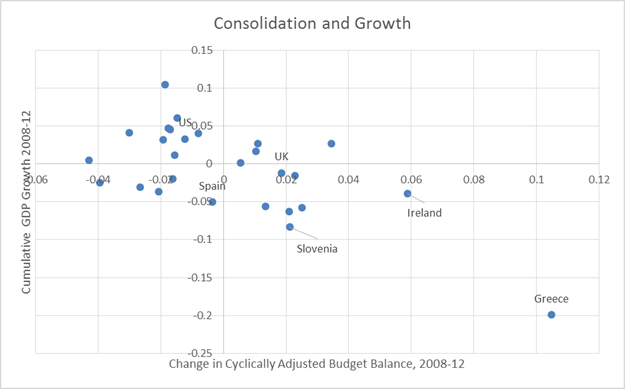

Countries that increase the structural budget balance the most have experienced the slowest growth. Here is the scatter plot for the 2008-2012 period.

Figure 1: Average Cumulative growth of real GDP (in domestic currency) versus change in structural budget balance, 2008-2012. 0.10 = 10%. Sample: Advanced economies ex.-East Asia, ex.-Israel, by IMF definition. Source: IMF, WEO (April 2013) database [h/t Idiosyncratic Risk via kebko for noting error in vertical axis description].

The slope coefficient from an OLS regression is -1.2, with a t-statistic of -3.4, using White heteroskedasticity consistent standard errors. The adjusted R2 is 0.41. Dropping Greece leaves intact a negative, statistically significant relationship.

This is an updated and expanded version of a graph presented by Paul Krugman here. So, if you were wondering, yes, contractionary fiscal policy is contractionary (as noted [1] [2] [3] [4] [5] [6]).

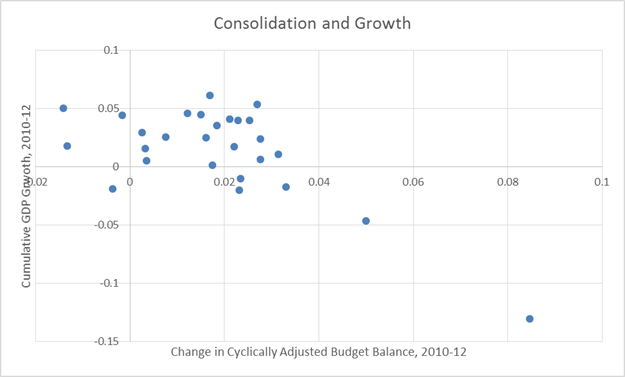

Update, 9/19 8:50AM: Reader Steven Kopits asks why plot changes over the 2008-12 period, when most consolidation occurred over the 2010-12. I was following what many other studies used as a sample period, but gee, if I do what he suggests, the negative relationship becomes more negative. Thanks to Mr. Kopits for suggesting that I check this correlation.

Figure 2:

A four year sample? So what? Is there a point here?

If you don’t trust your country’s politicians not to hock the future through spending foolishly on S-T political handouts like excessive public sector pensions, freebies to cronies, whatever, keeping the politicos on a short leash financially may forgo some S-T GDP growth.

Which may be a good thing L-T. Or not. Who can say? Remember that the L-T forecasting ability of academic economists is – shall we say – limited.

Why 2008? In most countries, the deficit peaked in 2009 or 2010.

Miezie wrote:

So, if you were wondering, yes, contractionary fiscal policy is contractionary…

Yes, and a balnced fiscal and monetary policy allows growth.

Yes, and force feeding an grossly obese man only makes him fatter and sicker.

It’s important to note that cyclically adjusted budget balance isn’t acyclic. It washes out cyclic changes in taxes and unemployment benefits but not changes in other income-support programs. Depending on the country’s welfare structure, it can be fairly endogenous to GDP changes.

Of course, there’s a saying about the long term…

I love when people talk about debt loads and their impact on ‘the kids’ and some sort of legacy they are leaving them. However, they almost universally fail to mention the real current legacy of 60% youth unemployment rates in Greece and other similar problems across nations for young people finding jobs.

Lots of the consolidation is not about impacting the “handouts” ct mentions. It was about laying off currently employed teachers, cops, firefighters, not hiring replacements when people retire, cutting welfare & unemployment benefits that rise with a depressed economy, and putting off infrastructure improvements that have been needed for a while.

Steven Kopits: If you think working off of 2010-12 would eliminate the illustrated negative relationship, you would be wrong. See Figure 2 I have added to the end of the post.

C: Excellent point. That is why the October 2010 IMF World Economic Outlook (Chapter 3) used a narrative approach to demonstrate the point I have made here.

c thomson: What, you want a regression using, say, time-series cross-section panel regression techniques? Well, somebody should do that. Oh, wait, yes indeed, somebody has. In fact, I discussed these types of studies here and here and here and… See also IMF WEO (Oct. 2010)

So, if you were wondering, yes, contractionary fiscal policy is contractionary…

Except in California, the land of fiscal responsibility.

Yes it is sort of funny that those people who are worried that we “leave to the next generation to deal with the debt” rarely suggest the logic solution of bringing taxes up to pay for what we already spend. From the children’s point of view (and I am sure their worry is about the children – right?) cutting head start, food stamps, education and infrastructure is worse than funding those types of benefits for kids and future generations by deficit spending.

The real travesty is that we are leaving for future generations to do and suffer the taxation that we should have done since Reagan. At the same time we have wrecked our democracy and left the plutocrats in total control. So getting that essential job done will cost huge amounts of blood and suffering.

tj: You made this same point in a comment to my last post; do you have so little imagination, that you have to re-use text? And, are you so limited in mathematical capabilities that you can’t respond to my explanation in response to your comment (gee, California did experience a recession; it — and the nation overall — just recovered faster than Wisconsin). Finally, how do you have so much time to burn, writing and re-writing the same (frankly inane) comments already rebutted. I think there is a term for people who do that…

If I eyeball the second graph, and drop the two outliers (bottom right), I don’t see any clear correlation at all between fiscal consolidation and growth.

Steven Kopits: You would, again, be wrong (and you really want to drop Portugal?). Slope coefficient is -0.6, t-stat using White robust standard errors is -2.11. If I apply Robust least squares regression to the entire sample, then the coefficient is -1.2, t-stat -3.9.

Is there any way to disaggregate the growth? If contractionary fiscal policy primarily limits growth in government spending, and that in turn limits the headline growth number, but leads to increased growth in the private sector, some would still see that as a preferable situation to a higher overall growth rate with a higher growth rate in government spending.

You know, the same people who don’t think that government spending should be included in GDP.

Buzz –

Well, that’s what we’re debating. The numbers I posted yesterday were consistent crowding out, not stimulus.

There’s an additional question of return on deficit, ie, is the cost/benefit on deficits high enough to justify their use.

I’ll try to make some time and run through the data in greater detail, but I don’t have the time right now.

Buzzcut and Steven Kopits: You would need to download more detailed data from either IMF, IFS or OECD National Accounts. WEO does not report real government spending and relevant deflators to calculate Divisia indices for nongovernmental expenditures (does report total government expenditures, spending on goods as well as transfers). Shortcut might be to subtract nominal government spending on goods and services from nominal GDP, then deflate by the GDP deflator, but that would be wrong, as they say. I look forward to seeing what you produce. If either of you generate and send a properly documented graph, I will consider posting.

@Steven Kopits:

“If I eyeball the second graph, and drop the two outliers (bottom right), I don’t see any clear……..”

So how do you define “outliers”. Is it just data that fail to confirm your already drawn conclusions? You may be able to drop Greece using accepted scientific definitions of “outliers” (I am not sure) – but how would dropping Portugal be anything but cherry-picking data to avoid reaching an undesired conclusion?

Steven Kopits The numbers I posted yesterday were consistent crowding out, not stimulus.

Huh? So a nominal interest rate stuck at zero for 5 years and inflation consistently below the Fed’s 2% target are economic signals consistent with crowding out? Really?

Buzzcut If contractionary fiscal policy primarily limits growth in government spending, and that in turn limits the headline growth number, but leads to increased growth in the private sector, some would still see that as a preferable situation

You’ve kind of assumed away the problem, haven’t you. This is a financial recession. Consumers and businesses have been going about the business of deleveraging debt. That is not a recipe for “increased growth in the private sector.” If consumers and businesses will not generate aggregate demand because they are saving income and deleveraging debt, then it’s up to either the government or foreign consumers to make up the shortfall. Since this is a global recession I wouldn’t want to count on Canada absorbing more of our exports. That leaves the government. And when the government borrows from the private sector it also provides the private sector with the safe financial assets needed to make desired saving possible.

Steven Kopits There’s an additional question of return on deficit, ie, is the cost/benefit on deficits high enough to justify their use.

Menzie and others have posted various graphs showing the cumulative lost output due to the lingering recession. That lost output dwarfs any plausible level of additional fiscal stimulus needed to close that gap. If the ARRA had been $1.7T in spending rather than $0.7T in a mix of spending and tax cuts, do you think we’d still have a large output gap today? I don’t. I think we would be at full employment. And today’s deficit would have been even lower because if the economy reached full employment, then we could (and should) switch to fiscal consolidation.

Menzie

Is this contractionary fiscal policy? Yes or No?

The California case according to Menzie:

In one case,(California) I close the gap by 50-50 mix of tax increases and spending on goods and services cuts.

You also said in the original post:

In a previous post, I compared economic outcomes in two states that implemented contrasting fiscal policies: California, which surged ahead while raising taxes and cutting spending

So, in your own words, California raised taxes and cut spending but its economy surged ahead. In your own words California proves that contractionary fiscal policy can be followed by expansion. Is that not the definition of expansionary fiscal contraction?

The California case seems to disprove your claims that contractionary fiscal policy can never lead to expansion. I would think you’d be crowing about it, since it’s California.

Your math was correct, but you were using it to compare Cali and Wisconsin. I ignored it because it had little to do with my point, which I made by using your own words to prove you wrong.

Finally, how do you have so much time to burn, writing and re-writing the same (frankly inane) comments already rebutted. I think there is a term for people who do that…

…says the man with enough time to write countless blog entries to the man who averages a few each week.

tj: I count 13 entries by you in the last two weeks. I guess that’s “a few each week”.

Let me try again for your benefit, sans algebra. If government spending on goods and services (e.g., infrastructure) is more stimulative than government transfers (and transfers are negative taxes), then a 50-50 mix of spending cuts and tax increases is less contractionary than 100% government spending cuts. If the 100% government spending cut is coupled with an aim to reduce the size of government, that would be even more contractionary, even if in both cases the same budget deficit reduction is achieved.

If there is underlying growth (say from population growth), then contractionary effects deduct from that growth, but do not necessarily make the growth rate negative.

Menzie wrote:

“…government transfers (and transfers are negative taxes)…

Sorry Menzie but this is hogwash, governmental, central planning double talk. Types of government transfers are “welfare (financial aid), social security, and government making subsidies for certain businesses (firms).” “Negative taxes” are only transfers when the governemnt takes something from one person or entity and gives to another.

Here you are implying that reduced taxes are transfer payments and that is hogwash. Reducing taxes means that the government confiscates less of what a producer has produced and rightfully owns.

Menzie, your Progressive political new-speak often detracts from any economic wisdom you might discover.

From 1999 through 2007 the real median household income fell 1 percent. It fell another 4 percent during the 2008-09 recession. And then, incredibly, fell again during the recovery, dropping an estimated 5 percent in 2010-13.

…The Fed manages what has become the biggest transfer programme to the rich, channeling cheap credit to the government and big business, at the expense of small businesses…”

Once a champion of market prices, the Fed is setting short-term interest rates artificially low. This distorts the economy and markets, keeps the dollar weak and increases commodity prices. That benefits the rich, who own and trade commodities, but hammers average Americans, who need low prices and can’t hedge against asset price inflation. The Fed’s policy of lowering long-term interest rates helps the rich more—they do most of the long-term borrowing, using high incomes and assets as collateral. The burden falls on retirement funds and savings accounts of the middle class.

David Malpass in Forbes India

Still waiting for the invisible bond vigilantes to come and slay us all!

Update: Three months later I almost forget why I flagged this comment from our friend Ricardo but I promised to put it on my calendar and so the reminder popped up today. It’s not even his most radical comment! It’s pretty standard stuff.

(https://econbrowser.com/archives/2013/06/revisions_in_ex.html#comments)

I think maybe my problem with it is that I’ve been reading and hearing versions of this every hour of every day for the last 5 years. From customers. From employees. From random people trolling the internets! Meanwhile, the S&P 500 has gone up nearly 250% from its March 2009 intraday low.

Slug,

Your aggregate analysis lumps FED monetary expansion into your numbers. Real businesses are hurting and no amount of statistical or econometric manipulation will change that. Let’s just see what is ahead.

Love, Ricardo

(ok ok he didn’t say Love Ricardo)

Right. So where exactly are we? Still shivering like scared children waiting for the invisible bond vigilantes, that’s where! In the meantime what do we know:

1. Inflation is too low. It is nowhere near the target. A little more inflation might help propel things along faster.

2. Philly Fed – Solid Expansion.

3. Good activity in the housing markets.

4. Robust profit in the private sector. Surprises to the upside outweigh surprises to the downside

5. Hiring has been remarkably steady, though lower than we would like. I think Obama is now president #3 in job creation in the post WWII era.

See Calculated Risk for the graphs.

Even with the surprise decision by the fed not to taper, we haven’t seen a Titanic wreck in the markets. There are headwinds to be sure. The uncertainty of Obamacare! Well, not exactly…the uncertainty whether the hostage will be shot in an insurgent attempt by GOP demagogues to defund the Affordable Care Act. Maybe that’s why the small business confidence index has flattened out.

In summary, I am constantly amazed that, regardless of any evidence to the contrary, supposedly rational thinking people are basically hoping for catastrophe, and are doing whatever they can to usher it into reality.

Regards.

PS: I don’t know HTML tags so this might look all mashed up. If so, my apologies.

Ricardo: Would that be the same David Malpass that predicted no recession in 2008, and predicted a recession a year ago? Why, yes it is!.

Menzie

tj: I count 13 entries by you in the last two weeks. I guess that’s “a few each week”.

Exactly, less than 1 a day. How many did you have? How do you find time for your real job? I suppose you count this as “service” so you get paid for it.

Let me try again for your benefit, sans algebra.

I used your own words to show that a cut in governmenet spending combined with an increase in taxes [fiscal contraction] was followed by [expansion].

I am simply pointing out that a round of fiscal contraction can be followed by economic expansion. We don’t need to be as fearful of spending cuts as the Progressive brain trust would lead us to believe.

Sumner on fiscal multipliers:

http://www.themoneyillusion.com/?p=23715

ZH on Fed over-forecasting:

http://www.zerohedge.com/news/2013-09-19/guess-what-feds-original-2013-gdp-forecast-was

tj: Over the period you posted 13 times, I posted 20 comments. If 20 is countless, and 13 is a few, it’s no wonder you make the mathematical conclusions you do.

And if you think blogging on a non-university website counts as service, then you are indeed more out-of-touch than I had previously believed. “Service” includes things like serving on department, college or university committees, serving as an administrator, serving on an admissions committee, serving on search committees. Those are things I’d put on my professional activities report. Do you really believe Greg Mankiw, James Hamilton, Paul Krugman, Tyler Cowen, etc., put blogging down under “Service”? Or do you only think it’s just me…

But frankly, I guess it is not surprising to see such misinformation coming from someone who wrote “I would say that the Progressive Liberal leadership is as much, or more bigoted than Conservative leadership.”

I do agree that expansion can follow a fiscal contraction. It happened eventually… after 1933…

Let me end by thanking you for your comments on Econbrowser. They are excellent examples of a particular worldview that all should be aware of.

Menzie,

We have already discussed your biased views of David Malpass. You are very selective in your choice of his work. And he does not draw his salary from the government. He actually works and very successfully, I might add.

Ricardo: The fact that one does not draw a salary from the government excuses one for making incredibly bad forecasts?

I looked at the data, and it looked to me like the initial level of expenditures and the initial structural deficits were the causal factors.

http://idiosyncraticwhisk.blogspot.com/2013/09/austerity-in-recessions.html

Ricardo He actually works

Do you? My guess is no.

Menzie, drawing a salary from the state does not justify a lack of rigor in analysis – but it does facilitate it. Working at a real job demands rigor or you no longer have a job. Contrary to government jobs real workers can be fired for incompetence.

menzie

You began with – Finally, how do you have so much time to burn, writing and re-writing the same (frankly inane) comments already rebutted. I think there is a term for people who do that…,

You never rebutted my claim. You took it out of context and rebutted a strawman. In fact, you just admitted you were wrong. I do agree that expansion can follow a fiscal contraction. It happened eventually… after 1933…

You ended with – But frankly, I guess it is not surprising to see such misinformation coming from someone who wrote “I would say that the Progressive Liberal leadership is as much, or more bigoted than Conservative leadership.”

Let me end by thanking you for your comments on Econbrowser. They are excellent examples of a particular worldview that all should be aware of.

It almost sounds like you are intolerant of a conservative worldview? Is that correct? Otherwise, I’m not sure what you are talking about. What is it about my worldview that is so troubling to you? You are quick with innuendo, but slow with facts to back it up, other than dredging up out of context quotes for old posts.

I’ve seen you do that before when presented with facts that conflict with your point of view. Very intolerant of you, no?

Let’s put things in perspective.

You claimed –

I think this comment highlights the sad state of policy discourse, at least on one side

Your implication being that the view of one bigoted poster was representative of the conservative view.

Eventually, you had to admit you were wrong, just like you did in this thread.

Bigot – One who is strongly partial to one’s own group, religion, race, or politics and is intolerant of those who differ.

This is the rest of the post that provided quotes from Progressive leaders to counter your innuenedo that “one side” (conservatives) have a racist/bigoted world view.

I began – There are plenty more than the few examples of liberal bigotry below, just google it, and then apologize to your conservative readers. (which you did, thank you.)

Here are the quotes I used to show your “one side” innuendo was incorrect.

Joe Biden – “You cannot go to a 7-11 or a Dunkin Donuts unless you have a slight Indian accent. I’m not joking!”

Joe Biden “I mean you’ve got the first sort of mainstream African-American who is articulate and bright and clean and nice-looking guy.”

Harry Reid on Obama – “a ‘light-skinned’ African American with ‘no Negro dialect, unless he wanted to have one.’”

Left-wing radio host Neil Rogers – “Is you their black-haired answer-mammy who be smart? Does they like how you shine their shoes, Condoleezza? Or the way you wash and park the whitey’s cars?”

Spike Lee (On Clarence Thomas)- “A handkerchief-head, chicken-and-biscuit-eating Uncle Tom.”

Hillary Clinton to political operative Paul Fray –

“You f*cking Jew b@stard.”

Jesse Jackson’s description of New York City while on the 1984 presidential campaign trail -‘Hymies.’ ‘Hymietown.’

Al Sharpton – “White folks was in the caves while we [blacks] was building empires … We built pyramids before Donald Trump ever knew what architecture was … we taught philosophy and astrology and mathematics before Socrates and them Greek homos ever got around to it.”

So you see Menzie, your out of context quotes, insults and innuendo actually reflect a level of intolerance that you accuse others of having. Why? Because others have a conservative worldview that conflicts with your Progressive worldview. Do yourself a favor. In the future use facts to back up your innuendo and be a little more tolerant of the conservative worldview.

I really hate it when I let a Progressive bait me into personal attacks.

Malpass doesn’t need me to defend him. His success defends him.

tj: Still waiting for the explanation of how 13 is “a few” and 20 is “countless”. I’ll leave it at that. And I remain confident that 80% of the people reading your quote “I would say that the Progressive Liberal leadership is as much, or more bigoted than Conservative leadership.” will know exactly what sort of person says this; the other 20% thinks this statement is true.

Now you are again (literally) re-using text, so I think I’ll call it a day on this point…

Cutting government spending is very contractionary in an economy that operates way below capacity (i.e. is demand constrained), because government spending is funneled mostly into the consumer class. Government workers and contractors are not rich investor class people so most of governments spending support increased demand.

Government tax cuts can be completely ineffective in helping the economy if they are targeted to the rich investor class (more investment money does nothing to help the real economy when capacity is already in excess of demand). Similarly government tax increases targeted to the rich investor class does minimal harm to the economy because the “investment” money removed has no productive places to be invested (and tend to create damaging asset inflation instead).

So reducing deficits exclusively by cutting government spending does more harm to the economy than a similar deficit reduction by a mixture of 50% (harmfull) cutting spending and 50% (harmless) increasing taxes on the investor class.

kebko: I agree that the deeper causal factors might be beginning structural balances and initial higher revenues. A scatterplot is merely a scatterplot. Of course, this point does not deny that if a country embarks upon contractionary fiscal policy — for whatever reasons — output will fall more. But I do take his main point (consolidate when near full employment) fully! See this 2006 post).

Ricardo Working at a real job demands rigor or you no longer have a job. Contrary to government jobs real workers can be fired for incompetence.

How would you know? You don’t even have a job. I’ve worked in both government and the private sector and both have their dumping grounds for poor performers. People are people and you get about the same distribution of slackers and incompetents in both the private and public sectors. And you’re simply flat out wrong about not being able to fire public sector employees. This is just an urban myth constantly repeated by Fox News (talk about not firing incompetent reporters!!!) and right-wing radio.

randomworker,

Your challenge of a three month change in economic data was absurd at the time and it is still absure but let’s play the game.

Monetary expansion has propped up the stock market but little of the increase in the market is in innovation and manufacturing. That is going overseas. The monetary expansion has moved the economy from a production innovation economy to a casino economy. In the 1990s 48% of all IPOs in the world were on the US stock exchange. We are now below 10%. So yes, the stock market has gone up.

20-Jun-13 20-Sep-13 Var Var %

DOW 15,112.27 15,636.55 524.28 3.47%

The unemployment rate has also decreased in the past three months, but the participation rate continues to decline. This rate is a phony rate.

Unemployment 7.60% 7.30% (0.00) -3.95%

Participation rate 63.50% 63.20% (0.00) -0.47%

Exposing the phony unemployment rate is the percentage employed to the total population. In the past three months it has fallen from 44.8% to 43.7% and year over year it has fallen 2%.

Employment:Population 44.80% 43.70% (0.01) -2.46%

Even with the FED admitting that “tapering” was a head-fake the 10-year Treasury yeild continue to increase.

10-year Treasury yield 2.53% 2.75% 0.00 0.09

You seem to love the housing situation. Let’s look at it a little.

Slug,

I am happy for you that there are government jobs for you after you fail in the private sector. It is obvious you are a Democrat. Failure in the private sector is a Democrat resume enhancer. But isn’t your “private sector job” actually with the MSM as a Democrat apologist?

2slugbaits,

Excellent point.

Rgds,

Alex