From Reuters yesterday:

The rouble tumbled on Wednesday after Russia’s central bank effectively abandoned the trading corridor for the currency, halting the multi-billion dollar daily interventions that had propped it up through sanctions and plunging oil revenues.

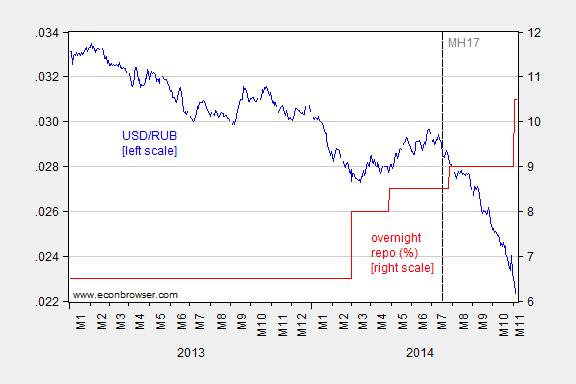

Figure 1 shows the collapse in the rouble, even as the central bank’s overnight repo rate has been raised. The drop occurs as forex intervention is capped at $350 million/day.

Figure 1: USD/RUB exchange rate (blue, left scale), and overnight repo rate, % (red, right scale). Source: Pacific Exchange Service, Central Bank of Russia.

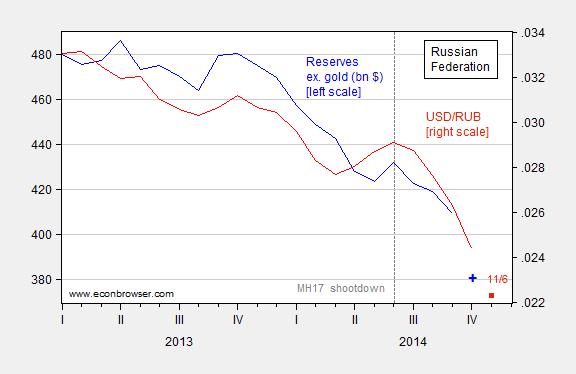

Figure 2 depicts the decline in foreign exchange reserves, as capital outflows have increased and the current account balance has deteriorated. October figures are not out yet. However, press reports indicate $29 billion was spent in forex intervention in October. If the private balance of payments was zero, then reserves ex.-gold would be about $280 $380 billion (indicated by the +).

Figure 2: Russian reserves ex.-gold, in billions, end-of-month (blue, left scale), and USD/RUB exchange rate, monthly averages of daily data (red, right scale). Reserves observation for October 2014 is calculated assuming $29 billion forex intervention in October [1], and private balance of payments equal zero. Exchange rate observation for November is 11/6. Source: Pacific Exchange Service, Central Bank of Russia.

The depreciation of the rouble has already had an effect (along with Russian counter-sanctions). Inflation in the year ending in October was 8.3%, while food price inflation was 11.5% through September.

For more on sanctions and the Russian economy, see this post.

Let’s hope that the Russians just take this good medicine and behave.

If they don’t, be very very worried about what this damaged, lame duck president of ours might do. Wag the dog is always tempting, and so much easier than compromising with Republicans.

And then there is the ‘near abroad.’ And the Chinese military – aka the auld alliance.

Or maybe don’t be all that worried. It was baby Bush, not Obama, who said he wanted to be a great president and that all great presidents are war presidents. Kind of a clue about what to expect. Obama has been caught in a the trap of the Middle East, responding cautiously and conventionally, showing no eagerness to engage on the ground. He has at no point suggested that the US should engage Russia militarily. Obama is not Bush. Nor is he Cheney, nor any of their clan. Neocons are trying to make a comeback, but it’s proving tough going.

We need to ask Hillary and the GOP wannabes. Most of them ( though not Rand Paul) seem more belligerent than Obama.

Here’s what Nathan Lewis wrote in 2008:

Nate continued in his 10/16/2014 article in Forbes:

I don’t know if anyone in the Russian government read this, but I do know that, in early 2009, they took exactly the measures described. In February 2009, the monetary base shrank by 22%, with an exactly corresponding quantity of sales of foreign currency. And it worked: the ruble rose in value, and the crisis passed. I documented it in my 2013 book Gold: the Monetary Polaris, which is available in free eBook (.pdf) version …. The part about Russia begins on page 133.

So, we know it works.

The appalling thing is that Russia’s central bank should know this, because they are the ones that did it, and it worked for them. But, they seem to have forgotten.

Seems to me that the Russians have stopped supporting the rouble in order to create unrest among the proletariat. This will give them ample cover and support for the coming invasion of Ukraine and lasing out at the West. Unlike T Thomson, I don’t think the Russkis are about ‘behaving’ or ‘taking medicine’. Putin wants the former glory back and the only way he’s going to get it is if he takes it himself. I believe Putin thinks that we are stretched too thin militarily and politically to attempt to stop his land ventures. Now that a new gas contract has negotiated with Europe, he is getting ready to test his theory with land grabs. Ukraine would just be the start of “Iron Curtain 2”.

I just spoke to Occham, and he said Russia quit supporting the ruble because of the drain on reserves. If Russia could realistically afford to continue supporting the ruble, the choice to abandon support might need some other explanation. As things stand, the choice to end support was becoming more necessary every day.

Gridlock misread me – I don’t expect the Russkis to behave – my worry is what our silly Obie might do. As with Carter the First, we have a turkey at the controls.

T Thompson. I thought this was a place for economic comments not a place to display your ignorance about politics!

T Thomson Gee, I’ll bet you’re also worried about “Obie” sending in the black helicopters to seize your guns.

When I look deep into Putin’s soul I see a pathetic ex-colonel who is clueless about economics. I have no idea why Russia would want to absorb eastern Ukraine. It’s even more of an economic basket case than Russia. It’s main industries are coal and steel from obsolete plants. Not exactly the kinds of businesses you want to be in today if you’re a central European country. Invading Crimea at least made some half-assed economic sense even if it didn’t make any military or strategic sense. But eastern Ukraine??? You’d think Putin would be looking for a way to step back from his mistakes. History tells us that gangster governments depend upon the distribution of economic goodies to keep the loyalty of clients and potential rivals. If Russia’s economy continues to shrink there will be plenty of rival kleptocrats ready and willing to replace Putin.

Since Obie has just been systematically trashed by American voters, I need make no further comments to Hurley or Sluggo about the silly dude.

As to Sluggo’s deep insights into Col. Putin’s soul, I remember an ex-corporal who was also clueless about economics but interested in a number of places like Ukraine. And in the Crimea as have been empires back to the dawn of history. Look at a map.

Then again Stalin and Mao weren’t always logical economic thinkers either, unlike say members of the US Congress.

t thomson, since it is not unusual for a party to lose control in midterm elections your gloating is a bit unwarranted. you do still realize you will need to compromise with obama and the democrats going forward? you cannot pass legislation without them, and you cannot override the veto. blame will fall on the republicans in the next election if no new legislation gets passed, no matter who slows it down, because the republicans now hold ownership of the legislature. things change when the whole population votes during the presidential elections, rather than when only retired folks vote during the midterms.

“If the private balance of payments was zero, then reserves ex.-gold would be about 280 billion (indicated by the +).”

Shouldn’t that be 380?

Nick: Yes, you are absolutely right! Thanks for catching that — fixed in text; graph is still correct.