it, all crisis escalation and resolution mechanisms (ESM) are in place, and I watch this without losing any sleep.

3. Menzie Chinn

I have uploaded an updated version of

http://de.slideshare.net/genauer/gd-pper-capita-in-ppp-us-versus-euroarea-germany

which includes now also UK and Japan, and spells out the average growth rates per trend line fit.

When I look at the back and forth above between us 2, I see this as a very good example, when 2 honest experience people look at the same graph, but still see very different things.

Your interpretation of “US ahead of Euro” is based on the arbitrary selection of the year 2007 as reference point, not unusual for an American economist, but a year with clearly very unsustainable credit behavior (US private credit rising with 5% GDP, some southern Europe with more than 10% GDP)

The long term trend is a wash between US, Euro, Japan (all 2.5%), the US translated to Europe a.k.a. UK is clearly worse (< 2%) , and Germany (3.6%) is clearly ahead of the pack, and all this with very sound private and public finances.

I say Germany can tell others how that is done, and not the other way around.

As a fellow German I’m disgusted by the lies and propaganda that people like genauer are constantly spewing forward. Since 2000 unemployment dropped by 1 Million, while the same number oft hours was worked. A good quartier of all workers is massively underemployed and spends their free time collecting and returning bottles. The stagnating or falling incomes are not in unionized jobs, but the sectors without any lobby or support by the press, which tells us almost daily how well off we are.

These cheap sectors is where the wage dumping is happening, and germany can only exploit this trick because the currency union prevents our exchange rate from adapting. We undershot the inflation target of 2% for over a decade, and now complain that prices in other countries rose faster in order to compensate? There was a time when the SPD managed to explain what these current account surpluses really mean: that we are giving away investment and consume, and that we are taking it from wage earners.