Reader Tom argues that economic discourse should not include discussion of variables that are unobservable, to wit (or at least indicate that it’s an estimate):

You announce somebody’s estimations of a theoretical, unobservable phenomenon as “the output gap” or “the actual output gap” as if you and they actually know them to be the output gap.

If we used this criterion, what variables would be ruled out from polite conversation? A lot…let’s just take the real interest rate.

What is the real interest rate; conceptually (remember, this is a made-up concept), it is:

rt = it – πet+1

where it is the nominal interest rate at time t, and πt+1 is the inflation rate between time t and t+1, and the “e” superscript denotes the market’s expectation.

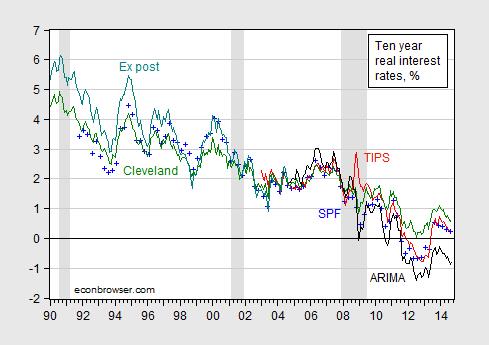

Since the market’s expectation is unobservable, then the real interest rate is in some sense not “knowable”. This is demonstrated in Figure 1.

Figure 1: Real ten year interest rate measured as constant maturity ten year nominal interest rate minus median survey response from Survey of Professional Forecasters (blue +), minus Cleveland Fed expected inflation (green), minus ARIMA predicted ten year inflation (black), minus ex post inflation (teal), and from TIPS (red). ARIMA(1,1,1) estimated over 1967M01-2014M09 period. NBER defined recession dates shaded gray. Source: Federal Reserve Board via FRED, Philadelphia Fed, Cleveland Fed, BLS, NBER, and author’s calculations.

In point of fact, in modern macroeconomics where expectations of the future are central, the most important variables are often not observable. So when one hears a criticism like that leveled by Tom, realize that taking such a criticism to its logical conclusion means that almost no macroeconomic discussion can proceed. Everything will have to have appended to it the adjective “estimated”.

Now, to blow your mind, think about a stock price “fair value”. A stock price should equal the present discounted value of the expected stream of dividends. Once one allows that this equality might not hold exactly (I think Summers, J.Finance (1986)), then “fair value” might be construed as a “counterfactual”, in Tom’s lexicon.

(So, on Friday, we should say “estimated” nonfarm payroll employment; we should be referring everywhere and always to “estimated” GDP; and so on and so forth.)

Update, 11/7, 10:20AM Pacific: In order to comply with Tom’s requests, I have comprehensively edited as of yesterday the offending (to him) post, so that there should be no doubt about the uncertain nature of the relevant economic macro variables. I welcome readers assessments whether the text now reads better (reader Tom has not thus far responded).

I must confess that I have feelings like Tom’s when it comes to the Solow residual and TFP. It’s essentially just the stuff that your model specification can’t explain and it’s units of measurement have no meaningful interpretation. But if you call it technological progress everyone will love it.

Markets impose discipline on estimates of inflation and stock prices. There’s no discipline or reckoning in output gap estimates.

Nathan: Gee, I’ll tell the Argentines that the inflation estimates have been disciplined by the markets.

So, you believe stock prices always equal the PDV of expected dividends?

If my estimate of future inflation is wrong I’ll lose many years worth of accumulated savings. I can’t take an outrageous position on inflation without risking something valuable to me.

What happens if your estimate of the output gap is wrong? Will you lose your tenure? Is it possible to write an enforeable contract based on output gaps? What mechanism is there to falisfy outrageous output gap estimates?

If his estimated output gap is wrong, that will have a small effect on Professor Chinn, it’s true. He might lose a bit of credibility but that’s about it. Much the same is true in the Inflation example though, if you think about it. If my estimate of inflation is 5% too high for example, that will cause me to buy a few more things today (but I still want to keep much of my savings since I want to smooth out my consumption). The costs are small. What about if my inflation estimate is 100% too high? In that case yes, my costs will be substantial. However if Prof Chinn’s estimates were wrong to that extent, it would be clearly visible even for an abstract variable such as the output gap. It would have real consequences for him.

There are also quite a few people whose salaries do (in part) depend on getting the estimated output gap very close to right. Think of investment bankers who need to know what the Fed is going to do.

Even by your (somewhat odd) criterion, the output gap is acceptable.

Don’t feed the trolls Menzie….

Menzie,

I think Tom raises a serious point about Macroeconomics. The field is filled with concepts that are either unknowable or at least not measurable with a precision that makes them useful.

I remember back in the early 1990s all the talk about NAIRU. It seemed to be an article of faith that NAIRU was about 6.5% and that if the unemployment rate fell below 6.5% then inflation would necessarily accelerate. Everybody was talking about: private sector economists, the CBO, the Fed, etc. The Fed took this very seriously and I think it was a big reason the Fed hiked very hard in 1994, since the unemployment rate was starting to touch the NAIRU by January of 1994.

At the time, I was thinking, “how do people know the value of NAIRU with such precision?” Much to my surprise, I found that it was a highly uncertain concept. I remember one econometric estimate I looked at that people relied on that had standard errors you could drive a truck through. The reality was that no one could measure NAIRU with any kind of precision to be useful. Of course, once the unemployment rate continued to fall over the 90s, finally touching 4% without any acceleration of inflation, NAIRU fell out of favor. The excuse became that NAIRU is “time-varying.”

Another big problem in macro is that often these unmeasurable concepts are joint hypotheses. For example, in your own field of international finance, you are constantly dealing with concepts you can’t really measure. Is the failure of uncovered interest parity explained by the failure of rational expectations? Or are there time-varying risk premia? Or is there a peso problem? Rational expectations is the idea that expectations of an agent about some economic quantity are the same as the mathematical expectation of that quantity. So, agents must understand probability distributions of economic quantities and must be able to form mathematical expectations. How could we know whether they can really do that? And how do we tell if there are time-varying risk premia? Don’t you need a model to estimate that? How do you know the model is valid? And good luck with the peso problem, because if there is one we don’t have enough data to know.

Even a seemingly simple concept like market efficiency is problematic. Most people understand that it means that the market reflects all available information so that abnormal returns, on a risk adjusted basis, aren’t really possible. However, to test the hypothesis, you need a model in which you will have to make assumptions about expected utility maximization, rational expectations, etc. to tell if returns really are abnormal. If your test rejects efficiency, how do you know whether the problem is failure of rational expectations, a bad model, or failure of market efficiency?

I’m not arguing that we shouldn’t employ concepts that are difficult to measure. But I’m suggesting that many of the concepts of macroeconomics are not measurable with a precision that makes them useful; and therefore they should not be used. I’d put NAIRU, potential output, and that sacred relic from the barbarous age of macroeconomics, the multiplier, in that category.

Macroeconomists don’t want to stop talking, but maybe they should stop talking if they are not actually talking about anything. I mentioned Nietzsche in a previous comment but I think it’s time to bring out a new philosopher: The last line of the Tractatus Logico-Philosophicus will bring the point home:

“Whereof one cannot speak, thereof one must be silent.”

Rick Stryker: Well, then we concur on the idea that just because there is no absolute certainty about certain values , we shouldn’t give up. Where to draw the line is something that I think we would disagree on. I still think it is possible to measure the exchange risk premium, although as you say, it’s a joint hypothesis.

If I thought about places where the hurdles are highest, I’d say it’s in welfare economics — where’s the core? But maybe that’s the bias of a macro person.

Menzie,

I think reasonable people can disagree where we draw the line on all this. And I’d agree that there are similar problems on the micro side.

This post is wholly facetious and just plain childish. You know perfectly well that I didn’t say that you or anybody should exclude anything from public discussion. I said you should not pretend to know what the output gap is, because the output gap can’t be known.

For example, you wrote: “The current output gap is 3.6% (log terms); this is larger in absolute value than the gap when the G.W. Bush proposed a second round of tax cuts”. I replied “You have a bizarre way of writing about output gaps as if they were knowable.” I elaborated: “You announce somebody’s estimations of a theoretical, unobservable phenomenon as “the output gap” or “the actual output gap” as if you and they actually know them to be the output gap. You can’t know what we could have produced. It’s a counterfactual.” You, facetiously pretending not to understand, replied: “Indeed, using your criterion, we should close up shop here at Econbrowser. Sounds like we can’t talk about anything, since GDP — especially advance — includes a big chunk of extrapolated data.” I explained again (emphasis added): “There are observable phenomena, such as GDP and backward-looking real interest rates. There are forecasts of observable phenomena, such as expected inflation and forward-looking real interest rates. And there are unobservable phenomena that exist only in theory, such as potential GDP and NAIRU. Obviously, neither estimating GDP nor forecasting GDP are at all like estimating potential GDP or NAIRU. GDP is observable, albeit too big and complicated to precisely measure. Potential GDP is a counterfactual. It exists only in theory. I never said it’s silly to write about potential GDP or the output gap or any other theoretical, unknowable thing. I said it’s silly to write about them as if they are known. You can measure slack capacity, but you can’t measure how much value slack capacity would have added had it been employed.”

And even after that, you persisted in facetiously pretending not to understand, and carried on claiming that I want to exclude the output gap from discussion. I don’t understand why you’re motivated to be so dishonest. Why would you want to lie to your audience about what I’m saying? I don’t know you at all but I’ve only seen such behavior before from children who can’t control their emotions and haven’t learned yet that transparently lying doesn’t persuade people for long.

I’ll try one more time, and leave it to other readers to judge who’s being reasonable. You should not write: “the output gap is X”. You should write something like, “the output gap is X, accourding to Y’s estimate.” If you are trying to draw conclusions from somebody’s estimate of the output gap, you should explain the methodology and the inherent uncertainty of the estimation process.

Again, the output gap isn’t merely a measure of slack, which is itself very hard to quantify. The output gap is an estimate of the maximum value that could be sustainably added if slack capacity were employed. That’s inherently extremely uncertain. Writing a post like you did that tells people “the output gap is X and was Y and Z and from that it’s clear that we need to A and B” just isn’t a serious approach. You need to admit that you don’t really know what output gap is. You’re only quoting somebody’s estimate made with a fairly crude methodology, which may or may not be correct or relevant. It’s a matter of being modest about what you don’t know.

Take for example two statements, “there were about 100,000 people at today’s parade” and “there would have been 10,000 more people at the parade if we held it an hour later” Estimating the number at tonight’s protest is like estimating GDP: you don’t count every single person at the parade or every transaction in the economy, you use sampling. Estimating the number of people who didn’t show up but would have if the event was held an hour later is like estimating the output gap. They are things that can’t me measured or observed at all; they’re counterfactuals.

What you’ve done with the output gap is rather like drawing a graph over many years of the trend of potential extra parade-goers that could have shown up if the parade were held an hour later, and justifying some action with that trend. To make that kind of an argument at all persuasive you’re going to have to do better than simply state what you think the gap and its trend are. You’re going to have to make a very strong explanation of why we should believe the estimations you’re using.

Tom: I guess the citation of CBO as source might be a tipoff that it’s CBO’s estimate of a gap. But seriously, you’re the only person who is irritated I didn’t put the adjective “estimated” there, possibly because of the umpteen previous posts on estimating potential, natural output, etc. See for a few instances: [1], [2], [3], [4], and [5].

I’m also not sure your characterization of the output gap is the CBO’s. Sounds more like Friedman’s plucking model. See this post.

CBO doesn’t know what potential GDP is, as Fig 1b at this link shows. http://www.voxeu.org/article/secular-stagnation-hypothesis

They’ve been reducing potential GDP not because of new calculations of that number, but because observed GDP is not approaching the potential GDP line. This is an extraordinarily primitive approach, but if the data don’t fit the model, sooner or later, you’ll abandon the model and come up with something that fits the data, even if you have to manually adjust the coefficients.

Having said that, I believe the 2007 potential GDP estimate remains the right one.

By the way, McBride agrees with me on the path and right policy on the economy: http://www.calculatedriskblog.com/2014/11/thursday-unemployment-claims.html

He also provides some comfort for Slugs on wage growth.

Dems got very unlucky on election timing, I think. Were the election six months from now, the electorate might have been in a more rosy state of mind. On the other hand, Obama is the most singularly tone deaf president I can recall in recent times. I was in my car listening to the President’s post election press conference. It was just unbelievable. The Dems were crushed in the polls after the President explicitly said it was a referendum on his policies, and the guy just doubles down on everything that the voters just rejected. If I were a Democrat politician, I would be disgusted with the President right now. He hung them out to dry.

Chris Matthews nails my sentiments here: http://www.realclearpolitics.com/video/2014/11/05/chris_matthews_rips_obama_theres_something_in_this_guy_that_just_plays_to_his_constituency.html

Steve Kopits: Sometime you should actually read what the CBO writes about how it calculates potential GDP. I won’t look up the exact cites, but having been a visiting scholar in the Macroeconomic Analysis Division at, and on the academic advisory board of, the CBO, I have some slight acquaintance with the issue.

Typically, in a short recession, potential GDP should not be reduced; however, recalling the use of the production function approach, many years of very depressed fixed investment will mechanically reduce potential because Y*=A×F(K,N) , where A is total factor productivity, and K is the capital stock (which is the cumulation of net investment!!!). In addition, long term unemployment will mechanically reduce human capital stock (which fits into N if N is expressed in effective labor units).

Now, one big factor in calculations is (“estimated” — must make Tom happy!!!) total factor productivity. This must be projected, and the trend in this has been revised down. But I don’t think that’s the mechanism you had in mind — that is I think a kind of trend chasing. I think you’d need to critique people using statistical filters to really have that critique “bite” fully.

Nonsense. The methodology you are promoting is clearly flawed, as it has produced bad estimates–by the CBO’s own assessment–since 2007. Indeed, potential GDP for 2017, in 2013 dollars, has been revised down the $2 trillion since 2007.

Should I now assume that the CBO’s 2017 potential GDP is correct? Absolutely not. They were wrong–by their own scoring–every year since 2007. If I look at the matter in light of forecasting track record, potential GDP will continue to be revised down. The CBO, by its own admission, is unreliable. All they are doing is changing their fudge factors to bring potential GDP closer forecast GDP in the out years, because they have no compelling narrative otherwise (ie, they would have to make the case for a higher GDP growth rate–forecasts of which they and the rest–the IMF, Fed, OECD, et al–have been blowing consistently since 2010). Ergo, since they cannot take Mohammed to the mountain, they are bringing the mountain to Mohammed. That simple.

As for the specific terms. If you need more capital, you will build it. There may be a lag to catch up to potential GDP, but no impediment to getting there. In the matter of effective labor units, these are probably under-estimated. As I have written before, US employment to population ratio speaks to very poor labor markets policy, per this post. http://www.prienga.com/blog/2014/10/31/employment-to-population-ratio-detail This is a key set of reforms for incoming Republicans.

TFP is clearly tricky. I think Fernald’s work on this is admirable, but I am not entirely convinced. If you found a technology to lower the cost of oil by $25 / barrel, you think that’s important technology innovation? How about self-driving cars? I think it’s very difficult to forecast the pace of technology development. By it’s very nature, it defies linear forecasting tools, and one is reduced to making faith-based claims (which may prove justified).

So, like Tom, I have no objection to discussions of potential GDP, but it needs to be understood as something subject to quite considerable uncertainty. I still think the 2007 potential GDP estimate (a simple long term extrapolation) will prove the best forecast in the end.

It was a referendum on the economy which is determined not only by his policies but the policies of the opposition. The exit polls also gave poorer marks to the Congress, but punished the most visible person. The results also depended on motivating supporters and here both the democrats and the President did a lousy job.

Tom: I’ve decided to edit the offending post. I hope you are now mollified. I must confess it sounds a little pedantic to me now, but it is in accord with the spirit of your comments, I think.

Thanks for commenting!

We talk about counterfactuals all the time. E. g., “That car almost ran me over!” An output gap is something fairly mundane, assuming that we can measure output. We have the current output and the output that would have occurred if certain conditions were different, and the difference between them. So the output gap has to be estimated, given the different conditions. So what else is new?

My complaint is that, in public economic discourse, I never see error estimates for output gaps or any number of estimates. That makes me wonder if the people doing the estimating know what they are doing. Without an error estimate, its by guess and by golly.

Anti-business sentiment of the Obama administration being precisely one such known but difficult to quantify variable.

and that is why employment growth is stronger under Obama tha it was under Bush, right?

Menzi wrote:Reader Tom argues that economic discourse should not include discussion of variables that are unobservable, to wit (or at least indicate that it’s an estimate):

“You announce somebody’s estimations of a theoretical, unobservable phenomenon as “the output gap” or “the actual output gap” as if you and they actually know them to be the output gap.”

Menzie, did you really misread Tom’s argument this bad? Did you really not understand what he was saying? Do you really believe the straw man you argue against was his intent? Or is your statement simply rhetorical misrepresentation so you can make a point?

Another issue with the output gap, similar to the “not observable” contention, is that it can close not by improving GDP but by redefining potential down. Whatever ails the economy to reduce potential – rather than actual – GDP needs to be identified and corrected (assuming the estimate is correct). Generic stimulus may be the answer, but that has not been shown.

http://johnhcochrane.blogspot.com/2014/05/declining-expectations.html

Graph showing longer series with log-linear trend.

http://andolfatto.blogspot.com/2014/06/how-far-are-we-from-trend.html

This is all really amusing. It is obvious that this isn’t really about uncertainty of the “output gap.” It’s really about this one sentence from Menzie Chinn’s original posting — “However, while growth seems to be firming, it is far too soon to take away stimulus.”

Tom’s real issue is that stimulus is not warranted because there is no measurable output gap. Which is rather ironic considering the election results which indicate that the public is not happy with the current economy.

This is the sort of twisted logic and cognitive dissonance we’ve come to expect from conservatives — Hey, no more stimulus, the economy is fine. There is no output gap. But, by the way, the economy is doing terrible, so vote Republican.

Tom isn’t really disputing the output gap. He’s just stating a fact that he doesn’t want stimulus no matter what the state of the economy is and using the uncertainty of output gap as an excuse. That’s a political argument, not an economic one. The dispute about the output gap is just a smokescreen.

“spencer

November 6, 2014 at 7:12 am

and that is why employment growth is stronger under Obama tha it was under Bush, right?”

Which multi-verse are you posting from?

> and that is why employment growth is stronger under Obama than it was under Bush, right?”

> Which multi-verse are you posting from?

Given that employment growth over Bush’s 8-year term was net zero, the only time this has occurred in history, I don’t think there is much to dispute.

Well, no sooner do I chastise poor Rick Stryker for not being nuanced, and then he goes and surprised me with a fairly sophisticated and nuanced post about epistemology in macro. Lordy, Lordy. The difference between what Tom’s comment and Rick Stryker’s comment is that what Tom said is a slippery slope to nihilism. What Rick Stryker said cautions us to be mindful of the difference between understanding a thing-in-itself and our ability to actually measure and directly observe it. And since we’re getting all epistemological, let’s call it the difference between the noumenal world and the phenomenal world that can be directly observed. The mission of econometrics is to try and bridge the gap between those using indirect and imperfect proxies for things like GDP and output gap. Imperfect knowledge is still better than no knowledge. All that said, I think Rick Stryker goes too far and ultimately throws the baby out with the bathwater. Basically he wants to discard any macro concept that might support a Keynesian view of the world. But why not apply that same critique to microeconomics and finance? For example, the concept of “profit” (something near and dear to his heart) refers to the return to capital; however, what we actually measure rarely if ever conforms with that concept. How many firms distinguish between profit and economic rents? None. Just yesterday I was reviewing an economic proposal in which the defense contractor wanted to base profit on the wage bill! I would submit that we are no more able to accurately align observed profits with the economic concept of profit anymore than we are able to accurately align observed output gaps with the macro concept of an output gap. But I do not therefore conclude that we should keep silent about profits and output gaps.

Rick Stryker also mentioned rational expectations as a one of those fuzzy macro concepts, but then defined it in a peculiar (and I believe incorrect) way. Rational expectations is not the same thing as mathematical expectations, although all mathematical expectations are also rational expectations. The concept of rational expectations as I understand it simply means that economic agents operate out of an internally consistent economic model that is more or less consistent with the economic model assumed by the paper’s author. More specifically, it means that expectations are formed in a forward looking way by taking some model of how the world works and applying it dynamically. Rational expectations is usually contrasted with adaptive expectations in which the agent looks backwards and tries to uncover some static equilibrium.

As to the NAIRU, the Fed always viewed it as “time varying” long before the productivity increases of the 1990s, so it’s hardly an after-the-fact “excuse” as you called it. You can reasonably argue that the Fed’s measurement of the NAIRU was always influenced too much by time series methods, but that’s very different from being just an excuse. And most of the time the Fed did get the NAIRU” more or less right:

http://www.philadelphiafed.org/research-and-data/real-time-center/greenbook-data/nairu-data-set.cfm

But since you brought up rational expectations, I’d like to throw out a challenge to JDH and Menzie. How do macroeconomists reconcile the concept of rational expectations with the results of Tuesday’s election? Rational expectations assumes that economic agents mark their beliefs to the market and discard those that don’t work. Rational expectations assume that agents always act in their own interests and are not systematically victims of false-consciousness. Rational expectations assumes that agents are not frozen in time, where it’s always and forever 1979. It’s hard to see how economic agents with rational expectations could vote to re-elect Sam Brownback. So JDH and Menzie, the challenge is out there. Have at it. It would make for an interesting blog post sure to get lots of hits.

And since we’re talking about epistemology in the context of political economy, I’ll conclude with yet another philosopher’s quote: The owl of Minerva spreads its wings only with the falling of dusk.

2slugs,

You missed the “nuance and context” of my discussion of rational expectations, a nuance and context you claim I don’t have. I was talking about rational expectations in the context of the failure of uncovered interest parity (UIP). UIP asserts that

E[t,private]s(t+1) = f(t)

In words, the agent’s private expectation at time t, using all info available at time t, of the log of the exchange rate at time t+1, is equal to the log of the forward exchange rate set at time t for time t+1.

The assumption of rational expectations in this context is that the agent’s private expectation can be equated to the mathematical expectation with respect to information known to the econometrician at time t as follows:

E[t,private]s(t+1) = E[t,mathematical]s(t+1)

and

s(t+1) = E[t,mathematical]s(t+1) + e(t+1)

where e(t+1) is an i.i.d. random variable with mean 0 and variance sigma, and e(t+1) is uncorrelated with any information at time t. With this assumption, we can write UIP as

s(t+1) = alpha + beta*f(t) + e(t+1)

where, under the null hypothesis that UIP is true, alpha = 0 and beta = 1. However, since the evidence suggests that FX rates are non-stationary, this regression is run as

s(t+1) – s(t) = alpha + beta*(f(t) – s(t)) + e(t+1)

which is the same model under the null hypothesis.

Of course, I realize Menzie is the expert on this topic so I will accept his correction if I have this wrong.

Rick Stryker: I would say both of you are right. 2slugsbait is using rational expectations in the broadest, most technically correct sense. In implementation, most people (in int’l finance and macro) use the term “rational expectations” as shorthand for “rational expectations in steady state” when agents have learned how the underlying model works, using all available information. That interpretation validates what is sometimes called “the McCallum substitution” (old terminology, I know — refers to Bennett McCallum and substituting in the ex post for the ex ante value of the relevant variable). And that’s the sense you are using “rational expectations”.

But not all papers use the substitution (which is appropriate assuming unbiased expectations) even assuming rational expectations. For instance, there was a large literature (e.g., Karen Lewis, Kathryn Dominguez, Rene Stulz, etc.) that incorporated learning. And of course, when there is learning, then survey based expectations (as used in my work with Frankel) could also be “rational”.

It’s important to know if the economy is underproducing or overproducing.

One way is averaging actual output to estimate potential output.

However, we need to know what changed, since the trough in 2009, that caused a sudden slowdown in GDP growth.

It’s not easy to determine the net effect of hundreds of major forces pushing and pulling a large, diversified, and dynamic economy.

If a car in the past accelerated from zero to 60 in five seconds and reached a top speed of 150 MPH, but now underperforms substantially, we need to know why.

Menzie,

I wasn’t taking issue with 2slugs definition of rational expectations; rather I was taking issue with his statement that I had defined it incorrectly, which I did not do. But since you bring up 2slugs’s definition, I would not agree that it is the most technically correct or even an especially accurate definition. 2slugs stated the definition very vaguely.

As you know people define rational expectations differently but a useful way to categorize definitions is in terms of the information we assume that agents have, which makes the definitions of rational expectations analogous to weak and strong market efficiency.

The definition I gave assumes that agents have the same information at time t as is available to the econometrician. But the more commonly used definition makes the much stronger assumption that agents possess the same information at time t as the modeler. This means in particular that:

1) The agent know all information the econometrician knows at time t and

2) The agent knows the structure of the econometric model and the decision rule used by himself and any other agent in the model

3) The agent knows the actual values of any exogenous variables in the model

4) The agent knows all the properties of an probability distributions that govern any variables in the model at time t

5) The agent knows the realized values of all endogenous and stochastic exogenous variables at time t

This broader definition is not more technically correct, any more than strong form market efficiency is a more technically correct definition than is weak form efficiency. It’s just different because it makes different assumptions about the information set.

The broader definition, although widely employed, is obviously much more problematic, as it makes very unrealistic assumptions about what agents know. For one thing, it assumes that agents know more than the econometrician testing the model. I’d certainly have to put this definition up as another concept in macro which may be too uncertain to use for policy. I think this problem is widely understood though. Sargent has tried to justify the broad definition of rational expectations in terms of the limiting expectations of agents with bounded rationality and limited information who learn each period.

In any event, I can only give 2slugs half credit for his definition. (And I don’t take off for spelling.)

Rick Stryker: OK, perhaps I read too quickly — or typed too quickly. My view is that rational expectations as I was taught it is your 1-5 definition. How to operationalize it is another matter, and so oftentimes, for shorthand, people just equate “unbiasedness” for “rational expectations”. Sometimes people equate model consistent expectations with rational expectations. That’s another shorthand. My view is pretty much a live and let live one — just define what you’re assuming when you say what information you think the agents have.

(For what it’s worth, I believe Sargent’s bounded rationality is probably more rational than what is termed rational expectations as you’ve listed 1-5).