Republicans are keen to sacrifice CBO’s role as impartial arbiter of fiscal measures on the altar of “dynamic scoring” of tax measures.[0] But there is no economic reason for restricting this approach to only tax measures.

First, on tax measures, from Jane Gravelle in a Congressional Research Service review of the policy literature:

Economists were attracted to intertemporal models because they were dissatisfied with the ad hoc treatment of savings in Solow models. However, intertemporal models are far less transparent, and modelers appear in some cases to make little attempt to connect the elasticities associated

with labor supply to the ones found in empirical evidence. The JCT [Joint Committee on Taxation] model used in the past has come close but, as illustrated, it is possible to come even closer to matching the empirical evidence, while at the same time minimizing “shooting in the dark” with a labor supply response to the interest rate. JCT also incorporates life-cycle elements in their MEG [Macroeconomic Growth Model] model that do not involve labor supply responses to rates of return. Nevertheless, the assumption of equal substitution elasticities between consumption across far apart periods means that these models still rest on unproven, and probably unreasonable assumptions about the elasticity of substitution between consumption amounts that are ten or twenty years apart. There is a question of whether intertemporal models do more harm than good, at least with respect to the feedback effects during the budget horizon, especially when parameter choices may induce a large labor supply response to the rate of return.Intertemporal modelers presenting the background on their models sometimes report the first two values in Table 4 but no measure of the leisure share of time, which makes it impossible to evaluate on the basis of their published work. Sometimes even the minimal information on elasticities is not provided. (JCT and CBO report all their relevant assumptions.) Without the parameters to understand the models (and particularly without information on the time endowment), these models become impossible to evaluate or compare.

In other words there is a tremendous amount of uncertainty — model and parameter — associated with the intertemporal models necessarily used dynamic scoring of tax policies. See also this discussion of the Bush Administration’s foray, in this post. (Of course, I am skipping nonsensical analyses such as the Heritage Foundation’s Center for Data Analysis of, for instance, the Ryan plan [1] [2] [3]).

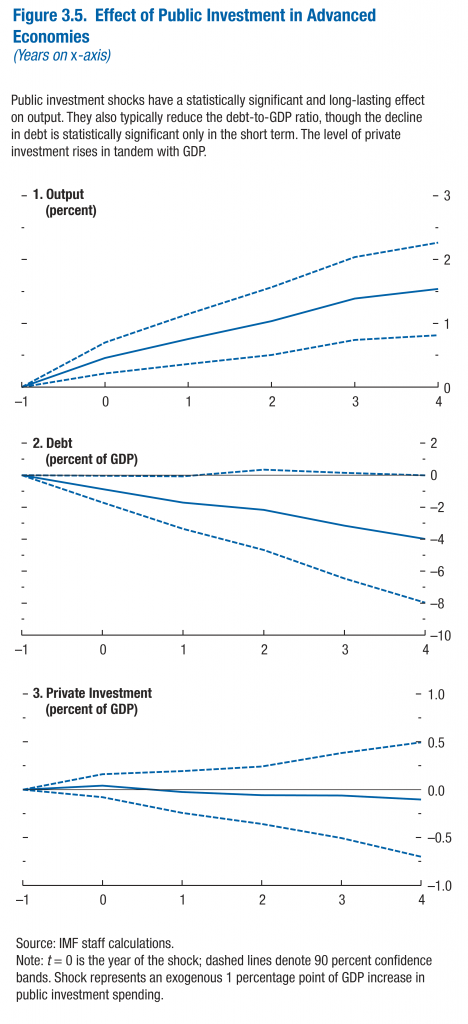

Second, as pointed out by Alan Auerbach, there is no reason to only analyze tax policies. For instance, spending on Head Start which might enhance labor productivity should in principle be scored dynamically. And, so too should infrastructure. Consider this assessment from the IMF’s Research Department, regarding public investment.

Source: IMF, World Economic Outlook, (October 2014), Chapter 4.

Notice that debt declines 4 percentage points of GDP in response to an exogenous 1 percentage point of GDP increase in public investment. In addition output increases 1.5 percentage points relative to baseline. Now, one could argue — particularly with respect to debt-to-GDP — the response is only statistically significantly different from zero in the short term. However, one has even less empirical evidence regarding statistical significance for tax revenue responses to tax rate changes in many instances.

So, let’s think twice about dynamic scoring…

Update, 12/15, 8pm Pacific: From Orszag (2002):

To be sure, many advocates of “dynamic” scoring favor its use in the context of tax cuts, not expansions of public capital investment. Such a distinction between revenue and expenditure proposals, however, makes little sense. The arguments in each case are quite similar; just as advocates of tax cuts often cite controversial evidence regarding their macroeconomic benefits, advocates of public capital, education, and health spending cite

controversial academic research showing large macroeconomic benefits from the expansion of such programs. Furthermore, dynamically scoring tax proposals but not expenditure programs would create an even larger incentive to transform spending programs into tax incentives, even if that involves unnecessary administrative and economic costs. Thus, if macroeconomic effects were to be included in the scoring of revenue proposals, they should also be included in the scoring of public capital investments, education programs, and health spending.

Thanks Menzie. I do not think you realize it but you have actually made the point of those who talk of considering dynamic elements of government intrusion in the market. Most who believe in the dynamic impact are actually making the point that neither static nor dynamic scoring can anticipate the market. After dedicating his whole life to finding the perfect mathematical formulae to define economic activity near the end of his life Schumpeter actually dropped his econometric obsession and began to look at real world economic events. He essentially agreed with Hayek that it was impossible to define all the parameters that have an effect on the market because from moment to moment the conditions change, living is dynamic.

I am reading James Grants excellent book THE FORGOTTEN DEPRESSION and it is amazing how perceptive these non-academic financial leaders were simply basing their decisions on their years of experience in banking and finance (Benjamin Strong only had a high school education).

Today’s government economics reminds me of the phrase, “over-educated idiots.” Dynamic scoring should not be a method to give the arrogant government authorities new studies to impose their hubristic whims on citizens but it should be considered as the reason real world results differ from the formulaic econometric “solutions.”

Well, then, France and Japan must have killer growth rates.

‘For instance, spending on Head Start which might enhance labor productivity should in principle be scored dynamically. ‘

Bring it on.

Patrick R. Sullivan: Thank you for the intellectually vapid comment.

I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

“For instance, spending on Head Start which might enhance labor productivity should in principle be scored dynamically.”

Not sure if parody?

“And, so too should infrastructure.”

Indeed it should. I anticipate you’d be disappointed, however, to learn that any halfway decent dynamic model would score any infrastructure intervention by the American federal government as deeply negative when weighed against plausible alternatives. Federal spending programs are hugely inefficient. On the other hand, the American capital investment markets are probably the most efficient on the planet.

To overcome this mountain would require rare genius indeed, even absent any further confounding political concerns (our projects absolutely must use sustainable organic concrete, union labor, and pass a dozen or two environmental impact assessments each taking 12 months or more).

Menzie,

You should let this Patrick Sullivan quote go. I might have been cute the first time but it is quite petty after a while and simply becomes irritating.

Ricardo: Thank you on your advice on how to comment on my own blog.

ricardo, is patrick being petty as well? patrick knows how to correct the situation but refuses and continues to comment. perhaps it is patrick who is irritating?

Ricardo: Sullivan doesn’t have the guts and intellectual honesty to admit his mistake. Too often people make comments unsupported by any facts and assume those who are silent agree with them.

It seems to me that a couple of issues are confused here. The reason for advocating dynamic scoring in evaluating proposals in tax policy is because changes in taxes change behavior of economic agents. This is because taxes are distortionary, and this distortion affects economic agents’ behavior.

On the other hand, Head Start and public infrastructure produce externalities, hopefully, positive externalities. It is not clear that such expenditure will change behavior. Yes, with Head Start you may (or will) end up with a better educated populace, but why does this mean that there is a distortion? Same thing with “infrastructure”. If I build a better highway, why does this imply a distortion? It just means that economic agents have better means to allocate resources while using that publicly provided good (be it the highway or the educated workforce).

So you do not think the interstate highway systems changed behavior.

Maybe you should ask a railroad executive about that.

Manfred: From the Auerbach article cited in the post:

Menzie – sorry, I was out of commission for the weekend. Only now did I see your post. My reaction is: the best I can establish, Auerbach’s paper on Dynamic Scoring is from 2005, for an Annual Meeting of the American Economic Association. I did not check if it was published in the May 2005 issue of the AER. But anyway – Auerbach’s paper is from 2005 – did anybody follow up? Is there any academic paper, working paper, following up on Auerbach’s suggestion? The most popular Intermediate Public Finance textbook is Harvey Rosen’s Public Finance (lately co-authored with Ted Gayer); Menzie – show me chapter and section and page number where they deal with the distortion (in the economic way, as understood for taxes) with positive externalities; show me in this textbook, the change of behavior of economic agents, given a change in positive externalities (pointing out the chapter on positive externalities does not count – what matters is the CHANGE in the externalities, in the same sense that what matters in taxes, is the CHANGE in tax policy).

We all understand what a positive externality does – privately supplied it may lead to undersupply, because of free ridership. The usual way to correct this is through Pigouvian taxation or take a Coase approach and establish property rights. This is the textbook treatment.

Show me a working paper that does the same thing as they do with dynamic scoring, with positive externalities. Show me an NBER Working Paper or a chapter of a textbook, or any other working paper of a reputed university that does the same thing, as Auerbach (2005) suggests.

I am willing to be educated. I am willing to learn, but you cannot throw claims around, just because Auerbach claimed this almost 10 years ago. Back it up with hard evidence, not just claims.

Manfred: Yes, it was published, here. Search in Google Scholar, and you will find the Auerbach paper referred to in 31 papers, including papers in J.Public Economics, National Tax Journal, OECD Journal of Budgeting, etc., by some obscure types like Mankiw, Elmendorf, Gale, Furman, Steuerle, etc. I haven’t read them all, but you can take a look…

Now as to substance, it seems to me if roads provide positive externalities, then we should increase spending until marginal social costs equal marginal social benefits.

Menzie – ok, thanks; Auerbach’s paper is in the 2005 May AER. Fine. And it has 31 Google Scholar citations. Perusing them quickly, the vast majority deal with *tax* related dynamic scoring (some of them are extensions of Mankiw & Weinzerl’s paper, who, again, deal with tax cuts). Again, why? Because taxes are distortionary – this word, “distortionary” has a very specific meaning in Public Finance. This meaning involves that changes in tax policy, change the behavior of agents, and thus, agents change their resource allocation.

Auerbach suggests in his AER P&P paper that this should be *also* applied to government spending. Fine. But it seems to me that even 10 years later of Auerbach’s paper, nobody has done this. And it is in no textbook.

My point was only that I am not so sure that government provided public goods, that (presumably) have positive externalities, have the effect of changing behavior of the agents. You are right Menzie, if a road has positive externalities, there could be a role be played by government in subsidizing this road construction. I am not so sure that economic agents would change their behavior in a similar manner as with changes in the tax code. And I wondered aloud if that could be the reason of why nobody, after 10 years of Auerbach’s paper, took this up showed this.

That’s all I am saying.

Thanks for the exchange Menzie – I did enjoy it, and I mean it.

(I left this comment on Mark Thoma’s site as well.) The danger of this I think has been generally overstated, for three reasons.

Once you’re in this ballgame, deficit financed tax cuts don’t necessarily look great. There’s always a piper to pay, sooner or later, and the dynamic models are attentive to this. The budget horizon is infinite. In past work CBO’s ventures in dynamic scoring haven’t made tax cuts the greatest thing since sliced bread.

Second, it’s not so easy to get this kind of organization saluting every time you run up the flag, no matter what it is. The next director is up to Congress, but uprooting or beating on the staff is another matter. CBO is more professionalized, independent organization than a Congressional committee staff. Right-wingers don’t necessarily want staff jobs in the Gov. They can make more elsewhere being total shills.

Third, the spending side can be scored too, as Auerbach has said. (I think he is actually against such scoring but he throws it out there to slow down the R’s.) One bit not mentioned is the scoring for increased funding to the dreaded IRS. Most of the lit shows more dough for tax administration (including prosecuting deep-pocket tax evaders) is a a money-maker, by high multiples. Score this!

MaxSpeak: I agree that dynamic scoring doesn’t always get the proponents the answers they want. Let me re-state my link to an earlier post where I discuss the Bush Administration’s analysis using dynamic scoring.

My view is that should a certain group of individuals be unable to bend CBO to its will, there is always the option highlighted by the fate of the Office of Technology Assessment (OTA). That institution was defunded in the wake of Newt Gingrich’s Contract with America. I would not put it beyond the realm of possible that, if those individuals cannot make the CBO sufficiently pliant, they will seek to “disappear” it.

I think, we need to look at the overall scoreboard.

For example, Western Europeans, even with thousands of years of accumulated wealth, live in smaller houses, drive smaller cars (or ride bicycles), have fewer shopping malls, etc. than Americans.

They lag the U.S. badly in the Information and Biotech economic revolutions.

Per capita GDP is over $10,000 a year lower in Western Europe compared to the U.S..

When government tries to solve problems, it too often creates more problems than it solves.

And, although each government program, in isolation, can be a net positive, the aggregation of those programs can be negative.

Certainly, we don’t fully understand how hundreds of major forces interrelate and interact in a large, dynamic, and diversified economy.

Reminds of something my son said about Levidicus: All of Levidicus or none of Levidicus.

Okay, so here in lies the issue, when do you know an investment is going to pay off? When do you know an investment is going to stop paying off? When is the best time to invest in crumbling infrastructure? Etc and so on.

The issue with the CBO is they do not know the future. They know what is happening right now. Most of the reports that I have watched from the CBO over the last two decades have been wrong. The trend line is correct but everything else has been… incorrect. Of course a trend line is fairly simple to calculate.

As to the answers above that I posed slightly rhetorically. You do not know when an investment will pay off. You do not know when an investment will stop paying off, and to be honest since infrastructure begins ‘crumbling’ the moment you put it into effect I would suggest the best time to update it is when you get a good cost benefit net to the work being completed to upgrade it, which can be complex in calculation.

Innocent: Geez, I better tell my colleague to stop teaching benefit-cost analysis. According to you, it’s all futile. Road repair undertaken by the local authorities should be done at random. Deciding who to hire for a particular job — who knows how they will turn out, once they are hired. Might as well do a lottery for hiring.

I do wonder about how many CBO reports you have actually “watched” (strange — I don’t usually watch the CBO reports – I usually read them). I would appreciate your tabulation of what proportion of reports are wrong (and in what sense? Projected growth was 2.3% instead of actual 2.2%?).

In fact, it seems to me that using your logic, large corporations should stop planning as well. It’s hard to tell when a project will pay off. Let those “animal spirits” loose!